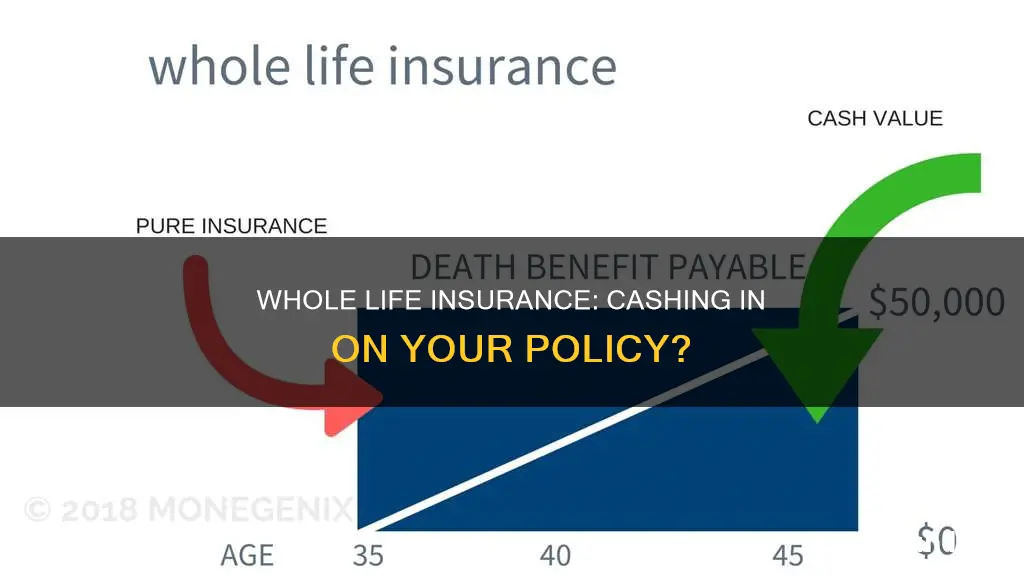

Whole life insurance is a financial tool that can provide added protection for your loved ones. It offers a death benefit payout and a cash value growth component. While whole life insurance is meant to provide financial security for your family after your death, there are ways to access the cash value of your policy early. This can be done through a policy loan, withdrawal, or surrender. However, it's important to carefully consider the benefits and drawbacks of each option, as well as consult a financial advisor, before making any decisions.

| Characteristics | Values |

|---|---|

| Can whole life insurance be cashed in? | Yes |

| What are the ways to cash in whole life insurance? | Surrender the policy, Withdraw cash from the policy, Take out a policy loan, Sell the policy |

| What are the pros of cashing in whole life insurance? | Access to cash, Supplement retirement income, Fund a house remodel, Pay for college tuition |

| What are the cons of cashing in whole life insurance? | Impact on the death benefit, Higher tax liabilities, Reduced payouts to beneficiaries, Surrender fees, Impact on the financial future |

What You'll Learn

section title: Surrendering a policy

Surrendering a policy

Surrendering your whole life insurance policy means cancelling it and receiving a cash payment for the value of the policy, minus any fees. This is a last resort option, as you will lose your insurance coverage and your heirs will not receive a death benefit from the policy when you die.

If you surrender your policy during the early years of ownership, when the value is relatively low, the insurance company will likely charge surrender fees, reducing the cash value. These charges vary depending on how long you've had the policy and, often, on the amount being surrendered. Some policies can levy surrender charges for many years after the policy is issued.

In addition, when you surrender your policy for cash, the gain on the policy may be subject to income tax. Additional taxes could be incurred if you have an outstanding loan balance against the policy.

Although surrendering the policy can get you the cash you need, you're giving up the right to the death-benefit protection afforded by the insurance. If you want to replace the lost death benefit later, getting the same coverage might be more complicated or more expensive.

If you have the means, consider other options before using your life insurance policy for cash, such as borrowing against your 401(k) plan or taking out a home equity loan.

Country Life Insurance: Accident Forgiveness and You

You may want to see also

Subtopic: Taking a loan from your insurance

Taking a loan from your whole life insurance policy is a quick and easy way to get cash in hand when you need it. However, there are a few things to keep in mind. Firstly, you can only borrow against a whole life insurance policy or a universal life insurance policy, as term life insurance does not have a cash value component.

When you take out a loan against your whole life insurance policy, your insurer lends you the money and uses the cash in your policy as collateral. This means that the policy's cash value can continue to accumulate, but it's important to check with your insurance company how interest and any dividends will be determined and paid when you have an active loan. Policy loans do not affect your credit and there is no approval process or credit check. Additionally, the loan is not recognised by the IRS as income and remains tax-free as long as the policy stays active and is not a modified endowment contract.

It's important to note that a policy loan reduces your available cash value and death benefit. If you pass away while still owing money on a life insurance loan, the outstanding balance, including any interest, will be deducted from the death benefit your beneficiaries receive. Therefore, it is crucial to pay back the loan in a timely manner, on top of your regular premium payments, to avoid your policy lapsing.

Insurers have varying rules for how much cash value a policy must have before you can borrow against it and what percentage of cash value you can borrow. Typically, you can borrow up to 90% of the policy's cash value, but it's important to check with your specific insurer.

Before taking out a loan against your whole life insurance policy, it is recommended to consult a financial advisor to weigh the pros and cons and explore alternative options.

