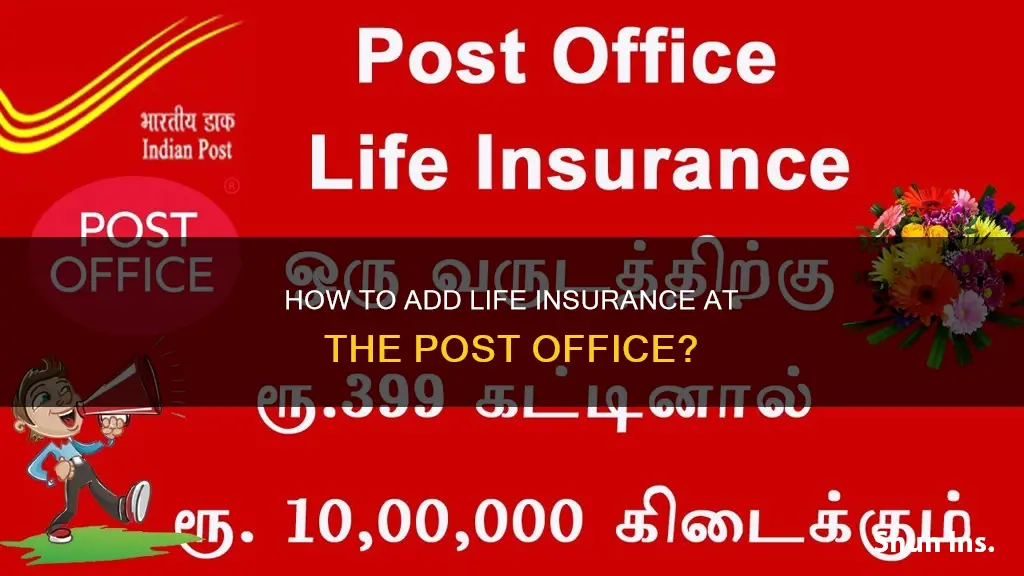

Life insurance is a policy that pays out a lump sum to your family or loved ones if you pass away or are diagnosed with a terminal illness during the policy term. It can offer your loved ones peace of mind and financial security. The Post Office offers life insurance with premiums from £7.54 a month, with a free £100 gift card. You can also add critical illness and children's cover at an extra cost.

| Characteristics | Values |

|---|---|

| What is life insurance? | A contract between you and an insurance company. |

| How does it work? | You make regular payments to the insurer. If you die or become critically ill during your policy, the insurer will pay out a lump sum to your beneficiaries. |

| Who is it for? | People who want to protect their loved ones' financial future, e.g. parents, homeowners, etc. |

| Types of life insurance | Term life insurance (for a specific amount of time) and whole life insurance (cover until death). |

| Why might you need life insurance? | Financial security for your family, help with mortgage payments, growing your savings, planning inheritance tax. |

| Joint life insurance | Insures two people under one policy with one monthly premium payment. Only pays out once if a policyholder dies within the term. |

| Critical illness cover | Can be added to your policy for an additional cost. Pays out a cash sum if you're diagnosed with a serious illness. |

| Children's cover | Can be added to your policy for an additional cost. Pays out a cash sum for accidental death or medical expenses if your child suffers a serious illness or injury. |

| Over 50s life cover | Available for UK residents aged 50-80. No medical check required. |

| Gift card offer | £100 gift card for Life Insurance and £125 gift card for Over 50s Life Cover. |

What You'll Learn

Critical illness cover

The critical illness cover is available for an additional cost and can be added when applying for Post Office Life Insurance or after the policy has started. The minimum cover amount is £10,000, and the maximum cover amount is £200,000 or 100% of the main policy cash sum, whichever is lower. It's important to note that critical illness cover cannot be purchased separately from life insurance.

When adding critical illness cover, you can choose the amount of coverage you need, ranging from £10,000 to £200,000. This optional coverage provides extra peace of mind and financial security for you and your family. In the event of a claim, the critical illness cover will end, but the main life insurance policy will continue until the end of its term.

