Cashing out a whole life insurance policy is a big decision that can have a lasting impact on your financial future. Whole life insurance is a type of permanent life insurance that provides guaranteed protection for your entire life. It has two components: the face value, which is the amount paid to beneficiaries upon death, and the cash value, which is a savings account funded by a portion of your premiums. When you cash out a whole life insurance policy, you receive the full cash value, not your full premium contributions. There are several options for accessing the cash value, each with its own pros and cons, including surrendering the policy, making withdrawals, taking out loans, or selling the policy. It's important to carefully consider the advantages and disadvantages of each option before making a decision, as they can have financial implications and impact the death benefit for your beneficiaries.

| Characteristics | Values |

|---|---|

| When can you cash out? | After the first two years of the policy |

| What do you get? | The cash value of the policy, minus any surrender fees |

| What happens to the policy? | The policy ends |

| What happens to the death benefit? | The death benefit is reduced |

| What are the tax implications? | Withdrawals above the cost basis may result in taxable ordinary income |

| What happens if the policy owner is under 59 ½? | Any taxable withdrawal may be subject to a 10% federal tax penalty |

| What happens if the policy lapses or is surrendered? | Any outstanding loans considered gain in the policy may be subject to ordinary income taxes |

| What happens if the policy is a Modified Endowment Contract (MEC)? | Loans are treated like withdrawals, but as gain first, subject to ordinary income taxes |

| What happens if you don't pay the loan back? | The amount owed will be deducted from the death benefit |

What You'll Learn

Surrendering your policy

Surrendering your life insurance policy means cancelling the policy and receiving a lump sum payment, known as the surrender value. This is the cash value of the policy minus any surrender fees. Surrendering a policy is permanent and cannot be undone.

How to Surrender Your Policy

Most life insurance companies make it straightforward to surrender your policy. While you will need to check the specific details of your policy, most policies require you to contact your insurance company or agent. You may have to sign paperwork to confirm the surrender. Once this is done, you will likely just need to wait for the surrender value check. The insurance company will handle the details of calculating your final payout. This amount is generally your cash value balance minus any surrender fees or outstanding loans on your policy.

Surrender Fees and Taxes

Most policies require you to pay surrender fees when cancelling your policy early. Surrender charges vary by policy but often decrease over time, so the longer you wait to surrender your policy, the less you will pay in fees.

In addition to surrender fees, you may also have to pay taxes on your life insurance surrender value as taxable income. You will only pay income tax on interest or earnings over the amount you paid into the policy. Consult a tax professional to determine when life insurance is taxable.

When to Surrender Your Policy

There are generally no restrictions on when you can surrender a life insurance policy, as long as you have made it through the surrender period. This period varies by policy and can be anywhere from a couple of years to over 15 years. After the surrender period, the timing for surrendering your policy depends on your personal preference and financial situation.

Alternatives to Surrendering Your Policy

Before surrendering your policy, consider the following alternatives:

- Withdrawing from your policy: You can withdraw funds from the cash value of your policy. Withdrawing up to the amount you have paid in premiums is usually tax-free. Withdrawing more than this amount will likely be taxable.

- Borrowing against your policy: You can borrow against your policy's cash value. There is no loan application or credit check, and you can choose whether or not to pay the loan back. If you do not pay it back, the loan amount and interest will be deducted from the death benefit paid to your beneficiaries.

- Selling your policy: You can sell your policy to a third party for a lump sum that is greater than the cash value. This is known as a life settlement. You will no longer be responsible for premium payments, but the death benefit will go to the third party when you die.

- Using alternative sources of funding: You could consider taking out a home equity loan, a personal loan, or a loan from your retirement account. You could also use a credit card with a 0% introductory rate or borrow from your 401(k).

Insurability Evidence: Life Insurance's Critical Requirement Explained

You may want to see also

Withdrawing your entire cash value

Understanding Cash Value in Whole Life Insurance

Whole life insurance policies often include a cash value component, which grows as premiums are paid on time. This cash value can be accessed by the policyholder in various ways, including withdrawing the entire amount. However, it's important to note that not all whole life insurance policies offer cash value, and it may take a few years for the cash value to accumulate.

Surrendering Your Policy

One option for withdrawing your entire cash value is to surrender your policy. This means cancelling the policy and receiving the cash value, minus any surrender fees and outstanding debts or loans. Surrendering your policy will result in the loss of life insurance coverage, and your beneficiaries will not receive a death benefit. It's important to check with your insurance company about the surrender fees, as they can vary and are typically calculated as a percentage of the policy's cash value.

