Voluntary term life insurance is a type of life insurance policy that individuals can choose to purchase on their own, without any requirement from an employer or other entity. It is a temporary coverage option that provides financial protection for a specific period, typically ranging from one to ten years. This insurance policy is designed to offer a cost-effective way to secure a death benefit for beneficiaries in the event of the insured's passing during the term. Unlike permanent life insurance, voluntary term life insurance does not accumulate cash value and is generally more affordable, making it an attractive choice for those seeking short-term coverage needs.

What You'll Learn

- Definition: Voluntary term life insurance is a temporary policy offering coverage for a set period

- Benefits: It provides financial protection for loved ones during the policyholder's chosen term

- Cost: Premiums are typically lower than permanent policies but may vary based on factors

- Flexibility: Policyholders can choose the term length, coverage amount, and other customizable features

- Comparison: Compare with permanent life insurance for long-term financial security

Definition: Voluntary term life insurance is a temporary policy offering coverage for a set period

Voluntary term life insurance is a type of life insurance policy that provides coverage for a specific, predetermined period. It is a temporary solution designed to meet the needs of individuals who require insurance coverage for a particular duration, often for a limited time, such as a few years or a decade. This type of insurance is typically offered as an optional benefit in group insurance plans, such as those provided by employers, or it can be purchased directly by individuals through insurance companies.

The key characteristic of voluntary term life insurance is its temporary nature. Unlike permanent life insurance policies, which provide coverage for the entire life of the insured individual, term life insurance is designed to cover a specific period. This makes it a flexible and cost-effective option for those who need insurance during a particular phase of their lives, such as when they are starting a family, purchasing a home, or covering educational expenses.

When purchasing voluntary term life insurance, the insured party selects a specific term length, which could be 10, 20, or 30 years, depending on their needs and preferences. During this term, the policy provides a death benefit if the insured individual passes away. Upon the expiration of the term, the policy may automatically convert to a permanent life insurance policy, or the coverage may end, requiring the individual to decide whether to renew or purchase a new policy.

This type of insurance is particularly useful for individuals who want to ensure their loved ones are financially protected during a specific period. For example, a young professional might choose a 10-year term life insurance policy to cover their family's expenses if they were to pass away during that time. Similarly, a homeowner with a mortgage might opt for a 20-year term to ensure the mortgage is paid off if they were to die during that period.

In summary, voluntary term life insurance is a flexible and temporary life insurance solution that provides coverage for a set period. It is a valuable tool for individuals who require insurance during specific life events or periods, offering peace of mind and financial protection without the long-term commitment of permanent life insurance.

Smoking: Life Insurance Premiums and Policy Impact

You may want to see also

Benefits: It provides financial protection for loved ones during the policyholder's chosen term

Voluntary term life insurance is a type of life insurance policy that offers financial protection for a specified period, known as the 'term'. This insurance is typically offered as a voluntary benefit by employers to their employees, providing an additional layer of security for individuals and their families. The primary purpose of this insurance is to ensure that the financial responsibilities of the policyholder are met, especially in the event of their untimely demise.

When an individual purchases voluntary term life insurance, they select a specific term duration, which could range from a few years to several decades. During this chosen term, the insurance company promises to pay out a predetermined death benefit to the policyholder's beneficiaries if the insured individual passes away. This financial protection is particularly crucial for those who have financial dependents, such as a spouse, children, or other family members relying on their income.

The benefits of voluntary term life insurance are significant. Firstly, it provides peace of mind, knowing that your loved ones will be financially secure even if you are not around. This insurance can cover various expenses, including mortgage payments, education costs, daily living expenses, and other financial obligations that the policyholder may have left behind. By ensuring that these financial responsibilities are met, the insurance helps maintain the standard of living for the family and prevents them from falling into financial hardship.

Moreover, voluntary term life insurance is often more affordable than traditional life insurance policies, making it accessible to a broader range of individuals. The cost of the policy is typically based on the term length, the amount of coverage, and the policyholder's age and health. This affordability factor allows more people to protect their loved ones without incurring significant financial strain.

In summary, voluntary term life insurance is a valuable tool for individuals to provide financial security for their families during a specific period. It offers a practical solution to ensure that loved ones are protected and financially stable, even in the face of the policyholder's death. This type of insurance is an essential consideration for anyone looking to safeguard their family's future and well-being.

Surrendering VA Life Insurance: Taxable Event or Not?

You may want to see also

Cost: Premiums are typically lower than permanent policies but may vary based on factors

Voluntary term life insurance is a type of life insurance policy that is offered as an optional benefit to employees through their employer. It provides coverage for a specific period, often aligned with the duration of employment. This insurance is designed to offer financial protection to individuals during their working years, ensuring their loved ones are cared for in the event of their untimely passing. One of the key advantages of voluntary term life insurance is its cost-effectiveness compared to permanent life insurance policies.

The cost of premiums for voluntary term life insurance is generally lower, making it an attractive option for many employees. This affordability is a significant factor in its popularity, as it allows individuals to secure valuable coverage without incurring high expenses. The lower premiums are often a result of the policy's term-based nature, which means the coverage is active only for a defined period. This approach enables insurers to offer competitive rates since the risk is limited to the specified term.

