Checking the status of your auto insurance policy is a crucial aspect of responsible vehicle ownership. It ensures you are legally compliant and helps you stay informed about your policy coverage and renewal dates. Here's a comprehensive guide on how to check your auto insurance status online and offline.

Online Methods:

1. Insurance Provider's Website: Visit the website of your insurance provider. They maintain records of all insurance policies sold, and you can check your policy status by entering your policy or vehicle registration details.

2. Insurance Information Bureau (IIB) Portal: Log in to the IIB web portal and enter your personal details, such as name, address, mobile number, email, and vehicle registration number. You can also check the status by entering your vehicle's engine and chassis numbers. Note that the IIB portal only displays information for vehicles purchased on or after a certain date, usually April 1, 2020.

3. Parivahan Sewa/VAHAN Portal: Visit the Parivahan Sewa website and select 'Know Your Vehicle Details' from the 'Informational Services' menu. Log in with your mobile number and enter your vehicle registration number and verification code. Click on 'Search Vehicle' to view your vehicle details, including insurance validity.

4. mParivahan App: Download the mParivahan app, create an account, and enter your vehicle registration number to check your insurance status.

5. Regional Transport Office (RTO) Website: Visit the RTO website, select 'Vehicle-related Online Services', click on 'VAHAN Citizen Services', and enter your RTO branch details. Navigate to the 'Status' option, select 'Know Your Vehicle Details', and enter your vehicle registration, chassis, and engine number, along with the CAPTCHA code.

Offline Methods:

1. Contact Insurance Company: Call your insurance company and provide your vehicle registration number or policy number to retrieve your insurance details over the phone.

2. Visit Insurer's Office: Visit the office of your insurance provider in person to obtain policy details and verify your vehicle's insurance status.

3. Visit RTO Office: Your vehicle must be registered with the RTO, and they maintain records of all registered vehicles. Visit the RTO office and provide your vehicle registration number to check your insurance status.

Remember to keep your vehicle's registration number, policy number, and other relevant details handy when checking your auto insurance status.

| Characteristics | Values |

|---|---|

| Importance of checking car insurance status | To renew the policy on time, avoid penalties/fines, and ensure continued coverage against liabilities |

| Online platforms to check car insurance status | Insurer's website, Parivahan Sewa/Vahan portal, mParivahan app, IIB portal, RTO's website |

| Offline methods to check car insurance status | Contacting the insurance company, visiting the insurer's office, or visiting the RTO |

| Information required to check car insurance status | Vehicle registration number, policy number, name, address, mobile number, accident location, date of accident |

| Purpose of checking car insurance status | To verify the renewal date and track the car accident history |

What You'll Learn

How to check car insurance status online

Checking your car insurance status online is a straightforward process and can save you from legal repercussions and fines. Here is a step-by-step guide on how to do it:

Online Platforms:

You can check your car insurance status online through various platforms, including:

- Insurer's Website: Visit your insurance provider's website and log in to your account using your registered mobile number, email address, or policy number. You will then be able to access your policy details and check the validity of your insurance.

- Parivahan Sewa/Vahan Portal: Go to the Parivahan Sewa website and select "Know Your Vehicle Details" from the "Informational Services" menu. Log in with your mobile number and enter your vehicle's registration number and verification code. Click on "Search Vehicle," and you will be able to view the insurance validity along with other vehicle details.

- MParivahan App: Download the mParivahan app on your smartphone and create an account. Select your preferred language and enter your vehicle's registration number. After logging in with your mobile number, you will be able to view the insurance validity and vehicle details.

- VAHAN Portal: Access the VAHAN online portal and log in with your mobile number. Fill in your vehicle's registration number and the unique code, then click on "Search Vehicle." The vehicle details, including insurance validity, will be displayed.

- Insurance Information Bureau (IIB) Portal: Log in to the IIB web portal and enter the required details, such as your name, address, mobile number, email address, vehicle registration number, and accident details, if applicable. If you are unable to find the insurance details with the registration number, you can try searching with the vehicle's engine or chassis number.

- Regional Transport Office (RTO) Website: Visit the RTO's official website and look for "Vehicle-related Services" or "Online Services for Citizens." Select your specific RTO and choose "Know Your Vehicle Details." Provide the vehicle registration, chassis, and engine number, along with the CAPTCHA code, to access the vehicle insurance policy details.

Offline Methods:

If you prefer, you can also check your car insurance status through offline methods:

- Contact Your Insurance Company: Call your insurance provider or visit their office. Provide them with your car's registration number or policy number, and they will be able to retrieve the insurance details for you.

- Visit the Insurer's Office: You can also visit the office of your insurance provider in person to obtain the policy details and confirm the validity of your insurance coverage.

- Regional Transport Office (RTO): Your vehicle is registered with the RTO when you purchase it. As they maintain records of all registered vehicles, you can visit the RTO to verify your insurance details and check the expiration date of your coverage.

It is important to keep your car insurance policy up to date and renew it on time to avoid legal issues and ensure continuous coverage. Additionally, always carry your valid insurance documents with you while driving to comply with legal requirements.

