Auto insurance can be cancelled at any time, but there may be financial consequences for doing so. Depending on the insurance company and the jurisdiction, a cancellation fee may be charged, and this may be a flat fee or a percentage of the remaining policy premium. It's also important to ensure that a new policy is in place before cancelling an existing one, to avoid a lapse in coverage which could result in higher future premiums or legal consequences for driving without insurance.

| Characteristics | Values |

|---|---|

| Can you cancel at any time? | Yes |

| Do you need to give notice? | Yes, usually 15 or 30 days |

| Will you get a refund? | Yes, but it may be partial due to fees |

| How do you cancel? | Phone call, email, letter, mobile app, in person |

| When should you cancel? | When you have a new policy in place |

What You'll Learn

Auto insurance cancellation fees

Overview

Most car insurance companies can legally charge a cancellation fee if you end your policy early. However, many insurers choose not to impose cancellation fees to avoid negative reactions and bad reviews. Cancellation fees are usually relatively small, typically under $100.

Types of Cancellation Fees

There are two primary types of car insurance cancellation fees: flat fees and short fees. A flat fee is a set amount, whereas a short fee is calculated based on the remaining policy time. Short fees are usually 10% of the remaining premium.

Avoiding Cancellation Fees

You can usually avoid cancellation fees by waiting until your policy is about to expire or has ended. Some insurers will also waive the fee if you wait for the date your policy is set to expire. It's important to notify your insurer of your intention to cancel to avoid extra charges.

