The new life insurance rule has been a topic of much discussion and debate in the financial industry. This regulation, which aims to enhance consumer protection and transparency, has significant implications for both insurance companies and policyholders. It introduces stricter requirements for insurers, including more detailed reporting and disclosure of policy terms and conditions, to ensure that customers fully understand their coverage and any potential risks. The rule also mandates that insurance companies provide clearer information about the costs and benefits of various policies, helping individuals make more informed decisions. This new regulation is a step towards a more regulated and fair insurance market, offering greater security and clarity for those relying on life insurance policies.

What You'll Learn

- Enhanced Transparency: New rules require clear, detailed disclosures about policy terms and fees

- Stricter Underwriting Standards: Insurance companies must adhere to stricter medical and financial criteria for coverage

- Longer Conversion Periods: Policyholders have more time to convert term life to permanent life

- Increased Consumer Protection: Regulations aim to protect consumers from unfair practices and misleading information

- Digital Accessibility: Online platforms must provide easy access to policy information and support

Enhanced Transparency: New rules require clear, detailed disclosures about policy terms and fees

The recent regulatory changes in the life insurance industry have brought a significant focus on transparency, aiming to empower policyholders with clearer and more comprehensive information. One of the key aspects of these new rules is the emphasis on enhanced transparency, particularly regarding policy terms and fees. This shift in regulation is designed to ensure that individuals can make well-informed decisions when purchasing life insurance, fostering a more competitive and fair market.

Under the new guidelines, insurance companies are mandated to provide detailed and easily understandable disclosures about their policies. This includes a comprehensive breakdown of the policy's terms, conditions, and any associated fees. For instance, policyholders should receive clear explanations of the coverage amounts, the duration of the policy, and the specific benefits they are entitled to. Additionally, the rules require insurers to disclose all applicable fees, such as initial premiums, administrative fees, and any charges for additional services or riders.

The goal of this enhanced transparency is to eliminate the confusion and complexity often associated with life insurance policies. By presenting the information in a clear and structured manner, policyholders can better understand the costs and benefits of their chosen plan. This empowers individuals to compare different policies more effectively, ensuring they select the most suitable option for their needs. Moreover, it reduces the likelihood of misunderstandings or disputes between the policyholder and the insurance company.

These new rules also encourage insurers to provide regular updates and notifications about any changes to the policy. This could include adjustments to premiums, coverage amounts, or the introduction of new features. By keeping policyholders informed, the industry aims to build trust and foster long-term relationships with customers. As a result, individuals can feel more confident in their insurance choices, knowing they have access to accurate and up-to-date information.

In summary, the focus on enhanced transparency in life insurance regulations is a significant step towards improving consumer protection and market fairness. It ensures that policyholders receive the necessary details to make informed decisions, fostering a more competitive and customer-centric industry. With these new rules, individuals can navigate the complex world of life insurance with greater confidence and clarity.

Lifestyle Changes: Impacting Your Life Insurance Premiums?

You may want to see also

Stricter Underwriting Standards: Insurance companies must adhere to stricter medical and financial criteria for coverage

The insurance industry is undergoing significant changes with the introduction of new regulations aimed at improving the fairness and transparency of life insurance policies. One of the key aspects of these new rules is the implementation of stricter underwriting standards, which will impact how insurance companies assess and approve applications for life coverage. This shift towards more stringent criteria is designed to mitigate risks and ensure that insurers can provide reliable and sustainable policies.

Under the new guidelines, insurance providers must adhere to more rigorous medical and financial assessments when evaluating potential policyholders. This means that applicants will likely face more comprehensive health screenings and financial evaluations than before. For instance, insurers might require detailed medical histories, including information about pre-existing conditions, lifestyle choices (such as smoking or excessive alcohol consumption), and any recent medical procedures or treatments. These factors are crucial in determining an individual's risk profile and can significantly influence the terms and cost of a life insurance policy.

In addition to medical scrutiny, financial assessments will also play a more prominent role. Insurance companies will scrutinize an applicant's financial situation to gauge their ability to meet the policy's obligations. This includes evaluating income stability, debt levels, and overall creditworthiness. A thorough financial review ensures that the insurer can accurately assess the risk associated with providing coverage to a particular individual. As a result, those with substantial debts or unstable income sources may find it more challenging to secure favorable life insurance terms.