When Does Canceling Car Insurance Take Effect?

You may want to see also

How to check car insurance status offline

There are several ways to check your car insurance status offline. Here are the steps you can take:

Contact Your Insurance Company

Call your insurance company and provide your car registration number and/or policy number to retrieve the insurance details over the phone. You can also ask them about the policy expiry date.

Visit the Insurer's Office

You can visit the insurer's office in person to get the policy details and verify your vehicle's insurance status.

Visit the Regional Transport Office (RTO)

Once you buy a new vehicle, it must be registered with the Regional Transport Office (RTO). As the RTO maintains records of all registered vehicles, you can easily verify your insurance details and confirm the expiration date of your insurance coverage through the RTO.

To check your car insurance status through the RTO, follow these steps:

- Find the RTO website.

- Look for the 'Online Services for Citizens' or 'Online Services' option.

- Click on the 'Vehicle-related Online Services' or 'Related Online Services' tab.

- Choose the 'Vahan Citizen Services' option.

- Select the RTO information related to your vehicle's registration.

- From the menu bar, navigate to the 'Status' option and then choose 'Know Your Vehicle Details'.

- Fill in your vehicle's engine number, chassis number, and registration number.

- Enter the CAPTCHA code and submit the details.

- Along with the expiration date of your vehicle insurance policy, you will find information about your vehicle on the Parivahan Vehicle.

Contact a Third-Party Administrator

If you purchased your insurance policy through a third-party administrator, you can contact them to inquire about the status of your policy.

Mercury Auto Insurance: Good Option?

You may want to see also

What to do if you can't find your insurance details online

If you can't find your insurance details online, there are several options you can try. These include:

- Visiting your insurer's branch office: If you can't find your insurance details online, you can always visit your insurer's branch office in person. Here, you can speak to a representative and ask for help in retrieving your insurance information. It's a good idea to bring any relevant documents or information with you, such as your policy number, vehicle registration, or personal identification.

- Contacting your insurer: If you can't find the information you need online, you can try contacting your insurance company directly. You can usually find their contact information on their website or your insurance policy documents. They may be able to help you retrieve your policy information, such as your policy number, coverage details, and renewal dates.

- Checking with the DMV: Depending on your location, the Department of Motor Vehicles (DMV) may be able to assist you in finding your insurance information. In some cases, they may be able to provide the name of your insurance company if you provide your vehicle's license plate number. However, the laws and requirements for this may vary by state or region.

- Checking with the RTO: If you have registered your vehicle with the Regional Transport Office (RTO), you can contact them or visit their office to inquire about your insurance details. They may be able to provide information about your insurance policy, especially if it is linked to your vehicle registration.

- Reviewing your email: If you have email correspondence with your insurance company, you may be able to find important insurance details there. Search for emails from your insurance provider, as they may contain information about your policy number, coverage, and renewal dates.

- Checking paper records: If you have physical copies of your insurance policy or related documents, review them carefully. These documents may include your insurance card, policy booklet, or billing statements. They typically contain essential information such as your policy number, coverage details, and contact information for your insurance provider.

- Contacting the third-party administrator: If you purchased your insurance policy through a third-party administrator, such as an insurance broker or agent, you can reach out to them for assistance. They may have access to your policy information or be able to guide you on how to retrieve it.

Remember to keep your insurance information up to date and securely stored to avoid facing difficulties in the future.