The Post Office Life Insurance policy also offers children's cover as an optional add-on. This provides financial protection for your child if they suffer a serious illness, accidental death, or specified injury. The minimum cash sum for each insured child is £10,000, and the maximum is £30,000. There is no limit to the number of children that can be covered under this policy.

By adding critical illness and children's cover to your Post Office Life Insurance, you can ensure that you and your family have the financial support needed during difficult times. These optional extras provide reassurance and help ease the financial burden associated with critical illnesses or injuries.

Life Insurance Payout: Managing Your Sudden Windfall Wisely

You may want to see also

Children's cover

You'll pay an additional premium each month for your children's cover. When you apply for cover, the minimum cash sum for each insured child is £10,000, up to a maximum of £30,000. Each insured child can be covered for a different individual cash sum, based on the limits above. In the event of a claim for an insured child, the children's cover cash sum is payable once for each insured child. The cash sum payable is specified in your policy schedule.

The children must be under 21 years of age and must be resident in the United Kingdom at the start date; or if children's cover is added to the Post Office Life Insurance policy later, the date when they are accepted for cover. You cannot make a claim within the first 3 months of cover; if the condition was known to be present at birth or if the injury or illness occurred before the insured child's cover started.

Please refer to terms and conditions for exclusions and limitations.

COVID Antibody Test: Impact on Life Insurance Policies

You may want to see also

Level term cover

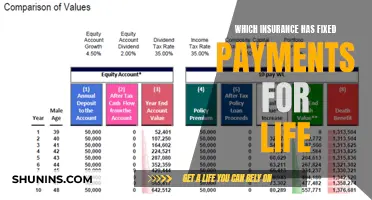

Level term life insurance is a type of life insurance policy that offers a level death benefit for the duration of the policy. This means that the payout to your beneficiaries will remain the same, regardless of whether you die in the third year or last year of your policy. It can also be called level benefit term life insurance, emphasising the death benefit as the fixed part of the policy.

Level term life insurance is sometimes used interchangeably with level premium term life insurance, which offers the additional benefit of a level premium that does not change over the life of the policy. However, it is important to clarify which product you are interested in when speaking to a life insurance agent or shopping online, as they are technically different.

Advantages of Level Term Life Insurance

- Predictability: You and your beneficiaries will know exactly how much money will be paid out if you die during the policy term, allowing for long-term planning.

- Budgeting: Level benefits often come with level premiums, making budgeting easier. The amount you pay for coverage remains the same year after year, assuming no changes are made to the policy.

- Long-term cost savings: Level term life insurance lets you lock in a rate and coverage amount based on your current health. If you are young and healthy, this means you can secure affordable life insurance coverage for 10, 20, or even 30 years.

Drawback of Level Term Life Insurance

Health-linked premiums: Rates for level term life insurance are based on your current health, and not everyone is as healthy as they could be or plan to be. If your health improves over the years, you may end up paying a level but inflated price for the entire term. In this case, an annually renewable policy for a shorter period may be more suitable, after which you can reapply for a level term policy once you've achieved a healthier lifestyle.

MetLife Group Insurance: Marijuana Testing and You

You may want to see also

Decreasing term cover

Decreasing term insurance is a type of renewable term life insurance with coverage that decreases over the life of the policy at a predetermined rate. The premiums are usually constant throughout the contract, and reductions in coverage typically occur monthly or annually. The terms of decreasing term insurance range from one year to 30 years, depending on the plan offered by the insurance company.

Decreasing term life insurance is usually used to guarantee the remaining balance of an amortizing loan, such as a mortgage or business loan, over time. It is also often purchased to provide personal asset protection. It may be required by a lender to guarantee the remaining balance of a loan until its maturity in case the borrower dies.

A decreasing term life policy is very similar and may mirror the amortization schedule of a mortgage. The predominant use of decreasing term insurance is for personal asset protection. Small business partnerships also use decreasing term life policies to protect indebtedness against startup costs and operational expenses.

