Mortgage life insurance is an optional product offered by lenders or third parties, such as insurance companies, to cover some or all of your mortgage in the event of your death. It is different from mortgage loan insurance, which you must buy if your down payment is less than 20% of your home's purchase price. While mortgage life insurance is not mandatory, cancelling it can be tricky. If you signed a contract agreeing to purchase mortgage life insurance, cancelling it may be considered a breach of contract, and the lender could demand full repayment of the mortgage loan. However, this does not mean you have to continue paying your lender for this coverage. You can explore alternative options, such as purchasing a term life insurance policy from an independent insurance broker, which may offer better coverage at a lower cost.

| Characteristics | Values |

|---|---|

| Is mortgage life insurance mandatory? | No, it is optional. However, if you have signed a contract agreeing to purchase it, you are bound by the terms of the contract. |

| Can you cancel it? | Yes, you can cancel it at any time. |

| What are the alternatives? | You can purchase a term life insurance policy from an independent insurance broker. |

| What are the benefits of mortgage life insurance? | It is convenient and easy to buy, and the premiums are not based on your individual medical situation. |

| What are the drawbacks of mortgage life insurance? | It is often not as cost-effective as other life insurance policies, and the longer you have the policy, the less it is worth. It also only covers your mortgage and not any other expenses. |

What You'll Learn

- Cancelling mortgage life insurance is possible, but you may be held in breach of contract

- You can cancel mortgage life insurance and get a normal life insurance policy instead

- You can cancel mortgage life insurance and get term life insurance instead

- You can cancel mortgage life insurance at any time but can't get it later in the mortgage

- You can cancel mortgage life insurance, but you may need to prove you're insured by someone else

Cancelling mortgage life insurance is possible, but you may be held in breach of contract

Mortgage life insurance is an optional product offered by lenders or third parties, such as an insurance company. It is designed to pay off some or all of your mortgage in the event of your death, plus some interest. However, it is different from mortgage loan insurance, which you must buy if your down payment is less than 20% of your home's purchase price.

When offered by a lender, mortgage life insurance is usually accompanied by a contract that you are bound to. If you cancel the insurance, you could be held in breach of contract, and the lender could demand full repayment of the mortgage loan. However, this does not mean that you are required to continue paying your lender for this coverage. You can explore alternative options, such as speaking to an independent insurance broker who can offer more comprehensive coverage at a lower cost.

Additionally, it is important to note that mortgage life insurance policies have a declining payout. This means that while you continue to pay the same premium, the coverage decreases over time as you pay down your mortgage. As a result, you may be paying the same premium for less coverage.

Before making any decisions, carefully review the terms and conditions of your mortgage contract and insurance policy. It is crucial to understand your rights and obligations to make an informed choice.

Insure Your Life, Health, and Property: A Comprehensive Guide

You may want to see also

You can cancel mortgage life insurance and get a normal life insurance policy instead

Yes, you can cancel mortgage life insurance and get a normal life insurance policy instead. In fact, mortgage life insurance is not mandatory and you can choose to get a life insurance policy from a third-party insurer.

Mortgage life insurance is an optional product that lenders or third parties, such as an insurance company, may offer you. When offered by a lender, it is important to note that this insurance protects the lender, not you. It is designed to pay off some or all of your mortgage in the event of your death, in addition to some interest. On the other hand, life insurance offers protection in the event of death and pays a tax-free death benefit to the beneficiary specified on the policy.

There are several advantages to choosing a life insurance policy over mortgage life insurance. Firstly, with life insurance, you have more control over the policy. You decide on the amount of insurance, the beneficiary, and how the insurance proceeds are used. Secondly, life insurance policies typically offer more flexibility in terms of coverage and payment schedules. You can purchase as much or as little life insurance as you want and choose from a variety of term lengths. Additionally, life insurance policies often provide personalized service from licensed life insurance advisors, ensuring that you and your family are properly protected.

If you decide to switch to a life insurance policy, it is important to follow the proper steps to cancel your mortgage life insurance. Contact your lender or insurance company to initiate the cancellation process. Be sure to review the terms and conditions of your mortgage life insurance policy, as there may be cancellation fees or other requirements. Additionally, make sure you have a new life insurance policy in place before cancelling your current coverage to ensure continuous protection.