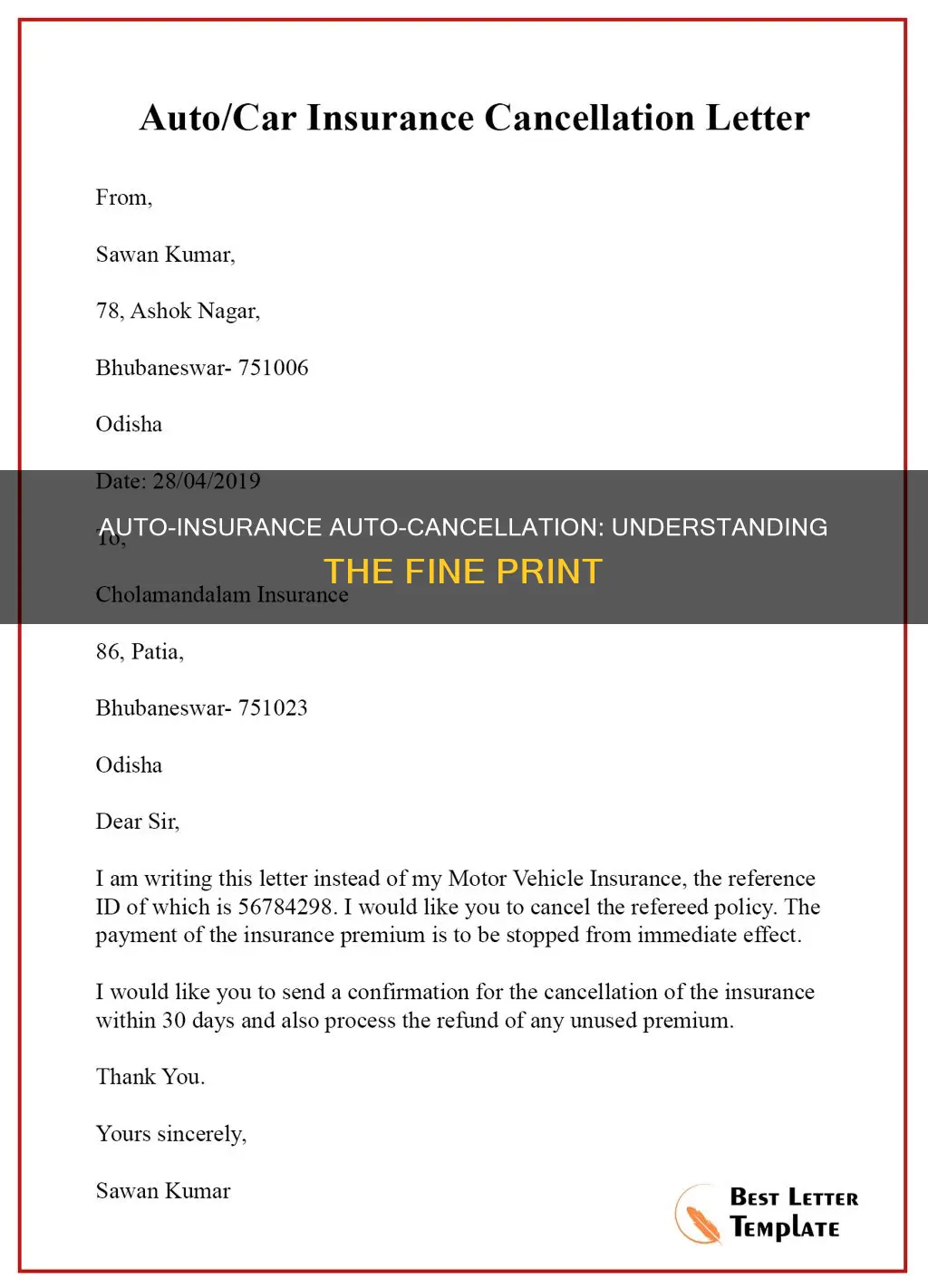

Cancelling Car Insurance

Cancelling car insurance is generally a straightforward process. You can usually cancel at any time, but it's essential to initiate a new policy before cancelling your existing one to avoid a lapse in coverage. You can cancel by calling your insurer, mailing or faxing a signed request, or asking your new carrier for assistance.

Leasing a Ford: Gap Insurance Included?

You may want to see also

Reasons for cancellation

Auto insurance companies can cancel your policy, although you will typically be given enough notice to obtain a new one. Here are some common reasons for cancellation:

- Non-payment of premium

- Fraud or material misrepresentation in your insurance application or renewal

- Your driver's license or vehicle registration was revoked or suspended

- You failed to disclose your car accidents and moving traffic violations or car insurance claims for physical damages within the previous 36 months (if your application requests this information)

- You made a false or fraudulent claim, or assisted someone else in making a false or fraudulent claim

- You or any other driver in your household or someone who customarily drives your car has a medical condition that affects their ability to drive safely, such as epilepsy or heart attacks, and does not have a certificate from a physician testifying to their ability to drive a car

- You or any other driver in your household or someone who customarily drives your car has been convicted of driving under the influence (DUI), driving while intoxicated (DWI), or operating under the influence (OUI)

- Your car isn't safe to drive due to mechanical problems or failing to pass inspection

- You use your car for business purposes, such as visiting job sites or making deliveries

- You drive passengers for hire, such as for a rideshare company, and don't inform your insurer

It's important to note that the specific reasons for cancellation may vary depending on your location and the insurance company's policies.

Commission Earnings of Auto Insurance Agents

You may want to see also

Cancelling without a new policy

Yes, you can cancel your auto insurance at any time, but there are a few things you should know about cancelling without a new policy in place.

First, it's important to understand your provider's cancellation policy to avoid paying unnecessary fees and to ensure you don't miss out on any refunds. While you can generally cancel at any time, some insurance companies require a notice period of 15 or 30 days, so be sure to check. You may also need to provide a letter of intent or complete a cancellation form.

When you cancel your policy, you may be entitled to a refund for any premiums paid in advance. This refund may be prorated, and there may be a cancellation fee involved, especially if you are cancelling soon after buying the policy. This fee is usually nominal, around $50, or a small percentage of your final premium.

It's critical to avoid a lapse in coverage when cancelling your auto insurance. In most states, it is illegal to drive without insurance, and a lapse in coverage can result in fines and increased premiums in the future, as insurance companies will consider you a high risk. Make sure to notify your insurance provider of your intent to cancel and provide the necessary documentation to ensure a seamless transition.

