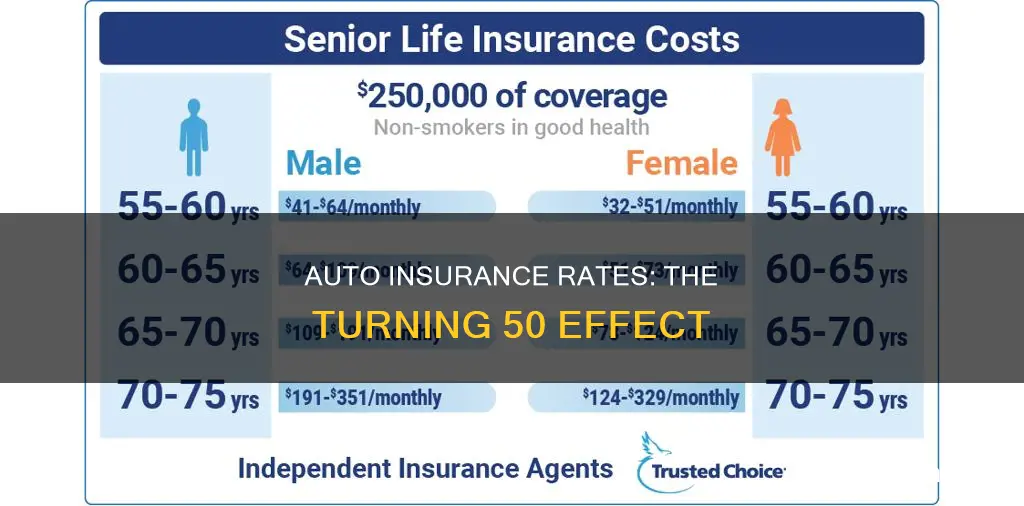

Auto insurance rates are typically lowest for drivers in their 50s, as they have extensive driving experience and are less likely to suffer from hearing or vision impairment. However, rates can start to increase once drivers reach their mid-60s, as insurers consider older drivers to be riskier to insure due to age-related changes in health and reflexes.

| Characteristics | Values |

|---|---|

| Age when auto insurance rates start to increase | 65 |

| Average cost of car insurance for a 65-year-old | $1,740 a year |

| Average car insurance rates for a 75-year-old | $2,008 a year |

| Average annual car insurance cost for 50-year-olds | $703 for a six-month policy |

| Cheapest auto insurance for 50-year-olds | State Farm, Nationwide, GEICO, Progressive |

What You'll Learn

Auto insurance rates for those aged 50 and over

Auto insurance rates are largely determined by the level of risk a driver poses. Younger drivers are generally considered to be more likely to have accidents or take risks on the road, so they are often charged higher rates. As a result, insurance rates tend to decrease as drivers get older and gain more experience.

Drivers in their 50s can expect some of the lowest auto insurance premiums. According to The Zebra, drivers in this age group pay an average of $703 for a six-month policy. Progressive also reports that insurance rates tend to be stable or decrease slightly for drivers aged 34 to 75.

However, it's important to note that insurance rates can vary depending on factors such as gender, driving record, credit score, and the state you live in. In addition, insurance companies may offer different rates and discounts. For example, some companies provide discounts for senior drivers or loyalty discounts for long-term customers.

Once drivers reach their 70s, insurance rates typically start to increase again due to the higher risk of accidents and more severe injuries. Despite this, seniors are still unlikely to pay the high rates that teen drivers face, especially if they maintain a clean driving record.

To get the best rates, it's recommended to compare quotes from multiple insurance companies and take advantage of any available discounts. Seniors can often get discounts by completing state-approved driving courses or by maintaining safe driving records. Bundling auto and home insurance policies or paying premiums in full can also lead to cost savings.

Ally's Gap Insurance Refund Policy

You may want to see also

How age impacts insurance rates

Age is one of the most important factors in determining your car insurance rate. While there are good drivers in every age group, younger drivers are generally more likely to have accidents or take risks on the road. Experienced drivers are less likely to have accident claims, which means they cost less to insure.

Teenagers

Car insurance is most expensive for teenagers because they don't have much driving experience and are therefore more likely to get into a car accident. The cheapest insurance companies for teen drivers are GEICO, American Family, and USAA.

Young adults

As drivers age, the difference in premium between genders narrows. The cost of auto insurance coverage generally begins to drop by the time a driver reaches their early 20s. By the age of 25, drivers might notice a significant reduction in their premiums.

Adults

Drivers in their 50s will see some of the lowest premium rates offered to any driver at any age. This is because middle-aged drivers have extensive driving experience and aren't as likely to be hearing or vision-impaired.

