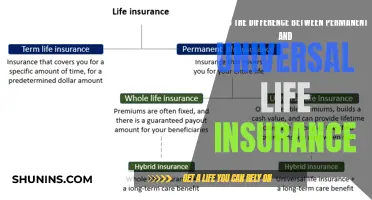

Life insurance is a way to protect your family and ensure they are provided for after you die. There are two main types of life insurance: term life insurance and whole life insurance. Term life insurance covers you for a fixed period, such as 10, 20 or 30 years, and pays out a death benefit if you die during that time. Whole life insurance, on the other hand, covers you for your entire life and also has a cash value component that grows over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. While term life insurance is generally more affordable, whole life insurance offers permanent coverage and the certainty of a payout, making it a better value option for some. You can also have both types of policies, and some term life insurance policies can be converted into whole life insurance.

| Characteristics | Values |

|---|---|

| Length of coverage | Term life insurance covers a set period of time, such as 10, 20 or 30 years. Whole life insurance covers the policyholder for their entire life. |

| Cash value | Term life insurance does not have a cash value component. Whole life insurance has a cash value component that grows over time. |

| Cost | Term life insurance is cheaper than whole life insurance. |

| Complexity | Term life insurance is simpler than whole life insurance. |

| Conversion | Term life insurance can often be converted to whole life insurance. |

What You'll Learn

- Term life insurance is cheaper but has an expiration date

- Whole life insurance is more expensive but lasts your entire life

- Term life insurance is straightforward, whole life is more complex

- Whole life insurance has a cash value component, term life does not

- Whole life insurance is a good option for end-of-life planning

Term life insurance is cheaper but has an expiration date

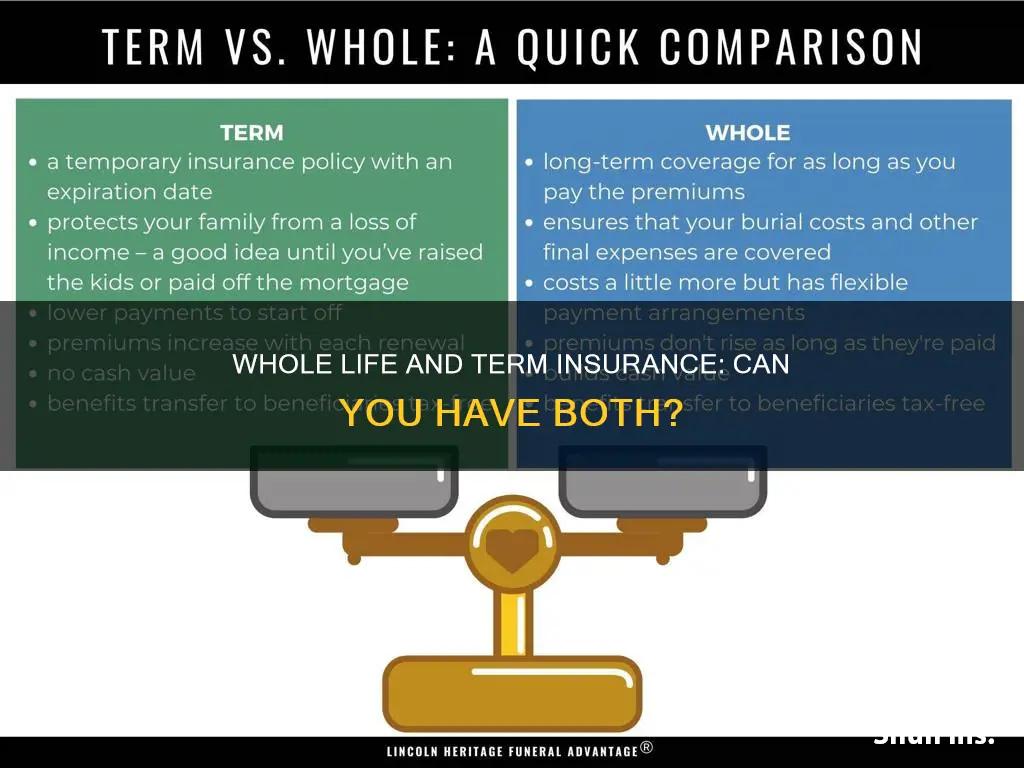

Term life insurance is a more affordable option than whole life insurance, but it comes with an expiration date. While whole life insurance can be extremely costly in comparison, it does offer lifelong protection.

