Life insurance is a crucial financial tool that provides financial security and peace of mind for individuals and their loved ones. One type of life insurance that has gained popularity is IUL, or Indexed Universal Life. IUL offers a unique blend of permanent life insurance coverage and investment opportunities. It allows policyholders to build cash value over time, which can be used for various purposes, such as supplementing retirement income, funding education, or providing a financial safety net. IUL policies are designed to offer a competitive return on investment, often linked to stock market performance, while also providing guaranteed death benefits and the potential for long-term growth. Understanding the features and benefits of IUL can help individuals make informed decisions about their life insurance needs and financial planning.

What You'll Learn

- Benefits: Covers death, critical illness, and disability, providing financial support to beneficiaries

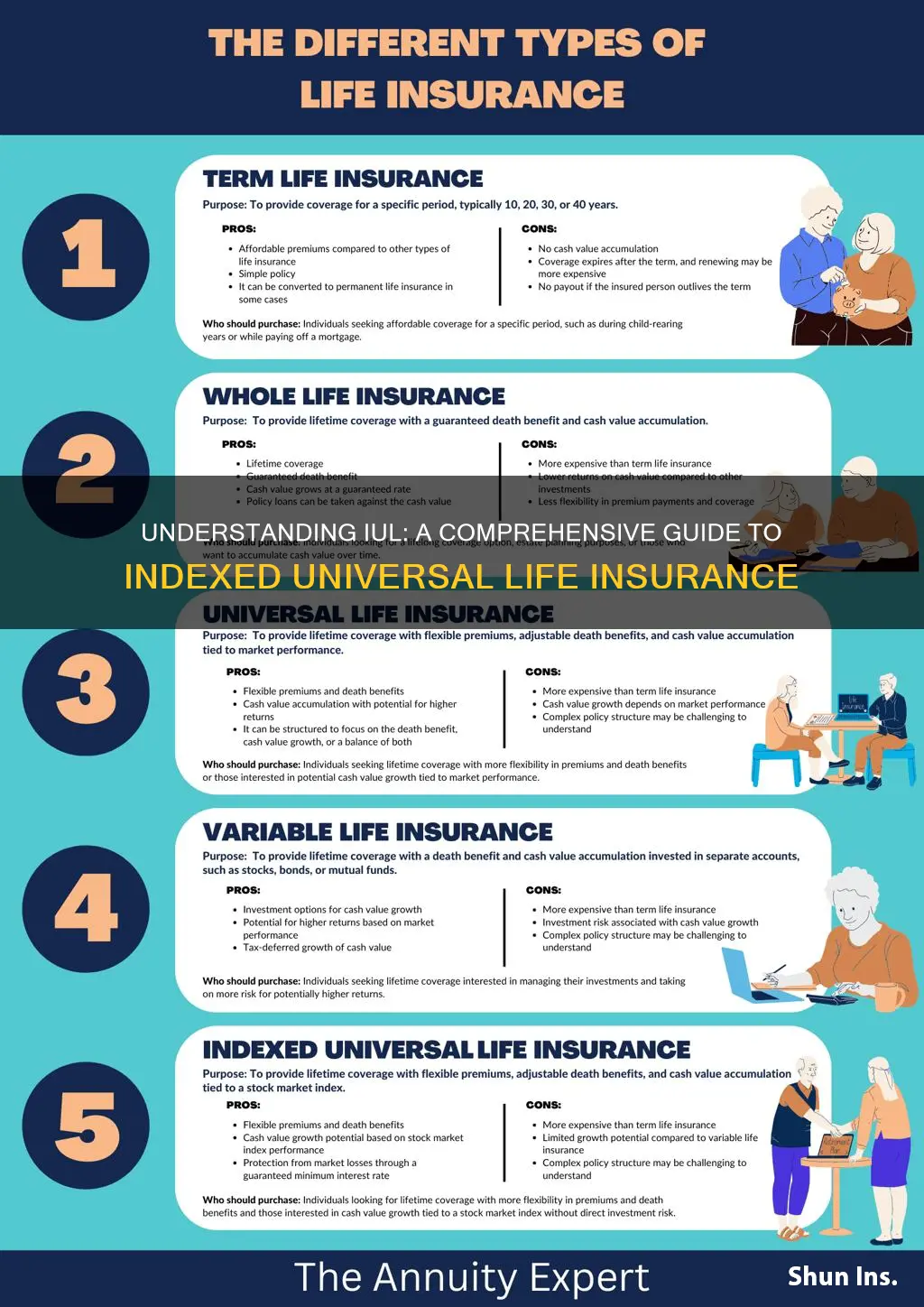

- Types: Term, whole life, universal, and variable offer different coverage periods and investment options