Seniors

Car insurance rates for seniors start to go up at around 65. Aging-related factors like vision or hearing loss and slowed response time might make seniors more likely to get into accidents. The average cost of car insurance for a 65-year-old is $1,740 a year, while for a 75-year-old it increases to $2,008 a year.

Gap Insurance: Payout or Pitfall?

You may want to see also

Discounts for seniors

Auto insurance rates for seniors depend on a variety of factors, including age, gender, location, driving record, and credit score. While rates generally increase for older drivers, there are discounts available specifically for seniors that can help offset the cost. Here are some tips and discounts for seniors to consider when it comes to auto insurance:

- Defensive Driving Course Discount: Many insurance companies offer discounts for seniors who take a defensive driving or mature driver course. These courses are designed to refresh driving skills and update knowledge of traffic laws, and they can result in savings of 5% to 15% on car insurance premiums. Examples include the AARP Smart Driver Course, as well as courses offered by AAA and the National Safety Council (NSC).

- Multi-Policy Discount: Bundling your auto coverage with another type of insurance, such as homeowners, renters, or life insurance, can often lead to a discount.

- Accident-Free Discount: Maintaining a clean driving record without any accidents can result in significant savings on your car insurance.

- Safe Driving Discount: Even if a provider doesn't offer a defensive driving discount, many companies offer discounts for safe driving habits. Some use telematics insurance programs that monitor driving behaviour and apply discounts accordingly.

- Multi-Car Discount: Insuring more than one car with the same company can often lead to a discount on your premium.

- Safety Features Discount: If your vehicle is equipped with anti-lock brakes, airbags, daytime running lights, or other safety features, you may be eligible for a discount on your insurance.

- Pay-in-Full Discount: Ask your insurance provider if they offer a discount for paying your premium in full, rather than in monthly instalments.

- Paperless Billing Discount: Some companies offer a small discount if you opt for paperless billing and manage your policy online.

- Low Mileage Discount: If you're a senior who doesn't drive often, you may be eligible for a low mileage discount. This is especially relevant if you have a separate vehicle for longer trips or only drive locally.

- Time of Day Driving Discount: Driving during off-peak hours or avoiding busy times of day may qualify you for a discount with certain insurance providers.

- Good Driver Discount: Maintaining a clean driving record with no accidents or violations can result in substantial savings, with good driver discounts of up to 40% available from some insurance companies.

- Membership Discounts: Membership in certain organizations, such as AARP, can often lead to discounts on your car insurance. Additionally, retired government and military personnel may be eligible for discounts from certain providers.

- Usage-Based Insurance: Signing up for a usage-based insurance program, such as Progressive's Snapshot or Travelers' IntelliDrive®, can save you money by adjusting your rates based on your actual driving habits and mileage.

- Loyalty Discount: Staying with the same insurance company for an extended period can sometimes lead to loyalty discounts.

- Vehicle Safety Discount: If you drive a car with the latest safety features, such as collision avoidance systems or lane-keeping assist, you may be eligible for a discount.

- Bundling Services: In addition to bundling insurance policies, some companies offer discounts if you bundle your auto insurance with other services, such as home security or utility services.

- Other Discounts: There are numerous other discounts that may be available depending on your specific circumstances. These can include discounts for paying by automatic bank account withdrawal, having an anti-theft device installed in your vehicle, or being a student or alumni member of a particular organization. Always ask your insurance provider about any potential discounts that may apply to you.

It's important to remember that not all insurance companies offer the same discounts, and eligibility requirements may vary by state. It's always a good idea to shop around, compare quotes, and ask about available discounts when looking for the best auto insurance rates as a senior. Additionally, it's worth reviewing your coverage needs periodically, as you may be able to adjust your policy to better suit your driving habits and budget.

Auto Insurers: Hit-and-Run Reporting Requirements

You may want to see also

Why insurance rates increase for older drivers

Age is one of the most important factors in determining your car insurance rate. While younger drivers are generally more likely to have accidents or take risks on the road, older drivers are also considered riskier to insure. This is due to several factors, which we will outline below.

Firstly, older drivers are more prone to car accidents due to physical, cognitive, or visual impairments. Aging-related factors like vision or hearing loss and slowed response time can make seniors more likely to get into accidents. Statistics show that seniors are more accident-prone than younger drivers, and this is caused by age-related changes in hearing or vision, slower reflexes, and changes in overall health.

Secondly, older drivers suffer graver injuries and more fatalities in car accidents than younger people. This means that insurance companies have to pay out larger claims, which results in increased car insurance rates.