Fidelity Life Insurance: Physical Exam Requirements and Details

You may want to see also

You can cancel mortgage life insurance and get term life insurance instead

Yes, you can cancel mortgage life insurance and get term life insurance instead. Here are some things to keep in mind when making this switch:

Cancelling Mortgage Life Insurance

Cancelling your mortgage life insurance policy is a significant decision and the process can vary depending on the type of coverage you have and how long you've had the policy. It's important to review the terms of your policy and understand any potential consequences or penalties for cancellation. Some policies may have a

Switching to Term Life Insurance

Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years, and is often a more affordable option. When switching to term life insurance, be sure to compare rates and coverage options from multiple providers to find the best fit for your needs. Consider the following:

- The length of the term: Choose a term that aligns with your financial obligations, such as the length of your mortgage or until your children become financially independent.

- The amount of coverage: Calculate your financial obligations, including your mortgage, daily expenses, and future expenses like college tuition, to ensure your coverage is sufficient.

- Additional coverage: Consider adding disability and critical illness insurance to your term life insurance policy for more comprehensive protection.

Benefits of Term Life Insurance Over Mortgage Life Insurance

Term life insurance offers several advantages over mortgage life insurance:

- Level premiums and coverage: With term life insurance, your premiums and coverage amount remain the same throughout the term, whereas mortgage life insurance premiums typically increase over time as your age and health status change.

- Payout flexibility: In the event of your death, term life insurance pays out directly to your chosen beneficiary, who can use the funds as needed, whereas mortgage life insurance payouts go directly to the bank to cover the remaining mortgage balance.

- Guaranteed payout: Term life insurance guarantees a payout to your beneficiary, whereas mortgage life insurance payouts are at the bank's discretion.

- Portability: Term life insurance policies are not tied to your mortgage, so you can take your policy with you if you switch lenders or move to a new home.

In summary, switching from mortgage life insurance to term life insurance can offer better coverage, more flexibility, and potentially lower costs. Be sure to carefully review your current policy, compare options, and seek advice from an independent insurance advisor or broker to make an informed decision.

Life Insurance and Drug Testing: Urine Sample Checks?

You may want to see also

You can cancel mortgage life insurance at any time but can't get it later in the mortgage

Mortgage life insurance is an optional product that lenders or third parties may offer you when you take out a mortgage. It is designed to pay off some or all of your mortgage in the event of your death, plus some interest. However, it is important to note that mortgage life insurance only covers your mortgage and not any other expenses.

You can cancel mortgage life insurance at any time. If you are within your cooling-off period, usually a 30-day window from starting the policy, you should be able to cancel without issue. After this period, you can still cancel at any time, but you may not get a refund for any premiums you have already paid. It is important to check the terms and conditions of your policy first, as there may be a fee for cancelling mid-way through.

To cancel your mortgage life insurance, you will need to contact your insurer via phone or email and explain that you would like to end the contract. It is important that you do not cancel your direct debit without doing this, as your insurer might not cancel the policy and you could end up in arrears.

While you can cancel your mortgage life insurance at any time, you may not be able to get mortgage insurance later on in the life of your mortgage. This is because mortgage life insurance premiums are often based on your age, so it will be more expensive to get life insurance at a later date. Additionally, as your mortgage insurance policy is tied to your mortgage balance, the longer you have the policy, the less it is worth.

Purchasing Life Insurance While on Medication: What You Need to Know

You may want to see also

You can cancel mortgage life insurance, but you may need to prove you're insured by someone else

Yes, you can cancel mortgage life insurance, but it's important to understand the implications and alternatives. Firstly, check the terms and conditions of your policy to understand any potential fees or consequences of cancellation.

Mortgage life insurance is different from other types of life insurance. It is specifically designed to pay off your mortgage in the event of your death, but it does not cover other expenses. The payout decreases over time as you pay off your mortgage, while the premiums often remain the same. This means that the longer you have the policy, the less value it offers. Additionally, mortgage life insurance is usually tied to the mortgage itself, so if you refinance or switch lenders, the policy may be cancelled.

Before cancelling your mortgage life insurance, consider alternative options. One option is to switch to a term life insurance policy, which could lower your monthly premiums while maintaining a consistent payout rate. Term life insurance is often more flexible, allowing you to choose the amount of coverage, the term length, and the beneficiary. It can also cover other expenses beyond just your mortgage.

If you decide to cancel your mortgage life insurance, be aware that you may need to prove that you have alternative coverage in place. This is especially important if your lender requires you to have life insurance as part of your contract. Cancelling your policy without having another one in place could put you in breach of contract, leading to potential demands for full repayment of the mortgage loan. Therefore, it is crucial to ensure that you have alternative coverage or a new policy in place before cancelling your existing mortgage life insurance.

ETFs: A Viable Alternative to Life Insurance Policies?

