A person's marital status can have a significant impact on their auto insurance rates. Married individuals are often considered safer drivers and more financially stable, resulting in lower insurance premiums. On average, a married driver pays $96 less per year than a single, widowed, or divorced driver. This disparity is based on statistical data indicating that married people are less likely to be involved in accidents and file fewer insurance claims. As a result, insurance companies view married clients as less risky and offer them discounted rates.

| Characteristics | Values |

|---|---|

| Auto insurance companies check marital status | Yes |

| Reason | To use marriage as a rating factor when determining the premium |

| Marital status and premium | Married drivers are seen as more financially stable and safer drivers, so they pay less |

| Average premium for married couples | $694 for a standard six-month policy |

| Average premium for a single driver | $742 for a standard six-month policy |

| Average premium for a divorced driver | $1,486 per year |

| Average premium for a widowed driver | $1,437 per year |

What You'll Learn

- Auto insurance companies use marriage as a rating factor when determining premiums

- Married drivers are seen as safer and more financially stable, so they pay less for car insurance

- Divorced drivers file more claims than married drivers, so their premiums are higher

- Widowed drivers are statistically more likely to get into accidents and file claims than married drivers

- Combining policies after marriage does not automatically lead to savings

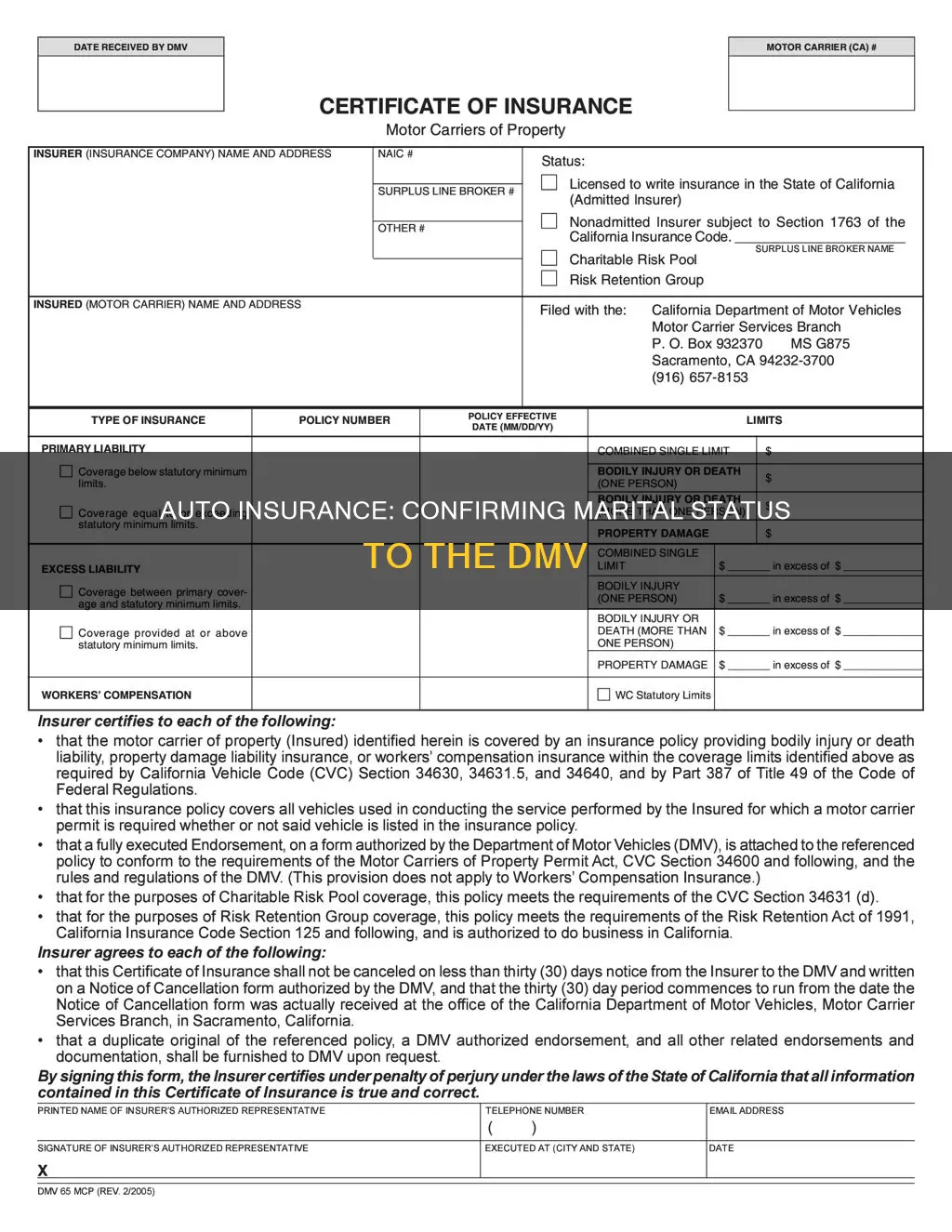

Auto insurance companies use marriage as a rating factor when determining premiums

When determining premiums, auto insurance companies consider the risk of the driver making a claim or getting into an accident. Several factors influence this risk assessment, including age, driving record, occupation, and marital status. Younger drivers, those with poor driving records, and drivers with high-risk occupations are typically considered high-risk and are charged higher premiums. On the other hand, married drivers are viewed as safer and more financially stable, leading to lower premiums.

The impact of marital status on auto insurance rates varies depending on the state and insurance company. In most states, being married results in slightly lower premiums than being single, widowed, or divorced. However, it's important to note that combining policies with a spouse after marriage may not always lead to savings. If your spouse has a poor driving record or drives a more expensive or classic car, your rates could increase.