- Cost: Premiums vary based on age, health, coverage amount, and policy type

- Tax Advantages: Life insurance offers tax-deferred growth and potential tax-free death benefits

- Lapse and Renewal: Policies may lapse if premiums are not paid, requiring renewal or termination

Benefits: Covers death, critical illness, and disability, providing financial support to beneficiaries

Life insurance is a crucial financial tool that offers a safety net for individuals and their loved ones. One popular type of life insurance is the Indexed Universal Life (IUL) policy, which provides a unique combination of benefits and flexibility. IUL insurance offers a comprehensive approach to protecting your loved ones and yourself, ensuring financial security during challenging times.

One of the primary benefits of IUL insurance is its ability to provide financial support in the event of death. When an individual passes away, the policy's death benefit is paid out to the designated beneficiaries. This financial payout can help cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or even provide a lump sum for the family's future needs. Knowing that your loved ones will be financially secure in the event of your passing can bring peace of mind and ensure their long-term stability.

Additionally, IUL policies often include coverage for critical illnesses, which can be a significant financial burden. Critical illness insurance pays out a lump sum if the insured individual is diagnosed with a specified list of critical illnesses, such as heart attacks, strokes, cancer, or kidney failure. This coverage can help cover medical expenses, rehabilitation costs, and even provide income replacement during the recovery period. By having this additional layer of protection, individuals can focus on their health and recovery without worrying about the financial implications of a critical illness.

Furthermore, IUL insurance can also offer disability coverage, which is essential for maintaining financial stability if an individual becomes unable to work due to an injury or illness. Disability insurance provides income replacement during the period of disability, ensuring that the insured person can meet their financial obligations and maintain their standard of living. This benefit is particularly valuable as it allows individuals to focus on their recovery and rehabilitation without the added stress of financial instability.

The beauty of IUL insurance lies in its flexibility and customization. Policyholders can choose the level of coverage, premium payments, and investment options that align with their financial goals and risk tolerance. This flexibility allows individuals to tailor their policy to their specific needs, ensuring they receive the most appropriate level of protection. Moreover, the investment component of IUL policies allows policyholders to potentially earn interest and grow their money over time, providing an additional financial benefit.

In summary, IUL insurance offers a comprehensive solution for individuals seeking to protect their loved ones and themselves. With its death, critical illness, and disability coverage, IUL provides financial support during challenging life events. The flexibility and customization options make it an attractive choice for those looking to secure their financial future and provide peace of mind. By understanding the benefits and features of IUL insurance, individuals can make informed decisions to safeguard their loved ones' well-being and financial stability.

Sleep Apnea: Impacting Life Insurance Rates and Your Health

You may want to see also

Types: Term, whole life, universal, and variable offer different coverage periods and investment options

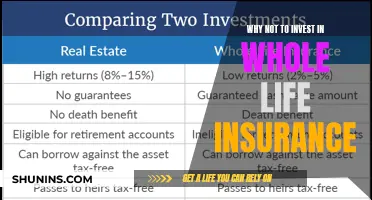

When considering life insurance, it's important to understand the various types available, each with its own unique features and benefits. One of the most common types is term life insurance, which provides coverage for a specified period, typically 10, 20, or 30 years. This type is ideal for those seeking affordable coverage for a defined period, such as covering mortgage payments or providing financial security for children's education. During the term, the policyholder pays a fixed premium, and if an insured event occurs (like death), the beneficiary receives a death benefit. Once the term ends, the policy may be renewed, but premiums can increase significantly.

