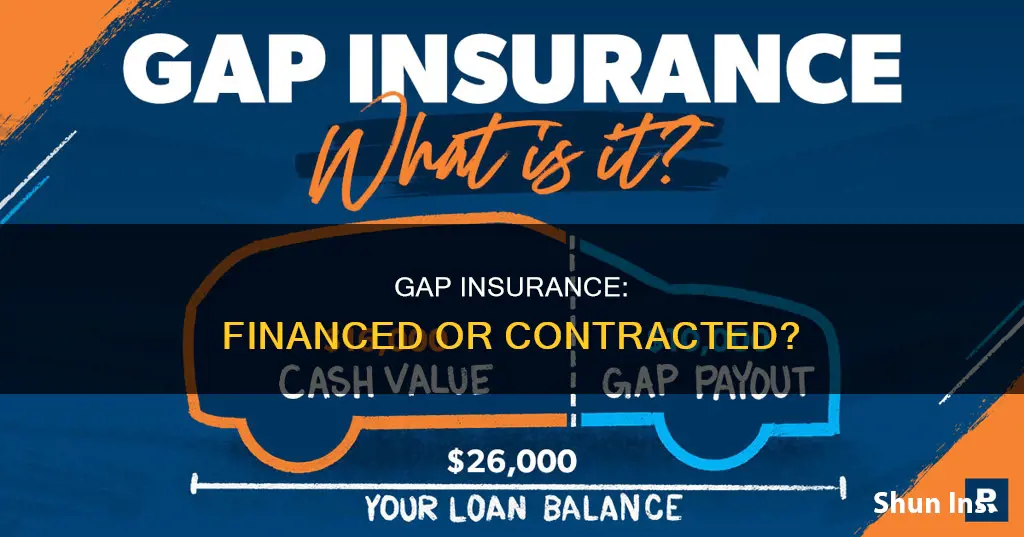

Gap insurance is an optional type of car insurance that covers the difference between the compensation you receive after a total loss of your vehicle and the amount you still owe on your loan or lease. In other words, it covers the gap between what a car is worth and what the driver owes on their auto loan or lease if the car is stolen or declared a total loss.

Gap insurance is worth considering if you made a small down payment on your vehicle, have a long-term loan, or if your car depreciates quickly. It is not required by state law but may be required by lenders and lessors.

| Characteristics | Values |

|---|---|

| What is gap insurance? | A type of auto insurance that covers the difference between the compensation received after a total loss of a vehicle and the amount still owed on the loan or lease. |

| When is gap insurance needed? | When the current value of a vehicle is less than the balance of a loan or lease. |

| Who needs gap insurance? | People who lease their car or have a car loan. |

| Who specifically should consider gap insurance? | People who have a car that depreciates in value quickly, made a low down payment, have a long-term loan, or carried over negative equity from a past car loan into their current car loan. |

| Who does not need gap insurance? | People who have already paid off most of the loan balance, made a significant down payment, or could pay for the gap themselves. |

| How much does gap insurance cost? | Between $20-$40 per year when added to a car insurance policy, or a total of $400 to $700 when purchased from a dealership. |

| Where can gap insurance be purchased? | From most major car insurance companies, or from a car dealership, lender, or lessor. |

What You'll Learn

- Gap insurance covers the difference between the compensation received and the amount owed on a car loan

- It is optional but may be required by a lease or loan agreement

- It is worth considering if you have a small down payment, long finance period or a car that depreciates quickly

- It can be purchased as an endorsement on a car insurance policy or from a dealer

- It is not required if your vehicle is not financed

Gap insurance covers the difference between the compensation received and the amount owed on a car loan

Gap insurance is a type of auto insurance that covers the difference between the compensation received and the amount owed on a car loan. It is an optional coverage that you can purchase to protect yourself financially in case your car is totalled or stolen and the compensation you receive does not cover the amount you owe on your loan or lease agreement.

Gap insurance is especially useful if you owe more on your car loan than the car is worth. This can happen if you did not make a down payment when purchasing the car, or if you chose a long loan term. In these cases, gap insurance can help bridge the financial gap between the car's value and the amount you still owe.

