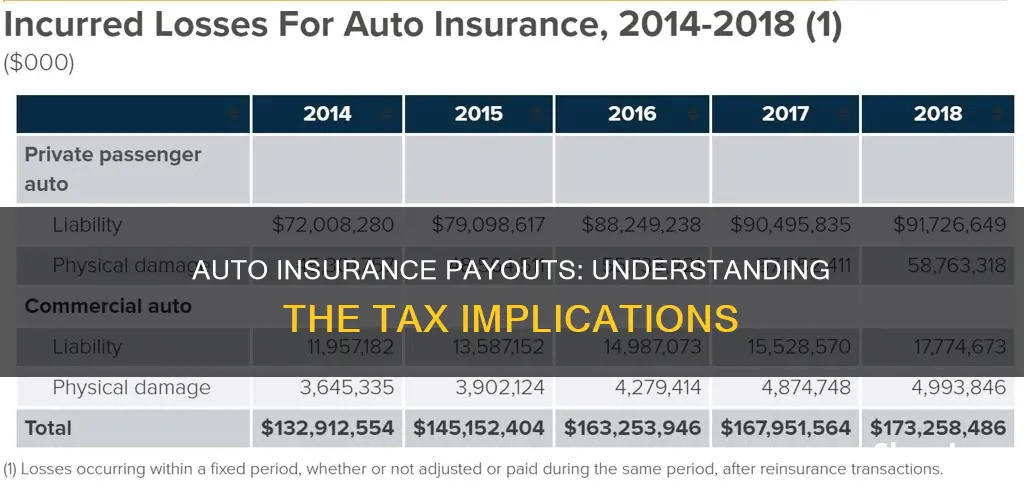

Whether auto insurance payouts are taxable or not depends on the type of compensation and the relevant tax laws. In the US, the Internal Revenue Service (IRS) taxes income that increases your net worth or wealth. Auto insurance is designed to compensate for financial losses, so it generally doesn't count as income. However, certain types of payouts may be considered taxable income by the IRS, such as compensation for lost wages, pain and suffering, and emotional distress. On the other hand, payouts for car repairs, medical expenses, and property damage are typically not taxed. It's important to consult tax professionals or experts as tax laws can vary by state, and understanding which parts of your insurance settlement are taxable is crucial.

What You'll Learn

Lost wages are taxable

Let's assume you earn $37,000 a year and are in a 15% tax bracket. If you receive a smaller settlement, like $5,000, it shouldn't impact your tax rate. It will be taxed as income but at your current rate of 15%. However, since you are not an insurance company employee, they will issue a 1099 instead of a W-2, which means you're taxed as a self-employed person instead of an employee. Because of this, you will be responsible for the employer's part of Social Security and Medicare taxes, which will run about 15.3%.

If you receive a large settlement representing several years of income all at once, you will most likely be taxed at a higher rate than you usually pay. For example, at $37,000 a year, you'd be taxed at a 15% rate. However, if you receive three years of lost wages in your settlement, you're now paying taxes on $111,000, which puts you in the 28% bracket. You'll also have to pay Social Security and Medicare taxes on the insurance settlement money.

If you had to get a lawyer involved, your piece of the pie would grow smaller while your tax bill got bigger. Even though your lawyer will take roughly one-third of your settlement, you will be responsible for taxes on the entire settlement amount and paying the Social Security and Medicare taxes.

In the case of a lost wage settlement of $5,000, you would pay:

- $1,650 in attorney fees

- $750 in income tax (at a 15% rate)

- $765 in Social Security and Medicare tax (at a 15.5% rate)

If you itemize deductions, you may be able to deduct the attorney's fees from your income, saving you around $248 in taxes. After paying your attorney and taxes, you should receive a net auto insurance settlement of $2,083, less than half of the total amount.

Michigan Auto Insurance: Denial and Your Rights

You may want to see also

Medical bills are tax-exempt

Medical bills are generally considered tax-exempt, but there are some exceptions. The IRS allows taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7.5% of their adjusted gross income. This includes unreimbursed payments for preventative care, treatment, surgeries, dental and vision care, visits to psychologists and psychiatrists, prescription medications, appliances such as glasses, contacts, false teeth and hearing aids, and expenses paid to travel for qualified medical care.

However, any medical expenses that are reimbursed, such as by insurance or an employer, cannot be deducted. Additionally, the IRS generally does not allow deductions for cosmetic procedures, non-prescription drugs (except insulin), or other general health purchases like toothpaste, health club dues, vitamins, diet food, and non-prescription nicotine products.

It is important to note that tax laws can vary by state, so it is always recommended to consult a tax professional or CPA to determine the taxability of specific circumstances.