Term life insurance is a good option for those who want to provide for their family in the event of their death. It is also a good option for those who are young and healthy and want to support their family. It is a straightforward insurance policy that guarantees a death benefit to the insured's beneficiaries after they die, as long as they are still within the term. This term is usually 10, 15, 20, or 30 years, but can be longer or shorter.

The cost of term life insurance is based on a person's age, health, and life expectancy. The older you are, the more you will pay for a policy. Most policies require a medical exam, but some offer simplified underwriting that may not require one. The premiums for term life insurance are typically fixed for the duration of the policy, but some policies have increasing premiums over time.

If you outlive your term life insurance policy, it will usually just end without any action needed from the policyholder. The insurance carrier will send a notice, premiums will stop, and there will be no death benefit. However, some term policies offer the option to renew on a yearly basis after the initial term expires, although this is usually more expensive due to age-related risk increases.

Term life insurance is a good option for those who want affordable coverage for a specific period, such as the length of their mortgage or until their children are financially independent. It is also a good choice for those who want the flexibility to wait to purchase whole life insurance at a later date, as some term policies can be converted to whole life insurance.

In contrast, whole life insurance is a form of permanent life insurance that offers lifelong protection and includes a cash value component that the policyholder can borrow against or withdraw under certain conditions. The cash value of whole life insurance grows over time, tax-deferred, and can be used as a savings vehicle for retirement or other financial needs. However, it is important to note that any outstanding loans or withdrawals will reduce the death benefit.

Whole life insurance policies have guaranteed premiums that do not increase over time. They also offer the ability to lock in your premiums for life, which can be beneficial for those who want predictable payments. However, whole life insurance is much more expensive than term life insurance, with premiums costing approximately 17 times more for the same death benefit.

In summary, term life insurance is a cheaper option than whole life insurance, but it comes with an expiration date. It is a good choice for those who want affordable, temporary coverage, while whole life insurance offers lifelong protection and additional benefits such as a cash value component.

Sun Life Insurance: Cataract Surgery Coverage Explained

You may want to see also

Whole life insurance is more expensive but lasts your entire life

Whole life insurance is more expensive than term life insurance, but it is designed to last your entire life. While term life insurance is cheaper, it only covers you for a set number of years. Whole life insurance, on the other hand, is a permanent form of insurance that remains in force until your death, as long as you continue to pay the premiums. This is one of the reasons why whole life insurance is more expensive. Insurers assume that they are more likely to pay out a death claim on a whole life policy compared to a term life policy.

Whole life insurance also has a cash value component that allows you to accumulate cash value over time. A portion of your premium payments goes towards the insurance costs, while another portion goes into a cash value account that grows at an established interest rate. This cash value can be borrowed against or withdrawn under certain conditions. However, if there is an outstanding loan when you die, the death benefit will be reduced by the amount owed. The cash value component is another factor that contributes to the higher cost of whole life insurance.

The cost of whole life insurance depends on several factors, including age, health, gender, and the type of policy. The younger and healthier you are when you purchase the policy, the lower your premiums will be. Women tend to pay lower premiums than men due to their longer life expectancy. Additionally, whole life insurance policies with higher coverage amounts will result in higher premiums.

While whole life insurance is more expensive, it offers permanent coverage and the ability to build cash value. On the other hand, term life insurance is a more affordable option for those who only need coverage for a specific period. It is important to consider your budget, time frame, and whether you want a savings component when deciding between term and whole life insurance.

Temporary Employees: Group Life Insurance Eligibility

You may want to see also

Term life insurance is straightforward, whole life is more complex

Term life insurance is a straightforward product that offers a guaranteed death benefit to the policyholder's beneficiaries if the insured person dies during the term of the policy. The term is usually between one and 30 years, or until the policyholder reaches a specific age. It is generally the cheapest type of life insurance because it is temporary and has no cash value component. The premiums for term life insurance are typically level, and the policyholder is not required to undergo a medical examination.

On the other hand, whole life insurance is a more complex product that offers permanent coverage for the policyholder's entire life, rather than a fixed period. Whole life insurance also includes a cash value component that grows over time and can be borrowed against or withdrawn under certain conditions. The premiums for whole life insurance are typically higher than those for term life insurance because the coverage is lifelong and the policy accumulates cash value. The cash value growth in a whole life insurance policy is guaranteed, and the premiums remain level throughout the policy.

In summary, term life insurance is a straightforward product that offers temporary coverage at a low cost, while whole life insurance is a more complex product that offers permanent coverage with a cash value component at a higher cost.