If you are selling your car, it is generally recommended to hold off on cancelling your coverage until the new owner takes possession and the title is transferred. Check with your local DMV about any specific requirements or responsibilities regarding licence plates and insurance.

In summary, while you can cancel your auto insurance at any time, it's important to understand your provider's policies, avoid lapses in coverage, and be aware of any fees or refunds involved to ensure a smooth and cost-effective transition.

Retitle First: Vehicle Insurance Removal 101

You may want to see also

Cancelling without a refund

Cancelling your car insurance without a refund can occur in a few different scenarios. Firstly, if your insurance company cancels your coverage due to non-payment, fraud, or other reasons, you likely won't receive a refund. It's important to properly notify your insurer about your intent to cancel and provide a specific cancellation date to avoid issues. Additionally, if you cancel your policy before the end of its term, you may be charged a cancellation fee, which could be subtracted from any refund you were otherwise entitled to. This cancellation fee varies depending on the company and state laws.

In some cases, you might choose to forgo a refund to maintain continuous coverage. For instance, if you're switching insurance providers, it's recommended to have your new policy in place before cancelling your old one to avoid a lapse in coverage, which could lead to higher rates in the future. Similarly, if you're reducing your coverage, such as dropping comprehensive and collision insurance, you might not receive a refund, but you can avoid a gap in coverage.

Furthermore, if you've already paid for your policy in advance and cancel before the end of the term, your insurer might refund the remaining balance. However, this refund could be subject to cancellation fees, and the amount and availability of refunds are governed by state insurance statutes. For example, in Texas, if you finance your premium through a premium finance company, the refund may go to the finance company instead of you. Therefore, it's essential to review your insurer's cancellation policy and state regulations to understand your specific situation regarding refunds.

AAA and Salvage Vehicle Insurance

You may want to see also

Cancelling without notifying your insurer

Cancelling your car insurance without notifying your insurer can lead to a number of issues. Firstly, if you have set up automatic payments, your insurance company will continue to withdraw money from your account until you officially cancel your policy. This means you could end up paying for duplicate coverage if you take out a new policy without cancelling your old one.

Secondly, if you don't notify your insurer, you may be charged extra fees. While some insurers will cancel your policy at renewal without payment, many offer an automatic grace period, which extends your coverage beyond the end of your policy to give you extra time to pay missed bills. If you don't pay during this period, you may be charged for the coverage extension as well as non-payment penalties.

Thirdly, if you don't notify your insurer, your policy may not actually be cancelled. This means you could continue to be charged for coverage you no longer want or need.

Finally, it's important to maintain continuous coverage to avoid being seen as a high-risk driver and charged higher premiums in the future. Even if you're not using your car, insurance companies and the state consider a lapse in coverage to be the same as driving without insurance.

To avoid these issues, it's best to notify your insurer of your intention to cancel your policy. You can do this by calling your insurer, contacting an agent through their website or mobile app, mailing in a cancellation request, or speaking to an agent in person. Some insurers may also allow you to cancel online.

U.S.A.A. Vehicle Insurance: Cheaper Option?

You may want to see also

Frequently asked questions

Yes, you can cancel your auto insurance at any time, but it is recommended that you look into your provider's cancellation policy to avoid paying unnecessary fees and to see if you are eligible for a refund.

If you paid any premiums in advance, your provider should refund them to you. You might also receive a prorated refund on your current premium, but this will be subject to cancellation fees.

To cancel your auto insurance, you may need to provide a letter of intent or complete a cancellation form. You can then call your insurance provider to cancel your policy.

If you don't officially cancel and simply stop paying, your credit score will be negatively impacted. Your next auto insurance provider may also see you as high risk and charge you more for insurance.

Yes, your insurance company can cancel your auto insurance if you don't pay your premium on time, but this will result in higher rates when you purchase new coverage.