Capital One offers Guaranteed Asset Protection (GAP) insurance to individuals financing their vehicles with a car loan through Capital One Bank. GAP insurance is an optional type of coverage that you can pay for through your regular car insurance provider, your dealership, or added onto your loan agreement when financing with a bank or credit union. It is intended to protect you if your car is totaled or stolen and your remaining loan balance is larger than the insurance proceeds received for the car.

| Characteristics | Values |

|---|---|

| What is GAP insurance? | Guaranteed Asset Protection (GAP) insurance is intended to protect you if your car is stolen or totaled and you still owe more on your loan than the insurance payout covers. |

| Who offers GAP insurance? | Capital One offers GAP insurance to individuals financing their vehicles with a car loan through Capital One Bank. |

| How does GAP insurance work? | GAP insurance helps cover the difference between the amount paid by your insurer and your remaining car loan balance. |

| When is GAP insurance worth it? | GAP insurance is worth it if you made a down payment of 20% or less, the car is financed for 50+ months, you leased the vehicle, your car is expected to depreciate in value faster than the average car, or you rolled over negative equity from an old auto loan into your new loan. |

| How much does GAP insurance cost? | It costs a few dollars a month to add GAP insurance to a full-coverage insurance policy. According to the Insurance Industry Institute, you can expect to pay around $20 a year, or 5% to 6% of your full-coverage premium. However, costs can vary based on age, driving record, state, credit history, and vehicle model and model year. |

| Can you get a GAP insurance refund? | You may be able to qualify for a GAP insurance refund if you cancel your policy early, usually after repaying your loan or selling/trading in your vehicle. The amount of the refund will depend on factors such as the value of the vehicle, the amount of the auto loan, the vehicle's current mileage, and the loan repayment term. |

What You'll Learn

- Capital One offers GAP insurance to customers financing vehicles with a car loan through Capital One Bank

- GAP insurance is optional and can be purchased through a regular car insurance provider, dealership, or added to a loan agreement

- GAP insurance covers the difference between the amount paid by your insurer and your remaining car loan balance

- GAP insurance is beneficial if you've made a down payment of 20% or less, or if your car is financed for 60 months or longer

- GAP insurance does not cover missed payments or interest accrued on late fees

Capital One offers GAP insurance to customers financing vehicles with a car loan through Capital One Bank

Capital One offers Guaranteed Asset Protection (GAP) insurance to customers financing vehicles with a car loan through Capital One Bank. This type of coverage is intended to protect you in the event that your car is stolen or totaled and you still owe more on your loan than the insurance payout you receive for the car.

GAP insurance is an optional type of coverage that you can add to your regular car insurance policy or purchase through your dealership or lender. If you choose Capital One Auto Finance as your lender, you will have the option to purchase GAP insurance and include the price in your total loan amount. However, you cannot purchase GAP insurance from Capital One if you are not using them as your auto loan provider.

The main benefit of GAP insurance is that it provides financial protection if your car is stolen or totaled. It covers the "gap" between the depreciated value of your car and the amount you still owe on your loan. This type of insurance is particularly useful if you have a brand-new car, as cars typically depreciate by up to 20% in the first year of ownership.

It's important to note that GAP insurance does not cover any damage that doesn't result in a total loss of the vehicle, and it won't cover missed payments or interest accrued on late fees. The cost of GAP insurance can vary depending on various factors, but it generally only costs a few dollars a month to add to a full-coverage insurance policy.

Gap Insurance: One-Time Payment?

You may want to see also

GAP insurance is optional and can be purchased through a regular car insurance provider, dealership, or added to a loan agreement

GAP insurance is an optional form of coverage that you can purchase through your regular car insurance provider, dealership, or loan agreement. It is not a requirement, but it can be beneficial in certain situations. GAP insurance is designed to protect you financially if your car is stolen or deemed a total loss. It covers the difference between the amount paid by your insurer and the remaining balance on your auto loan, as standard insurance policies only cover the fair market value of the car. This type of insurance is particularly useful if you owe more on your auto loan than the car is worth, which is common at the beginning of a loan.

You can choose to purchase GAP insurance from your insurance provider, dealership, or lender, such as Capital One Auto Finance. If you opt for a dealership or lender, the cost of GAP insurance will be added to your monthly payments, and you will be paying interest on the insurance fees. It is worth noting that GAP insurance is typically required if you lease a vehicle.

Before purchasing GAP insurance, it is essential to understand its limitations. GAP insurance does not cover missed payments, interest accrued on late fees, or any damage that does not result in a total loss of the vehicle. It also does not provide support for repairs, rental car expenses, or extended warranties.

The cost of GAP insurance is generally affordable, with estimates ranging from $20 per year to 5-6% of your full-coverage premium. However, the price can vary based on factors such as age, driving record, state, credit history, and vehicle model.

Ultimately, the decision to purchase GAP insurance depends on your unique circumstances, financial situation, and risk tolerance. It may be more beneficial if you made a small down payment, leased the vehicle, or expect the car to depreciate in value quickly.

