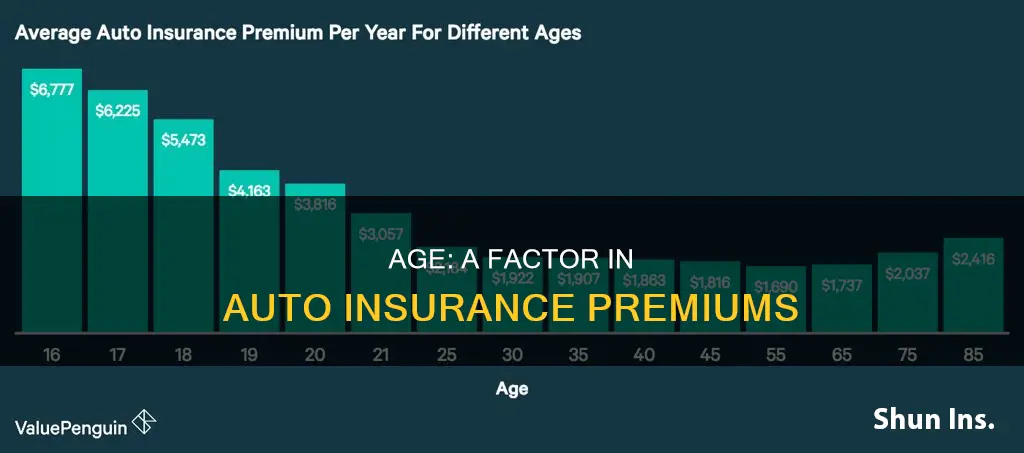

Age is one of the most important factors that insurance companies consider when determining your auto insurance premium. Young people, especially those under 25, tend to pay the highest rates as they are deemed to be high-risk due to their lack of driving experience. For instance, a 16-year-old driver pays around $613 per month for full coverage insurance, while a 25-year-old pays significantly less for the same coverage. Rates are at their lowest for 60-year-old drivers, costing around $158 per month, but they begin to rise again after this age as reflexes and cognitive functioning start to decline.

| Characteristics | Values |

|---|---|

| Age | Younger drivers, especially those under 25, pay more for car insurance than older drivers. |

| Driving experience | Less experienced drivers are deemed to be a higher risk and are therefore charged more. |

| Gender | Men, especially young men, pay more for car insurance than women. |

| Marital status | Married people are considered lower risk and are therefore charged less. |

| Geography | The state in which you live will affect your insurance premium. |

| Credit score | A good credit score indicates responsibility and can lead to lower premiums. |

What You'll Learn

Teen drivers pay more for insurance than older drivers

Teen drivers are subject to much higher insurance costs than older drivers. This is because teens are statistically less safe on the road than more experienced drivers. The Insurance Institute for Highway Safety (IIHS) reports that the rate of accident-related deaths per mile among 16- to 19-year-olds is three times higher than for drivers over 20. The rate of crash-related deaths per mile is highest among 16- and 17-year-olds.

Teens are also more likely to be in accidents because of their inexperience. They are also more likely to speed, tailgate, and not wear their seatbelts. These factors contribute to higher insurance rates for teen drivers.

In addition, young drivers are more likely to be reckless and distracted behind the wheel. They are also more likely to have lower credit scores, which can affect their insurance rates.

The cost of insuring a teen driver can be significantly higher than that of an older driver. For example, a 16-year-old driver may pay around $613 per month for full coverage insurance, while a 25-year-old driver may pay less than half that amount.

There are ways to mitigate the high cost of insuring a teen driver. For example, parents can add their teen to their existing policy, which is usually cheaper than purchasing a separate policy. Teens can also take a defensive driving course or maintain good grades to qualify for discounts.

Florida vs. PA: Cheaper Auto Insurance?

You may want to see also

Male drivers pay more than females

Male drivers typically pay more for car insurance than females, with the difference being especially pronounced for young men. This is because males are statistically more likely to be involved in road accidents, get tickets, and be arrested for driving under the influence. Men are also more likely to drive a car that is more expensive to insure.

In the US, men pay an average of 4% more for car insurance, but this varies by state. In Wyoming, for example, male drivers pay 13% more than women on average. In Florida, the difference is only $1.

The discrepancy is most significant for young male drivers. A 16-year-old male pays, on average, $843 more than his female counterpart. At 20, they pay $454 more, and at 25, the difference drops to $107. Overall, young drivers can expect their car insurance rates to be much more affordable at around age 25.

The price difference between male and female drivers varies by age. Until the age of 21, men pay an average of 10% more than women for full-coverage insurance. The gap shrinks after age 30, when men begin to pay 1% less than women until age 50. After age 50, females start to pay less again, but the difference is less than $50 annually.

While gender is a factor in determining insurance rates, it is not the only one. Other factors that can affect your car insurance premium include your age, location, insurance provider, driving record, credit history, and the type of car you drive.

Auto Insurance: Dropped or Renewed?

