Auto insurance companies use a point system to determine a driver's risk level and set insurance rates. These points are based on driving records, including accidents, traffic violations, and insurance claims. The more points a driver has, the higher the insurance rates as it indicates higher risk. While the specific point systems vary across companies and states, they generally follow a similar framework, with more serious offences resulting in more points and higher premiums.

What You'll Learn

Insurance points vs. license points

Insurance points and license points are two different systems for tracking driving infractions. While they are related, they are not the same.

Insurance Points

Insurance points are a reflection of your driving record, which insurance companies use to help calculate your rates. All but nine states currently use some kind of insurance points system. The points are an indicator of your driving risk based on your driving history.

When you apply for insurance, the insurance company will look at your DMV record and the number of insurance points you have. This will impact your insurance premium rates. If your price is much higher than the initial quote offered, it is likely because the insurance company found evidence of several insurance points on your record.

Insurance points are determined by insurance companies based on a driver's history of accidents, moving violations, and claims filed. Each insurance company has its own system for assigning points, and the number of points assigned can vary. Generally, more severe violations and accidents result in higher insurance points.

License Points

Most U.S. states have a system for adding points to your state driving record if you violate motor vehicle laws. The purpose of points is to encourage safer driving habits and to protect drivers, passengers, and others who share the road. Each legal violation has a fixed point number assigned to it, typically set by the state's department of motor vehicles.

Accruing too many license points may lead to losing your license. If you accumulate a specific amount of points in a certain amount of time (which varies by state), your license will often be suspended or revoked.

Differences

Insurance points and license points differ in their impact on drivers. License points affect driving privileges, while insurance points increase insurance rates.

Insurance points don't carry the same driving implications as license points, although they do impact the cost of insurance rates. License points, on the other hand, can result in the suspension or revocation of a driver's license.

Insuring Your Car: Adding a Girlfriend

You may want to see also

How insurance points are calculated

Insurance points are a reflection of your driving record, which insurance companies use to calculate your rates. These points are an indicator of your driving risk based on your driving history. The more points you have, the worse off you are.

The exact calculation of insurance points is opaque and varies from company to company and state to state. However, some general principles can be outlined.

Firstly, insurance points are assigned for transgressions of driving laws, such as speeding, running a red light, or driving under the influence. The more severe the transgression, the more points are added to your record. For example, in California, a speeding ticket will result in one point on your license, while a DUI will result in three points.

Secondly, insurance points remain on your record for a certain period, after which they are expunged. The length of time that points remain on your record depends on the severity of the transgression and the policies of your state and insurance company. Minor violations such as speeding tickets will typically drop off your record within three to five years, while more serious infractions such as DUIs can remain on your record for much longer, sometimes indefinitely.

Thirdly, accumulating too many insurance points will result in increased insurance premiums. Insurance companies will pull your driving record when you apply for or renew your policy and will take into account any points on your record when calculating your rates. The more points you have, the higher your premiums will be.

Finally, there are ways to reduce the number of points on your record or mitigate their impact on your insurance rates. Taking a state-approved defensive driving course can help remove points from your record in some states. Additionally, shopping around for insurance, raising your deductible, asking about discounts, and taking a defensive driving course can all help counteract the impact of points on your insurance rates.

New Drivers: Get Cheap Auto Insurance

You may want to see also

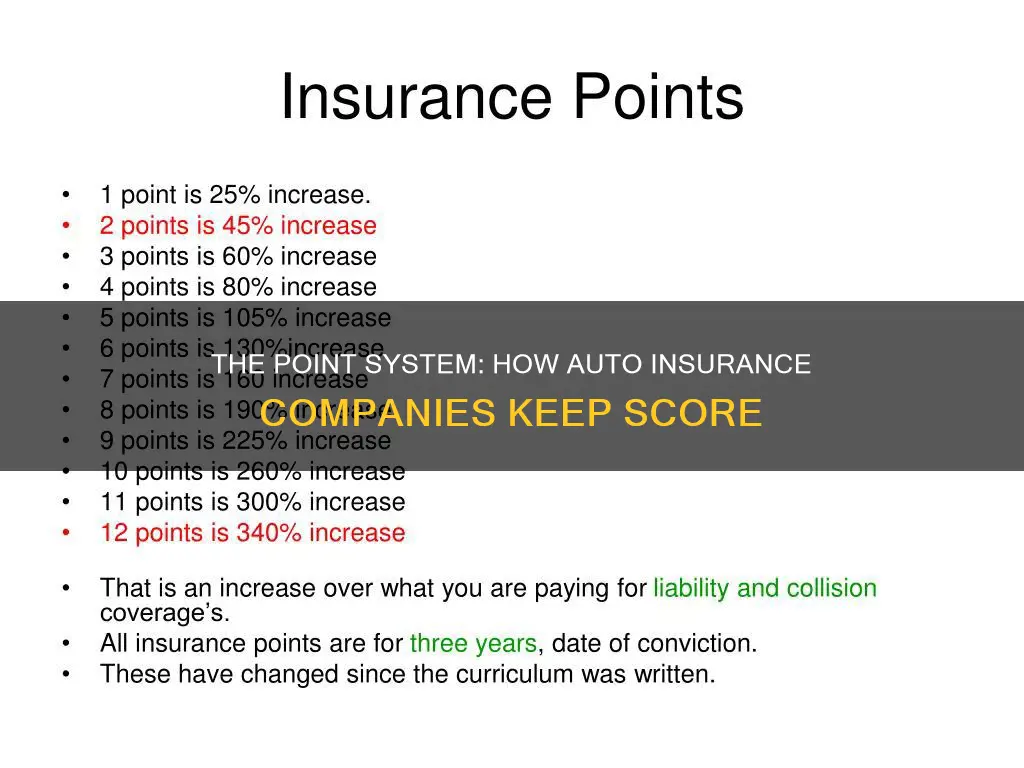

How insurance points impact insurance rates

The impact of insurance points on insurance rates varies depending on the state and the insurance company. However, generally speaking, the more points on your driving record, the higher your insurance rates will be. Insurance points are used by insurance companies to assess your eligibility for coverage and to calculate your rates. These points are based on your driving history and are an indicator of your driving risk.