Vehicle Insurance: Protection Essential

You may want to see also

GAP insurance covers the difference between the amount paid by your insurer and your remaining car loan balance

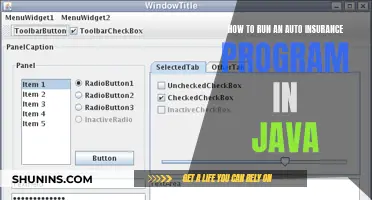

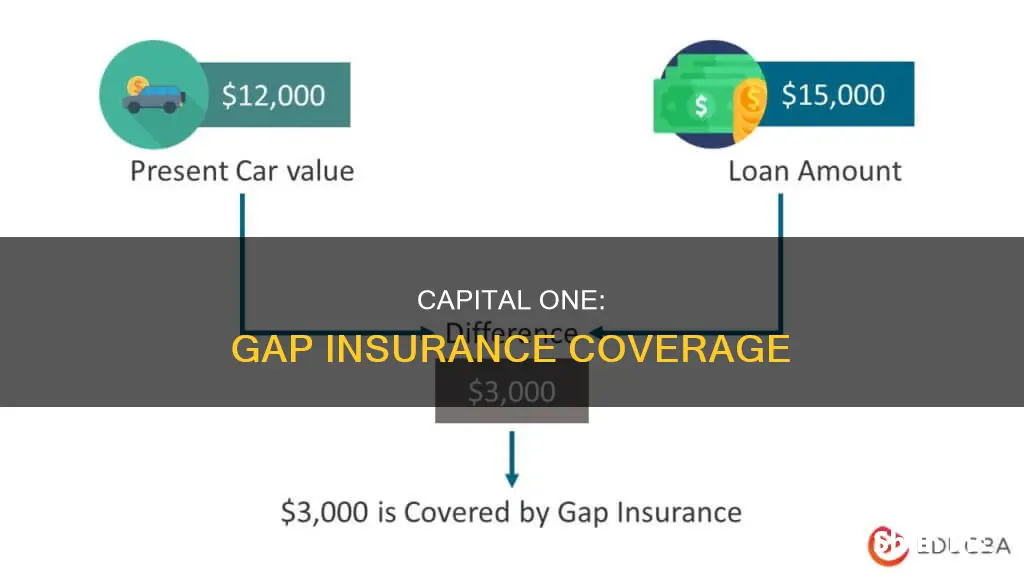

Guaranteed Asset Protection (GAP) insurance is intended to cover the difference between the amount paid by your insurer and your remaining car loan balance. In other words, it covers the difference between what a vehicle is currently worth (which your standard insurance will pay) and the amount you actually owe on it.

When you buy or lease a new car, the vehicle starts to depreciate in value the moment it leaves the car lot. Most cars lose 20% of their value within a year. Standard auto insurance policies cover the depreciated value of a car, or the fair market value, at the time of a claim. This means that in the early years of the vehicle's ownership, the amount of the loan may exceed the market value of the vehicle itself.

GAP insurance can be useful in this scenario, as it will cover the difference between the amount you owe on your auto loan and the amount the insurance company pays if your car is stolen or totaled. For example, if your car is stolen and you have $10,000 left on the auto loan, but your insurance company will only pay you $7,500 because that's their determined value of the car, GAP insurance will cover the remaining $2,500.

GAP insurance is typically offered as an optional add-on product by car dealers, lenders, and auto insurance companies. It is important to compare prices and coverage before purchasing GAP insurance, as the cost can vary greatly. Additionally, GAP insurance may be included in lease agreements and may be required for a lease.

While GAP insurance can provide valuable financial protection, it is important to note that it does not cover any damage that does not result in a total loss of the vehicle. It also does not cover missed payments or interest accrued on late fees.

Insurance Valuation of Totaled Cars

You may want to see also

GAP insurance is beneficial if you've made a down payment of 20% or less, or if your car is financed for 60 months or longer

Guaranteed Asset Protection (GAP) insurance is an optional insurance coverage that applies if your car is stolen or deemed a total loss. It is intended to protect you if the remaining balance on your account is larger than the insurance proceeds received for the car. Your regular car insurance usually covers the fair market value of the car, not the amount you still owe on your loan.

Additionally, GAP insurance can be beneficial if you leased the vehicle, as it is generally required for a lease, or if your car is expected to depreciate in value faster than the average car. If you decide that GAP insurance is right for you, it will usually cost you less to purchase it through your main auto insurance provider instead of a car dealership.

Audi Leases: Gap Insurance Included?

You may want to see also

GAP insurance does not cover missed payments or interest accrued on late fees

Guaranteed Asset Protection (GAP) insurance is intended to protect you if your car is stolen or written off and you owe more on your car loan than the insurance payout you receive. GAP insurance covers the difference between the amount paid by your insurer and your remaining loan balance.

However, it's important to note that GAP insurance does not cover missed payments or interest accrued on late fees. This means that if you fall behind on your car payments or accrue interest on late payments, you will not be reimbursed by GAP insurance. It is crucial to understand the limitations of GAP insurance before purchasing it.

While GAP insurance can provide valuable financial protection in certain situations, it is not a substitute for regular car insurance. Your regular car insurance policy typically covers the fair market value of your car, not the amount you still owe on your loan. This distinction is essential, as it means that without GAP insurance, you could be left with a significant financial burden if your car is stolen or written off and you owe more than its fair market value.

Additionally, GAP insurance does not cover any damage that does not result in a total loss of the vehicle. It also does not provide support for repairs, rental car costs during repairs, or extended warranties. GAP insurance is specifically designed to cover the difference between your insurance payout and your loan balance in the event of a total loss.

When considering whether to purchase GAP insurance, it is important to weigh the benefits against the limitations. While it can provide financial peace of mind in certain situations, it is not a comprehensive solution and may not be necessary if you have sufficient savings to cover potential losses.

Lexus Leases: Gap Insurance Standard?

You may want to see also

Frequently asked questions

Yes, Capital One offers Guaranteed Asset Protection (GAP insurance) to individuals financing their vehicles with a car loan through Capital One Bank.

GAP insurance helps cover the difference between the amount paid by your insurer and your remaining car loan balance.

Generally, it only costs a few dollars a month to add GAP insurance to a full-coverage insurance policy. According to the Insurance Industry Institute, you can expect to pay around $20 a year, or 5% to 6% of your full-coverage premium.

When applying for an auto loan through Capital One, you will be offered GAP insurance as an option.