When considering purchasing life insurance, it's important to understand the application process. Prudential offers a range of life insurance products, and the first step is to find the right application for your needs. You can obtain Prudential life insurance applications through their official website, where you'll find a comprehensive guide and the necessary forms. Alternatively, you can reach out to a licensed insurance agent who can provide personalized advice and help you fill out the application accurately. Additionally, many financial advisors and brokers also have access to Prudential's application materials, offering a convenient way to get started on your life insurance journey.

What You'll Learn

- Online Platforms: Websites like Prudential's official site offer digital application forms

- Financial Advisors: Agents can provide applications for clients seeking personalized advice

- Branch Offices: Visit local Prudential branches for in-person application assistance

- Mail-in Forms: Download and mail completed forms to the insurer's address

- Mobile Apps: Prudential's app may allow quick and convenient application submission

Online Platforms: Websites like Prudential's official site offer digital application forms

When it comes to finding Prudential life insurance applications, one of the most convenient and efficient methods is to explore online platforms. Many insurance companies, including Prudential, have embraced the digital age and offer their services through websites, making the application process more accessible and user-friendly. Here's a guide on how to utilize these online resources:

Prudential's Official Website:

The first and most straightforward step is to visit Prudential's official website. Prudential, being a well-known insurance provider, has a comprehensive online presence. On their website, you will typically find a dedicated section for life insurance products. Look for a 'Life Insurance' or 'Apply Now' tab, which will lead you to the digital application forms. These forms are designed to guide you through the process step-by-step, ensuring you provide all the necessary information. You can fill out the forms online, and in some cases, you may be able to upload supporting documents digitally as well. This method is efficient, especially if you prefer the convenience of applying from the comfort of your home.

Online Application Forms:

Online platforms often provide a seamless experience, allowing you to complete the entire application process without leaving your browser. These websites usually have a user-friendly interface, making it easy to navigate through the different sections. You'll be prompted to enter personal details, health information (if required), and financial details. Some websites may also offer the option to save your progress and come back later, ensuring you can complete the application at your convenience. This feature is particularly useful if you need time to gather all the necessary documents before submitting the application.

Digital Convenience:

The beauty of online application forms is the convenience they offer. You can access these platforms from anywhere with an internet connection, eliminating the need to visit a physical office. This is especially beneficial for those with busy schedules or those who prefer a more discreet approach to insurance applications. Additionally, many online platforms provide 24/7 accessibility, allowing you to apply at your preferred time. This flexibility is a significant advantage over traditional application methods.

Streamlined Process:

By utilizing online platforms, the application process becomes more streamlined. You can quickly provide the required information, and in some cases, you may even receive instant quotes or pre-approval, giving you a sense of the coverage you can expect. This digital approach often results in faster processing times, which is advantageous when you're in a hurry to secure your life insurance coverage.

In summary, exploring online platforms for Prudential life insurance applications is a convenient and efficient way to initiate the process. With the official website and other authorized online portals, you can easily access digital application forms, ensuring a smooth and modern experience when securing your life insurance needs.

Life Insurance Payouts: When Do They Become Taxable?

You may want to see also

Financial Advisors: Agents can provide applications for clients seeking personalized advice

Financial advisors play a crucial role in helping clients navigate the complex world of insurance, and Prudential Life Insurance is a well-known provider in this space. When clients are seeking life insurance, it's often a significant financial decision, and having access to the right resources and applications can greatly benefit their journey. Here's how financial advisors can assist in this process:

Providing Application Support: Financial advisors can offer a comprehensive service by providing Prudential life insurance applications to their clients. These applications are designed to gather essential information about the insured individual, including personal details, health history, and financial information. By having these forms readily available, advisors can streamline the process, ensuring that clients can quickly and efficiently provide the necessary data. This efficiency is particularly valuable for clients who may have busy schedules and prefer a seamless application experience.

