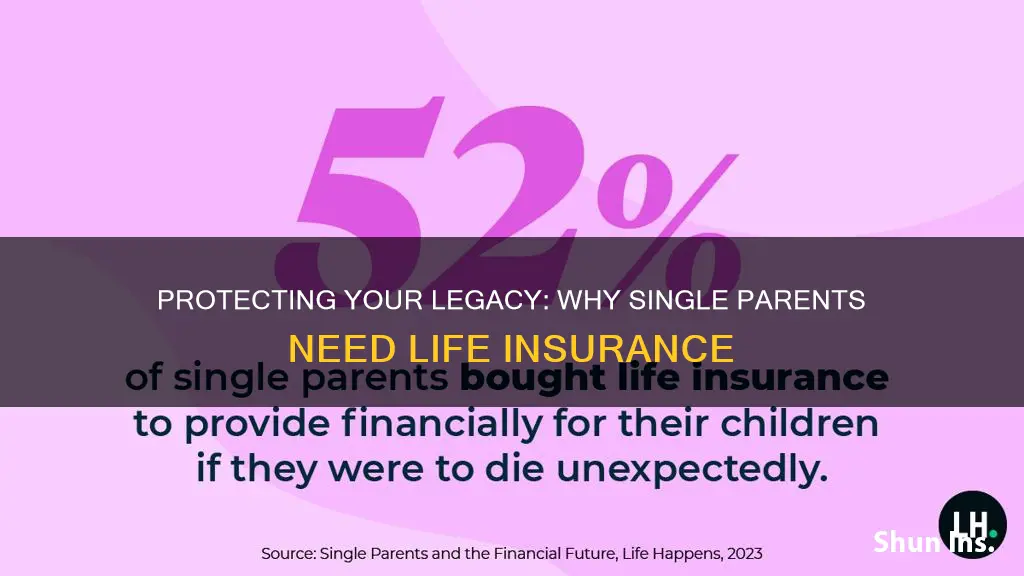

Single people with children often face unique financial responsibilities and concerns. While life insurance might not be the first thing that comes to mind for those without a partner, it can be an essential tool for protecting their loved ones. This insurance provides financial security for the child in the event of the parent's untimely death, ensuring that their educational needs, daily living expenses, and overall well-being are met. It offers peace of mind, knowing that the child's future is safeguarded, and it can be a crucial part of a comprehensive financial plan for single parents.

What You'll Learn

- Financial Security: Single parents need insurance to cover future expenses and protect their children's financial well-being

- Income Replacement: Life insurance ensures a steady income for the child in the event of the parent's death

- Education Funding: Policies can provide funds for the child's education, ensuring a secure future

- Medical Expenses: Insurance covers unexpected medical costs, protecting the child's health

- Emotional Support: A policy offers peace of mind, knowing the child is protected and loved

Financial Security: Single parents need insurance to cover future expenses and protect their children's financial well-being

Single parents often face unique financial challenges, and life insurance can be a crucial tool to ensure the long-term financial security of their children. Here's why this type of insurance is essential for single parents:

Protecting Against Future Expenses: Raising a child involves numerous expenses, from education costs to healthcare and everyday living expenses. As a single parent, you might be solely responsible for these financial obligations. Life insurance provides a safety net by offering a lump sum payment or regular income in the event of your passing. This financial cushion can help cover future expenses, ensuring your child's needs are met even if you're no longer around. For instance, the insurance payout can be used to pay for college tuition, medical bills, or even everyday living costs, providing a stable financial foundation for your child's future.

Securing Your Child's Financial Future: The primary goal of life insurance for single parents is to safeguard their child's financial future. By purchasing a policy, you are essentially providing a financial guarantee for your child's well-being. This insurance can help your child maintain their standard of living, access education funds, and even start their own financial journey without the added stress of financial burdens. The policy ensures that your child receives the necessary financial support to pursue their dreams and goals, even in your absence.

Peace of Mind: Knowing that your child's financial future is protected can offer significant peace of mind. As a single parent, you've already demonstrated strength and resilience in raising your child alone. Life insurance further empowers you by providing a sense of security and control over your child's future. It allows you to focus on the present and enjoy your time with your child, knowing that you've taken the necessary steps to protect their financial interests.

Customizable Policies: Life insurance policies can be tailored to suit the specific needs of single parents and their children. You can choose the coverage amount based on your child's anticipated expenses and future goals. Additionally, you can select the type of policy, such as term life insurance, which provides coverage for a specific period, or permanent life insurance, which offers lifelong coverage and a cash value component. This flexibility ensures that the insurance plan aligns perfectly with your financial objectives and your child's best interests.