However, it's important to note that the cost of premiums can vary based on several factors. These factors include the individual's age, health, lifestyle, and the amount of coverage chosen. Younger individuals typically pay lower premiums as they are considered less risky by insurers. Similarly, those in good health may also benefit from reduced costs. Additionally, the chosen coverage amount will directly impact the premium; higher coverage amounts will generally result in higher premiums.

Employers often play a role in determining the cost structure. They may offer different coverage options with varying premium rates, allowing employees to select a plan that suits their needs and budget. This flexibility empowers individuals to make informed decisions about their insurance coverage. It is essential for employees to carefully consider their choices, ensuring they understand the implications of different premium structures.

In summary, voluntary term life insurance provides valuable coverage at a potentially lower cost compared to permanent policies. The affordability is a significant draw, but it is crucial to remember that premium costs can vary based on individual circumstances and the chosen coverage. Employees should review their options and select a policy that aligns with their financial goals and provides the necessary protection for their loved ones.

Life Insurance and COVID: What Cover Does Your Term Offer?

You may want to see also

Flexibility: Policyholders can choose the term length, coverage amount, and other customizable features

Voluntary term life insurance offers a unique level of flexibility to policyholders, allowing them to tailor their insurance coverage to their specific needs and preferences. This type of insurance provides a temporary solution to secure financial protection, and the beauty lies in its adaptability. Policyholders have the autonomy to decide on the term length, which is the duration for which the insurance coverage is in effect. This choice is crucial as it ensures that the insurance aligns with the individual's current financial obligations and goals. For instance, a young professional might opt for a 10-year term to cover the costs of raising a family or paying off student loans, while a homeowner approaching retirement might choose a 20-year term to secure their family's future during their absence.

The coverage amount is another customizable aspect, enabling policyholders to determine the financial benefit that would be paid out in the event of the insured's death. This feature is particularly valuable as it allows individuals to assess their financial responsibilities and ensure that their loved ones are adequately protected. For example, a policyholder might decide on a higher coverage amount to cover substantial debts or to provide a substantial financial cushion for their family's future expenses.

Furthermore, voluntary term life insurance often provides additional flexibility in the form of optional riders or add-ons. These riders can enhance the policy's benefits, such as waiving the premium payments if the insured becomes disabled or providing an additional death benefit if the insured passes away within a specified period. Policyholders can choose to include these riders based on their specific circumstances and risk factors, ensuring that their insurance policy is comprehensive and tailored to their unique situation.

The flexibility of voluntary term life insurance empowers individuals to make informed decisions about their financial security. It allows them to adapt the policy as their life changes, ensuring that the coverage remains relevant and effective. Whether it's adjusting the term length to match career milestones or customizing the coverage amount to reflect evolving financial commitments, this type of insurance provides a dynamic solution. Ultimately, the ability to choose and customize various aspects of the policy ensures that voluntary term life insurance is a versatile and valuable tool for managing personal finances and providing peace of mind.

