Emphysema is a serious lung condition that affects millions of people worldwide. It is a form of chronic obstructive pulmonary disease (COPD) and is caused by damage to the alveoli, the tiny air sacs in the lungs. This damage results in larger air spaces instead of many small air sacs, reducing the total air surface of the lungs and leading to shortness of breath. While emphysema has no cure, treatments can help manage symptoms and slow its progression. As a progressive disease, emphysema raises important questions about life insurance options for those affected. So, can you get life insurance if you have emphysema?

| Characteristics | Values |

|---|---|

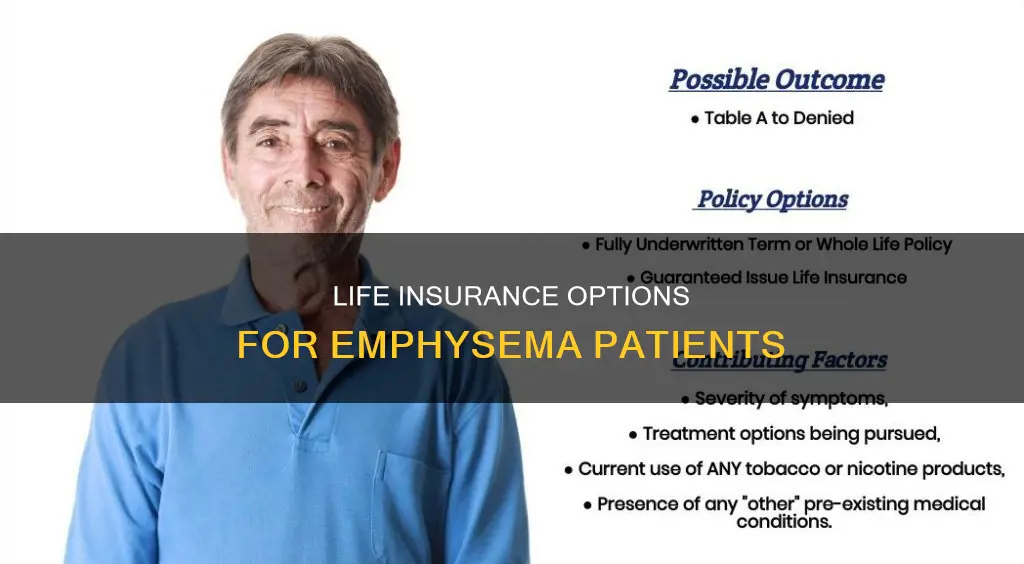

| Can you get life insurance with emphysema? | Yes, but it can be challenging. Some insurers may deny coverage or charge higher premiums. |

| Factors considered by insurers | Risk of mortality, severity of the condition, overall health, lifestyle, age, gender, occupation |

| Policy options for people with severe lung conditions | Guaranteed issue policies, graded death benefit policies, no-medical-exam policies, simplified issue policies |

| Impact of lung conditions on cost | Higher risk of mortality may result in higher premiums or denial of coverage |

| Tips for improving chances of coverage | Improve health, ensure medical records reflect improvements, shop around for policies, quit smoking |

What You'll Learn

How does life insurance factor in when you have emphysema?

Life insurance is a financial product that provides peace of mind and security for loved ones in the event of your death. It is a way to ensure that your family is protected financially and does not face a significant financial burden in your absence. When it comes to emphysema and life insurance, there are several factors to consider.

Emphysema is a lung disease that causes shortness of breath, coughing, and fatigue. It is a progressive disease, which means it continues to worsen over time. The condition damages the air sacs (alveoli) in the lungs, causing them to stretch out of shape or rupture. As a result, the lungs lose their natural elasticity and their ability to absorb oxygen and release carbon dioxide, leading to increased breathing difficulty.

Due to the progressive nature of emphysema and the associated risks, obtaining life insurance coverage can be challenging. Life insurance companies assess the risk of insuring an individual through a process called underwriting. For people with emphysema, this underwriting process often results in higher premiums or even a denial of coverage. The severity of the condition, as well as overall health and lifestyle factors, play a significant role in the underwriting process.

However, it is important to note that having emphysema does not mean you are completely uninsurable. There are still options available to obtain life insurance coverage. One option is to consider guaranteed issue policies, which do not factor in your health status and guarantee coverage to all applicants. These policies typically have lower coverage limits and can be significantly more expensive. Another option is a graded death benefit policy, where beneficiaries receive a percentage of the death benefit based on the length of the policy.