Personalized Advice: One of the key advantages of working with a financial advisor is the personalized guidance they offer. When clients approach an advisor for life insurance, they are likely seeking tailored advice. Advisors can use the Prudential applications as a starting point to collect client data and then provide expert recommendations. This might include suggesting appropriate coverage options, explaining different policy types, and addressing any concerns or questions the client may have. By offering personalized advice, advisors can help clients make informed decisions that align with their unique financial goals and circumstances.

Streamlining the Process: The application process for life insurance can be lengthy and intricate. Financial advisors can simplify this process by ensuring that clients have all the necessary documents and information at their fingertips. They can guide clients through the application, verifying the accuracy of the data and ensuring that no crucial details are missed. This level of support can significantly reduce the time and effort required to complete the application, making the overall experience more accessible and less daunting for clients.

Building Client Trust: Offering Prudential life insurance applications and providing personalized advice can significantly enhance the relationship between a financial advisor and their clients. By demonstrating expertise and a client-centric approach, advisors can build trust and establish themselves as reliable partners in financial planning. This trust is invaluable, as it encourages clients to seek further advice and recommendations, fostering a long-term advisory relationship.

In summary, financial advisors can be instrumental in facilitating the acquisition of Prudential life insurance by providing applications and offering personalized advice. This approach not only benefits clients by simplifying the application process but also strengthens the advisor-client relationship, leading to more successful and satisfying financial outcomes. It is a strategic move for advisors to ensure their clients receive the best guidance and resources when making important insurance decisions.

Life Insurance Claims: Time Limits After Death

You may want to see also

Branch Offices: Visit local Prudential branches for in-person application assistance

If you're in the market for Prudential life insurance, one of the most convenient and efficient ways to get started is by visiting your local Prudential branch office. These physical locations are designed to provide a comprehensive and personalized experience for customers, ensuring that you can find the right insurance plan to suit your needs. Here's a step-by-step guide on how to utilize this approach:

Locate Your Nearest Branch: Begin by using Prudential's online tools or contacting their customer service to find the branch office closest to you. Prudential often has a wide network of offices across various regions, so you can easily find one that's conveniently located. You can also check their website for a branch finder tool, which will provide you with the address, contact details, and operating hours of each branch.

In-Person Application Process: When you visit the branch, you'll be greeted by knowledgeable and friendly staff who can guide you through the application process. They will assist you in filling out the necessary forms, ensuring that all the required information is accurately provided. This in-person approach allows for immediate clarification of any questions or concerns you might have, making the process smoother and more efficient. The representatives can also help you understand the various insurance options available and recommend the best plan based on your specific requirements.

Benefits of Branch Visits: There are several advantages to choosing this method. Firstly, it provides a more personalized experience, allowing you to receive tailored advice and support. You can also benefit from the expertise of the local staff, who are familiar with the specific needs and preferences of the community. Additionally, visiting a branch office ensures that you have all the necessary resources and documentation readily available, streamlining the application process.

Additional Services: Prudential branch offices often offer more than just insurance applications. They may provide financial advice, retirement planning, and other related services. This one-stop approach can be beneficial if you require comprehensive financial solutions. You can discuss your long-term financial goals and receive expert guidance on how Prudential's insurance products can fit into your overall financial strategy.

Remember, while online applications and digital platforms are convenient, there's still value in the personal touch provided by physical branch offices. Visiting a local Prudential branch can offer a more comprehensive and satisfying experience, ensuring that you make an informed decision about your life insurance coverage.

Life Insurance for Minor Beneficiaries: How is it Paid Out?

