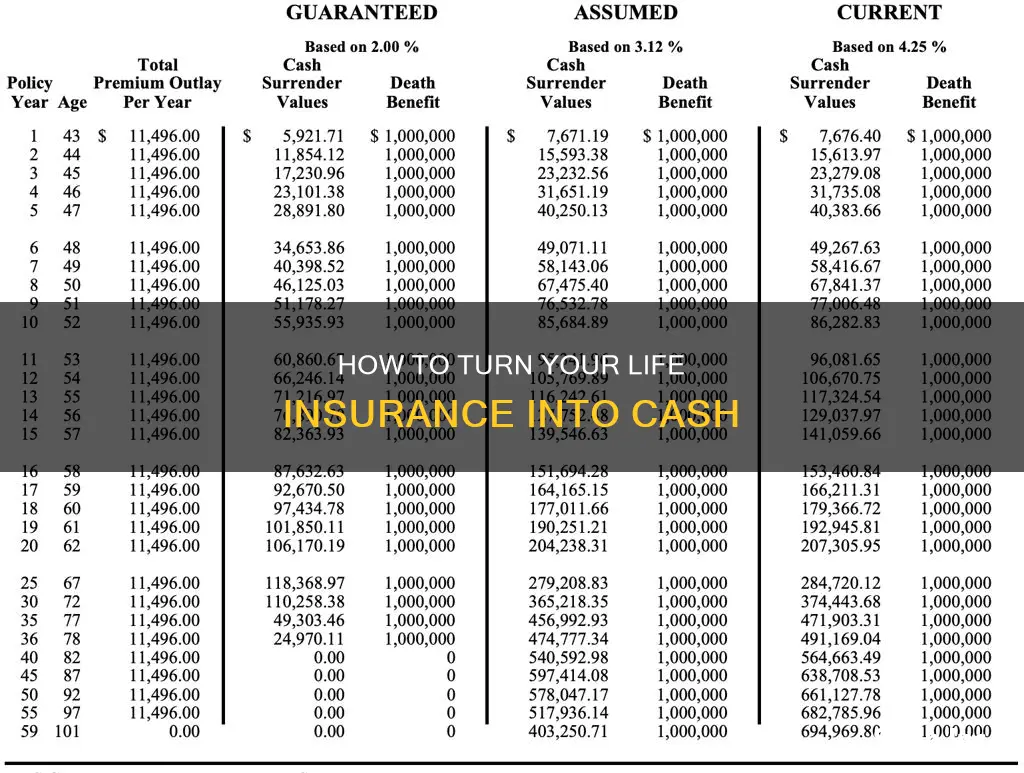

Life insurance is typically purchased to provide financial security for loved ones after the policyholder's death. However, life insurance policies can also be converted to cash while the policyholder is still alive. This is possible through various means, including loans, withdrawals, surrendering the policy, or selling the policy. The specific options depend on the type of life insurance policy, with permanent policies such as whole life and universal life insurance being the most common types that can be converted to cash. Term life insurance policies, on the other hand, usually do not offer a cash-out option. It is important to carefully consider the pros and cons of each option, as well as the potential financial implications and impact on the coverage provided for beneficiaries.

| Characteristics | Values |

|---|---|

| Types of life insurance that can be converted to cash | Permanent life insurance (whole life and universal life) |

| Types of life insurance that cannot be converted to cash | Term life insurance |

| Options for converting permanent life insurance to cash | Taking a loan, withdrawing cash value, surrendering the policy, paying premiums with cash value, using living benefits, or selling the policy |

| Options for converting term life insurance to cash | Converting to a permanent policy |

| What happens to unused cash value | It typically goes back to the insurance company after the policyholder's death |

| Tax implications of cashing out a life insurance policy | Generally tax-free up to the amount of premiums paid; taxes may apply on earnings or if a policy with a loan lapses |

| Pros of cashing out a life insurance policy | Access cash value, low-interest rate on loan, cover or eliminate premiums |

| Cons of cashing out a life insurance policy | Reduced death benefit, potential tax implications, less future earnings |

What You'll Learn

Surrendering a life insurance policy

When you surrender a life insurance policy, you are effectively cancelling your coverage. In return, your insurer will send you a cheque for the policy's cash surrender value. This value is the money that has built up in your policy's cash component over time, minus any surrender fees and taxes. Surrender fees typically range from 10-35% and are usually highest in the early years of the policy, phasing out over time. Most policies also have a waiting period of at least 15 years before you are able to surrender them.