Additionally, the management of your emphysema can impact your life insurance options. If your condition is well-managed and less severe, you may be able to qualify for standard policies such as term life or whole life insurance. Term life insurance is more affordable and expires after a set number of years, usually 10 to 30 years. Whole life insurance, on the other hand, lasts until death and includes a cash value feature for loans.

When shopping for life insurance with emphysema, it is essential to compare costs and benefits across different insurers, as underwriting standards vary. Improving your overall health and following your doctor's advice for managing emphysema can also increase your chances of obtaining coverage and reducing premiums. Quitting smoking, if applicable, is one way to improve your health and potentially lower insurance costs.

In summary, while emphysema may impact your life insurance options, there are still ways to obtain coverage to provide financial protection for your loved ones. Understanding the underwriting process, exploring different policy types, and improving your overall health can help you navigate the life insurance landscape with emphysema.

Life Insurance Options for Diabetics: What You Need to Know

You may want to see also

What policies are best for people with emphysema?

Life insurance policies for people with emphysema will depend on the severity of their condition and how long they want coverage for. Emphysema is considered a high-risk condition by life insurance carriers, so people with the condition may struggle to qualify for a traditional policy. However, there are other options available.

Guaranteed Issue Policies

If you have severe emphysema, a guaranteed issue policy may be your best option. These policies do not require a medical exam, and you will be approved no matter how serious your lung condition is. However, these policies tend to be significantly more expensive and provide a lower death benefit. They also have a waiting period, typically of two years, during which your beneficiaries will only receive a partial payout if you pass away.

Simplified Issue Policies

If you have mild and well-controlled emphysema, you may be able to qualify for a simplified issue policy. These policies do not require a medical exam, but they do require a brief health questionnaire. They are likely to be more expensive than traditional policies, but they may be a more affordable option than guaranteed issue policies.

Traditional Policies

If your emphysema is well-managed and less severe, you might be able to qualify for a traditional policy. Term life insurance is affordable and will expire after a set number of years (usually 10 to 30), so it may be best if your loved ones would only need support before you reach retirement age. Whole life insurance will last until you pass away and includes a cash value feature that allows for life insurance loans. Final expense insurance is a smaller, more affordable type of whole life insurance that's designed for people over 50 to cover their funeral costs and other final expenses.

Chase Life Insurance: What You Need to Know

You may want to see also

What to consider when shopping for life insurance with emphysema

If you have emphysema, you can still get life insurance, especially if your condition is well-managed. However, finding affordable life insurance can be challenging as some insurers will not cover you at all, while others will charge higher premiums due to your medical condition. Here are some things to consider when shopping for life insurance with emphysema:

Understand your options

You should be able to obtain a policy, but it is important to understand your options and the steps you can take to maximize your chances of finding affordable insurance. Some insurers may be more willing than others to offer you a policy with reasonable premiums despite your lung condition. It is worth shopping around and comparing costs and benefits to find a policy that suits your needs.

Improve your health

The better your overall health, the more easily you will be able to obtain coverage and the more affordable your policy will be. Follow your doctor's advice for managing your lung condition and comply with treatment recommendations. If you smoke, quitting can help reduce insurance costs and increase your chances of getting approved for a policy.

Consider a guaranteed issue policy

If you have severe emphysema, standard life insurance policies may be very expensive or even unaffordable. In this case, you could consider a guaranteed issue policy, which does not factor in your health and guarantees coverage to all applicants regardless of their current health status. However, the policy limits on this type of coverage are typically low, and the premiums can be significantly higher.

Look into other options for severe emphysema

If you have advanced or severe emphysema, you may also be a candidate for oxygen therapy, lung volume reduction surgery (LVRS), or bronchoscopic lung volume reduction (BLVR). These treatments can help improve your lung function and may increase your chances of obtaining life insurance.

Include specific life insurance riders

As emphysema often gets worse over time, you may benefit from including specific life insurance riders on your policy. For example, an accelerated death benefit (ADB) rider allows you to access your death benefit while you are still alive if you meet certain health-related conditions. A waiver of premium disability rider can also be helpful, as it allows you to stop making life insurance payments if you experience a qualifying disability, such as emphysema preventing you from working.

Life Insurance Tax Withholding: Indiana's Unique Case

You may want to see also

Can emphysema be cured?

