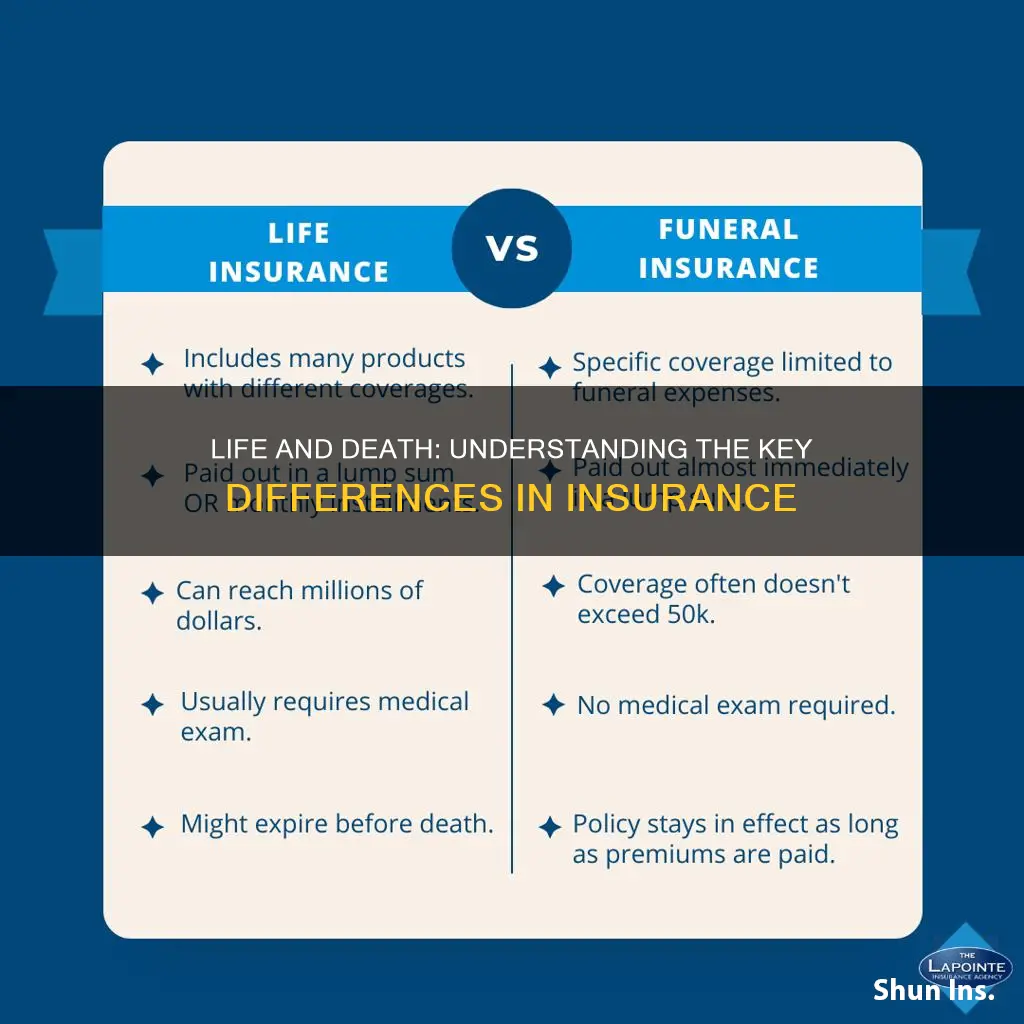

Life and death insurance are two distinct types of insurance policies that provide financial protection and peace of mind. While both serve to safeguard individuals and their loved ones, they differ in their primary focus and coverage. Life insurance is designed to offer financial support to beneficiaries in the event of the insured individual's death, ensuring that their dependents can maintain their standard of living and cover essential expenses. On the other hand, death insurance, also known as burial insurance or final expense insurance, is specifically tailored to cover the costs associated with funeral and burial expenses, providing a sense of security during a challenging time. Understanding these differences is crucial for individuals to choose the right insurance coverage that aligns with their specific needs and financial goals.

