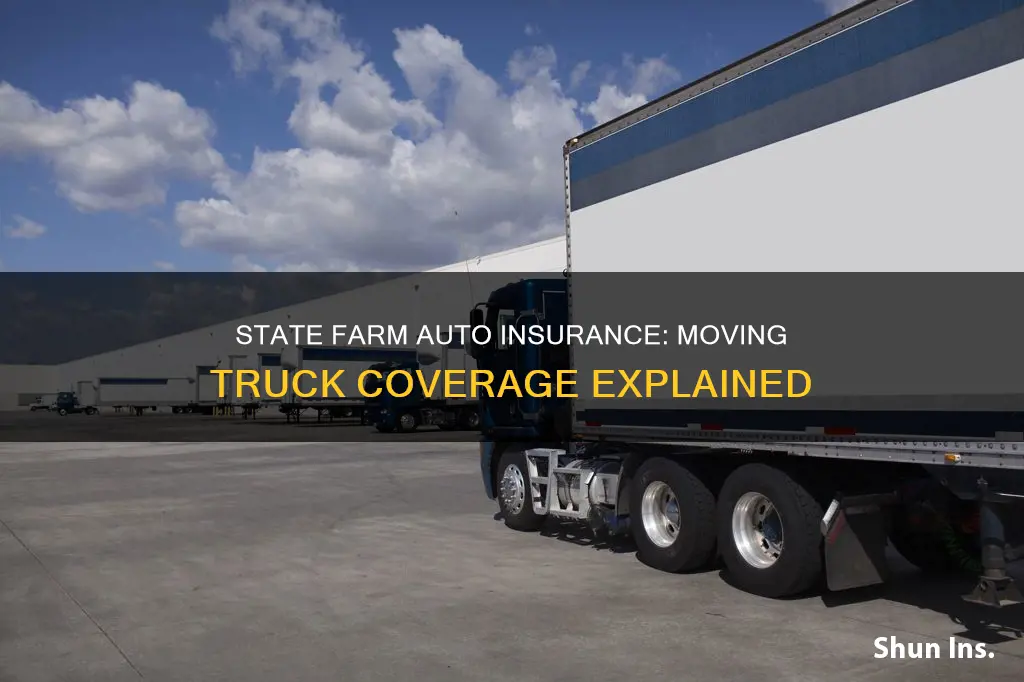

If you're renting a moving truck, it's important to know what your insurance policy covers or doesn't cover. Understanding your responsibilities and coverages makes a big difference if you get in an accident.

Your liability car insurance covers moving truck rentals, but comprehensive and collision coverage will not carry over. You can purchase physical damage coverage from the rental agency.

Your collision and comprehensive policies will not cover your rental moving truck. This is mainly because a moving truck is not a private passenger car and does not meet the conditions to receive collision or comprehensive coverage.

If you have State Farm insurance for your primary vehicle, it's reassuring to know that you're covered for rental cars with one caveat: you're only covered to the limits of your personal vehicle's auto policy.

If you're taking a longer trip, the Plus package may be worth the cost.

| Characteristics | Values |

|---|---|

| Does State Farm cover moving trucks? | No |

| Does car insurance cover moving truck rentals? | Yes, but only liability insurance |

| Does State Farm cover rental cars? | Yes, but only in the US and Canada |

| Does State Farm cover flat tires? | Yes, if your auto insurance includes roadside assistance coverage |

| Does State Farm offer free towing? | Yes, to the nearest repair facility |

| Does State Farm offer roadside assistance? | Yes |

| Does State Farm cover rental reimbursement? | Yes |

| Does State Farm cover towing a trailer? | Yes |

| Does State Farm cover towing a car? | Yes |

What You'll Learn

- Does State Farm cover damage to a rental moving truck?

- Does State Farm cover damage to your personal belongings during a move?

- Does State Farm cover medical bills due to an accident during a move?

- Does State Farm cover rental trucks for international moves?

- Does State Farm cover damage to a rental truck from fire?