When your car is totalled or stolen, your car insurance company will typically reimburse you based on the car's current value, taking into account depreciation. This reimbursement may be less than the amount you still owe on your loan or lease. Gap insurance can cover this difference, ensuring that you don't have to pay out of pocket to make up for the shortfall.

For example, let's say you bought a car two years ago and currently owe $20,000 on your financing agreement. Due to depreciation, your car's actual cash value is now only $15,000. If your car is completely written off in an accident or stolen, your car insurance policy will pay out $15,000. With gap insurance, the $5,000 "gap" between the reimbursement and the amount you owe on your loan would be covered. Without gap insurance, you would be responsible for paying the remaining $5,000.

The cost of gap insurance varies depending on factors such as your state, driving record, and vehicle. You can purchase it as an endorsement on your car insurance policy or as separate coverage from a dealer. It is important to carefully review the terms of your car loan or lease agreement to see if gap insurance is required.

Gap Insurance: Down Payment Refund?

You may want to see also

It is optional but may be required by a lease or loan agreement

Gap insurance is optional but may be required by a lease or loan agreement. It is designed to cover the difference between the compensation received after a total loss of a vehicle and the amount still owed on the loan or lease. This type of insurance is particularly useful for those who have a low down payment, a long-term loan, or a car that depreciates quickly.

If you are considering gap insurance, it is important to review the terms of your lease or loan agreement carefully. Gap insurance may be required by your financing agreement, and it is generally a good idea if you are leasing a car or have a long-term loan. It can also be beneficial if you have made a small down payment, as this results in a bigger gap between what you owe and the car's depreciated value.

The cost of gap insurance varies depending on your circumstances and where you purchase it. Dealerships and banks typically charge a lump sum of up to $700 for gap insurance, which is added to your auto loan with interest. On the other hand, insurance companies often charge as little as $3 per month or $20-$40 per year for coverage. It is worth comparing the costs of different options to find the best fit for your needs.

When deciding whether to purchase gap insurance, it is important to consider your financial situation and the value of your car. Gap insurance is likely to be worth it if you have a low down payment, a long-term loan, or a car that depreciates quickly. However, if you have already paid off most of your loan, made a significant down payment, or could afford to pay the gap yourself, gap insurance may not be necessary.

Savings Vehicles: Insured or Not?

You may want to see also

It is worth considering if you have a small down payment, long finance period or a car that depreciates quickly

Gap insurance is an optional type of car insurance that covers the difference between the compensation you receive after a total loss of your vehicle and the amount you still owe on a car loan. It is worth considering if you have a small down payment, a long finance period, or a car that depreciates quickly.

If you have a small down payment on your car loan, you will be upside down on your auto loan the moment you drive off the lot. It may be several years before the loan amount and the car's actual cash value begin to balance. A small down payment and a long loan period delay equity in the vehicle. Therefore, gap insurance makes sense for people who put no money down and choose a long payoff period since they may owe more than the car's current value.

Gap insurance is also worth considering if you have a long finance period. A long-term loan takes longer than usual to hit the break-even point, which is when your loan balance and the car's value begin to equalize. Long-term loans almost guarantee that the car buyer will have negative equity for some period.

Finally, gap insurance is worth considering if you have a car that depreciates quickly. The average car depreciates by 10% in the first month of ownership. Electric vehicles depreciate faster than other vehicle types, losing about half of their value in five years. Certain types of luxury cars depreciate at a much faster rate. For example, the Maserati Quattroporte, BMW 7, and Maserati Ghibli all depreciate by more than 60% over five years.

Safeco's Insurance Policy for Rebuilt Cars

You may want to see also

It can be purchased as an endorsement on a car insurance policy or from a dealer

When buying a new car, you can purchase gap insurance from the dealer or your auto insurance company. Typically, gap insurance is optional if you're financing a purchase, but it might be mandatory if you're leasing a vehicle.

Gap insurance can be added to your comprehensive auto insurance policy, or you can buy separate coverage from the dealer. It is worth comparing the costs of both options to see which one is the best fit for your needs.