Thirdly, the age of the car is also a factor. Older cars tend to have fewer advanced safety features, making accidents and injuries more likely. They also have fewer anti-theft features, making them more likely to be stolen. As a result, you'll need more extensive insurance coverage to account for these risks.

Lastly, repair costs for older cars tend to be higher because their parts are more scarce, and they may require specialized repairs, which can be more expensive. This can lead to higher insurance premiums as insurance companies anticipate higher repair costs in the event of an accident.

Gap Insurance: Comprehensive Coverage?

You may want to see also

How to get cheaper insurance

While auto insurance rates can vary depending on a variety of factors, age is one of the most significant determinants. Younger and older drivers tend to have higher insurance rates compared to middle-aged drivers due to increased accident risks. However, there are ways to mitigate these costs and find cheaper insurance options. Here are some detailed tips to help you get cheaper car insurance:

- Compare quotes from multiple insurers: Shopping around is one of the best ways to find affordable car insurance. Compare rates from different insurance companies, considering both large and midsize insurers. You can use online tools and websites to get quotes and find the best deal for your needs.

- Ask for discounts: There are often various discounts available that can lower your insurance premium. For example, you might be eligible for a low-mileage discount if you don't drive much, or you could get a discount for bundling your car insurance with other types of insurance, such as homeowners insurance.

- Consider your car choice: The type of car you drive can significantly impact your insurance rates. Newer and more expensive cars tend to be more costly to insure than older or less expensive models. Additionally, certain makes and models may have lower insurance rates due to safety features or lower theft rates.

- Maintain a clean driving record: A good driving record can help you secure lower insurance rates. Safe driving habits and obeying traffic rules will keep your record clean and reduce the chances of accidents, resulting in lower insurance costs.

- Improve your credit score: In many states, insurance companies use credit-based insurance scores to determine car insurance rates. Improving your credit score can help you get cheaper insurance, as it indicates lower risk to insurers.

- Choose a higher deductible: Opting for a higher voluntary excess or deductible can lead to a reduction in your insurance premium. However, keep in mind that you will have to pay more out of pocket if you need to make a claim.

- Reduce annual mileage: Limiting the number of miles you drive annually can result in lower insurance rates. Insurance providers consider low mileage as a lower risk, so reducing your time on the road can help you secure cheaper insurance.

- Take advantage of life changes: Certain life events, such as getting married or moving to an area with lower accident and crime rates, can positively impact your insurance rates. Shop around for new quotes whenever you experience a significant life change.

- Consider usage-based insurance: Telematics or usage-based insurance policies monitor your driving habits and reward good driving behaviour with lower rates. These policies are often popular with young drivers but can also benefit older drivers.

- Take a defensive driving course: Enrolling in an advanced driving course, such as Pass Plus, can help you improve your driving skills and may lead to a discount on your insurance premium. Check with your insurance provider to see if they offer this discount.

- Add a named driver: If you're a new driver, adding a more experienced driver to your policy can reduce your premium. Even adding a second driver with a low-risk occupation could result in a lower rate. However, ensure that you don't engage in fronting, which is illegal and can invalidate your insurance.

- Build a good no-claims history: Avoiding claims on your insurance will earn you a no-claims discount at renewal. Even if you have a minor accident, it might be cheaper to pay for repairs yourself to maintain your no-claims status.

- Avoid penalty points and endorsements: Keeping your driving record clean and free of penalty points will help you secure better deals on your car insurance. Safe and sensible driving will lead to lower insurance rates.

- Choose your parking spot wisely: Where you park your car overnight can impact your insurance premium. Parking on a private driveway or in an area with lower accident and crime rates may result in cheaper insurance.

- Improve your car's security: Installing an industry-approved alarm or immobiliser in your car can help reduce the cost of your insurance. Contact your insurance provider to see if they offer discounts for additional security measures.

- Consider a higher-risk occupation: Certain jobs are considered higher risk by insurance providers, which can increase your premium. If you can accurately describe your occupation in a way that reflects lower risk, you may be able to get a cheaper quote. However, always be truthful, as providing misleading information can invalidate your insurance or lead to insurance fraud prosecution.

Gap Insurance: Financed or Contracted?

You may want to see also

Frequently asked questions

Auto insurance rates are typically lowest for drivers in their 50s, as they have extensive driving experience and are less likely to be hearing or vision-impaired.

On average, drivers in their 50s pay around $703 for a six-month policy.

Age is one of the most important factors in determining auto insurance rates. Other factors include gender, location, driving record, credit score, and the type of car.

Yes, many insurance companies offer discounts for senior drivers, such as loyalty discounts, good driver discounts, and discounts for safety features on the vehicle.

It is recommended to shop around and compare rates from multiple insurance providers. Getting quotes from at least three companies can help find the best rate.