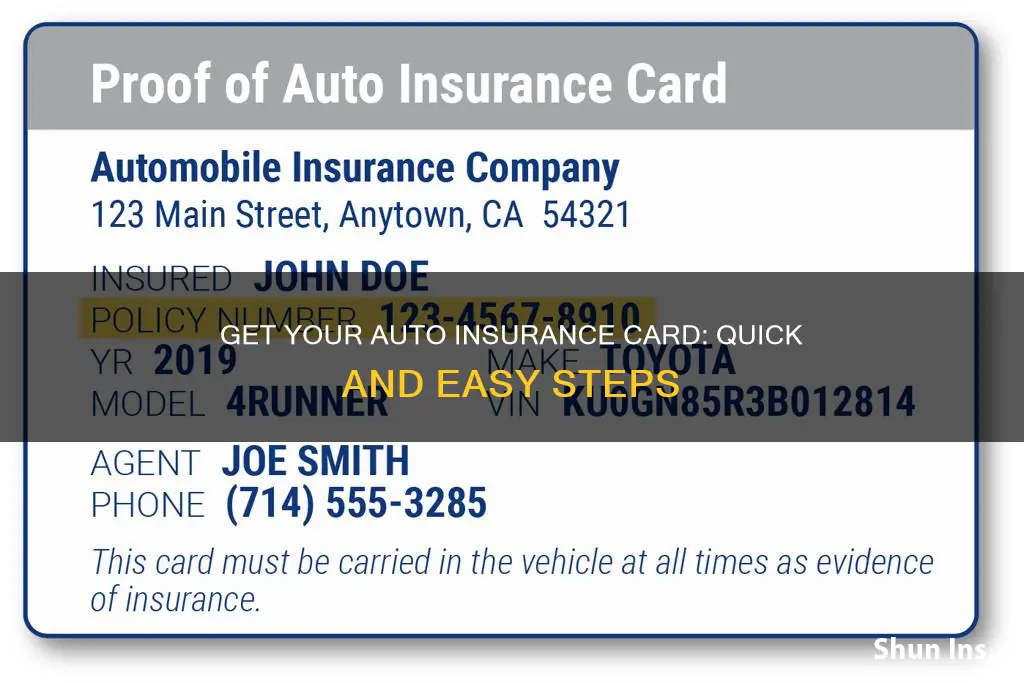

Getting auto insurance is a requirement in nearly every state, and with it comes an auto insurance card, also known as proof of insurance. This card is important to have on hand as it may be requested by law enforcement, especially if you are pulled over or in an accident. It is also needed when registering a newly purchased vehicle or renewing your license plate at the DMV. There are several ways to obtain your auto insurance card, including requesting a physical copy by mail, accessing it online and printing it yourself, or saving the card image to your phone.

| Characteristics | Values |

|---|---|

| How to get an auto insurance card | Request one from your insurance company by phone, email, or through their website |

| Print out a copy yourself | |

| Display your card on your phone through your insurance company's app | |

| Visit your insurance agent in person |

What You'll Learn

Request a physical copy by mail

Requesting a physical copy of your auto insurance card by mail is a straightforward process. Here's a detailed guide on how to do it:

Contact Your Insurance Provider

The first step is to reach out to your insurance company. You can find their contact information on their website or your policy documents. It's a good idea to have your policy number and personal details ready when you make contact.

Request a Physical Copy

When you speak to a representative, either over the phone or in person, inform them that you need a physical copy of your auto insurance card. Be sure to specify that you would like it mailed to your address. You may also need to provide your address for their records.

Confirm Delivery Details

Before ending the call or leaving the office, confirm the delivery method and the expected timeframe for receiving your physical copy. This will give you an idea of when to expect your insurance card in the mail.

Keep Your Information Updated

It's important to ensure that your insurance information is up to date. If there are any changes to your policy or personal details, be sure to inform your insurance provider. This will help ensure that the physical copy of your insurance card is accurate and reflects the most current information.

Explore Other Options

While requesting a physical copy by mail is a standard option, it's worth noting that many insurance companies offer digital alternatives. These days, most insurance providers have websites or mobile apps where you can access and download your insurance card. Some companies even allow you to save your insurance card to your digital wallet, providing easy access on your smartphone.

Remember, maintaining proof of insurance is crucial to meeting state auto insurance laws and avoiding penalties. Always keep your insurance card with you when driving, either as a physical copy or through the digital options provided by your insurance company.

Safe Auto Insurance: Understanding the Paper Trail

You may want to see also

Access your digital copy online and print it

If you have access to a computer and a printer, you can access your auto insurance card by visiting your insurance company's website and logging into your account. From there, you should be able to access and print a physical copy of your insurance card.

Most insurance companies offer digital services that allow customers to access their insurance documents online. You can log in to your account and navigate to the relevant section to download a digital copy of your insurance card. You can then print this copy and store it in your vehicle.

Some insurance companies also offer mobile apps that provide access to your insurance card. These apps often include a wallet function where you can save a digital copy of your insurance card. This way, as long as you have your phone with you, you can easily access your proof of insurance.