You may want to see also

Mail-in Forms: Download and mail completed forms to the insurer's address

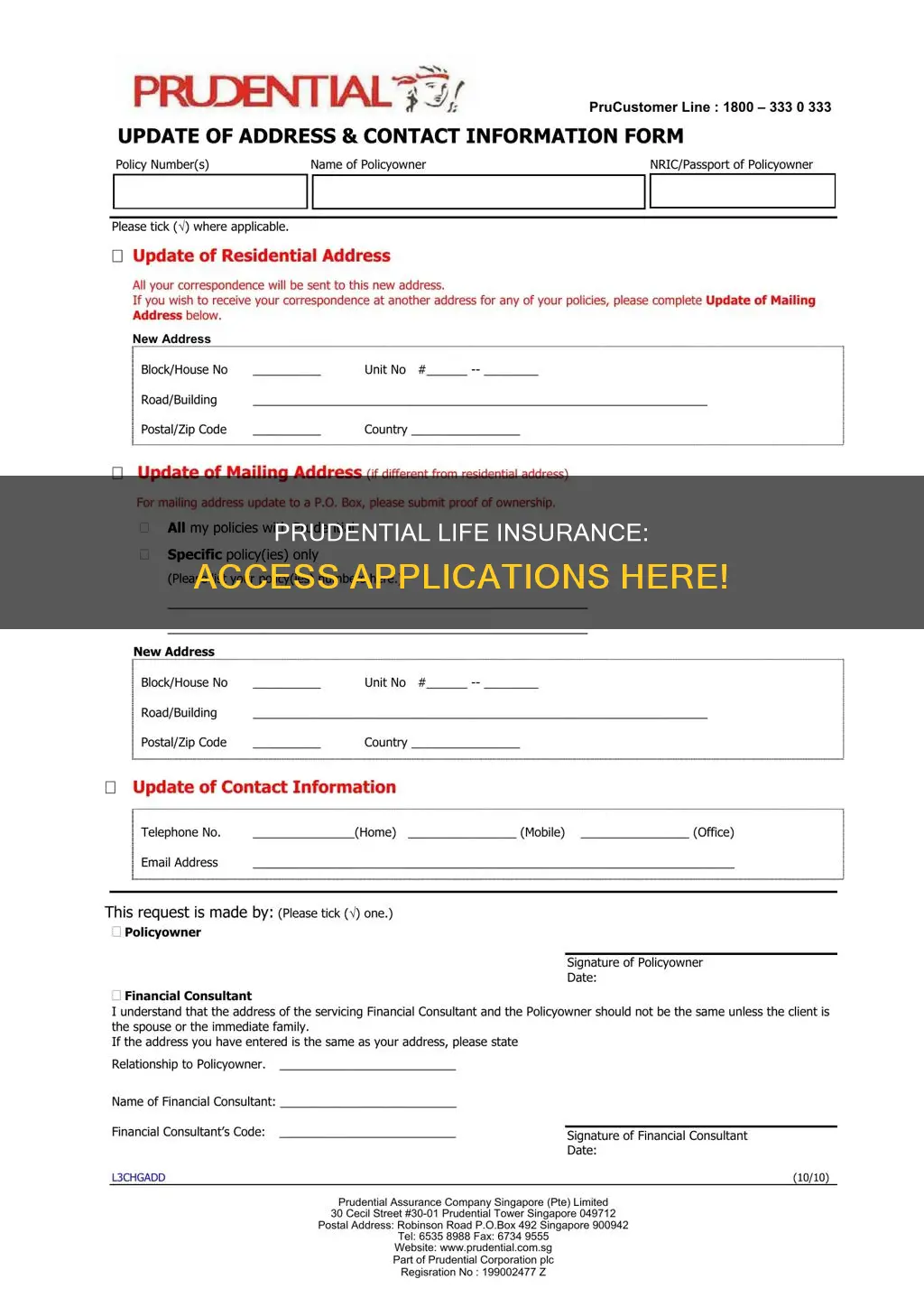

If you're looking to apply for Prudential Life Insurance, you can follow a straightforward process by downloading the necessary forms and mailing them in. Here's a step-by-step guide to help you navigate this method:

Step 1: Access the Prudential Website

Start by opening your preferred web browser and visiting the official Prudential website. In the search bar, type "Prudential Life Insurance Applications" or a similar query to locate the relevant page. Look for a section dedicated to customer resources, forms, or insurance applications.