You may want to see also

Age is a bigger factor than location

Age is a significant factor that insurance companies consider when determining auto insurance premiums. While location also plays a role in premium pricing, age is a more critical factor. Young drivers, especially those under 25, are deemed high-risk due to their lack of driving experience, making them more prone to accidents. As a result, they often pay much higher insurance rates than older drivers. For instance, a 16-year-old driver typically pays around $613 per month for full coverage insurance, while a 25-year-old driver's rate for the same coverage is significantly lower.

Insurance companies consider young, inexperienced drivers as a greater risk, which leads to higher insurance rates for this age group. Teen car insurance can cost over $500 per month, and the rates gradually decrease as drivers age and gain more experience. The data shows that drivers aged 16 to 19 are four times more likely to be involved in car accidents than older drivers. Additionally, drivers between 15 and 20 years of age account for 7% of all fatal accidents, despite representing only 4% of drivers.

The impact of age on insurance rates is evident in the significant cost difference between younger and older drivers. For example, there is a $454 monthly cost difference between a 17-year-old and a 60-year-old driver. This disparity highlights how age influences insurance premiums, with younger drivers facing substantially higher costs.

While location is a factor in insurance rates, age takes precedence. Drivers aged 55 and above generally pay the least for auto insurance, even in areas with higher average insurance rates. The experience that comes with age is a crucial factor in reducing insurance premiums. As drivers mature and gain more years behind the wheel, insurance companies view them as lower-risk, resulting in more affordable rates.

Arizona Gap Insurance: What's Covered?

You may want to see also

Senior drivers pay less for insurance

Age is one of the most important factors that insurance companies consider when determining your auto insurance premium. While younger drivers tend to pay more for car insurance, senior drivers are often eligible for lower rates. Here are some reasons why senior drivers pay less for insurance:

Lower Risk

Senior drivers, especially those over the age of 65, are generally considered lower-risk drivers compared to younger and less experienced drivers. Statistics show that teenagers and young adults have higher crash and death rates per mile driven. On the other hand, older drivers tend to have more driving experience and are more cautious on the road, resulting in fewer accidents.

Safe Driving Habits

Senior drivers often exhibit safer driving habits than their younger counterparts. They are more likely to follow traffic rules, wear their seatbelts, and avoid driving under the influence of alcohol. Additionally, they tend to drive during daylight hours and avoid driving at night, which is a safer time to be on the road. These factors contribute to lower accident rates among senior drivers.

Discounts and Special Programs

Many insurance companies offer discounts and special programs specifically for senior drivers. These can include mature driver courses, defensive driving classes, and low-mileage discounts. Completing these courses can help senior drivers improve their driving skills, stay up-to-date with traffic laws, and qualify for lower insurance rates. Some states even mandate discounts for senior drivers who complete approved driving courses.

Comparison Shopping

Senior drivers can benefit from comparing insurance rates from multiple companies. By shopping around and getting quotes from different insurers, seniors can find the most competitive rates and identify insurers that offer discounts specifically for senior citizens. This can help them find the best coverage at the most affordable price.

Choosing the Right Insurance Company

When it comes to insurance for senior drivers, not all companies are created equal. Some insurance providers, like State Farm, Nationwide, and Travelers, are known for offering competitive rates and discounts for senior drivers. It's important for seniors to research and compare different insurance companies to find the best coverage and rates that meet their specific needs.

Calculating Vehicle Insurance Replacement Value

You may want to see also

Young drivers can save money by taking driving courses

Young drivers are deemed high-risk drivers because they are inexperienced. As a result, they have the highest auto insurance premiums. However, there are ways for young drivers to save money on car insurance, including taking driving courses.

In Ontario, Canada, driving school courses are offered by MTO-approved driving schools. These courses can help young drivers save money on their insurance by providing them with a driver training certificate, which can result in significant discounts from insurance providers. The amount saved depends on the insurance company, but it can be anywhere from 10% to 30%—the equivalent of having three years of driving experience instead of one. For example, a 17-year-old driver could expect to save up to $1,689 per year by taking a driving course. Over a three-year period, this could result in savings of over $5,000.

Additionally, taking a driving course can help young drivers get their full G license quicker, which can be much more convenient for families and young people. The courses also make young drivers safer, reducing the risk of accidents and resulting in lower insurance rates.

The cost of attending driving school is typically around $600, but this investment can pay off in the long run with the potential for significant savings on car insurance. The courses usually include classroom instruction, in-vehicle training, and flexible training options such as online courses or simulators.

Overall, taking a driving course is a great way for young drivers to save money on their car insurance, gain confidence behind the wheel, and become safer, more responsible drivers.

Dual Auto Claim: One Accident, Two Policies

You may want to see also

Frequently asked questions

Yes, age is one of the most important factors insurance companies consider when determining your auto insurance premium. Teen drivers and first-time drivers pay the highest rates for auto insurance. Drivers under the age of 25 tend to pay the highest rates, and rates start to increase again after age 60.

Younger drivers are considered to be high-risk because they are inexperienced and are therefore more likely to be in an accident. According to the Insurance Institute for Highway Safety, drivers aged 16 to 19 are four times more likely to be in a car accident compared to older drivers.

The difference in auto insurance rates by age can be significant. For example, there is a $454 cost difference between 17 and 60-year-old drivers. Teen drivers can pay over $500 per month for coverage, while 60-year-old drivers pay around $158 per month for full coverage insurance.