The decision to surrender a life insurance policy depends on your individual circumstances. Some common reasons for surrendering a policy include no longer needing coverage, finding a better or more affordable policy, or needing cash urgently. It's important to carefully weigh the pros and cons before making a decision, as surrendering a policy can have significant financial implications.

Life Insurance: Geico's Offer and Your Options

You may want to see also

Withdrawing cash from a life insurance policy

Types of Life Insurance Policies

There are two main types of life insurance policies: term life and permanent life. Term life insurance is typically less expensive and provides coverage for a predetermined amount of time. It does not build any cash value, so you cannot withdraw cash from this type of policy. On the other hand, permanent life insurance policies are more expensive but provide coverage for your entire life and can build cash value. This type of policy can be further categorized into whole life and universal life. Whole life insurance offers fixed premiums, death benefits, and a guaranteed rate of cash value growth. Universal life insurance provides more flexibility, allowing you to adjust your premiums and death benefits within a certain range.

Accessing Cash Value

If you have a permanent life insurance policy that has accumulated cash value, there are several ways to access that cash while you are still alive:

- Withdrawal: You can withdraw cash from your permanent life policy, usually up to the amount you have paid in premiums, without incurring income taxes. However, this may reduce your death benefit, and there could be potential fees or taxes associated with the withdrawal.

- Loan: You can borrow money from your insurer, using your policy as collateral. This option usually has lower interest rates compared to personal or home equity loans, and there is no loan application or credit check required. However, any unpaid balance will reduce your benefits, and you will have to pay interest on the loan.

- Surrender: You can cancel your insurance policy and receive the surrender value in a lump sum or over time. This option will result in the loss of your life insurance coverage, and your beneficiaries will not receive a death benefit. There may also be surrender fees and taxes that reduce the amount you receive.

- Use Cash Value to Pay Premiums: You can use the accumulated cash value to pay your life insurance premiums, which can be helpful if you want to reduce expenses while retaining your coverage.

- Sell the Policy: You can sell your policy to a third party or a life settlement company for a lump sum that is greater than the cash value but less than the death benefit. The buyer will then be responsible for premium payments and will receive the death benefit upon your death.

Considerations

Before deciding to withdraw cash from your life insurance policy, carefully consider the pros and cons of each option. Weigh the immediate financial benefits against the potential long-term impact on your policy's performance and the reduced death benefit for your beneficiaries. Additionally, be sure to read the fine print and understand all the fees, taxes, and penalties associated with withdrawing cash from your policy. Consulting a financial advisor can help you make an informed decision that aligns with your overall financial plan and needs.

Life Insurance and Child Support: New York's Complex Reality

You may want to see also

Borrowing from a life insurance policy

The process of borrowing against a life insurance policy involves using the policy's cash value as collateral to take out a loan from the insurance company. There is usually no approval process, credit check or income requirement, and the funds can be used for anything. The interest rates on these loans are typically lower than those for personal loans or credit cards, ranging from 5% to 8%. However, it is important to note that unpaid life insurance loans may reduce the death benefit or cost you your policy.

When borrowing against a life insurance policy, there are a few key considerations to keep in mind. Firstly, the amount you can borrow is limited by the insurer, usually up to 90% of the policy's cash value. Secondly, it may take several years for the policy to accumulate enough cash value to borrow against. Thirdly, the loan must be repaid to avoid reducing the death benefit for your beneficiaries and risking a policy lapse. Finally, it is important to consider the tax implications, as unpaid loans or a policy lapse may result in taxes on the borrowed amount.

In conclusion, borrowing from a life insurance policy can be a convenient option for those with permanent life insurance policies who need quick access to cash. However, it is important to understand the risks and considerations involved, such as reduced death benefits, policy lapse, and tax implications, to make an informed decision.

Sarcoidosis: Life Insurance Options and Availability

You may want to see also

Selling a life insurance policy

Selling your life insurance policy is an option if you no longer need, want, or can afford it. By selling your policy, you can receive a cash payout and free up some room in your budget.