In summary, life insurance is a vital consideration for single parents to secure their child's financial future and provide a safety net for unforeseen circumstances. It empowers single parents to take control of their child's financial well-being, offering protection and peace of mind. By investing in life insurance, single parents can ensure that their children have the resources they need to thrive and build a secure future.

Digital Broker's Impact: Unlocking Life Insurance Sales Potential

You may want to see also

Income Replacement: Life insurance ensures a steady income for the child in the event of the parent's death

Life insurance is a crucial financial tool that can provide much-needed security and peace of mind for single parents and their children. One of the primary reasons why single people's children should consider life insurance is to ensure a steady income replacement in the event of the parents' untimely death. This is especially important for single parents who may rely solely on their income to support their children.

When a parent passes away, the financial burden of raising a child can become overwhelming for the surviving parent, especially if they were the primary breadwinner. Without life insurance, the surviving parent might struggle to maintain the same standard of living and provide for their child's needs, including education, healthcare, and daily expenses. Life insurance steps in to fill this gap by providing a regular income stream to the child, ensuring that their financial needs are met even after the parent's passing.

The policy proceeds from a life insurance policy can be used to cover various expenses associated with raising a child. This includes educational costs, such as school fees, college tuition, and other educational resources. Additionally, the insurance payout can cover daily living expenses, such as food, clothing, and housing, ensuring that the child's basic needs are met. Over time, the income replacement provided by life insurance can help the child build a stable foundation for their future, allowing them to focus on their education and personal growth without the added stress of financial instability.

It is essential to choose the right type of life insurance policy to maximize the benefits for the child. Term life insurance is often recommended for this purpose, as it provides coverage for a specific period, typically until the child reaches a certain age or becomes financially independent. This ensures that the child receives the necessary financial support during their formative years. Moreover, term life insurance policies are generally more affordable, making it an accessible option for single parents.

In summary, life insurance is a vital consideration for single parents to ensure their children's financial security. By providing a steady income replacement, life insurance allows single people's children to maintain their standard of living and receive the necessary support for their upbringing. It is a proactive step towards safeguarding the child's future and should be given serious consideration by single parents.

Protective Life Insurance Payouts: Cashing In Your Check

You may want to see also

Education Funding: Policies can provide funds for the child's education, ensuring a secure future

Education funding is a critical aspect of planning for a child's future, especially for single parents or individuals who are the primary caregivers. Establishing a financial strategy that includes education funding can provide a secure and stable environment for the child's growth and development. This is particularly important for single parents who may face unique challenges in ensuring their child's financial well-being.

One effective policy to consider is setting up a dedicated education fund. This fund can be designed to accumulate savings specifically for the child's educational expenses, such as tuition fees, books, and other educational resources. By allocating a portion of your income regularly into this fund, you create a financial cushion that grows over time. The power of compound interest means that even small contributions can result in a substantial amount saved for the child's education. It is a proactive approach that ensures the child has the necessary financial resources when they embark on their academic journey.

Life insurance can also play a significant role in this context. While it is often associated with providing financial security for loved ones in the event of an untimely death, it can also be utilized to fund a child's education. Term life insurance, for instance, offers a death benefit that can be designated to pay for educational expenses. This ensures that even if the primary caregiver passes away, the child still has access to the necessary funds for their education. It provides a safety net and peace of mind, knowing that the child's future is protected.

Furthermore, life insurance can be structured to provide an income stream for the child during their educational years. This can be particularly beneficial if the child has specific educational goals or aspirations that require a steady financial support. By utilizing the death benefit or the policy's cash value, you can create a structured plan to provide for the child's education over an extended period. This approach ensures that the child's educational journey is well-funded and that they have the opportunity to pursue their chosen path without financial constraints.

In summary, implementing policies that focus on education funding is essential for single parents or caregivers to secure their child's future. By setting up dedicated education funds and exploring life insurance options, you can provide a stable financial foundation for your child's educational pursuits. These strategies empower you to take control of your child's financial future, offering them the best possible start in life and the tools to achieve their dreams. It is a thoughtful and proactive approach that demonstrates a commitment to the child's long-term well-being.

Waiting Periods for Life Insurance: What You Need to Know

You may want to see also

Medical Expenses: Insurance covers unexpected medical costs, protecting the child's health

Life insurance is an essential consideration for single parents, especially when it comes to safeguarding their children's well-being. One of the primary reasons single parents should prioritize life insurance is to ensure their children are protected financially in the event of their untimely passing. This is particularly crucial for single individuals who may not have a partner to rely on for financial support. By obtaining life insurance, parents can provide a safety net for their children, covering various expenses that may arise during their minority.