The stricter underwriting standards are expected to lead to more accurate risk assessments, which can benefit both the insurance companies and the policyholders. For insurers, it means reduced exposure to high-risk individuals, potentially improving the overall financial health of the company. For policyholders, this could result in more tailored and affordable coverage, as insurers will be better equipped to provide appropriate policies based on individual risk profiles. However, it may also mean that some individuals with pre-existing conditions or financial challenges might need to explore alternative insurance options or work on improving their health and financial situations to meet the new criteria.

In summary, the new life insurance rules mandate that insurance companies adopt stricter underwriting practices, focusing on detailed medical and financial assessments. This change aims to enhance the integrity of the insurance market and provide more sustainable and fair policies for all parties involved. As these regulations take effect, it is essential for both insurance providers and applicants to understand the new standards and their implications to navigate the life insurance landscape effectively.

Does Life Insurance Blood Test Detect Cancer?

You may want to see also

Longer Conversion Periods: Policyholders have more time to convert term life to permanent life

The recent regulatory changes in the life insurance industry have introduced a significant benefit for policyholders: longer conversion periods. This new rule allows individuals who initially purchase term life insurance to have an extended window of opportunity to convert their policy to permanent life insurance. This is a crucial development, as it provides policyholders with more flexibility and control over their insurance coverage, ensuring they can make the best financial decisions for their long-term needs.

Under the previous regulations, term life insurance policyholders often faced a limited time frame to decide whether they wanted to convert their policy. This could be a stressful and rushed decision, especially for those who were not entirely sure about the benefits of permanent life insurance. The new rule addresses this concern by providing a more extended conversion period, typically ranging from 10 to 20 years, depending on the insurance company and the specific policy terms. This extended timeframe allows policyholders to thoroughly evaluate their options and make an informed choice.

During this longer conversion period, policyholders can assess their financial situation, understand the long-term implications of permanent life insurance, and compare it with other insurance products. For instance, they can consider the potential tax benefits, the accumulation of cash value, and the guaranteed death benefit that permanent life insurance offers. This comprehensive evaluation ensures that policyholders can make a decision that aligns with their future goals and financial objectives.

Additionally, the longer conversion period can be particularly advantageous for those who initially purchased term life insurance as a temporary solution. It provides them with the option to transition to a more comprehensive and permanent insurance plan without feeling rushed. This is especially relevant for young families or individuals who are planning for the long term and want to ensure their loved ones are protected.

In summary, the introduction of longer conversion periods in life insurance policies is a significant improvement in consumer protection and financial planning. It empowers policyholders to make well-informed decisions about their insurance coverage, ensuring they have the necessary time to understand the benefits of permanent life insurance and choose the option that best suits their needs. This new rule is a step towards a more transparent and customer-centric insurance industry.

Life Insurance: Death's Companion or Just a Myth?

You may want to see also

Increased Consumer Protection: Regulations aim to protect consumers from unfair practices and misleading information

The recent regulatory changes in the life insurance industry have introduced a new era of consumer protection, ensuring that policyholders are better informed and safeguarded from potential pitfalls. These regulations are designed to address long-standing concerns and provide a more transparent and fair environment for consumers. One of the key focuses is on enhancing transparency and reducing the complexity of life insurance products. Insurance companies are now required to provide clear and concise information about their policies, including any potential risks, benefits, and associated fees. This means that consumers can make more informed decisions when purchasing life insurance, knowing exactly what they are signing up for.

Under these new rules, insurers must disclose any potential conflicts of interest and ensure that their agents or representatives act in the best interest of the policyholder. This transparency helps to build trust and ensures that consumers are not misled or manipulated during the sales process. For instance, if an insurance agent receives a commission for selling a particular policy, they must disclose this to the customer, allowing them to make an informed choice. This level of disclosure empowers consumers to ask the right questions and seek alternatives if needed.