It is important to note that while most states accept digital proof of insurance, there may be variations in acceptance depending on your location. For example, in New Mexico, law enforcement officers are not required to accept electronic proof, so it is recommended to have a physical copy as a backup. Always check the specific requirements and acceptance of digital proof of insurance in your state or the areas you plan to drive in.

The Auto Insurance Mystery: Unraveling the NYC Conundrum

You may want to see also

Save the card image to your phone

Saving the card image to your phone is a convenient way to ensure you always have your auto insurance card to hand. Most major insurance companies, including Allstate, Geico, Progressive, and State Farm, offer this option.

You can save the card image to your phone by downloading it from your insurance company's website or mobile app. If you can't find the option to download the card, you can try taking a screenshot of the card image on the website or app. Alternatively, you can email a copy of the card to yourself and then save the image to your phone.

Once you have the card image on your phone, you can save it in a folder or gallery that is easily accessible. You may also want to consider using a "wallet" app to store the card, which will keep it secure and easily accessible. Some insurance companies offer apps with a wallet function, or you can use a third-party wallet app.

Having a digital copy of your auto insurance card on your phone is a great backup option, even if you primarily use a physical card. It's important to note that nearly every state accepts digital insurance cards as proof of insurance, except for New Mexico, where law enforcement is not required to accept electronic proof. So, it's always a good idea to keep a physical copy of your insurance card in your wallet or glove compartment as well.

South Carolina Auto Insurance Requirements: Understanding the Law

You may want to see also

Display the card on your insurance company's mobile app

Displaying your auto insurance card on your insurance company's mobile app is a convenient way to ensure you always have proof of insurance when you need it. All major auto insurers now allow customers to access their digital insurance ID cards via a mobile app.

Here's how to display your auto insurance card on your insurance company's mobile app in a few simple steps:

Step 1: Download the Mobile App

Firstly, you'll need to download your insurance company's mobile app onto your smartphone or tablet. You can find the app by searching for it on the App Store or Google Play store, depending on your device.

Step 2: Log In to the App

Once you've downloaded the app, open it and log in to your account. You may need to create an account if you don't already have one. You can usually do this by providing some personal details and your policy number.

Step 3: Access Your ID Card

After logging in, navigate to the section of the app where you can view and access your digital ID card. This is usually labelled as "ID Cards" or something similar. From here, you'll be able to view, download, and save your auto insurance card.

Step 4: Save Your ID Card

You can choose to save your ID card to your device for easy offline access. This is a convenient option, as it allows you to access your ID card even when you're not logged in to the app or don't have an internet connection.

Step 5: Add to Your Mobile Wallet (Optional)

If you're an Apple user, you may also have the option to add your digital insurance ID card to your Apple Wallet. This allows for quick and convenient access to your ID card, and it will automatically update whenever you renew your policy or make changes.

By following these steps, you'll be able to easily display your auto insurance card on your insurance company's mobile app and access it whenever needed. It's a good idea to check with your insurance provider and your state's requirements to ensure that digital ID cards are accepted as valid proof of insurance in your location.

Gap Insurance: DCU's Coverage Options

You may want to see also

Visit your insurance agent in person

If you are unable or unwilling to retrieve your auto insurance card by phone, email, or online, you can always visit your insurance agent in person. This is a good option if you don't have access to a computer or fax machine, or if you would prefer to interact with your insurance agent face-to-face.

Most of the best auto insurance companies, such as State Farm, Farmers, Allstate, and Liberty Mutual, have in-person agents nationwide who are ready to assist auto insurance policyholders with getting proof of insurance. While most providers welcome walk-ins, you can also contact your insurance agent to schedule an appointment. If you're not sure where your local agent is, simply use your insurer's website to locate the nearest one with your ZIP code.

When you visit your insurance agent, be sure to bring the necessary information to verify your identity, such as your policy number, name, and any other relevant details. You can then request a physical copy of your auto insurance card.

It's important to note that, in addition to having a physical copy, many insurance companies also offer digital insurance cards that can be accessed through their mobile apps or websites. This can be useful if you want to have your proof of insurance easily accessible on your phone. However, it's always a good idea to carry a paper copy as well, in case your phone is dead or you don't have service when you need to provide proof of insurance.

Auto Insurance Coverage Across State Lines: A Comprehensive Guide

You may want to see also

Frequently asked questions

You can get an auto insurance card by contacting your insurance provider, either by phone, through their website, or by visiting an agent in person. You can also print a copy yourself.

You will need to provide your policy number, name, and any other details requested by the insurance company to verify your identity.

Insurance companies do not usually charge a fee for providing a copy of your auto insurance card. However, it is always good to confirm with your insurance provider if any fees or charges apply.

The time it takes to receive an auto insurance card varies depending on the insurance company and their processes. In many cases, you can expect to receive it within a few business days. If you need the card urgently, inform your insurance company about the time sensitivity so they can expedite the process.