Step 2: Locate the Application Forms

Once you're on the Prudential website, navigate through the menu options until you find the 'Forms' or 'Downloads' section. Here, you should be able to locate the application forms for life insurance. These forms are typically available in PDF format, ensuring you can easily download and print them.

Step 3: Download and Complete the Forms

Click on the appropriate form(s) to download them to your computer or device. Carefully read through the instructions and fill out the application form(s) with accurate and complete information. Double-check all the details to ensure there are no errors, as this may lead to delays in processing your application.

Step 4: Gather Required Documents

In addition to the application form, Prudential may require supporting documents. These could include proof of identity, such as a driver's license or passport, and financial information. Gather these documents before proceeding to ensure a smooth application process.

Step 5: Mail the Completed Forms

After filling out the forms and gathering the necessary documents, it's time to mail your application. Locate the address provided by Prudential for insurance applications. Enclose the completed forms and supporting documents in a pre-paid envelope or package, ensuring they are securely sealed. Send it via a reliable mailing service to guarantee timely delivery.

Remember, when downloading and mailing forms, always use the official Prudential channels to ensure the security and validity of your application. This method provides a structured approach to obtaining life insurance, allowing you to complete the process at your own pace while ensuring all necessary steps are followed.

Who Has Life Insurance on Me?

You may want to see also

Mobile Apps: Prudential's app may allow quick and convenient application submission

In today's fast-paced world, the ability to manage personal finances and insurance needs on the go is highly valued. Recognizing this, Prudential, a well-known insurance provider, has developed a mobile app that revolutionizes the way individuals can apply for life insurance. This app is designed to streamline the application process, making it quick, convenient, and accessible to a wide range of customers.

The Prudential mobile app offers a user-friendly interface, ensuring that the application process is intuitive and straightforward. Upon launching the app, users are guided through a series of simple steps. The app begins by requesting basic personal information, such as name, contact details, and date of birth. This initial step is crucial for verifying the applicant's identity and ensuring a secure process. Following this, the app prompts users to provide financial details, including income, assets, and any existing insurance coverage. By gathering this information, Prudential can assess the applicant's eligibility and tailor the policy accordingly.

One of the key advantages of the Prudential app is its ability to facilitate digital document submission. Instead of traditional paper applications, users can upload required documents, such as proof of identity, income statements, and medical records, directly through the app. This digital approach saves time and eliminates the hassle of printing, scanning, and physically submitting documents. The app's secure file upload feature ensures that sensitive information remains protected, providing users with peace of mind.

Furthermore, the app's design allows for a personalized experience. Users can save their progress and return to complete the application at their convenience. This flexibility is particularly beneficial for individuals with busy schedules or those who prefer a step-by-step approach. The app also provides instant feedback, notifying users of any missing information or errors, ensuring a smooth and efficient application process.

With the Prudential mobile app, the once complex and time-consuming task of applying for life insurance has been transformed into a seamless experience. Users can now complete the entire application process from the comfort of their homes or while on the go, saving time and effort. This innovative approach to insurance application submission is a testament to Prudential's commitment to providing convenient and accessible financial services.

Key Person Life Insurance: Protecting Your Business's Future

You may want to see also

Frequently asked questions

You can find Prudential Life Insurance applications on the official Prudential website. Simply go to their website and look for the "Apply Now" or "Get a Quote" section, where you'll find the necessary forms and guides. You can also contact their customer service team for further assistance and to request physical copies of the application forms.

Yes, apart from the official website, you can reach out to a licensed Prudential insurance agent or broker. They can provide you with the required applications and guide you through the process. Additionally, some financial advisors or insurance brokers might have access to these applications and can assist clients in completing them.

It is generally recommended to obtain application forms directly from the official sources. While some third-party websites might offer similar forms, they may not be up-to-date or accurate. To ensure you have the correct and most recent application materials, it's best to use the resources provided by Prudential directly or through their authorized representatives.