You may want to see also

Frequently asked questions

Mortgage life insurance is not mandatory, but some lenders may require you to have it. If you cancel, you could be held in breach of contract and the lender could demand full repayment of the mortgage loan.

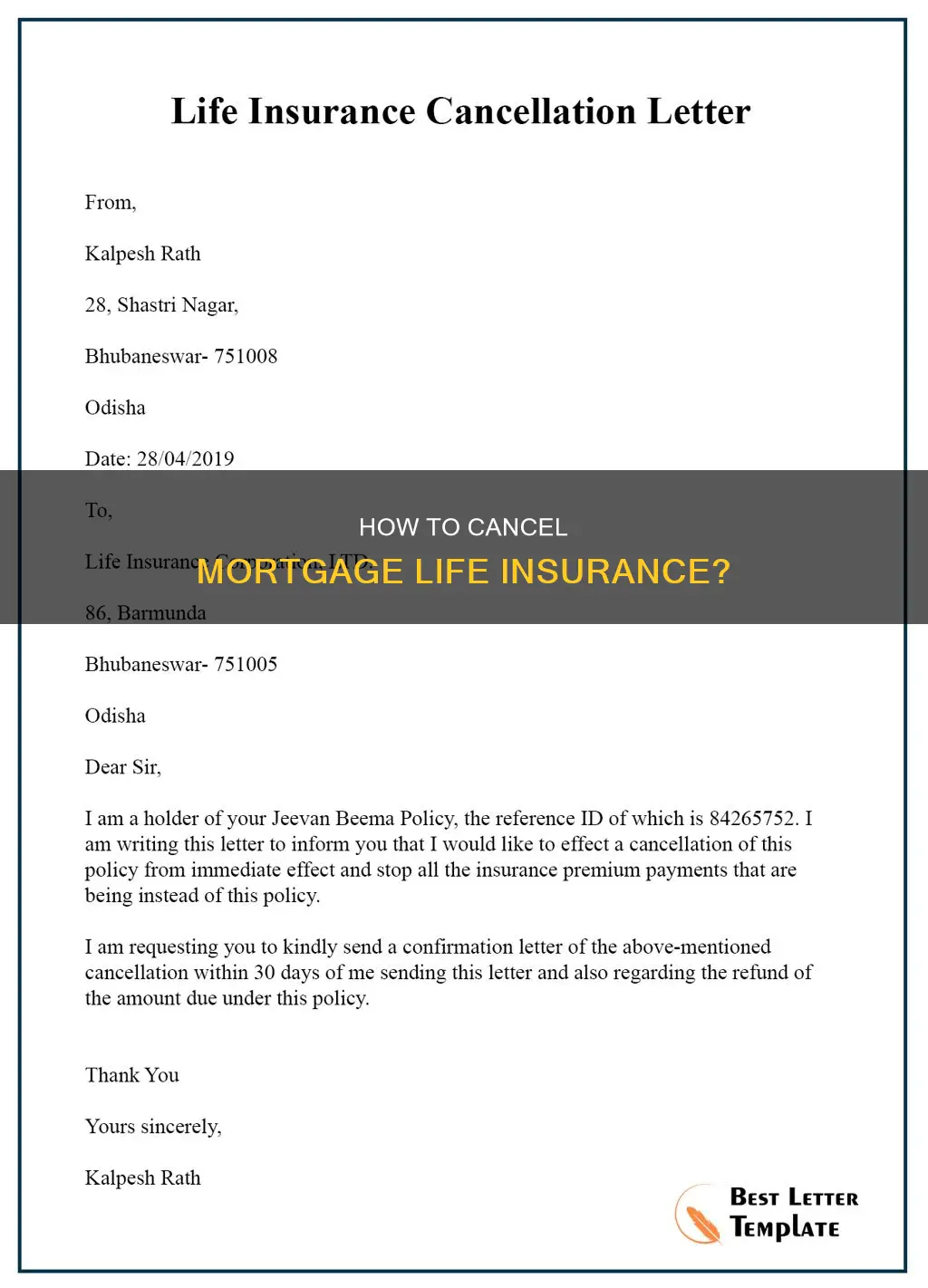

You can cancel your mortgage life insurance by contacting your insurer via phone or email. However, make sure you have another insurance policy in place before you cancel your current one.

Mortgage life insurance is specifically designed to pay off some or all of your mortgage in the event of your death, in addition to some interest. It is also convenient as you can get mortgage insurance at the same time as you get your mortgage.

Mortgage life insurance is often not as cost-effective as other life insurance. The longer you have the mortgage insurance policy, the less its worth because it is tied to your mortgage balance.