The regulations also aim to protect consumers from unfair practices, such as hidden fees, excessive commissions, and misleading sales tactics. Insurance companies are now required to provide detailed breakdowns of costs and ensure that all charges are fair and reasonable. This includes providing clear explanations of surrender charges, which are fees levied when a policy is surrendered or canceled early. By making these charges transparent, consumers can better understand the financial implications and make more informed decisions about their long-term financial planning.

Additionally, the new rules emphasize the importance of accurate and timely information. Insurance providers must ensure that policy documents, summaries, and any marketing materials are free from misleading or exaggerated claims. This includes avoiding the use of confusing jargon and providing clear explanations of policy terms and conditions. By doing so, consumers can better understand their rights and obligations, and in the event of a dispute, they have a solid foundation to build upon.

In summary, the increased consumer protection regulations in the life insurance industry are a significant step towards a more transparent and fair market. These measures empower individuals to make informed choices, protect them from unfair practices, and ensure that insurance companies act responsibly. With these new standards in place, consumers can have greater confidence in the life insurance process, knowing that their interests are being safeguarded.

Life Insurance: Private Placement Benefits and Features

You may want to see also

Digital Accessibility: Online platforms must provide easy access to policy information and support

In today's digital age, ensuring accessibility and inclusivity in the insurance industry is more important than ever. The recent regulatory changes, often referred to as the 'New Life Insurance Rule', emphasize the need for online platforms to offer seamless access to policy information and support for all customers, including those with disabilities or special needs. This shift towards digital accessibility is a significant step towards creating a more equitable and user-friendly environment for policyholders.

Online life insurance platforms are now required to implement several key practices to meet these new standards. Firstly, they must ensure that their websites and mobile applications are compatible with assistive technologies. This includes screen readers, speech recognition software, and other tools that enable users with visual, auditory, or motor impairments to navigate and understand the content easily. For instance, implementing alternative text for images, ensuring keyboard accessibility, and providing clear and concise language in all communications are essential.

Secondly, these platforms should offer a range of communication options to cater to diverse customer needs. This might include email, phone, and live chat support, with the option for customers to choose their preferred method of contact. Additionally, providing a clear and easily accessible contact page with all relevant information, such as phone numbers, email addresses, and physical addresses, is crucial. This ensures that customers can quickly reach out for assistance without any barriers.

Another critical aspect is the provision of clear and concise policy information. Online platforms should present policy documents, terms, and conditions in a user-friendly manner, avoiding complex jargon and technical language. Using simple language, bullet points, and clear headings can significantly improve accessibility. Moreover, offering interactive tools or features that allow customers to customize their policy information according to their needs can be highly beneficial.

Furthermore, the implementation of a robust feedback mechanism is essential. Online platforms should encourage and facilitate customer feedback to identify and address any accessibility issues promptly. This can be achieved through user surveys, feedback forms, or even a dedicated customer support team that focuses on accessibility matters. By actively seeking feedback, insurance companies can ensure that their digital platforms remain accessible and user-friendly over time.

In summary, the 'New Life Insurance Rule' highlights the importance of digital accessibility in the insurance sector. Online platforms must adhere to these guidelines by providing accessible content, multiple communication channels, clear policy information, and an efficient feedback system. By doing so, insurance companies can create a more inclusive and user-friendly environment, ensuring that all customers, regardless of their abilities, can easily access and understand their policy information and receive the necessary support.

Life Insurance: Can Weight Impact Your Application?

You may want to see also

Frequently asked questions

The new life insurance rule, also known as the "Regulation of Insurance Companies and Agents," is a set of guidelines introduced by the Insurance Regulatory Authority (IRA) in 2023. This regulation aims to enhance transparency, protect consumers, and improve the overall insurance industry in the country.