Life Insurance: Getting Mortgage Covered

You may want to see also

Subtopic: Withdrawing from your insurance

Withdrawing from your insurance

Withdrawing from your whole life insurance policy is possible, but it's important to be aware of the potential tax consequences and other considerations. Here are some options for withdrawing cash from your whole life insurance policy:

- Take out a policy loan: Whole life insurance often lets you borrow money with no credit check and a low, flexible repayment rate. In some cases, you may not owe taxes on borrowed amounts, and your death benefit doesn't decrease. However, interest accumulates on your outstanding balance, and if the balance exceeds the cash value, your policy could lapse.

- Make a withdrawal: You can withdraw a limited amount of cash from your whole life insurance policy, usually up to your policy basis (the total amount of premiums you've paid into the policy). Withdrawals that exceed your basis may be subject to taxation. Withdrawals will also reduce your death benefit, sometimes by more than the amount withdrawn.

- Surrender your policy: If you no longer need coverage or want to stop paying premiums, you can cancel your policy and receive the cash value, minus any surrender fees. Surrendering your policy means giving up your insurance coverage, and your heirs will not receive a death benefit. You may also owe taxes on any interest earnings from the policy.

- Sell your policy: You can sell your policy through a life settlement, where you sell it to a third party for a lump sum that is greater than the cash value but less than the death benefit. The buyer will then take over premium payments and receive the death benefit when you pass away. Life settlements can be complicated and may come with fees and tax liabilities, so it's important to do your research beforehand.

Remember, while withdrawing from your whole life insurance policy can provide significant funds, it may also come with downsides. It's important to carefully consider your options and consult a financial advisor before making any decisions.

How to Cancel Mortgage Life Insurance?

You may want to see also

Subtopic: Selling your policy

Selling Your Policy

Selling your whole life insurance policy is known as a life settlement. This is when you sell your policy to a third party for a lump sum that is greater than the cash value but less than the death benefit. The buyer will then take on the responsibility of paying the premiums. In return, they will receive the death benefit when you pass away.

Who Can Sell Their Policy?

To sell your whole life insurance policy, you must be both the policy's owner and the named insured. The policy must be individual life insurance, not group life insurance, and it usually needs to have a death benefit of at least $100,000. There is often an age restriction, with most buyers looking for sellers who are 65 or older. However, younger people with severe health conditions might also be able to sell their policies.

The value of your policy is determined by several factors, including its cash value, anticipated future premiums, your age, and your health condition. The cash value of a $100,000 whole life insurance policy may be approximately 2-4% of the policy's death benefit per year of the policy age.

Pros and Cons of Selling Your Policy

Selling your policy can provide immediate financial relief, especially if you're facing large or unexpected expenses. It can also free up money that would otherwise go on premium payments. However, by selling your policy, you forfeit the death benefit that would have been paid out to your beneficiaries. There may also be tax implications, as any income above the premiums you've paid may be subject to taxes. Plus, if your health declines after selling your policy, it could be more difficult or expensive to get a new one in the future.

How to Sell Your Policy

To sell your policy, you'll need to contact a life settlement company. They will evaluate your policy and may provide you with an offer. You can then decide whether to accept the offer and sign the necessary documents to transfer the policy. You can also hire a life settlement broker to handle the more complex parts of the process.

Alternatives to Selling Your Policy

Before selling your policy, consider the alternatives. You could keep the policy and continue paying the premiums, borrow against the cash value of the policy, or use the policy as collateral for a loan.

ETFs: A Viable Alternative to Life Insurance Policies?

You may want to see also

Subtopic: Using cash value to pay premiums

Whole life insurance is a form of permanent life insurance that lasts for the lifetime of the holder and features a cash value savings component. The cash value of a whole life insurance policy can be used to pay premiums.

If you are short on cash and are finding it challenging to continue paying your whole life insurance premium, you may be able to use the cash value of your policy to cover the premium. This option is available when your cash value reaches a certain point, and it can be helpful if you need to reduce your monthly expenses but want to keep your policy in place.

Using the cash value to pay premiums can help you keep your life insurance coverage while managing your expenses. However, it's important to note that any amount taken from your cash value account and not repaid before your death will reduce the death benefit paid to your beneficiary. Therefore, careful management of your cash value and premium payments is essential.

Consulting with a financial advisor or tax professional can help you understand the potential consequences of using your cash value to pay premiums and ensure that you make informed decisions regarding your whole life insurance policy.

Insuring Another Person's Life: Is It Possible?

You may want to see also

Frequently asked questions

The face value of a whole life insurance policy is the amount that will be paid to your beneficiaries when you die. The cash value, on the other hand, is a savings account that is funded by a portion of your premiums. When you cash out a whole life insurance policy, you receive the full cash value, not the face value.

There are a few ways to cash out your whole life insurance policy. You can surrender your policy, which means cancelling it and receiving the cash value minus any surrender fees. Alternatively, you can make a withdrawal from your policy or take out a loan from your cash value. Withdrawing or taking a loan will not cancel your policy, but it will reduce the death benefit.

There may be surrender fees or taxes associated with cashing out your whole life insurance policy. Surrender fees are usually higher for newer policies and don't apply after 10 to 15 years. You may also owe taxes on any gains made on the cash value portion of the policy.

Yes, there are a few alternatives to consider if you need access to funds. You could take out a home equity loan or line of credit, a personal loan, or borrow from your retirement account. These options may provide you with the funds you need without having to cash out your whole life insurance policy.