Emphysema is a lung disease that causes shortness of breath, coughing, and fatigue. It is caused primarily by smoking but can also be caused by air pollution, chemical fumes, and genetic factors. Emphysema affects the alveoli in the lungs, which are small, thin-walled, fragile air sacs that inflate with air when you inhale and deflate to force carbon dioxide out of the body when you exhale. In people with emphysema, these alveoli break and form larger air pockets, reducing the surface area of the lungs and making it difficult to breathe.

Unfortunately, emphysema cannot be cured, and lung tissue damaged by the disease cannot heal. However, treatments can help reduce symptoms and improve quality of life. Quitting smoking is the most important step in treating emphysema, and medications such as bronchodilators and inhaled corticosteroids can help relax the muscles around the airways and reduce inflammation. Antibiotics can be used to treat bacterial infections, and oxygen therapy can help those with severe emphysema and low oxygen levels in their blood. Pulmonary rehabilitation, which includes exercise, nutritional counselling, and psychological counselling, can also help improve the well-being of people with emphysema.

In severe cases of emphysema that do not respond to other treatments, surgery or lung transplants may be considered. Lung volume reduction surgery involves removing damaged lung tissue to help improve breathing, while lung transplants replace a damaged lung with a healthy lung from a donor. However, transplants carry risks, including infection and rejection of the transplanted lung.

Adjusting Life Insurance in a Trust: Can You?

You may want to see also

How does emphysema affect your life expectancy?

Emphysema is a chronic lower respiratory disease and is the third leading cause of death in the United States. It is a progressive disease that affects the quality of life and life expectancy. While it is not a death sentence, it is a serious condition that requires active management.

The life expectancy of a person with emphysema depends on various factors, including age, disease stage, smoking history, and genetic factors. People with milder forms of the disease tend to have a longer life expectancy than those with more advanced forms. For example, a 2018 study found that the mean life expectancy for someone with stage 1 (mild) disease was 9.7 years, compared to 7.1 years for those with stage 2 (moderate) disease. The same study also compared these figures to the general population, finding a mean survival rate of 10.2 years.

Older research suggests that people with early-stage emphysema can expect to lose a few years of life expectancy at age 65 when compared to people without lung disease. Additionally, people with more advanced disease, especially if they smoke, tend to have a shorter life expectancy. Smoking reduces life expectancy by approximately 3.5 years.

The Global Initiative for Chronic Obstructive Lung Disease (GOLD) categorizes emphysema into four stages based on the severity of the condition:

- Stage 1: Mildest stage, with lung function at least 80% of healthy lungs.

- Stage 2: Moderate emphysema, with lung function between 50-79% of healthy lungs.

- Stage 3: Severe emphysema, with lung function between 30-49% of healthy lungs.

- Stage 4: Very severe emphysema, with lung function less than 30% of healthy lungs.

The impact of emphysema on life expectancy is also influenced by the person's ability to manage the condition. Starting treatment early and quitting smoking can significantly improve life expectancy and quality of life. Treatment options such as bronchodilators, inhaled corticosteroids, oxygen therapy, and lung volume reduction surgery can help slow down the progression of the disease and improve symptoms.

Life Insurance While Hospitalized: Is It Possible?

You may want to see also

Frequently asked questions

Yes, you can still get life insurance if you have emphysema. If you have trouble qualifying for a traditional policy due to severe emphysema, you can apply for guaranteed issue policies, which do not factor in your health. However, these policies are significantly more expensive and provide a lower death benefit.

The cost of a life insurance policy for someone with emphysema will depend on how risky insurers believe it is to insure you and your overall health. If your condition is chronic, progressive, or advanced, the risk may be too high for most insurers.

Anyone who applies for a life insurance policy must go through an underwriting process. Underwriting is how an insurer assesses risk. Insurers want to provide insurance to people who have a small risk of dying while covered by the policy because they don't want to pay out the death benefit.

A guaranteed issue policy is a type of coverage where the insurance company guarantees coverage to all applicants, regardless of their current health status. Many insurers don't require medical exams for this type of policy, and you will be approved no matter how severe your condition is. However, the policy limits on this type of coverage will typically be fairly low.

A graded death benefit policy is a type of coverage where your beneficiaries will not receive the full death benefit right away if you pass away. Typically, these policies are structured so that your beneficiaries receive a set percentage of the death benefit based on how long the policy has been in effect.