In the case of small businesses, if one partner dies, the death benefit proceeds from the decreasing term policy can help fund continuing operations or retire the percentage of the remaining debt for which the deceased partner is responsible. The security allows the business to guarantee commercial loan amounts affordably.

Decreasing term insurance is a more affordable option than whole life or universal life insurance. The death benefit is designed to mirror the amortization schedule of a mortgage or other personal debt not easily covered by personal assets or income, like personal loans or business loans.

Decreasing term insurance allows a pure death benefit with no cash accumulation, unlike, for example, a whole life insurance policy. As such, this insurance option has modest premiums for comparable benefit amounts to either a permanent or temporary life insurance policy.

Decreasing term life insurance is a temporary type of life insurance designed to cover a specific financial need, usually a loan or other type of outstanding debt. It is commonly called DTA insurance or mortgage insurance. If you buy decreasing term life insurance directly from an insurance company, you will be able to choose the beneficiary. If you buy it as part of your loan, the bank is usually the beneficiary.

The Post Office offers decreasing term insurance as one of three types of life cover options, the others being level and increasing cover.

Liver Transplant Recipients: Getting Life Insurance After Surgery

You may want to see also

Increasing term cover

Increasing term insurance is a type of term life insurance in which the sum assured increases every year at a fixed rate. The sum assured is the amount of money that the insurer will pay out to the policyholder's nominees in the event of their death during the policy term. The fixed rate at which the sum assured increases is predefined and remains the same throughout the policy term. This rate can be expressed as a percentage or an absolute amount.

Features of Increasing Term Cover

- The premiums for increasing term insurance may increase or remain the same depending on the terms and conditions of the insurer.

- There may be a certain limit to the maximum raise of the sum assured amount. Once the sum assured amount reaches this limit, it remains constant for the rest of the policy tenure.

- In the event of the policyholder's death, a death benefit equal to the sum assured amount is paid to the nominee of the policy. Some increasing term insurance plans also offer different payout options, such as monthly, increasing monthly, or lump sum + monthly instalments.

- Riders are add-on benefits that can be added to the policy to enhance the base coverage. Common term insurance riders include critical illnesses, terminal illnesses, accidental death riders, accidental total permanent disability riders, and waiver of premium riders.

Advantages of Increasing Term Cover

- Helps to beat inflation: The coverage amount you purchase for your family now might not be enough to cover your liabilities in the future due to rising inflation. As the sum assured amount in this term plan increases every year, it helps to ensure the financial security of your loved ones.

- Helps to fulfil increased financial requirements: As you get older, your financial responsibilities may increase. An increasing term insurance plan helps to ensure that your coverage keeps up with your growing financial needs.

- Affordable premiums: The main benefit of buying an increasing term insurance policy is that it offers low and affordable premium rates.

- Tax savings: The premium paid towards the policy up to a maximum limit is eligible for tax exemption. Additionally, the death benefit received by the nominees of the plan is also tax-free.

Whole Life Insurance: Building Wealth Through Long-Term Policies

You may want to see also

Frequently asked questions

Life insurance is a contract between you and an insurance company. You make regular payments to the insurer, and in return, they provide financial security to your loved ones if you pass away or become critically ill.

Life insurance is a way to protect your loved ones financially if something unexpected happens to you. It can help cover living expenses, mortgage payments, funeral costs, and other financial burdens.

The Post Office offers different types of life insurance, including term life insurance and whole life insurance. Term life insurance covers you for a specific period, while whole life insurance covers you for your entire life as long as you pay the premiums.

The cost of life insurance from the Post Office depends on various factors, including your age, health, and lifestyle. Premiums start from £7.54 per month for a 31-year-old non-smoker in good health, buying £100,000 level cover over a 21-year term.

Yes, you can choose to add critical illness cover to your Post Office Life Insurance policy at an additional cost. Critical illness cover provides a lump sum payment if you suffer from a critical illness, such as a heart attack, stroke, or specific types of cancer.