Liability Insurance: Auto Claims Explained

You may want to see also

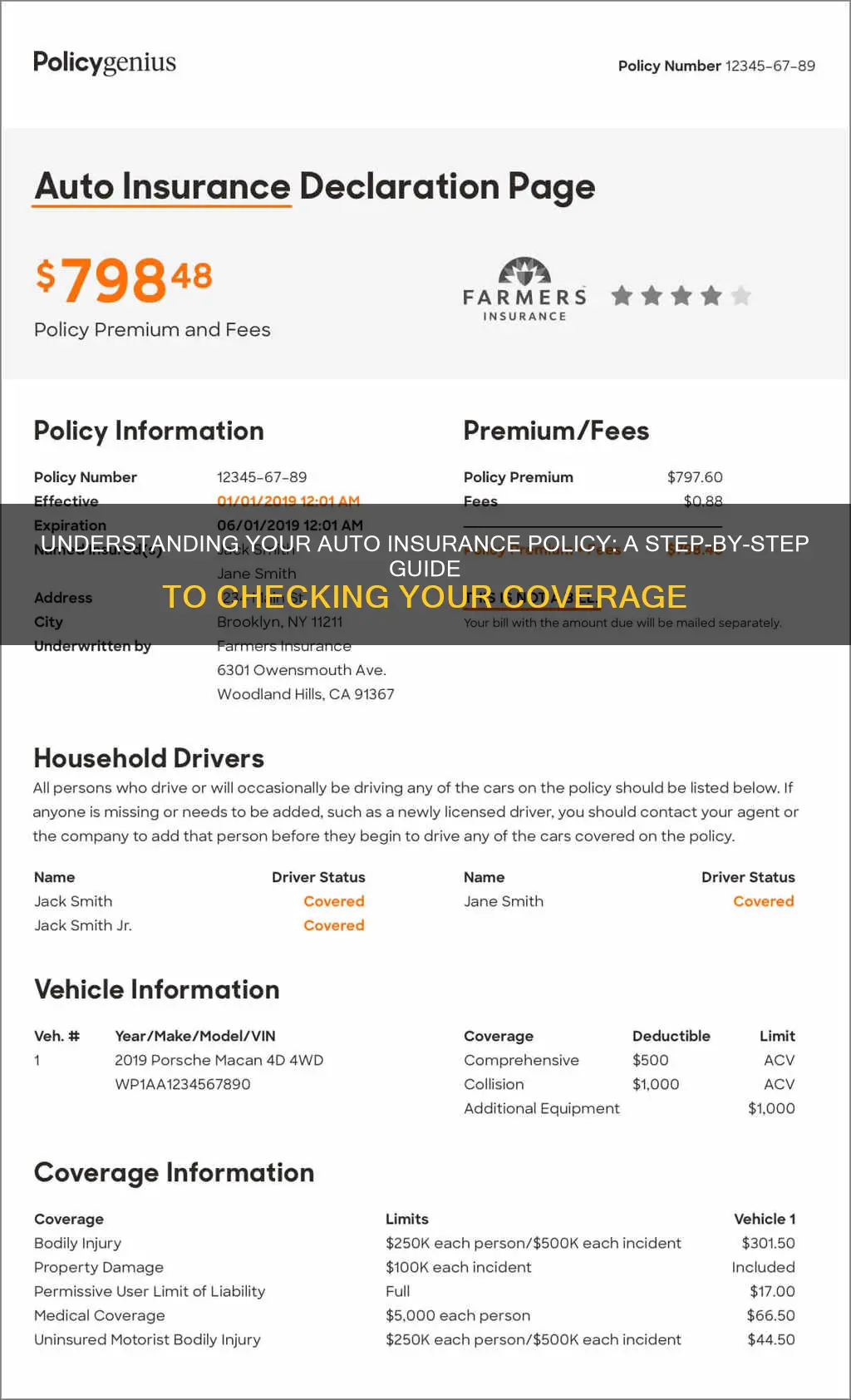

What information do I need to check my insurance status online?

To check your insurance status online, you will typically need your vehicle registration number and policy number. This will allow you to access your insurance details through online portals or apps.

In the case of receiving an order from the DMV about a lapse of liability insurance, you will need the letter or order from the DMV, which will include the 10-digit document number and your vehicle plate number.

If you are unable to recall your vehicle insurance information or cannot find your policy documentation, you can still verify or follow the status of your vehicle policy online. You can quickly check your vehicle insurance information using websites or mobile applications. For example, the name of your insurer, the date that your policy expires, the date that it is due for renewal, and the current status of your vehicle insurance are all easily accessible online.

U.S.A.A. Home and Auto Insurance: Comprehensive Coverage for Members

You may want to see also

How often should I check my insurance policy?

It is recommended that you check your insurance policy at least once a year to ensure that your family and belongings are appropriately protected. However, there are several other instances where you should review your insurance policy.

Firstly, whenever your policy comes up for renewal, you should take the time to review your coverage. Ask yourself questions such as whether the company has made any changes in coverage, if you should raise your deductible to save money, and if you are taking advantage of all available discounts.

Secondly, if you have made any major purchases or improvements to your home, you should check your insurance policy to ensure you have the proper coverage. This includes receiving gifts such as expensive artwork or a diamond engagement ring.

Thirdly, if you have made your home safer, for example, by installing a state-of-the art fire/burglar alarm system or upgrading your heating, plumbing, or electrical system, you should review your insurance policy to see if you qualify for any discounts.

Finally, you should review your insurance policy when you experience major lifestyle changes, such as marriage, divorce, or adult children moving back in. Other significant life events that may require you to adjust your insurance coverage include having a baby, sending your child off to college, receiving an inheritance, or a change in your health.

In addition, if you have expensive, high-value possessions or are taking steps to increase the safety of your home, it may be a good idea to review your insurance coverage to ensure it is up-to-date.

Cure Auto Insurance: Available in Few States

You may want to see also

Frequently asked questions

You can check your car insurance status online through websites and apps such as the Insurance Information Bureau (IIB) portal, the Parivahan Sewa website, the mParivahan app, the VAHAN portal, or your Regional Transport Office (RTO)'s website.

Typically, you will need your vehicle registration number, accident details (if applicable), and personal contact information such as your name, address, email address, and mobile number.

Yes, you can contact your insurance provider directly by calling their customer support or visiting their office. Alternatively, you can visit the RTO to verify your insurance status using your vehicle's registration number.

It is recommended to check your car insurance status periodically, especially around the time of policy renewal, to ensure your coverage is active and up-to-date.

Failing to renew your car insurance policy by the due date can result in consequences such as no claims being entertained, violation of motor laws, higher renewal premiums, and loss of No Claim Bonus (NCB) discounts.