The process of selling a life insurance policy involves the following steps:

- Application: You complete an application and grant the settlement company permission to obtain information about your policy and health.

- Documentation: The settlement company underwriters gather information about your policy and request a copy of your medical records.

- Appraisal: Underwriters determine the market value of your policy, considering its investment potential and your health.

- Offer: The settlement company makes an offer, which you can accept or decline.

- Closing: If you accept the offer, you review and sign the closing package. Once you return the signed documents, the settlement company notifies your insurance provider, and you receive the funds.

What to consider

- Eligibility: To sell your policy, you typically need to be the policy's owner and the named insured. The policy must also meet certain requirements, such as being an individual policy with a minimum death benefit.

- Timing: The selling process can take between 60 and 120 days, depending on how quickly your insurance company and healthcare providers respond to information requests.

- Cooperation: Selling a life insurance policy requires the cooperation of both the policy owner and the insured person. The policy owner grants access to policy information, while the insured person grants access to medical records.

- Tax implications: A portion of the settlement may be considered taxable income, and the specific tax consequences depend on various factors such as the amount of the settlement and the cash value of the policy.

- Public assistance: The extra income from the sale may affect your eligibility for public assistance programs such as Medicaid.

- Alternatives: Before selling your policy, consider alternatives such as using the cash value of the policy, converting to a whole life insurance policy, or seeking an accelerated death benefit.

The amount of money you can get for selling your life insurance policy varies and depends on several factors, including your age, health, premiums, and the type of policy you have. According to the Life Insurance Settlement Association (LISA), the average life settlement is 20% of the policy's face value. For example, if your policy has a $100,000 benefit, you might receive $20,000 from selling it.

Life Insurance Dividends: Assignable or Not?

You may want to see also

Using cash value to pay premiums

Using the cash value of a life insurance policy to pay premiums is a popular option for older policyholders who want to use retirement income for living expenses but still want to keep their life insurance coverage. This is because permanent life insurance policies can be expensive, ranging from a few hundred dollars a month for a healthy 30-year-old with a $500,000 whole life policy, to four times that amount for a healthy 60-year-old.

Using the cash value to pay premiums can be a good way to reduce monthly expenses while keeping the policy in place. However, it's important to note that any amount taken from the cash value account and not repaid before the policyholder's death will reduce the death benefit paid to the beneficiary.

Additionally, it's worth considering that it can take a few years for the cash value in a policy to grow to a usable sum. And, if you're thinking of using the cash value to pay premiums, it's important to check with your insurer to understand the requirements and costs involved.

Another option for accessing the cash value of a life insurance policy is to take out a loan against the cash value balance. Insurers often offer these loans once policyholders have paid a certain amount into the policy. Life insurance loans typically come with lower interest rates than personal loans or home equity loans, and there are no credit or income checks required. However, an outstanding loan could reduce the cash value growth, and if the policyholder dies before paying off the loan, the outstanding balance will be deducted from the death benefit.

Withdrawing funds directly from the policy is another option for accessing cash value. Withdrawals are typically tax-free up to the amount that has been paid into the policy, but any amount above this may be subject to income tax. Withdrawals will also usually result in a reduction to the death benefit, and may set back the growth of the cash value account.

Marketing Term Life Insurance: Strategies for Success

You may want to see also

Frequently asked questions

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance does not typically offer a cash-out option, whereas permanent life insurance policies such as whole life and universal life insurance include a cash value component that can be converted to cash.

There are several ways to access the cash value of a permanent life insurance policy, including withdrawing a portion of the cash value, taking out a loan against the policy, surrendering the policy and receiving the cash surrender value, or selling the policy to a third party through a life settlement.

Yes, it's important to consider the tax implications when converting life insurance to cash. Withdrawing more than you've paid in premiums may be taxable, and surrendering a policy may result in taxes on any gains earned on the cash value portion. Additionally, selling a policy through a life settlement may incur income taxes on the amount received.

Converting life insurance to cash can provide immediate financial benefits, such as supplementing retirement income or covering large expenses. However, it's important to weigh the potential reduction in the death benefit for your beneficiaries and the impact on the growth of your policy's cash value. Surrendering a policy may also result in surrender fees and the loss of life insurance coverage.