Gap insurance is a type of auto insurance that covers the difference between the compensation you receive for a totalled car and the amount you owe on your financing or lease agreement. In other words, it covers the gap between the money you receive from the reimbursement and the amount you still owe on the car. This type of insurance is useful for drivers who owe more on their car loan than the car is worth, for example, if they didn't make a down payment or chose a long loan term. Gap insurance is optional and can be purchased as an endorsement on an existing car insurance policy or separately from a dealer.

What You'll Learn

- Gap insurance covers the difference between the value of a vehicle and the amount owed on it

- It is a type of auto insurance

- It is optional, but may be required by a financing agreement

- It is also known as Guaranteed Asset Protection insurance

- It can be purchased from car insurance companies, banks, credit unions, and dealerships

Gap insurance covers the difference between the value of a vehicle and the amount owed on it

Gap insurance is a type of auto insurance that covers the difference between the value of a vehicle and the amount owed on it in the event of an accident. This type of insurance is particularly useful if you owe more on your car than it is worth, for example, if you didn't make a down payment or if you chose a long loan term.

When you buy a new car, it starts to depreciate in value immediately. In fact, most cars lose 20% of their value within the first year. Standard auto insurance policies will only cover the depreciated value of the car in the event of an accident, which is the current market value of the vehicle at the time of the claim. This means that if you have only made a small down payment, it is possible that in the early years of owning the vehicle, the amount you owe on the loan will exceed the market value of the car itself.

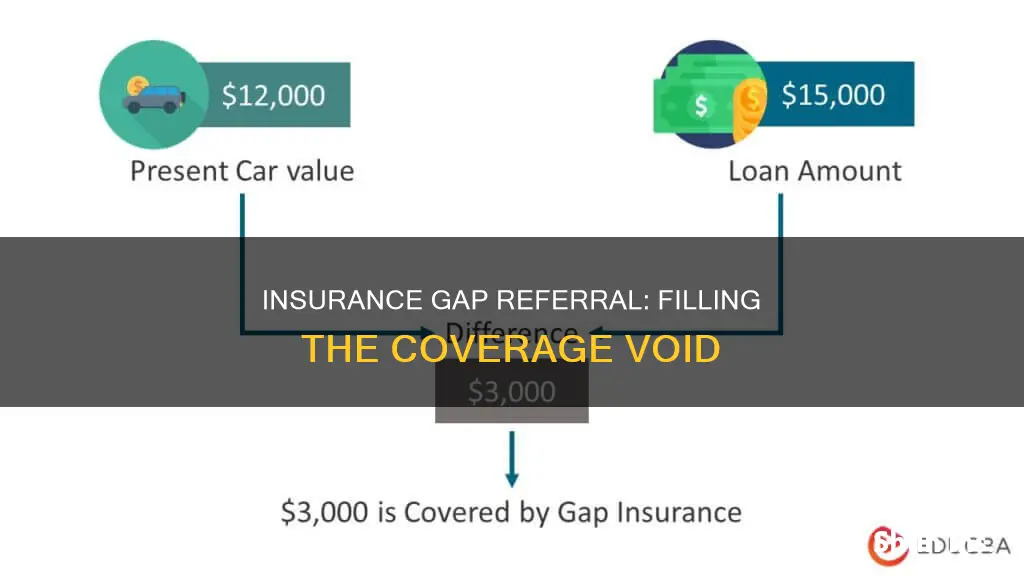

This is where gap insurance comes in. Gap insurance covers the difference between what your car is currently worth (which your standard insurance will pay) and the amount you owe on your loan or lease. For example, say you bought your car two years ago and owe $20,000 on your financing agreement. However, due to depreciation, your car's actual cash value is now only $15,000. If your car is completely written off as a result of an accident or theft, your car insurance policy will only pay out $15,000. You can put that $15,000 toward your car loan, but you will be $5,000 short of what you owe, even though you no longer have a car. If you have gap insurance, it would cover this $5,000 "gap".

Gap insurance is not mandatory, but it might be required by your financing agreement, especially if you are leasing a car. It is a good idea to carefully review the terms of your car loan to see if you need gap insurance. You can typically buy gap insurance from car insurance companies, banks, or credit unions. The cost of gap insurance depends on your state, driving record, and vehicle, and it is usually added as an endorsement to your existing car insurance policy.

MCA Assessments: Vehicle Insurance Explained

You may want to see also

It is a type of auto insurance

Gap insurance is a type of auto insurance that you can purchase to protect yourself financially in the event of an accident or theft of your vehicle. It covers the "gap" between the amount of compensation you receive from your standard insurance policy and the amount you still owe on your car loan or lease. This type of insurance is particularly useful if you owe more on your car loan than the vehicle's current market value or book value.

When you buy a new car, it starts to depreciate in value immediately. Standard auto insurance policies typically only cover the depreciated value of the car, which is the current market value at the time of a claim. This means that if your car is badly damaged or totalled in an accident, your standard insurance will only pay out the current market value, leaving you with a gap between what you receive and what you still owe on your loan. This is where gap insurance comes in. It covers the difference, ensuring that you don't have to pay out of pocket to make up for the shortfall.

Gap insurance is especially important if you made a small down payment or chose a long loan term when financing your vehicle. In these cases, you may owe more on your loan than the car is worth, and gap insurance can provide valuable financial protection. Additionally, if you leased your vehicle, carrying gap insurance is generally required.

The cost of gap insurance varies depending on factors such as your state, driving record, age, and vehicle. It can be purchased as an endorsement on your existing car insurance policy or as separate coverage from a dealer. However, it is worth comparing the costs of both options, as buying gap insurance from a dealer may be more expensive.