Key Man Life Insurance: Protecting Your Business's Future

You may want to see also

Whole life insurance has a cash value component, term life does not

Term life insurance and whole life insurance are two of the most common types of life insurance available. Term life insurance is a temporary form of insurance that covers a set period, such as 10, 20, or 30 years. Whole life insurance, on the other hand, is a form of permanent life insurance that lasts as long as the policyholder lives, provided they continue to pay the premiums.

One of the key differences between term and whole life insurance is that whole life insurance has a cash value component, while term life insurance does not. This means that whole life insurance policies can accumulate cash value over time, which can be accessed by the policyholder in several ways, including loans, withdrawals, or surrendering the policy. In contrast, term life insurance policies do not accrue any cash value, and there is no cash available to the policyholder during the term.

The cash value component of whole life insurance policies offers several benefits. Firstly, it provides lifelong coverage, meaning that the policyholder's loved ones will receive a death benefit payout regardless of when they pass away. Secondly, it offers flexible access to funds, as the policyholder can borrow against or withdraw from the cash value. Finally, whole life insurance policies typically have reasonable premiums, making them a more affordable option for those seeking lifelong coverage.

However, it is important to note that the cash value component of whole life insurance policies comes at a cost. Whole life insurance premiums are typically much higher than term life insurance premiums due to the added cash value feature. Additionally, the complexity of whole life insurance policies can make them more difficult to evaluate and understand. Nevertheless, for those seeking lifelong coverage and the ability to access cash value, whole life insurance can be a valuable option.

Thrivent's Decreasing Term Life Insurance: What You Need to Know

You may want to see also

Whole life insurance is a good option for end-of-life planning

Whole life insurance is a form of permanent life insurance that lasts as long as you live, provided you pay the policy's premiums. It includes a cash value account that grows tax-free over time and that you can withdraw from or borrow against while you are alive. This makes whole life insurance a good option for those who want to use their policy as a savings component or wealth-building strategy. The cash value of whole life policies grows at a guaranteed rate set by the insurer, and loans and withdrawals are generally tax-free.

Whole life insurance is a good option for those who want permanent coverage and can comfortably afford the higher premiums. The death benefit from whole life policies typically pays out whenever you die, and if you name life insurance beneficiaries, the payout will go directly to them and not through your estate. Whole life insurance can also be useful for those with lifelong dependents, such as children with disabilities, as it lasts your entire lifetime. It can also be used as a valuable tool in succession planning for small businesses, providing financial protection in the event of the loss of a key employee or partner.

Whole life insurance is also a good option for those who want the flexibility to adjust their coverage. You can generally choose a policy length that suits your needs, and some insurers offer the option to blend term life with your policy to lower the premiums while maintaining permanent coverage. Additionally, you can customise your coverage with various riders, such as an accelerated death benefit or a waiver of premium rider.

However, it's important to consider the drawbacks of whole life insurance. It is significantly more expensive than term life insurance, with premiums typically being much higher. Whole life insurance is also more complex than term life, making it more difficult to evaluate. Additionally, borrowing against the cash value of your policy carries interest, and there may be surrender charges if you cancel the policy early.

Divorced Families: Claiming Life Insurance Benefits

You may want to see also

Frequently asked questions

Term life insurance offers coverage for a specific period, such as 10, 20, or 30 years, and is more affordable. Whole life insurance, on the other hand, provides lifelong coverage and tends to have higher premiums. It also includes a cash value component that grows over time, which you can borrow against or withdraw.

Term life insurance is a good option if you want low-cost coverage for a specific period. It is also simpler and easier to understand than whole life insurance. However, a con of term life insurance is that it does not offer lifelong coverage and does not include a cash value component.

Whole life insurance offers lifelong coverage and builds cash value over time, which can be borrowed against or withdrawn. It also provides more financial flexibility. However, whole life insurance is significantly more expensive than term life insurance and can be complex to understand.

When choosing between term and whole life insurance, consider your budget, the length of coverage needed, and whether you want a savings component. Term life insurance is ideal if you want lower premiums and only need coverage for a specific period. Whole life insurance is suitable if you want lifelong coverage, a policy that builds cash value, or need coverage for lifelong dependents.

Yes, you can have both term and whole life insurance policies. This approach, known as "laddering life insurance," can be beneficial if you want coverage for specific debts or expenses, such as a mortgage, while also having lifelong coverage.