Indexed universal life insurance (IUL) is a type of permanent life insurance that provides a cash value component and a death benefit. The policyholder can decide how much cash value to assign to an equity-indexed account and a fixed-rate account. The money in the cash value account can earn interest by tracking a stock market index chosen by the insurer. IUL policies offer flexible premiums and adjustable death benefits. Policyholders can withdraw money from their IUL policy at any time, but fees and surrender charges may apply.

| Characteristics | Values |

|---|---|

| Opting out anytime | Yes, but there may be fees and surrender charges |

| Cashing in policy | Yes, but the death benefit will be reduced by the withdrawal amount |

| Borrowing against policy | Yes, but any outstanding loans will be deducted from the death benefit |

What You'll Learn

Indexed universal life insurance (IUL) pros and cons

Yes, you can opt out of indexed universal life insurance anytime. However, there may be fees and surrender charges associated with doing so. If you cancel your policy, you will lose the death benefit named in the policy.

Pros

- Higher return potential: IUL policies have the potential for higher returns compared to other types of life insurance, such as whole life or fixed universal life insurance.

- Greater flexibility: IUL insurance offers flexibility in terms of investment goals and customisation. Policyholders can decide their risk tolerance, adjust death benefit amounts, and choose from a variety of riders.

- Tax-free capital gains: IUL policyholders do not pay capital gains taxes on the increase in cash value over time, unless they abandon the policy before it matures.

- No Social Security impact: Cash value accumulation from an IUL policy does not count towards Social Security earnings thresholds, allowing policyholders to take a loan against their policy without detracting from their benefit amount.

- Death benefit: IUL insurance provides a death benefit for loved ones, which is generally tax-free and can be used for funeral expenses, outstanding debts, college costs, or living expenses.

Cons

- Possible limits on returns: Insurance companies may set participation rates that limit how much of the index return policyholders receive each year. Returns may also be capped at a maximum amount.

- Unpredictable returns: IUL policies offer variable returns based on an index, which means policyholders must be comfortable with fluctuations and potentially higher premiums.

- Higher fees: IUL policies may have higher fees and various costs, including premium expense charges, administrative expenses, and commissions.

- Risk of lapse: If policyholders do not maintain sufficient cash value to cover costs and any loans taken against the policy, there is a risk of policy lapse, resulting in a financial loss.

- Tax implications: Withdrawals and loans from an IUL policy may have tax implications under certain circumstances, such as if the policy lapses or if withdrawals include investment gains before the policy matures.

- No guarantee of cash value growth: The cash value in an IUL policy may not grow, especially if the underlying index market performs poorly over an extended period.

How Nephews Can Insure Aunts' Lives

You may want to see also

IUL vs. other policies

Indexed Universal Life (IUL) insurance is a type of permanent life insurance that provides a cash value component along with a death benefit. The cash value in a policyholder's account earns interest by tracking a stock market index, such as the S&P 500 or the Nasdaq-100. The interest rate derived from the equity index account can fluctuate, and the policy may offer an interest rate guarantee, limiting losses but also capping gains. IUL insurance is more volatile than fixed universal life policies but less risky than variable universal life insurance policies as the cash is not directly invested in the stock market.

IUL insurance policies offer permanent coverage as long as premiums are paid. They provide greater upside potential, flexibility, and tax-free gains. However, there are some drawbacks, including possible limits on annual returns and no guarantees on premium amounts or future market returns. An IUL policy may be cancelled if the policyholder stops paying premiums.

When compared to other types of life insurance policies, IUL has both advantages and disadvantages. Here is a breakdown of how IUL stacks up against term life insurance, whole life insurance, and variable life insurance:

- Term life insurance is one of the most affordable and simplest types of life insurance. It offers a fixed benefit if the policyholder dies within a set period, usually between 10 and 30 years, but it does not have a cash value accumulation component.

- Whole life insurance is more permanent than term life insurance and lasts for the entire life of the policyholder as long as premiums are paid. The policy gains value according to a fixed schedule and has fewer fees than an IUL policy. However, whole life insurance does not offer the same level of flexibility in adjusting premiums.

- Variable life insurance offers even more flexibility than IUL, but it is also more complicated. The cash value of a variable policy may depend on the performance of specific stocks or securities, and the premium can also change, making it a riskier option than other types of life insurance.

Christians' Perspective on Life Insurance: A Complex Issue

You may want to see also

How IUL insurance works

How Indexed Universal Life Insurance (IUL) Works

Indexed Universal Life Insurance (IUL) is a type of permanent life insurance that provides a death benefit and a cash value component. The cash value in an IUL policy can grow based on the performance of a stock market index, like the S&P 500, with cap and floor rates that limit risk and reward.

Here's a more detailed look at how IUL insurance works:

Premium Payments

When you pay premiums for an IUL policy, a portion goes towards the cost of insurance, including the death benefit and administrative fees, while the remaining amount is allocated to the policy's cash value component.

Cash Value Component

The cash value in an IUL policy has the potential to grow based on the performance of a stock market index. Unlike direct investments in the stock market, your cash value is not directly invested in the underlying index. Instead, the insurance company uses financial instruments to link your cash value growth to the index's performance.