Whole life insurance, on the other hand, offers lifelong coverage, as the name suggests. It provides a guaranteed death benefit and a fixed premium that remains the same throughout the policy's duration. This type is attractive to those seeking long-term financial security and a consistent premium payment. With whole life, the policyholder also accumulates cash value, which can be borrowed against or withdrawn, providing a financial safety net. However, the premiums are generally higher compared to term life.

Universal life insurance combines the features of term and whole life. It offers flexible coverage, allowing policyholders to adjust the death benefit and premium payments over time. Universal life policies also accumulate cash value, which can be invested in various options, providing potential for growth. This type is suitable for those who want the flexibility to adapt their coverage as their financial situation changes.

Variable life insurance is another option, offering a flexible death benefit and the potential for investment growth. The policyholder can choose from a range of investment options, allowing for customization based on their risk tolerance and financial goals. This type provides more control over the policy's performance but also carries more investment risk. Variable life insurance is often more expensive and may not be suitable for those seeking a more straightforward and guaranteed approach.

Each of these life insurance types offers different coverage periods and investment opportunities, catering to various financial needs and preferences. Whether it's the affordability and defined term of term life, the lifelong security of whole life, the flexibility of universal life, or the customizable nature of variable life, individuals can choose the option that best aligns with their long-term financial objectives and risk tolerance. Understanding these types is crucial in making an informed decision when selecting life insurance coverage.

Life Insurance Surrender: Understanding the 10% Penalty

You may want to see also

Cost: Premiums vary based on age, health, coverage amount, and policy type

Understanding the cost structure of Indexed Universal Life (IUL) insurance is crucial for making informed decisions about your life insurance needs. IUL policies offer a unique blend of life insurance and investment opportunities, and the cost of these policies can vary significantly based on several factors.

One of the primary factors influencing the cost of IUL insurance is age. Younger individuals typically pay lower premiums compared to older adults. This is because younger people are generally considered less risky by insurance providers. As you age, the risk of developing health issues increases, which can lead to higher insurance costs. Additionally, older individuals may have already built up a substantial amount of coverage, which can also impact premium rates.

Health status plays a significant role in determining the cost of IUL insurance. Insurance companies assess your overall health and medical history to gauge the likelihood of future claims. Individuals with a history of chronic illnesses, smoking, or other health risks may face higher premiums. On the other hand, those with a healthy lifestyle and no significant medical conditions may benefit from lower rates. It's essential to maintain a healthy lifestyle and regularly review your health status to ensure you receive the best rates possible.

The coverage amount you choose also directly affects the cost. Higher coverage amounts mean the insurance company has to pay out a larger sum in the event of your passing. Consequently, they may charge higher premiums to account for this increased risk. Conversely, lower coverage amounts result in lower premiums. It's a delicate balance, and you should carefully consider your financial goals and risk tolerance when deciding on the coverage amount.

Lastly, the type of policy you choose will impact the cost. IUL policies come in various forms, each with its own set of features and benefits. Some policies offer more flexibility in investment options, while others may have stricter guidelines. Additionally, the frequency of premium payments (monthly, annually, etc.) can also influence the overall cost. It's advisable to compare different policy types and their associated costs to find the best fit for your financial situation and insurance requirements.

Understanding Whole Life Insurance: Unlocking Cash Value

You may want to see also

Tax Advantages: Life insurance offers tax-deferred growth and potential tax-free death benefits

Life insurance, particularly in the form of an Index Universal Life (IUL) policy, provides a range of tax advantages that can be highly beneficial for individuals and their families. One of the key benefits is tax-deferred growth, which allows the policy's cash value to accumulate over time without being subject to annual income taxes. This is in contrast to traditional savings accounts or investments, where interest or earnings are typically taxed as ordinary income. By investing in IUL, you can build a substantial cash value that grows tax-free, providing a more efficient way to save and invest for the future.

The tax-deferred nature of IUL policies encourages long-term savings and investment. As the cash value grows, it can be used to pay for future premiums, ensuring the policy remains in force and providing ongoing coverage. This strategy can be particularly advantageous for those who want to maximize their savings while maintaining a flexible approach to their finances. Over time, the tax-deferred growth can result in a more substantial death benefit, which is paid out tax-free to the policy's beneficiaries upon the insured individual's passing.