What You'll Learn

- Coverage Duration: Life insurance provides coverage for a specific period, while death insurance offers coverage until the insured's death

- Payout Purpose: Life insurance pays out to beneficiaries upon the insured's death, whereas death insurance provides a lump sum for immediate needs

- Term vs. Permanent: Life insurance can be term or permanent, while death insurance is typically term-based

- Beneficiary Selection: Both types allow for beneficiary designation, but life insurance offers more flexibility in beneficiary changes

- Cost and Premiums: Death insurance premiums are often lower due to shorter coverage periods, contrasting with life insurance's varying costs

Coverage Duration: Life insurance provides coverage for a specific period, while death insurance offers coverage until the insured's death

The concept of insurance is a crucial aspect of financial planning, and understanding the differences between various types of insurance policies is essential for making informed decisions. When it comes to life and death insurance, the primary distinction lies in the duration of coverage and the purpose of the policy.

Life insurance is a financial product designed to provide financial security to the beneficiaries in the event of the insured's death. It offers coverage for a specific period, often referred to as the 'term' of the policy. This term can vary, ranging from a few years to several decades. During this term, the insurance company promises to pay out a predetermined amount if the insured individual passes away. For example, if you purchase a 20-year term life insurance policy, the coverage will be in effect for two decades, and the death benefit will be paid out if you die within this period. This type of insurance is particularly useful for individuals who want to ensure their family's financial stability during a specific life stage, such as when they have children or a mortgage.

On the other hand, death insurance, also known as whole life or permanent insurance, provides coverage for the insured's entire lifetime. This means that as long as the insured individual remains alive, the policy remains in effect, and the death benefit is guaranteed to be paid out upon their passing. The primary advantage of this type of insurance is the long-term financial security it offers. With death insurance, the insured and their beneficiaries can have peace of mind knowing that a financial safety net is in place for the long term. This policy type is often more expensive than term life insurance due to the extended coverage and the insurance company's commitment to pay out the death benefit regardless of the insured's age at the time of death.

The key difference in coverage duration is that life insurance is time-limited, providing protection for a specific period, while death insurance offers lifelong coverage. This distinction is crucial when choosing the right insurance policy, as it aligns with an individual's financial goals and the level of security they wish to provide for their loved ones. Understanding these differences can help individuals make more informed decisions about their insurance needs and ensure they have the appropriate coverage to protect their families.

Smoking: Life Insurance Premiums and Policy Impact

You may want to see also

Payout Purpose: Life insurance pays out to beneficiaries upon the insured's death, whereas death insurance provides a lump sum for immediate needs

The primary distinction between life insurance and death insurance lies in their payout purposes and the timing of the payments. Life insurance is designed to provide financial security and support to the beneficiaries of the insured individual after their passing. When the insured person dies, the life insurance policy is activated, and the death benefit is paid out to the designated beneficiaries. This payout can be a significant financial resource for the family, covering various expenses such as funeral costs, outstanding debts, mortgage payments, or even providing for the long-term financial needs of the dependents. The purpose is to ensure that the loved ones of the deceased have the necessary financial support during a challenging time.

On the other hand, death insurance, also known as burial insurance or final expense insurance, is specifically tailored to cover the costs associated with funeral arrangements and other immediate expenses that arise after an individual's death. This type of insurance provides a lump sum payment to the policyholder or their beneficiaries, which can be used to cover funeral and burial costs, as well as any outstanding debts or expenses that the deceased may have left behind. Death insurance is often purchased to alleviate the financial burden on the family during a difficult period, ensuring that the practical aspects of the funeral and related matters are taken care of.

The key difference is that life insurance focuses on providing long-term financial security and support to the beneficiaries, ensuring their well-being and ability to maintain their standard of living even after the insured's passing. It is a more comprehensive and future-oriented financial planning tool. In contrast, death insurance is more immediate and specific, addressing the short-term financial needs and practical considerations that arise when an individual dies.

It's important to note that while death insurance provides a lump sum for immediate needs, it typically has a shorter coverage period compared to life insurance. Life insurance policies can vary in duration, offering coverage for a specific number of years or even for the entire lifetime of the insured individual. This flexibility allows policyholders to choose the coverage that best suits their needs and financial goals.