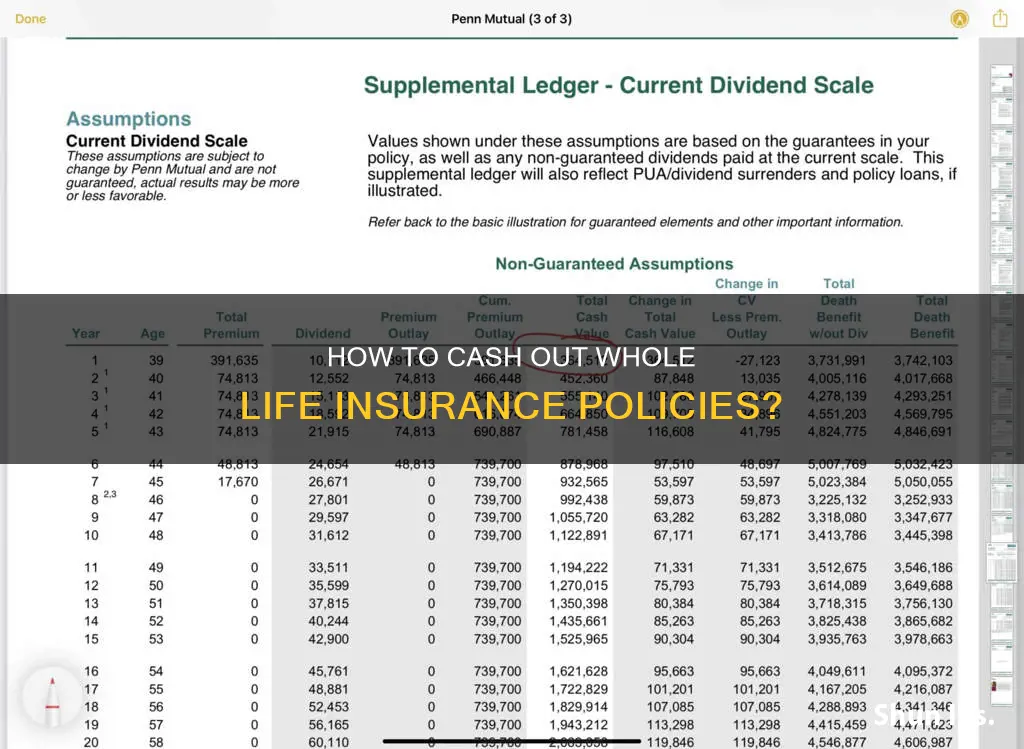

Timing and Tax Implications

When considering withdrawing your entire cash value, timing is important. Some policies may not have cash values during the first two years, and dividends may not be paid until the third year. Additionally, withdrawals above the cost basis may result in taxable ordinary income. If you are under a certain age, usually 59 ½, you may also be subject to a federal tax penalty on taxable withdrawals. Consult a financial professional to understand the tax implications for your specific situation.

Impact on Death Benefit and Policy Guarantees

Alternative Options

Before withdrawing your entire cash value, consider alternative options such as taking a loan against the policy, making a partial withdrawal, or using the cash value to cover your policy premiums. These options allow you to access cash while keeping your policy active. However, it's important to weigh the pros and cons of each option, as they can impact your policy and financial situation differently.

In conclusion, while it is possible to withdraw your entire cash value from a whole life insurance policy, it is a significant decision that should be made after careful consideration and consultation with financial professionals. The withdrawal will impact your policy's benefits and guarantees, and there may be tax implications to consider as well. Understanding the specific terms and conditions of your policy is crucial before making any decisions.

Kroger Life Insurance: What You Need to Know

You may want to see also

Making a partial withdrawal

- A partial withdrawal, also known as a partial surrender, allows you to access the cash value of your policy while keeping the policy in force. This means you can withdraw a portion of the cash value without cancelling the entire policy.

- Universal life insurance and whole life insurance policies permit partial withdrawals. However, whole life insurance policies have specific rules regarding partial withdrawals. Whole life policyholders can generally only withdraw cash value created through elective paid-up additions or dividends used to purchase paid-up additions. They cannot withdraw the guaranteed accumulation of base whole life cash value.

- When making a partial withdrawal, you may need to accept a reduction in the death benefit of your policy. For example, withdrawing $5,000 from a $500,000 whole life policy may result in a $125,000 reduction in the death benefit. This process can have significant consequences, so it should not be taken lightly.

- Partial withdrawals are usually available as soon as your policy has accrued cash value. However, some companies may charge early withdrawal fees during the first two years of the policy to encourage long-term investments.