When you apply for car insurance, the insurance company will typically look at your driving record, including any points you have accumulated. They will also consider various other factors, such as your age, the car you drive, and your credit score. Each insurance company has its own method of evaluating applicants, so the impact of points on your driving record may vary. For example, one company may significantly increase your rates after a speeding ticket, while another may be more concerned with texting and driving infractions.

In most states, traffic violations and accidents are tracked using a point system. These systems vary by state, and the number of points assigned to each infraction can differ significantly. For example, a speeding ticket may result in one point, while reckless driving could result in four or more points. If you accumulate a certain number of points within a specific time frame, your license may be suspended or revoked.

It's important to note that insurance points are not the same as driver's license points. Driver's license points are assigned by the state's Department of Motor Vehicles (DMV) and can lead to the suspension or revocation of your license. Insurance points, on the other hand, are used by insurance companies to assess your risk and determine your rates. These points may or may not match up with the points on your DMV record.

To find out how insurance points will impact your insurance rates, you can contact your insurance company or state insurance regulatory body to request their surcharge schedule. This will outline how your rates will be affected by the number of points on your record. You can also shop around and compare quotes from different insurance companies, as rates can vary significantly between carriers.

Autism and Auto Insurance: Teen Access

You may want to see also

How to remove insurance points

While there is no immediate way to remove insurance points, there are a few things you can do to reduce the number of points on your record or lower your insurance premiums. Here are some methods to consider:

Defensive Driving Courses

Taking a state-approved defensive driving course can help remove points from your license and lower your insurance costs. Many states allow drivers to take these courses to remove a few points, but it's important to verify if this option is available in your state. Some states also have specific programs, like New York's Point & Insurance Reduction Program, which can help reduce points and insurance premiums.

Pay Fines or Take Classes

In some cases, you may be able to remove points from your license by paying fines or taking classes. This option depends on your state and the nature of the violation.

Improve Your Credit Score

Insurance companies consider various factors when assessing your insurance rates, and one of them is your credit score. Improving your credit score can positively impact your insurance rates, as it demonstrates financial responsibility.

Safe-Driving App Programs

Participating in a safe-driving program or using a safe-driving app can help prove your safe driving habits to insurance companies. These programs monitor your driving habits, and if you achieve a certain score or complete the program, you may be eligible for insurance discounts.

Shop Around for Insurance Providers

Different insurance providers use their own points systems, and comparison shopping can help you find an insurer that is more lenient with your driving record and offers better rates.

Wait for Points to Expire

Insurance points typically remain on your record for three to seven years, or even longer in some cases. After this period, the points will be removed, provided you maintain a clean driving record.

It's important to remember that the best long-term strategy is to improve your driving behavior and avoid violations. By driving safely and responsibly, you can prevent insurance points from building up and keep your insurance premiums low.

Auto Insurance: To Cancel or Not?

You may want to see also

How long insurance points last

The length of time that insurance points remain on your record depends on several factors. These include the type of violation, the state in which the violation occurred, and the policies of your insurance company.

Most states use a point system to track traffic violations and accidents, and these systems can vary from state to state. Minor violations, such as speeding tickets, typically stay on your insurance record for three to five years, while more severe infractions, such as driving under the influence (DUI), can remain on your record for much longer, sometimes up to 75 years. For example, in Florida, a DUI stays on your driving record for 75 years. In most states, DUI offences remain on your record for at least seven to ten years.

In addition to the type of violation, the policies of your specific insurance company and the laws of your state will also influence how long the points stay on your record. Insurance companies typically examine your record from the previous two to three years when determining your rates, and they may go back five years if you are applying for a 'good driver discount'. It's important to note that your insurance rates may not increase immediately after a violation; instead, you can usually expect the increase at your next insurance policy renewal.

While the exact length of time that insurance points remain on your record can vary, it's important to maintain good driving habits and keep your driving record as clean as possible to minimise the impact on your insurance rates.

Parked Cars Need Insurance Too

You may want to see also

Frequently asked questions

Yes, auto insurance companies use a point system to grade each customer's risk as a driver. Points are assigned based on certain behaviours, such as filing accident claims or getting a speeding ticket. These points help insurance companies decide how much to charge drivers for a policy.

The point systems operated by insurers differ from company to company, but they all have the same purpose. They track your driving performance and then use that information to raise your car insurance rates if you get a ticket or are convicted of driving infractions.

Insurance points are assigned by insurance companies and are used to determine insurance rates. Driver's license points are assigned by the state's Department of Motor Vehicles (DMV) and are used to determine whether a driver's license should be suspended or revoked.

One way to reduce points is to wait for them to be removed automatically after a certain amount of time. This duration varies depending on the type of violation and state laws. Another way to reduce points is by completing a defensive driving course.