In summary, life insurance and death insurance serve distinct purposes. Life insurance provides ongoing financial support to beneficiaries, ensuring their long-term stability and well-being. Death insurance, on the other hand, offers a lump sum payment to cover immediate expenses and funeral costs, providing much-needed financial relief during a challenging time. Understanding these differences is crucial for individuals to make informed decisions about their insurance needs and ensure they have the appropriate coverage to protect their loved ones.

Bill Collectors and Life Insurance: What Are Their Rights?

You may want to see also

Term vs. Permanent: Life insurance can be term or permanent, while death insurance is typically term-based

When it comes to life insurance, there are two main types to consider: term and permanent. Term life insurance provides coverage for a specific period, often 10, 20, or 30 years, and it pays out a death benefit if the insured individual passes away during that term. This type of policy is straightforward and offers a clear-cut financial safety net for beneficiaries. On the other hand, permanent life insurance, also known as whole life insurance, provides coverage for the entire lifetime of the insured individual. It offers a cash value component that grows over time, and the death benefit is typically guaranteed for as long as the policy is in force.

The key difference lies in the duration of coverage. Term life insurance is designed to provide temporary protection, ensuring financial security for a defined period. It is an excellent choice for individuals who want coverage for a specific goal, such as covering mortgage payments or providing for children's education. During the term, the policyholder pays premiums, and if an insured event occurs, the death benefit is paid out. Once the term ends, the policy may be renewed, but premiums could increase, or it might not be available anymore.

In contrast, permanent life insurance offers long-term financial security. It provides coverage for the entire life of the insured, ensuring that beneficiaries receive the death benefit regardless of when the insured person passes away. The premiums for permanent life insurance are typically higher than term life insurance due to the lifelong coverage. Additionally, the cash value component allows policyholders to build equity over time, which can be borrowed against or withdrawn as needed.

Death insurance, often referred to as final expense insurance, is primarily designed to cover the costs associated with one's passing. It is typically a term life insurance policy, providing coverage for a specific period, usually until a certain age. Death insurance is intended to help cover funeral expenses, outstanding debts, or any other financial obligations that may arise when an individual passes away. This type of insurance is often more affordable and provides a safety net for those who may not qualify for more extensive coverage.

In summary, while life insurance can be either term or permanent, death insurance is generally term-based. Understanding the differences between these types of policies is essential for making informed decisions about financial protection and ensuring that your loved ones are taken care of in the event of your passing. It is always advisable to consult with a financial advisor or insurance professional to determine the best coverage options based on individual needs and circumstances.

Life Insurance and Suicide: What Coverage Includes

You may want to see also

Beneficiary Selection: Both types allow for beneficiary designation, but life insurance offers more flexibility in beneficiary changes

When it comes to insurance, understanding the nuances between different types is crucial, especially when it comes to life and death insurance. While both types of insurance serve similar purposes, they offer distinct advantages and considerations, particularly in the area of beneficiary selection.

In the context of insurance, a beneficiary is the person or entity designated to receive the proceeds or benefits of a policy upon the insured individual's death. This process of naming a beneficiary is a fundamental aspect of both life and death insurance policies. However, the level of flexibility and control over beneficiary designation varies between the two types of insurance.

Life insurance, a more comprehensive term, encompasses various types of policies, including term life, whole life, and universal life. One of the key advantages of life insurance is the ability to change beneficiaries easily. Policyholders can modify their beneficiary designation at any time, providing a high degree of flexibility. This flexibility is particularly beneficial in situations where life circumstances change, such as marriage, divorce, the birth of a child, or the death of a close family member. For instance, a policyholder may initially name a spouse as the primary beneficiary but later decide to add children as contingent beneficiaries, ensuring their financial security.

In contrast, death insurance, often referring to term life insurance, typically offers less flexibility in beneficiary changes. Once a beneficiary is designated, it can be challenging to modify the policy without significant administrative procedures. This lack of flexibility may be a concern for individuals who anticipate changes in their personal or family structure.

The difference in flexibility between life and death insurance can be attributed to the nature of these policies. Life insurance policies are often more comprehensive and may include additional features like cash value accumulation, making them more adaptable to changing needs. On the other hand, death insurance is primarily designed to provide a financial safety net in the event of the insured's passing, with less emphasis on long-term financial planning.