Does State Farm cover damage to a rental moving truck?

If you're renting a moving truck, it's important to know what your insurance policy covers or doesn't cover. Understanding your responsibilities and coverages makes a big difference if you get in an accident.

Moving trucks are classified as unowned vehicles but are covered differently than the typical rental. A rental car will receive all of the same coverage options carried on your policy, but a moving truck will not.

If you own a vehicle and you carry standard car insurance, you will be happy to learn that the liability coverage on your policy will still provide protection when you or a listed driver are driving the moving truck.

Whatever limits of personal liability you carry will follow you as you drive your rental truck. This is beneficial if you have an accident and you are deemed to be at fault for the damages and injuries. When this happens, you have peace of mind that your bodily injury and property damage limits will pay for reasonable damages.

Your insurer will fight for you if excessive bills are filed. This is another benefit that can pay off if you are taken to court for an injury claim.

State Farm, like most legitimate car insurance companies, does not offer any temporary coverage options. However, if you have homeowners or renters insurance, odds are you have some protection.

State Farm does not cover damage to a rental moving truck under a standard auto insurance policy. However, State Farm offers an additional rider on your auto insurance, called Unlimited Non-Owned Car Coverage (UNOC), which may cover rental moving trucks.

If your rental moving truck is damaged, you should contact your insurance agent to see if your personal auto policy covers the damage. If not, you may need to purchase additional insurance from the rental company. You may also be able to file a claim with your credit card company, as some offer additional rental car coverage that kicks in if the damage exceeds personal insurance coverage.

Switching Auto Insurance: The Money-Saving Move?

You may want to see also

Does State Farm cover damage to your personal belongings during a move?

Moving can be a stressful time, and the last thing you want is to be worrying about insurance. If you're renting a moving truck, it's important to know what your insurance policy covers.

State Farm does not offer any temporary coverage options. However, your homeowners or auto insurance policy may offer limited coverage for your possessions if you transport them in a rental vehicle. This means that if your belongings are damaged during a move, State Farm may cover the cost of repairs or replacements, but only up to a certain limit.

It's important to note that State Farm's coverage for rental vehicles may vary depending on the state you're in. Some states may have different rules and regulations regarding insurance coverage for rental vehicles. Therefore, it's always a good idea to check with your State Farm agent to see what specific coverage is available in your state.

Additionally, if you have homeowners or renters insurance, you may have some protection for your belongings during a move. However, it's important to review your policy or speak with your agent to see if your property is insured while in transit or storage.

Furthermore, if you're renting a moving truck, the rental company may offer insurance options to cover damage to the vehicle and your personal belongings. These options can provide additional protection in case of an accident or damage during your move.

When preparing for a move, it's crucial to understand your insurance coverage and any limitations. By reviewing your policy and speaking with your agent, you can ensure that you have the necessary protection for your belongings during transit.

Gap Insurance: What Providers Offer

You may want to see also

Does State Farm cover medical bills due to an accident during a move?

State Farm auto insurance does not typically cover moving trucks or trailers. A personal auto insurance policy covers passenger cars, including your own vehicle, but not commercial vehicles or rented trucks. The weight and height of rented trucks do not conform to the coverage the average personal auto insurance policy provides. For example, there is usually no coverage for a truck weighing 9,000 lbs. or more.

However, State Farm does offer rideshare insurance for drivers and passengers, which may be extended to cover a move. Additionally, if you have collision and comprehensive coverage on the vehicle being towed by a trailer, it should cover the car if it is damaged during transport.

State Farm also offers Medical Payments Coverage (Med Pay) and Personal Injury Protection (PIP) to help pay for medical and funeral expenses when a covered person is hurt in an auto accident, regardless of who is responsible. A covered person includes the policyholder, passengers, or a member of the policyholder's family. Med Pay can help cover expenses that your health insurance may not, such as chiropractic visits or an ambulance ride.