Gap insurance is optional, but it might be required by your financing or lease agreement. It is important to carefully review the terms of your car loan or lease to determine if gap insurance is necessary. Overall, gap insurance can provide valuable financial protection for car owners who want to ensure they are covered in the event of an accident or theft.

Gap Insurance Tax in Florida

You may want to see also

It is optional, but may be required by a financing agreement

An insurance gap referral, also known as gap coverage or loan/lease payoff coverage, is an optional type of insurance coverage offered by auto insurers. It is designed to protect individuals who are financing or leasing a vehicle and may owe more money on their loan or lease than their vehicle is currently worth. In the event of a total loss or theft of the vehicle, a gap referral can provide valuable financial protection.

The phrase "It is optional but may be required by a financing agreement" refers to the fact that while gap coverage is not mandatory by law, it may be required by the terms of your financing or lease agreement. This means that the lender or leasing company has the right to include gap insurance as a mandatory component of your financing contract. Their intention is to protect their investment and ensure that they do not incur a financial loss if the vehicle is declared a total loss.

In most cases, when you finance or lease a vehicle, the initial value of the car is higher than the amount you borrow or the lease amount. Over time, as the vehicle depreciates, this gap between the vehicle's value and the loan/lease amount widens. In the event of an accident or theft resulting in a total loss, standard insurance policies will only pay the actual cash value of the vehicle at the time of the loss, leaving you to cover the remaining balance owed on the loan or lease. This can result in a significant financial burden.

By making gap insurance a requirement, financing companies protect themselves and their borrowers. It ensures that in the event of a total loss, the gap between the insurance payout and the remaining loan balance is covered. This protects borrowers from having to pay out of pocket for a vehicle they can no longer use and provides peace of mind for both parties. However, it's important to note that even if it's not required by your financing agreement, purchasing gap insurance is still a wise decision to safeguard your finances.

In summary, while gap insurance is optional in the sense that it is not legally mandated, it may become a necessary expense if required by your financing or leasing agreement. Reviewing the terms of your contract and understanding the potential benefits of gap coverage can help you make an informed decision about whether to include this additional protection.

Gap Insurance: AARP's Coverage Options

You may want to see also

It is also known as Guaranteed Asset Protection insurance

Guaranteed Asset Protection (GAP) insurance is an optional insurance product that covers the difference between the amount owed on an auto loan and the amount paid out by the insurance company in the event of the vehicle being stolen or totalled. It is intended to protect the investment made in a vehicle in worst-case scenarios and is particularly useful when the loan amount is more than the vehicle's value. This situation can arise when a small down payment is made on a vehicle, or when a vehicle is leased. GAP insurance covers the "gap" between the amount reimbursed by the driver's car insurance policy and the amount they owe on their financing.

GAP insurance is offered by auto insurance companies and car dealers. It is usually purchased as an add-on product when buying or leasing a car, and the cost is rolled into the loan amount. However, it is important to note that GAP insurance is not mandatory and can be declined if it is optional. The cost of GAP insurance can vary, so it is recommended to compare prices and coverage before purchasing.

GAP insurance is designed to protect against negative equity, which occurs when the amount owed on a loan is higher than the value of the vehicle. In the event of a total loss, GAP insurance can cover the difference between what is owed on the loan and what the insurance company will pay. For example, if there is a loan balance of $15,000 and the insurance company settlement is $10,000, the remaining balance without GAP insurance would be $5,000. With GAP insurance, the total amount owed would be $0.

GAP insurance can also provide additional benefits, such as reimbursements for car insurance deductibles and credits towards the purchase of a new vehicle if the current one is totalled. It is important to carefully review the terms of a car loan to determine if GAP insurance is required and to understand the eligibility restrictions and coverage limitations.

Sitting Vehicle Insurance: Worth It?

You may want to see also

It can be purchased from car insurance companies, banks, credit unions, and dealerships

Gap insurance is a type of auto insurance that covers the difference between the amount reimbursed by the driver's car insurance policy and the amount they owe on their financing or leasing agreement. It is called 'gap' insurance because it covers the gap between the depreciated value of the car and the amount still owed on the loan or lease. This type of insurance is typically offered by car insurance companies, banks, credit unions, and dealerships.

When buying or leasing a new car, you can get gap insurance from the dealer or your auto insurance company. Usually, gap insurance is optional if you're financing a purchase, but it might be required if you're leasing a vehicle. Your car dealer may offer to sell you gap insurance on your new vehicle, but most car insurers also offer it and they typically charge less than the dealer. On most auto insurance policies, including gap insurance with collision and comprehensive coverage adds only about $20 a year to the annual premium.

Gap insurance from a dealership tends to be pricier compared to options available in the wider insurance market or through finance companies. It may be worth comparing the costs of both options to see which one is the best fit for your needs. If you already have car insurance, you can check with your current insurer to determine how much it would cost to add gap coverage to your existing policy.

You can typically add gap coverage to an existing car insurance policy or a new policy, as long as your loan or lease hasn't been paid off. Buying gap insurance from an insurance company may be less expensive, and you won't pay interest on your coverage. Note that you need comprehensive and collision coverage in order to add gap coverage to a car insurance policy.

Gap Insurance: Is It Required in Utah?

You may want to see also

Frequently asked questions

An insurance gap referral is when your insurance provider recommends you apply for an out-of-network exception, also known as a gap exception, to lower your costs for specialised medical services.

You might need an insurance gap referral if you need to see a specialist for a specific type of treatment that is not covered by your insurance plan.

You can call your insurance company and ask them for a list of specialists for your particular treatment. If there is a network deficiency, you can then request an insurance gap referral.

If your request for an insurance gap referral is denied, you can appeal to your state's insurance department for help. They regulate the sale of and compliance with all health plans in their state.