Auto insurance companies are required to notify you in advance if your policy is being cancelled, though the amount of notice varies by state. In most states, insurance companies must give at least 10 days' notice before a non-renewal, but cancellation notice requirements can range from 20 to 75 days. After receiving a cancellation notice, it's important to act quickly to find a new insurance provider or get your existing policy reinstated to avoid a lapse in coverage, which could lead to fines, higher premiums, and suspension of your vehicle registration.

| Characteristics | Values |

|---|---|

| Notice period | Depends on the state and reason for cancellation. Typically, 10-20 days for non-payment and 20-75 days for other reasons. |

| Reasons for cancellation | Non-payment, fraud, license suspension, health status change, etc. |

| Reinstatement | Possible if within the grace period. |

| Non-renewal | Occurs at the end of the policy term. Reasons include drunk driving, too many claims, credit score change, etc. |

What You'll Learn

How much notice do insurance companies need to give?

The amount of notice an insurance company is required to give before cancelling your policy depends on the state you live in and the reason for cancellation. In most states, insurance companies must give at least 10 days' notice before a non-renewal, but this can range from 20 to 75 days for other reasons.

If you are cancelling your policy due to non-payment, insurance companies usually give a grace period of around 30 days following the payment due date. If you can bring your payments up to date during this time, your insurance company will typically keep your policy active.

If your insurance company decides to cancel your coverage in the middle of your policy period, you will typically receive between 20 and 75 days' notice, depending on the state.

It is worth noting that insurance companies in some states are required to give at least 30 days' notice before cancelling your policy. This is to ensure that you have enough time to find another policy and avoid a lapse in coverage.

To find out the specific requirements in your state, it is recommended to check with your state's department of insurance.

Automated Auto Insurance Payments: Afternoon Debit?

You may want to see also

What happens if you can't afford your next payment?

If you can't afford your next auto insurance payment, there are several options to consider. Firstly, it is essential to understand the consequences of missing a payment, which can include late fees, a premium increase, and a grace period before your account becomes current. Failure to make payments can also result in your insurance company cancelling your coverage, which can have further repercussions.

To avoid these negative outcomes, consider the following strategies:

- Contact your insurance company: Get in touch with your insurer as soon as possible. They may be willing to work with you by extending the grace period, waiving late fees, or offering a payment plan to help you maintain your coverage.

- Shop around for a new insurer: Compare rates from different insurance companies, as prices can vary significantly. You may find a lower rate that better fits your budget.

- Reduce your coverage: While it is advisable to have full-coverage insurance, it is not legally required in most states. Consider reducing your coverage to the minimum state requirements to lower your premiums.

- Increase your deductible: Raising your deductible will lower the cost of your plan. Keep in mind that a higher deductible means you'll need to pay more out of pocket before your insurance company covers repairs.

- Ask about discounts: Many insurance companies offer discounts such as low-mileage, safe driving, good student, and multi-policy discounts. Ask your provider about the discounts they offer and see if you are eligible for any of them.

- Explore usage-based insurance: Consider usage-based insurance programs that track your driving habits and offer discounts for safe driving. If you drive less than the average driver, these programs can result in significant savings.

- Take a defensive driving course: Check with your provider to see if completing a defensive driving course can reduce your premium. Many states offer online courses that you can take at your own pace.

- Work on your credit score: In most states, car insurance companies use credit scores to determine insurance rates. Improving your credit score can help lower your insurance premiums over time.

- Ask about your state's assigned risk pool: If you're facing high insurance rates due to your driving record, inquire about your state's assigned risk pool. This program requires insurance companies to offer more affordable rates to high-risk drivers.

Remember, driving without insurance is illegal in most states and can result in fines, license suspension, and even jail time. It is crucial to maintain continuous coverage to avoid these penalties and ensure you are protected financially in the event of an accident.

IDV: Vehicle Insurance's Claim Value

You may want to see also

What happens if you miss a payment?

If you miss a payment on your car insurance, you may be charged a late fee of up to $15 per day until your insurance provider processes your payment. Late or missing payments can also result in a lapse in coverage, meaning you will no longer be protected. If you stop paying premiums altogether, your insurer is likely to cancel your policy.

If you miss a payment by just a day or two, you may still be covered under your insurance carrier's grace period. However, if you continually miss payments, you risk losing your coverage, higher insurance rates, repossession of your vehicle, and severe consequences such as the impounding of your vehicle or even jail time, depending on local laws.

If you receive a cancellation notice from your insurance company, you should contact your provider immediately to discuss next steps and make arrangements. You should also try to reinstate your policy with your current insurer or shop around for a new policy. It's important to avoid driving your car until you are no longer uninsured, as this could result in fines and other penalties.

To avoid late payments, confirm that you have the money in your account by the agreed-upon payment date. You may also be able to access your invoice online to view your payment history or leave a backup card on file with your insurer.

Pursuing a Career as an Auto Insurance Adjuster

You may want to see also

What happens if your insurance is cancelled?

If your insurance is cancelled, you will need to purchase a new policy. This may be more difficult and expensive, depending on the reason for the cancellation. The reasons that often lead to the cancellation, such as a license suspension, may be viewed by other insurance companies as evidence of high-risk behaviour, which generally leads to higher costs of car insurance.

If your insurance was cancelled due to non-payment, you may be able to get your previous insurer to reinstate the policy. However, they may charge you higher rates. It is also possible that your previous insurer will not offer you insurance at all, in which case you will need to go with another company, such as a nonstandard insurer.

If you are unable to line up a new policy with another insurance company, you may be able to get coverage through your state's "assigned-risk" program. This type of auto insurance is typically available to high-risk drivers who have trouble buying a policy in the private market.