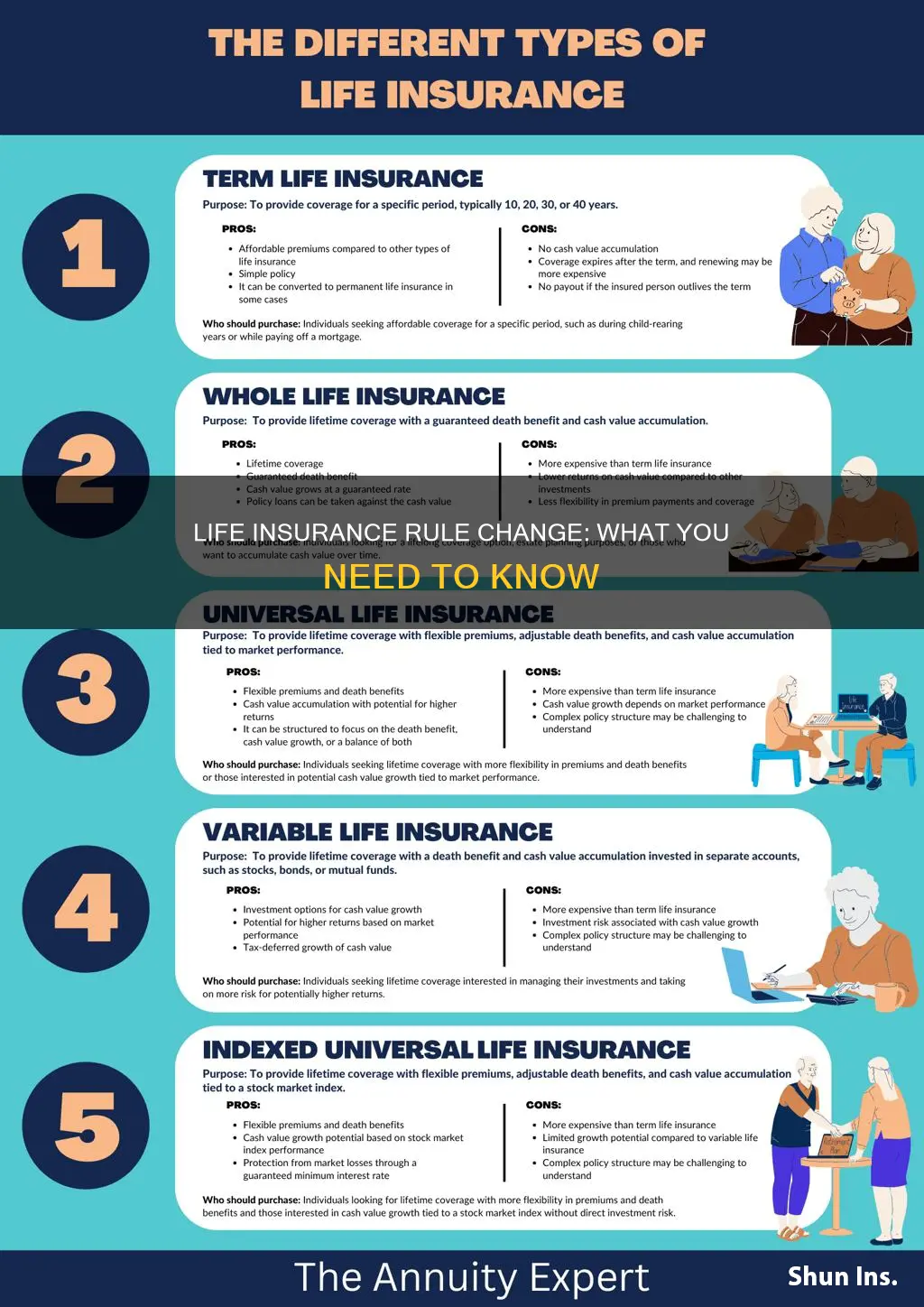

This rule brings several changes to life insurance policies. Firstly, it introduces a standardized policy document, making it easier for customers to understand the terms and conditions. It also requires insurers to provide more detailed information about policy benefits, fees, and potential risks. Additionally, the regulation sets guidelines for insurance agents, ensuring they are properly licensed and trained to offer accurate advice.

Absolutely! The new life insurance rule offers several advantages to policyholders. It ensures that insurance companies provide fair and clear communication regarding policy changes, claims, and settlements. Policyholders can now expect more frequent updates and notifications, allowing them to stay informed about their policies. Furthermore, the regulation promotes easier policy portability, making it convenient for individuals to switch insurers if needed.