In summary, while both life and death insurance allow for beneficiary designation, life insurance provides a more dynamic approach to beneficiary selection. This flexibility is a valuable feature for individuals seeking to adapt their insurance policies to life's changing circumstances, ensuring that their beneficiaries remain appropriate and relevant over time.

Understanding CIR: A Crucial Life Insurance Metric

You may want to see also

Cost and Premiums: Death insurance premiums are often lower due to shorter coverage periods, contrasting with life insurance's varying costs

The primary distinction between life and death insurance lies in their respective coverage durations and associated costs. Life insurance is a long-term financial product designed to provide financial security for beneficiaries over an extended period, often until the insured individual's death. This type of insurance offers a comprehensive safety net, ensuring that the insured's loved ones are financially protected in the event of their passing. The premiums for life insurance can vary significantly depending on several factors, including the insured's age, health, lifestyle, and the amount of coverage chosen. As such, the cost of life insurance can be relatively high, especially for those with pre-existing health conditions or engaging in risky activities.

On the other hand, death insurance, also known as term life insurance, is a more specialized and temporary form of coverage. It is typically designed to provide financial protection for a specific period, often 10, 20, or 30 years. The primary purpose of death insurance is to offer a safety net for a defined period, ensuring that beneficiaries are financially secure during that time. One of the key advantages of death insurance is its affordability. Since the coverage is limited to a specific duration, the insurance company assumes less risk, resulting in lower premiums compared to long-term life insurance. This makes death insurance an attractive option for individuals seeking cost-effective coverage for a particular period.

The shorter coverage period of death insurance is a critical factor in its lower premiums. With a defined end date, the insurance company knows exactly when the coverage will terminate, reducing the potential financial burden over an extended period. This predictability allows for more accurate risk assessment and pricing, often resulting in more competitive rates. In contrast, life insurance policies, especially those with longer coverage periods, may require the insurance company to account for potential risks over a more extended duration, leading to higher costs.

When considering the cost and premiums, it is essential to understand that death insurance provides a targeted and efficient solution for specific financial needs. For individuals seeking temporary coverage, such as those starting a family or purchasing a home, death insurance can offer peace of mind without breaking the bank. In contrast, life insurance is more comprehensive and suitable for long-term financial planning, ensuring that beneficiaries are protected throughout their lives.

In summary, the difference in cost and premiums between life and death insurance is primarily attributed to the varying coverage durations and the associated risks. Death insurance, with its shorter-term focus, offers more affordable options, while life insurance provides comprehensive long-term protection. Understanding these distinctions is crucial for individuals to make informed decisions when choosing the right insurance coverage for their specific needs and financial goals.

Canceling Life Insurance: Over the Phone Possible?

You may want to see also

Frequently asked questions

Life insurance and death insurance are essentially the same product, but they are often referred to by different names in different regions. Life insurance is the more common term used internationally, while death insurance is more prevalent in the United States. Both policies provide financial protection to the beneficiaries in the event of the insured person's death.

When you purchase a life insurance policy, you agree to pay regular premiums to the insurance company. In return, the insurer promises to pay a death benefit to your designated beneficiaries upon your passing. The death benefit can be a lump sum or an annuity, providing financial support to your loved ones during their time of need.

Life insurance offers several advantages. Firstly, it ensures financial security for your family, covering expenses like mortgage payments, education costs, or daily living expenses. It also provides peace of mind, knowing that your loved ones will be taken care of if something happens to you. Additionally, life insurance can be an essential tool for estate planning and wealth transfer.

Yes, many life insurance policies offer flexibility in terms of customization. You can typically choose the coverage amount, payment term (e.g., 10, 20, or 30 years), and beneficiary designation. Some policies also allow for additional riders or optional benefits, such as critical illness coverage or accidental death benefits, to enhance the policy's protection.

Yes, life insurance can provide tax benefits. In many countries, the death benefit paid to beneficiaries is generally tax-free. Additionally, the premiums paid for a life insurance policy may be tax-deductible, depending on the jurisdiction and the type of policy. It's always advisable to consult with a financial advisor or tax professional to understand the specific tax implications in your region.