Rideshare Insurance: Unraveling the Extra Costs for Drivers

You may want to see also

Physical pain/suffering is tax-exempt

When it comes to auto insurance payouts, it's important to understand which parts are taxable and which are tax-exempt. While most car insurance claim settlements are not taxed, there are situations where certain elements become taxable. The Internal Revenue Service (IRS) categorises each type of payment according to its specific purpose, and any payments that provide financial gain are generally considered taxable.

Physical pain and suffering are generally considered tax-exempt, but there are nuances to this. If the pain and suffering are a direct result of physical injury, they are typically not taxed. This is because the IRS views these payments as compensation for non-economic harm, which is meant to "make you whole" after a physical injury. In other words, it's not considered a financial gain but rather a reimbursement for your losses.

However, if the pain and suffering are classified as emotional distress or mental anguish unrelated to a physical injury, then it becomes a taxable component of your insurance payout. This is because emotional distress is considered a non-physical injury, and any compensation for it is viewed as a financial gain. It's important to note that tax laws can vary by state, so consulting a tax professional or a Certified Public Accountant (CPA) is always recommended to understand your specific situation.

To summarise, physical pain and suffering resulting from a physical injury are generally tax-exempt, while emotional distress or mental anguish unrelated to physical injury may be taxable. Consulting a tax expert is the best way to determine the tax implications of your auto insurance payout.

Auto Insurance: Phone Access?

You may want to see also

Emotional pain/suffering is taxable

Emotional pain and suffering are generally considered taxable income by the IRS. This is because the IRS deems such compensation to be a financial gain, which is taxable. However, there are some nuances to this.

Firstly, it is important to distinguish between emotional distress resulting from physical injury or sickness and emotional distress that occurs independently. If the emotional distress is directly linked to a physical injury or sickness, it is typically not taxable. This is because the IRS considers such distress to be a symptom of the physical issue. However, if the emotional distress is unrelated to any physical injury or sickness, it is usually taxable.

Secondly, the state in which you reside can also impact the taxability of emotional distress damages. For example, in Massachusetts, emotional pain incurred as a result of physical injury is not taxable. Therefore, it is essential to consult with a tax professional or a CPA to understand the specific rules in your state.

Additionally, the IRS considers interest on awards for emotional distress to be taxable. This is because the interest is deemed to provide financial gain. Punitive damages, which are meant to punish the defendant, are also taxable and should be reported as "other income".

It is worth noting that attorneys' fees and legal costs associated with claiming emotional distress damages are typically non-taxable.

Payoff Protector GAP Insurance: What's the Deal?

You may want to see also

Punitive damages are taxable

The IRS treats punitive damages as fully taxable ordinary income. This means that if a plaintiff receives compensatory damages that are excluded from income, any additional punitive damages received will be fully taxable. The IRS does not consider the underlying compensatory damages when taxing punitive damages. For example, if a plaintiff receives a $500,000 settlement for physical injuries in a car accident, that amount would be tax-free compensatory damages. However, if the plaintiff also receives $5 million in punitive damages, the full $5 million punitive damage amount would be taxable.

Before 2018, legal fees associated with punitive damages were deductible as a miscellaneous itemized deduction, but with limitations. Since the Tax Cuts and Jobs Act of 2017, miscellaneous itemized deductions have been suspended from 2018 to 2025. This means that legal fees attributable to punitive damages are non-deductible for the 2018-2025 tax years. A plaintiff who receives $5 million in punitive damages may pay 40% of that amount to their attorney as a legal fee, but they will not be able to deduct any of these legal fees on their tax returns.

The high tax bill on punitive damages can be a surprise to plaintiffs, and the taxes due can equal or exceed the entire amount of punitive damages received. To reduce taxes in cases involving punitive damages, plaintiffs can use a tool called the Plaintiff Recovery Trust. This trust allows plaintiffs to pay taxes only on the amount they personally receive after their attorneys are paid their fees. For example, if there are $5 million in punitive damages and the attorney charges a 40% legal fee, without the Plaintiff Recovery Trust, the plaintiff would pay taxes on the full $5 million. With the trust, the plaintiff only pays tax on the $3 million they actually receive.

Liability Insurance: How Much Auto Coverage?

You may want to see also

Frequently asked questions

Auto insurance claim settlements are generally not taxable, but there are some exceptions. The IRS taxes money that is considered income, i.e., money that makes you better off financially than before.

Money to fix or replace your car is not taxable, as it returns you to your financial position before the accident. On the other hand, settlements for lost wages, pain and suffering, and emotional distress are generally considered taxable income.

If you receive a mixed settlement, it is advisable to consult a tax professional or a CPA to determine how much, if any, of your insurance proceeds are taxable. They can guide you through the process and provide advice based on your unique circumstances and the applicable tax laws.