Another tax advantage of life insurance is the potential for tax-free death benefits. When an insured person dies, the death benefit is typically paid out to the designated beneficiaries free of income tax. This can provide a significant financial cushion for the family, especially if the insured individual was the primary breadwinner. The tax-free nature of the death benefit ensures that the entire amount goes directly to the beneficiaries, providing financial security and peace of mind.

Furthermore, IUL policies often offer the flexibility to make premium payments and take loans or withdrawals from the cash value without incurring immediate tax consequences. This allows policyholders to access their funds when needed, such as for education expenses or unexpected financial obligations, without triggering a tax liability. The ability to borrow against the cash value tax-free can be a valuable feature, providing a source of funds that can be repaid with interest, all while maintaining the tax-deferred status of the policy.

In summary, life insurance, especially in the form of IUL, offers significant tax advantages. The tax-deferred growth of the cash value and the potential for tax-free death benefits provide individuals with efficient ways to save, invest, and provide financial security for their loved ones. Understanding these tax benefits can be a crucial factor in making informed decisions about life insurance and long-term financial planning.

Life Insurance Face Value: Lost When Lapses?

You may want to see also

Lapse and Renewal: Policies may lapse if premiums are not paid, requiring renewal or termination

Life insurance, particularly in the form of an Index Universal Life (IUL) policy, offers a flexible and customizable way to protect your loved ones and build wealth over time. However, like any financial commitment, it requires careful management and understanding of its terms and conditions. One critical aspect to consider is the potential lapse in coverage if premiums are not paid on time.

When you purchase an IUL policy, you typically pay a series of premiums to maintain the insurance coverage. These premiums are used to fund the policy and ensure that the death benefit remains in force. However, if you fail to make these payments, your policy may lapse, leading to a loss of coverage. This is a crucial point to remember, as it can have significant financial implications.

The process of a policy lapsing can vary depending on the insurance company and the specific terms of your contract. Often, the insurer will provide a grace period during which you can still pay the missed premium and avoid the lapse. This grace period is usually a limited time frame, and if you miss it, the policy may be terminated. Once terminated, you will need to go through the renewal process to restore coverage, which may come with additional costs and potential health assessments, especially if a significant period has passed since the initial purchase.

Renewal after a lapse can be challenging and may not always be guaranteed. The insurance company will assess your current health and financial situation to determine if you qualify for renewed coverage. This assessment could involve a medical examination, and the insurer may offer a new policy with different terms and rates, which could be more expensive. In some cases, the insurer may decline to renew the policy, especially if the lapse was prolonged or if your health has deteriorated significantly.

To avoid the complications of a lapse and potential renewal issues, it is essential to stay informed about your premium payments and the policy's requirements. Set up payment reminders, ensure your payment method is up-to-date, and regularly review your policy documents. If you anticipate financial difficulties, contact your insurance provider to discuss options such as premium payment plans or policy adjustments. Being proactive and maintaining open communication with your insurer can help ensure that your IUL policy remains in force and provides the intended protection for your beneficiaries.

Life Insurance vs Annuities: Which is the Better Investment?

You may want to see also

Frequently asked questions

IUL is a type of permanent life insurance that offers a combination of life coverage and a cash value account. It is designed to provide long-term financial security and flexibility. The cash value grows tax-deferred and can be used to pay premiums, take loans, or withdraw funds (subject to certain conditions).

IUL stands out due to its unique features. It allows policyholders to control their investment by making premium payments and directing the cash value's growth. This customization enables individuals to tailor the policy to their financial goals. Additionally, IUL policies often offer higher guaranteed death benefits compared to term life insurance, providing more comprehensive coverage.

Investing in IUL can offer several advantages. Firstly, it provides a guaranteed death benefit, ensuring a financial safety net for your loved ones. The cash value accumulation can be used for various purposes, such as funding education expenses or supplementing retirement income. IUL policies also offer flexibility, allowing policyholders to adjust their coverage and investment strategy over time.

While IUL has benefits, it's important to understand the potential drawbacks. The investment aspect means there are no guarantees of investment returns, and the performance can vary. Policyholders should be aware of the fees associated with IUL, including surrender charges and potential investment management fees. Additionally, the complexity of the policy may require careful consideration and professional guidance to make informed decisions.