Insurable Interest: When Life Insurance Becomes Legally Binding

You may want to see also

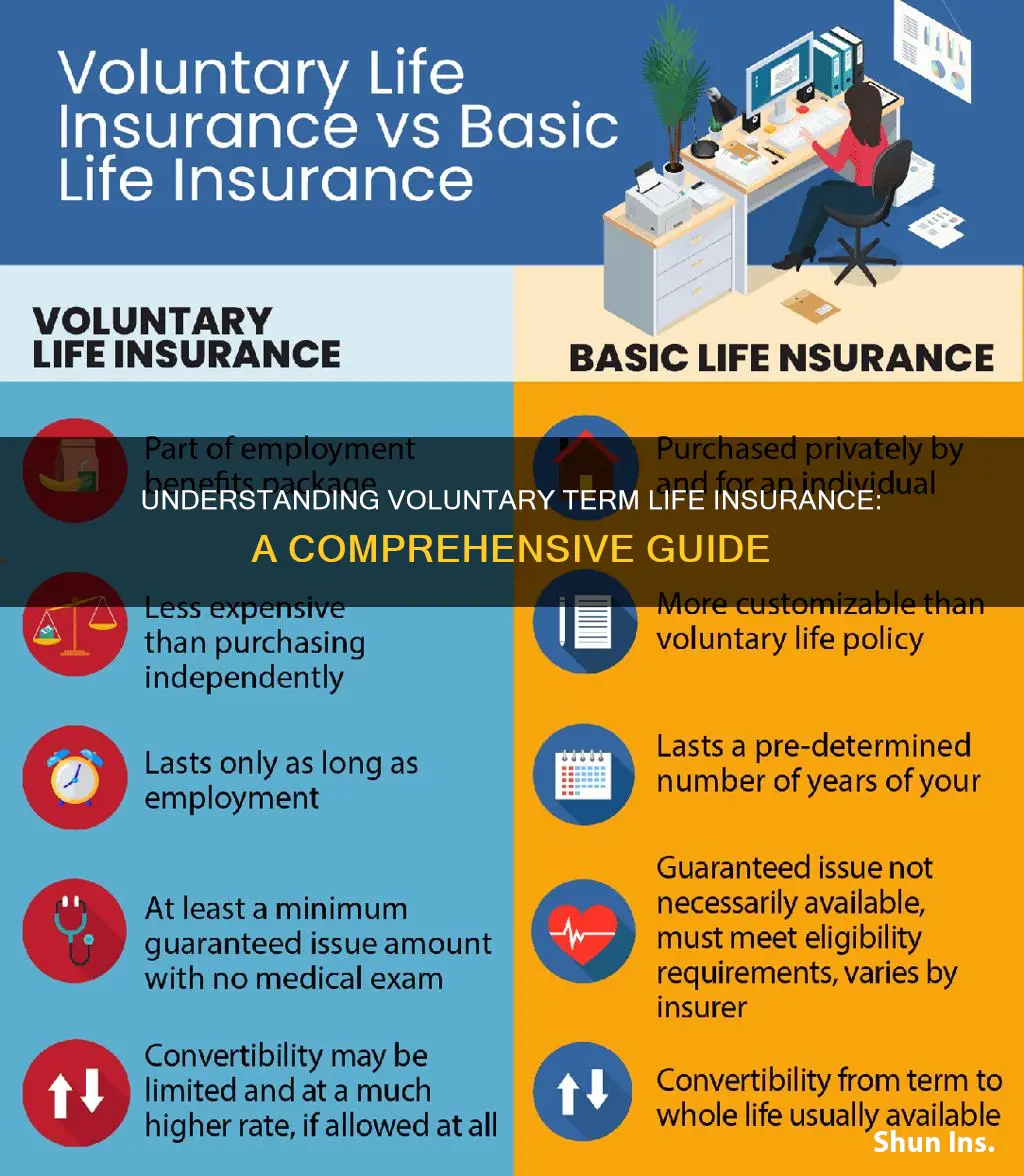

Comparison: Compare with permanent life insurance for long-term financial security

Voluntary term life insurance is a type of life insurance policy that is offered as an optional benefit to employees by employers. It provides coverage for a specific period, typically ranging from one to ten years, and is designed to offer financial protection during this term. This type of insurance is often seen as a more affordable and flexible alternative to permanent life insurance, making it an attractive option for many individuals.

When comparing voluntary term life insurance with permanent life insurance, the key difference lies in their duration and purpose. Permanent life insurance, also known as whole life insurance, provides lifelong coverage and accumulates cash value over time. It is designed to offer financial security for the insured individual and their beneficiaries for the entire duration of their lives. In contrast, voluntary term life insurance is a temporary policy that provides coverage for a specific period, after which it expires. This makes it a more short-term solution for financial protection.

One of the primary advantages of voluntary term life insurance is its affordability. Since it is a term policy, the premiums are generally lower compared to permanent life insurance. This is because the coverage is limited to a specific period, and the insurance company assumes less risk. For individuals who want financial security for a particular period, such as during the years when they have a mortgage or are raising a family, voluntary term life insurance can be an excellent choice. It ensures that their loved ones are protected financially during these critical years without the long-term commitment and higher costs associated with permanent insurance.

Permanent life insurance, on the other hand, offers a range of benefits that make it suitable for long-term financial planning. It provides a guaranteed death benefit, ensuring that the beneficiaries receive a specified amount upon the insured's passing. Additionally, permanent life insurance builds cash value, which can be borrowed against or withdrawn, providing financial flexibility. Over time, the cash value can grow, and the policyholder can even make withdrawals to fund various financial goals. This makes permanent life insurance a more comprehensive solution for long-term financial security.

In summary, voluntary term life insurance and permanent life insurance serve different purposes and cater to different needs. Voluntary term life insurance is ideal for short-term financial protection during specific life stages, offering affordable coverage for a defined period. Permanent life insurance, with its lifelong coverage and cash value accumulation, provides a more comprehensive solution for long-term financial security and planning. Understanding these differences can help individuals make informed decisions when choosing the right insurance coverage to meet their unique financial goals and requirements.

Who is a Claimant in Life Insurance Policies?

You may want to see also

Frequently asked questions

Voluntary term life insurance is a type of life insurance policy that individuals can choose to purchase on their own, without being required by an employer or other entity. It is a personal financial decision, allowing individuals to protect their loved ones in the event of their untimely death. This type of insurance provides a death benefit to the policyholder's beneficiaries, ensuring financial security during the term of the policy.

Unlike group life insurance, which is often provided by employers, voluntary term life insurance is purchased individually. It offers individuals the freedom to choose the coverage amount, duration, and other policy details according to their specific needs and preferences. This flexibility allows people to tailor the insurance to their personal circumstances, ensuring adequate protection for their families.

One of the key advantages is the ability to take control of your life insurance coverage. You can assess your financial obligations and determine the appropriate level of protection for your loved ones. Additionally, voluntary term life insurance often provides a higher death benefit compared to group policies, ensuring a more comprehensive safety net. It also offers the option to convert the term policy into a permanent life insurance plan if desired, providing long-term financial security.