Buying gap insurance from a dealer

If you buy gap insurance from a dealer, it can be bundled into your loan amount, which means you'll pay interest on your gap coverage. This can be more expensive than buying gap insurance from an insurer. When purchased at the dealer, gap insurance can cost several hundred dollars or more, spread equally throughout your loan payments. Some dealers may also include a cancellation period of 30 days, during which you can cancel your gap insurance and receive a full refund.

Buying gap insurance from an insurer

You can typically add gap coverage to an existing car insurance policy or a new policy, as long as your loan or lease hasn't been paid off. Buying gap insurance from an insurance company is usually cheaper than buying it from a dealer, and you won't pay interest on your coverage. If you already have car insurance, check with your current insurer to determine how much it would cost to add gap coverage to your existing policy.

Gap insurance makes sense if you owe more on your car than it is worth. For example, if you didn't make a down payment or if you chose a long loan term. It's not unusual to owe more on a car loan than your vehicle is worth, especially because cars depreciate quickly. The average car depreciates by 10% in the first month of ownership.

U.S.A.A. Insurance: Who or What Is Covered?

You may want to see also

It is not required if your vehicle is not financed

When you purchase a new vehicle, one of the decisions you'll need to make is whether to opt for Guaranteed Asset Protection (GAP) insurance. This type of coverage can provide valuable financial protection if your car is totaled or stolen. But is GAP insurance financed as part of your vehicle purchase contract? The answer may depend on a few factors, including whether you're financing your vehicle.

If you're paying cash for your vehicle or if your vehicle is not financed, GAP insurance is not required. In this case, the decision to purchase GAP insurance is entirely up to you. Here are some things to consider:

If you're paying cash for a vehicle, you may still want to consider GAP insurance to protect your investment. In the event of a total loss, GAP insurance can help cover the difference between the amount you've paid for the vehicle and the current market value. This can be especially useful if you've purchased a brand-new car, as vehicles can depreciate quickly after leaving the dealership lot. Consider the cost of GAP insurance relative to the potential benefit. If you're buying a used car or one that's less expensive, the cost of GAP insurance may outweigh the potential payout. However, if you're purchasing a newer or more expensive vehicle, the added protection could provide valuable peace of mind.

Remember that even if your vehicle is not financed, there may be other requirements or recommendations from your automotive insurance provider or the dealership. It's always a good idea to review your automotive insurance policy and understand what is and isn't covered in the event of an accident, theft, or total loss. Additionally, dealerships may offer extended warranties or other protection plans that you can opt into, providing additional coverage for your vehicle.

In summary, while GAP insurance is not required if your vehicle is not financed, it can still be a worthwhile investment to protect your financial interests. Consider the cost relative to the potential benefits, especially if you're purchasing a newer or more expensive car. Review your automotive insurance policy and understand the coverage you already have, and feel free to ask the dealership about any additional protection plans they may offer. Making an informed decision about GAP insurance can ensure you have the right level of protection for your vehicle.

Gap Insurance: Death Benefit

You may want to see also

Frequently asked questions

"Gap" stands for guaranteed asset protection. This type of insurance covers the difference between your vehicle's cash value and the amount you still owe in car payments in the event of a total loss claim (such as if your vehicle is stolen or totaled).

Gap insurance is something you purchase in addition to a full-coverage policy. You may want gap insurance if your vehicle is financed, especially if you only made a small down payment when you purchased your car.

If your vehicle is totaled, your insurance provider will pay out a maximum of your car's actual cash value. If you finance your vehicle, you may owe more in payments than the total value of your car. If this happens, gap insurance coverage will make up the difference.

You may not be able to buy gap insurance at any time. Older vehicles are typically not eligible for gap insurance coverage. Specific requirements vary by insurer, but usually, any vehicle more than three model years old is not eligible for gap insurance coverage.

Gap insurance is worth it if you finance a car with a low down payment, if you have a long-term auto loan, or if you lease a vehicle. It is an affordable way to protect yourself from the risk of a big expense if your car is stolen or totaled.