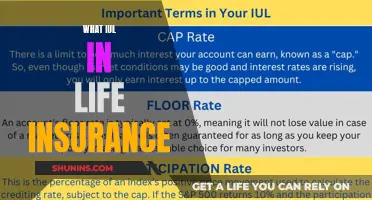

Cap and Floor Rates

IUL policies typically have cap and floor interest rates. The cap rate is the maximum return you can earn over a given period, while the floor rate is the guaranteed minimum interest rate. For example, if the cap is 12% and the index returns 15%, your earnings will be limited to 12%. On the other hand, if the floor is 0% and the index drops by 10%, your cash value won't decrease.

Flexible Premiums

IUL policies often allow flexible premium payments, meaning you can adjust the amount you pay within certain limits based on your financial situation. However, it's important to maintain enough cash value to cover the insurance costs and fees to avoid a policy lapse.

Death Benefit

Upon the policyholder's death, the beneficiaries receive a death benefit, which is generally tax-free. The death benefit can be a fixed amount or include the cash value, depending on the policy's structure.

Tax Advantages

The cash value in an IUL policy grows tax-deferred, so you don't pay taxes on capital gains as long as the money remains in the policy. You can also take out loans against the cash value, which are generally tax-free but may reduce the death benefit and cash value if not repaid.

Riders and Customization

IUL policies can be customized by adding various riders, such as accelerated death benefits, long-term care riders, and disability income riders, to meet your specific needs.

Withdrawals and Loans

You can withdraw or take out loans against the cash value of your IUL policy, but these actions may reduce the cash value and death benefit and have potential tax implications if not managed carefully.

Life Insurance Exams: What Medical Tests Are Required?

You may want to see also

Advantages of IUL insurance

Indexed Universal Life (IUL) insurance offers several advantages over other types of life insurance. Here are some of the key benefits:

Higher Return Potential:

IUL insurance provides the potential for higher returns compared to traditional universal life or whole life insurance policies. The cash value of an IUL policy is linked to the performance of an underlying stock market index, allowing for potential gains that can exceed those of other types of life insurance.

Flexibility:

IUL insurance offers flexibility in terms of premium payments and death benefit amounts. Policyholders can adjust their premiums to fit their financial situation and increase or decrease the death benefit as their financial obligations change. This adaptability makes IUL insurance suitable for those with varying financial needs.

Tax Advantages:

IUL insurance offers tax advantages on capital gains. The cash value accumulates tax-deferred, and the death benefit is tax-free for beneficiaries. Additionally, loans made against the policy are often tax-free, and withdrawals up to the amount of premiums paid are also typically tax-exempt.

No Social Security Impact:

IUL insurance does not affect Social Security benefits. The cash value accumulation and any loan amounts borrowed from the policy do not count towards earnings thresholds, so individuals can take out loans against their policy without reducing their Social Security benefit amount.

Lifelong Coverage:

IUL insurance provides permanent coverage for the policyholder's entire life, as long as premiums are paid. This lifelong coverage ensures that beneficiaries receive a payout, which can be used for various expenses, such as funeral costs, outstanding debts, or education funding.

Credit Life Insurance: Where and How to Purchase

You may want to see also

Disadvantages of IUL insurance

Indexed Universal Life (IUL) insurance is a type of permanent life insurance that offers a death benefit and a cash value component tied to the performance of an underlying stock market index. While IUL insurance can provide benefits such as potential higher returns and tax advantages, there are several disadvantages to consider before purchasing a policy.

Limited Returns and Unpredictable Returns

IUL insurance policies often include caps on returns, which can limit the actual rate of return credited to your account, regardless of how well the underlying index performs. These caps can result in lower returns compared to other investment options or life insurance policies. Additionally, IUL policies offer unpredictable returns as they are based on the performance of an index, whereas whole life insurance policies offer guaranteed interest rates.

High Fees

IUL insurance policies typically come with various fees and costs, including premium expense charges, administrative expenses, fees and commissions, insurance costs, and surrender charges. These fees can be high and may reduce the overall return on investment, especially in the early years of the policy.

Active Management Required

Managing an IUL insurance policy requires active involvement and a good understanding of market conditions, participation rates, and other factors. This level of active management may be demanding for some policyholders, requiring the assistance of a financial professional.

Risk of Lapse

If premium payments are not made on time, the policy could lapse, negating the point of life insurance. This is especially important to consider if the market is performing poorly, as high premium payments may be required to maintain the policy.

Complexity

IUL insurance is considered one of the most complex life insurance products, making it difficult for consumers to fully understand how the policy works and all the associated risks and costs. This complexity can make it challenging to compare different policy options and make an informed decision.

Higher Risks

IUL insurance carries greater risk than standard universal life insurance policies. While it offers protection against losses during market downturns, there is still a risk of losing out on significant gains due to caps and participation rates.

In conclusion, while IUL insurance can offer potential benefits, it is important to carefully consider the disadvantages and how they may impact your financial goals and risk tolerance.

Scheduling Your Life Insurance Exam: A Quick Guide

You may want to see also

Frequently asked questions

Yes, you can withdraw the cash value of a whole life insurance policy on a tax-free basis up to the amount of premiums you've paid. You can also borrow against a cash value, use a cash value toward premium payments, or cancel the policy to receive the cash value.

Indexed universal life insurance offers the benefit of market gains while building cash value and guarantees beneficiaries a payout upon death. It also provides permanent coverage as long as premiums are paid, and the potential for higher returns compared to other types of permanent life insurance.

Indexed universal life insurance policies have higher fees than other policies, returns are capped at a certain level, and there are no guaranteed returns.

Yes, you can sell your indexed universal life insurance policy and stop making premium payments. However, you will lose the death benefit named in the policy.