Therefore, if you are in an accident during a move, State Farm's Med Pay or PIP may cover your medical bills, depending on the specifics of your policy. It is important to review your policy or speak with a State Farm agent to understand the extent of your coverage.

Hyundai Lease Insurance Requirements

You may want to see also

Does State Farm cover rental trucks for international moves?

Moving can be a stressful experience, and one of the most important considerations is insurance coverage for your belongings during the move. If you're planning an international move and need to rent a truck, you may be wondering if your State Farm auto insurance policy will cover it. Here's what you need to know:

State Farm, like most car insurance companies, typically provides coverage for rental cars within the United States and Canada. However, when it comes to international moves, the coverage offered by State Farm may vary depending on your specific policy and the country you're moving to. It's important to carefully review your policy or contact your State Farm agent to confirm the details of your coverage.

Understanding Your State Farm Policy

When it comes to rental trucks, your State Farm auto insurance policy may provide limited coverage. Generally, liability insurance, which covers damage to others and their property, will extend to rental trucks. However, comprehensive and collision coverage, which protect your own vehicle, typically do not apply to rental trucks. It's important to note that rental trucks are often considered commercial vehicles, and personal auto insurance policies usually exclude coverage for such vehicles.

Purchasing Additional Insurance

To ensure that your rental truck and belongings are fully protected during an international move, it is highly recommended to purchase additional insurance. The rental truck company will offer various insurance options to cover damage to the truck, your belongings, and any injuries that may occur during the move. These options typically include:

- Supplemental liability insurance: This covers liability claims and damage to others and their property if you are in an accident while driving the rental truck.

- Damage waiver: This protects you from financial responsibility for damage to the rental truck itself.

- Personal accident and cargo protection: This covers injuries to you, your passengers, and your belongings during the move.

- Auto-tow protection: If you're towing your car behind the rental truck, this policy covers any damage to your vehicle during the tow.

Understanding Rental Truck Insurance

When renting a truck for an international move, it's crucial to understand how the rental company handles accidents and damage. Some companies may require reimbursement for any damage to the truck, regardless of fault. They may also charge you for lost rental revenue while the truck is being repaired. Therefore, purchasing additional insurance from the rental company can provide peace of mind and financial protection during your move.

In conclusion, while your State Farm auto insurance policy may provide limited coverage for rental trucks, it is unlikely to cover international moves. It's important to review your specific policy or consult with your State Farm agent to confirm the details of your coverage. Additionally, purchasing additional insurance from the rental truck company can provide comprehensive protection for your belongings and peace of mind during your international move.

Allstate: Your Health and Auto Insurance Partner

You may want to see also

Does State Farm cover damage to a rental truck from fire?

State Farm's auto insurance may cover a rental truck, but this depends on the specifics of your policy. It's important to note that a personal auto insurance policy typically covers passenger cars and not trucks or business vehicles. Therefore, it's unlikely that State Farm auto insurance will cover damage to a rental truck from fire. However, State Farm does offer rental reimbursement coverage, which can help pay for a rental vehicle if your car is in the repair shop due to damage covered by your comprehensive or collision insurance.

To determine if your State Farm auto insurance covers rental trucks, carefully review your policy or contact your State Farm agent for clarification. It's essential to understand the extent of your coverage before assuming that damage to a rental truck will be included.

Additionally, rental truck companies usually offer their own insurance options, such as supplemental liability insurance (SLI) and a limited damage waiver (LDW). These options can provide coverage for damage to the rental truck, including fire damage, and protect you from financial responsibility. Therefore, it is recommended to obtain insurance coverage from the rental truck company to ensure comprehensive protection.

Auto Insurance: How Much is Excessive?

You may want to see also

Frequently asked questions

State Farm auto insurance does not cover moving trucks. However, your liability insurance will carry over when you are renting a moving truck.

You can purchase physical damage coverage from the rental agency.

Most people don't realize that homeowners or renters insurance may not cover loss or damage to your possessions while in transit.

You can purchase the optional insurance protection and the supplemental options that the rental agency offers.