Medical expenses are a significant concern for any family, and this is especially true for single-parent households. Children often require regular medical check-ups, vaccinations, and specialized care, which can be costly. Unexpected illnesses or accidents can lead to substantial medical bills, and without proper insurance coverage, these costs can be overwhelming. Life insurance policies typically include a critical illness or accident benefit, which can help cover these unexpected medical costs. This coverage ensures that the child's health is protected, and the parent doesn't have to worry about accumulating debt to pay for essential medical treatments.

In the event of a parent's death, the insurance payout can provide financial security for the child's future. It can cover various expenses, such as education fees, extracurricular activities, and even daily living costs. This financial support can ease the burden on the surviving parent, allowing them to focus on providing emotional support and guidance to their child during a difficult time. Moreover, life insurance can also help with the practical aspects of raising a child, such as providing funds for a guardian or caregiver if the parent's passing leaves a gap in childcare.

Single parents should consider term life insurance, which offers coverage for a specific period, typically until the child reaches a certain age. This type of policy is often more affordable and provides adequate protection during the child's formative years. As the child grows older, the parent can review and adjust the policy to ensure it still meets their needs. Additionally, some life insurance policies offer flexible payment options, allowing parents to choose a plan that fits their budget without compromising on coverage.

In summary, life insurance is a vital tool for single parents to protect their children's future and well-being. It provides financial security, covering medical expenses and other essential costs that may arise during the child's life. By investing in life insurance, single parents can ensure their children are cared for and have access to the necessary resources, even in the absence of a second parent. It is a proactive step towards safeguarding the child's future and a wise decision for any single individual to make.

Whole Life Insurance: Interest Earned or Myth?

You may want to see also

Emotional Support: A policy offers peace of mind, knowing the child is protected and loved

For single parents, the decision to purchase life insurance can be a difficult one, especially when considering the emotional well-being of their children. However, it is a crucial step towards ensuring the child's future and providing them with the emotional support they need. Here's why:

Life insurance acts as a safety net, offering peace of mind to single parents. It provides a sense of security, knowing that your child will be financially protected in the event of your untimely passing. This is especially important for single parents who may have limited resources and rely solely on their income to provide for their children. By having a life insurance policy, you can ensure that your child's basic needs will be met, including education, healthcare, and everyday living expenses. This financial security allows you to focus on the present and create lasting memories with your child, knowing that their future is secure.

The emotional impact of losing a parent can be immense and long-lasting for children. It can lead to feelings of grief, confusion, and uncertainty about the future. With life insurance, you can provide your child with the emotional support they need during this challenging time. The policy ensures that your child will receive a lump sum payment or regular income, allowing them to maintain their standard of living and access the necessary resources for their well-being. This financial stability can help ease the emotional burden and provide a sense of continuity, knowing that your child's needs will be cared for.

Furthermore, life insurance can be a powerful tool to teach your child valuable life lessons. By involving your child in the process of choosing and understanding the policy, you can educate them about the importance of financial planning and the value of a secure future. This open communication can foster a sense of trust and security, allowing your child to grow up with a strong foundation.

In summary, life insurance provides single parents with the emotional support they need by offering peace of mind and financial security for their children. It ensures that your child's basic needs will be met, providing them with a stable environment to thrive. Additionally, it allows you to focus on the present and create lasting memories, knowing that your child's future is protected. By taking this step, you are not only securing your child's financial future but also providing them with the emotional foundation they need to navigate life's challenges.

Navigating Life Insurance: Your Essential Guide to Getting Started

You may want to see also

Frequently asked questions

Single parents often bear the primary responsibility for their children's well-being, including financial support. Life insurance can provide financial security for your children in the event of your passing, ensuring they have the means to cover essential expenses and maintain their standard of living.

A life insurance policy can be a valuable tool to secure your children's future. The proceeds from the policy can be used to pay for their education, cover living expenses, and provide a financial safety net until they reach adulthood. This ensures that your children's financial needs are met even if you're no longer around.

If you are the primary breadwinner, life insurance becomes even more crucial. In the event of your death, the policy's payout can help replace your income, covering daily expenses, mortgage or rent payments, and other financial obligations, ensuring your family's financial stability.

Absolutely. The financial security provided by life insurance can assist in funding your children's long-term goals, such as college tuition, starting a business, or purchasing a home. It offers peace of mind, knowing that their future aspirations are protected.

The amount of life insurance required depends on various factors, including your income, your children's age and future needs, and any outstanding debts or expenses. It is advisable to consult with a financial advisor to determine the appropriate coverage amount tailored to your specific circumstances.