Additionally, insurance companies may offer specific domestic partnership policies with similar terms as married couples' policies. These policies often result in decreased rates due to the lower chance of domestic partners being involved in accidents compared to single individuals.

Comprehensive Claims: Auto Insurance Rates Impact

You may want to see also

Married drivers are seen as safer and more financially stable, so they pay less for car insurance

Married drivers are often offered cheaper car insurance rates than single people. This is because insurance companies view married people as safer and more financially stable.

According to a 2015 study by the Consumer Federation of America (CFA), premiums for single, divorced, and separated drivers were almost always higher than those of married people with similar driving records. The study also found that two-thirds of the companies increased rates for widows by about 20%.

Insurance companies operate under the assumption that married couples are safer drivers, get into fewer accidents, and take fewer risks behind the wheel than unmarried people. This assumption is backed by statistics. A 2004 study of 10,525 adults by the National Institutes of Health found that unmarried drivers who had never been married had twice the risk of accident-related injury than married drivers. Similarly, data shows that married couples file fewer claims than single, divorced, or widowed drivers.

Married couples are also seen as more financially stable. They are more likely to own a home and, therefore, to have home insurance and life insurance. They are also more likely to pool their assets, own a second home, and have children. As a result, insurance companies are keen to convince married couples to purchase car insurance and bundle all their insurance policies.

In addition, married couples are more likely to have multiple vehicles and qualify for multi-driver discounts. They are also assumed to drive less often than single people, as they are thought to share driving responsibilities.

However, it's important to note that getting married doesn't always reduce car insurance rates. If one spouse has a poor driving record, this can negatively impact the rates for both partners.

Car-Free Auto Insurance: Is It Possible?

You may want to see also

Divorced drivers file more claims than married drivers, so their premiums are higher

Marital status is one of the factors that can significantly influence car insurance premiums. Insurance companies often view married individuals as more financially stable and less likely to engage in risky driving behavior, resulting in fewer accidents and claims. Consequently, they often offer lower premiums to married couples.

According to a study by the National Institutes of Health, drivers who have never been married had twice the risk of driver injury than married drivers. Similarly, a 2015 study by the Consumer Federation of America (CFA) found that premiums for single, divorced, and separated drivers were usually higher than those for married people with similar driving records.

Divorced drivers file more claims than married drivers, and their premiums are slightly higher as a result. The average divorced driver in the US pays $1,486 per year for car insurance, which is $99 more than a married driver. This difference in cost is not a penalty for being divorced but is instead based on historical data and statistical correlation.

While divorced drivers may face higher premiums, there are ways to lower your premium after a divorce. For example, if your ex-spouse was a high-risk driver or had a poor driving record, removing them from your policy could lead to reduced rates. Additionally, changes in your personal situation, such as a change in address, financial situation, or household members, should be communicated to your insurance company as they can impact your rates.

Vehicle Insurance Payouts: Taxable?

You may want to see also

Widowed drivers are statistically more likely to get into accidents and file claims than married drivers

Marital status is a factor that affects car insurance rates. While married people are generally considered more responsible and safer drivers, widowed drivers are statistically more likely to get into accidents and file claims. This increased risk is reflected in the higher insurance premiums that widowed drivers pay.

Widowed drivers are seen as more stable than single or divorced drivers, but they still pose a higher risk than married drivers. This is supported by statistical data and research, which shows that widowed individuals are more likely to be involved in accidents and make insurance claims. As a result, insurance companies charge higher premiums to widowed drivers to compensate for the increased risk.

The difference in premiums between married and widowed drivers is not a punishment for being widowed. Instead, it is based on historical data and risk assessment. Widowed drivers are more likely to submit claims, leading to higher insurance costs. This is in contrast to married drivers, who are often offered discounts and incentives by insurance companies due to their lower-risk status.

The death of a spouse can also impact the insurance rates of the widowed individual. In some cases, widows might experience a rate surge of up to 226% following the death of their spouse. This significant increase is due to the change in the risk profile of the widowed driver, who is now considered a higher-risk client.

While marriage is associated with financial benefits such as potential income tax breaks and purchasing power, it also results in cheaper car insurance rates. Married couples are viewed as financially stable and less likely to engage in risky driving behaviour. They are also more likely to bundle their insurance policies, own multiple vehicles, and qualify for multi-driver discounts, further reducing their insurance costs.

Insurance Salvage Vehicles: What's the Deal?

You may want to see also

Combining policies after marriage does not automatically lead to savings

Additionally, it may be more cost-effective to keep separate policies if your spouse meets certain criteria. For example, if they drive a car model that is more expensive to insure, a valuable classic car, or travel many more miles per day/month than you, it may be better to maintain separate policies.

There are other options for managing finances as a married couple. You could keep your finances completely separate, or you could have both separate and joint accounts. The latter option involves putting all income into a joint account and managing savings, debt, and retirement jointly, while also maintaining a private checking account for each spouse. This approach allows for financial transparency and joint goal-setting while giving each spouse freedom to spend their money as they wish.

Unlicensed Drivers: Can They Get Auto Insurance?

You may want to see also

Frequently asked questions

No information found.

Yes, marital status does affect auto insurance rates. Married people are often considered more financially stable and safer drivers, so they typically pay less for car insurance.

Auto insurance companies use marriage as a rating factor when determining insurance premiums. Married people are considered "safe" insurance clients because they are less likely to be in an accident and file fewer claims than single, divorced, or widowed people.

The average married couple in the US pays $116 per month or $694 for a standard six-month policy.