In the meantime, it is illegal to drive without insurance in nearly every state, so once your insurance is terminated, you won't be able to drive. The longer you go without coverage, the bigger the price increase will be when you get a new policy. A 15-day lapse could result in an 8% increase, while a 45-day lapse could result in a 24% jump.

Gap Insurance: Opt-in or Automatic?

You may want to see also

What happens if you can't get coverage after a lapse?

If you can't get coverage after a lapse, you may face serious consequences. Driving without car insurance is illegal in all states except New Hampshire and Virginia, and you could be subject to various penalties, including fines, having your car impounded, and even jail time, depending on the state. If you are in an accident while uninsured, you will be liable for any damage or injuries caused, and you may have to pay out of pocket.

In addition, a lapse in coverage will likely result in higher insurance premiums when you do get coverage again. Insurance companies see a lapse as a sign of additional risk, and you may be considered a high-risk driver. This perception of higher risk will also make it more difficult to find insurance, and you may have to turn to companies that specialise in insuring high-risk drivers, which often have fewer coverage options and higher rates.

To avoid these issues, it is important to maintain continuous car insurance coverage, even if it is the minimum amount required by your state. If your policy has lapsed, you should contact your insurance company immediately to see if your policy can be reinstated. If not, start shopping for a new policy right away.

Auto Insurance: Transmission Failure Covered?

You may want to see also

Frequently asked questions

The amount of notice you get depends on the regulations in your state and the reason for cancellation. Most states require car insurance companies to give at least 10 days' notice before a nonrenewal, but cancellation notice requirements for other reasons can range from 20 to 75 days.

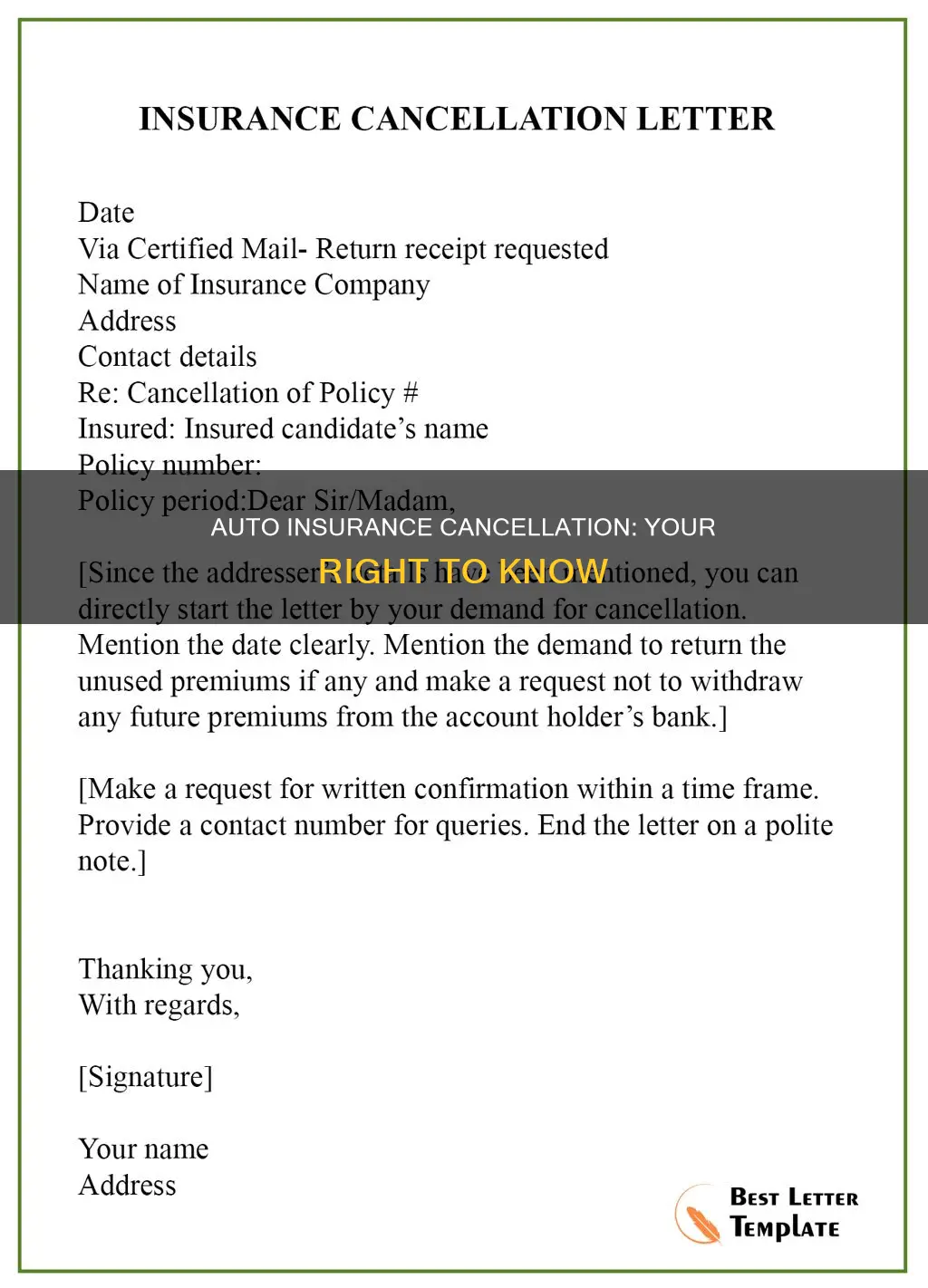

If you have received an auto insurance cancellation letter, your first step is to understand why your policy is being canceled and how long you have to find replacement coverage. You should then see if your provider is willing to consider reinstating your coverage. If not, you should start shopping for a new insurance provider right away.

No, auto insurance companies cannot cancel your policy without providing written notice.