- Withdrawals up to the amount you have paid in premiums are typically not taxable. However, withdrawals that exceed this amount may be subject to taxes. Additionally, withdrawals that reduce your cash surrender value could cause your premiums to increase to maintain the same death benefit, or your policy could lapse.

- Partial withdrawals are best suited for situations where the need for cash is permanent, and you do not plan on putting the money back into the policy. If the need for cash is temporary, or you intend to return the money, a loan against the policy may be a better option.

- Before making a partial withdrawal, it is essential to consult with a financial professional to understand the specific terms and conditions of your whole life insurance policy.

Universal Life Insurance: Investment Options Available?

You may want to see also

Borrowing money from your life insurance

When you borrow from your life insurance policy, your insurer lends you money while using the cash value of your policy as collateral. This means that you do not actually withdraw any money from the policy itself, and it can continue to accumulate. However, the loan will reduce the available cash value and death benefit of your policy. If you pass away before repaying the loan, the amount you owe, including any interest, will be deducted from the death benefit that your beneficiaries receive. Therefore, it is important to consider the impact on your loved ones before taking out a loan against your life insurance policy.

Another thing to keep in mind is that life insurance companies add interest to the loan balance. If left unpaid, this interest can cause the loan to exceed the policy's cash value and result in a policy lapse. In this case, you may owe taxes on the borrowed amount. Therefore, it is crucial to make regular interest and premium payments to avoid a policy lapse.

The process of borrowing from your life insurance policy is straightforward and does not require an approval process, credit check, or income verification. The only requirement is that you have sufficient cash value built up in your policy, which can take several years. The limit for borrowing is typically set at no more than 90% of the policy's cash value, but this may vary depending on the insurer.

Interest rates for life insurance loans are generally lower than those for personal loans or credit cards, making it a relatively affordable option. Additionally, there is no fixed repayment schedule, and you can pay back the loan at your own pace. However, it is important to stay on top of interest and premium payments to avoid a policy lapse and ensure the loan does not exceed the cash value.

In conclusion, borrowing from your life insurance policy can be a convenient way to access cash, especially if you need funds quickly and do not want to risk other assets. However, it is important to carefully consider the potential risks, such as reduced death benefits and policy lapse, and ensure that you understand the terms and conditions of your specific policy before making any decisions.

Denied Life Insurance? What You Need to Know

You may want to see also

Covering your premium payments

Whole life insurance is a permanent life insurance policy that remains in force for the life of the insured as long as the premiums are paid. Whole life insurance policies are more expensive than term life insurance policies because they cover the insured for their entire life and include a cash value component. This cash value component can be used to cover premium payments.

Whole life insurance policies typically feature level premiums, meaning the amount paid every month stays the same. However, there are some whole life insurance policies that offer modified premium structures, where premiums are lower for the first few years and then increase.

When you pay your premiums, the money goes towards the policy's cash value, which can be withdrawn or borrowed against later in life. This cash value grows tax-free, but withdrawals and loans will reduce the death benefit. Withdrawing more than you've contributed to the cash value may also be taxed.

If you are unable to pay your premiums, you can use the cash value of your whole life insurance policy to cover these payments. This will ensure that your policy remains in force and that your beneficiaries will still receive a payout upon your death.

It is important to note that withdrawing or borrowing against the cash value of your whole life insurance policy will reduce the death benefit. Additionally, if you do not repay any loans taken against the policy, this amount will be deducted from the death benefit. Therefore, it is crucial to weigh the benefits of accessing the cash value against the potential reduction in the death benefit.

In summary, whole life insurance policies offer a cash value component that can be used to cover premium payments. While this can be a useful feature, it is important to consider the potential impact on the death benefit and ensure that you can repay any loans taken against the policy.

Benefits of Multiple Life Insurance Policies for You

You may want to see also

Frequently asked questions

Yes, you can cash out your whole life insurance policy. This is known as "surrendering" your policy and will result in the cancellation of your insurance policy. You will receive the cash value of your policy, minus any surrender fees and taxes.

Yes, there are a few alternatives to cashing out your policy. You can make a partial withdrawal, borrow money from your policy, or use the cash value to cover your premium payments. These options allow you to access cash while keeping your policy in place.

The pros of cashing out include simplicity, low-interest rates, and no impact on your credit score. The cons include a lower death benefit, the possibility of withdrawal or loan restrictions, and the risk of your insurance policy lapsing.

Generally, withdrawals up to the amount of premiums paid are not taxable. However, withdrawals that exceed this amount may be subject to taxes. Additionally, if your policy is a Modified Endowment Contract (MEC), withdrawals may be subject to a 10% federal tax penalty if the policy owner is under 59 ½ years old.