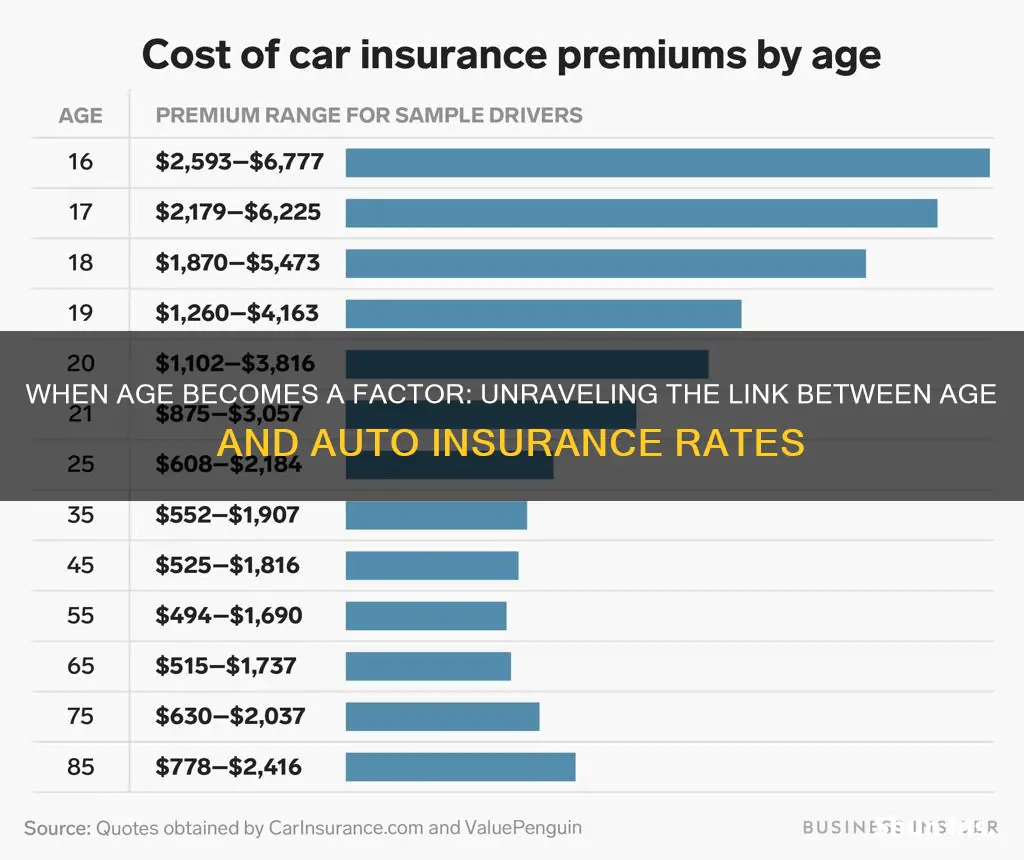

Age is one of the most important factors when it comes to determining your car insurance rate. While it may seem unfair, younger drivers are generally more likely to have accidents or take risks on the road. Inexperience and risky behaviour make teens more likely to get into serious car accidents. According to the Insurance Institute for Highway Safety, drivers aged 16 to 19 are four times more likely to be in a car accident compared to older drivers. This increased risk means insurance companies charge more to insure drivers under the age of 25.

| Characteristics | Values |

|---|---|

| Age | Younger drivers are charged more for auto insurance because they are more likely to have accidents or take risks on the road. |

| Gender | Men are more likely to pay more for auto insurance than women because they are more inclined to take risks behind the wheel. |

| Driving Experience | Drivers with more experience are less likely to have accidents and are therefore cheaper to insure. |

| Driving Record | A clean driving record can result in lower insurance premiums. |

| Safety Features | Cars with more safety features are cheaper to insure because they are less likely to be in accidents. |

| Cost of Parts | Cars with more expensive parts are more costly to insure because they are more expensive to repair. |

| Age of Car | Older cars may not need as much coverage as newer cars and can be cheaper to insure. |

What You'll Learn

Teen drivers are three times more likely to be in fatal crashes than older drivers

Auto insurance companies use a variety of factors to determine the premium for a customer, and age is one of the most significant. Teen drivers are considered some of the riskiest drivers to insure. Per mile driven, drivers aged 16 to 19 get into almost three times as many fatal car accidents as any other age group. This is due to a combination of immaturity and inexperience. Inexperience means teen drivers often don't recognize hazards or know how to respond to them. Immaturity leads to speeding and other risky driving habits.

The high rate of fatal crashes among teens has a significant impact on insurance rates. Insurers frequently charge more to insure teen drivers to offset the higher costs associated with teen driving claims. This is reflected in the data, which shows that a 16-year-old driver pays around $613 per month for full-coverage insurance, while a 25-year-old driver pays only one-third of that. The cost of insurance for teens can be mitigated by sharing a policy with family members or taking advantage of good student and driver training discounts.

As drivers gain more experience and age, their insurance rates generally decrease. By the time a driver reaches their early 20s, they can expect to see a significant reduction in their premiums. This trend continues throughout adulthood, provided the driver maintains a clean driving record. However, as drivers enter their senior years, insurance rates begin to creep back up due to factors such as vision or hearing loss and slowed response time.

While age is a significant factor in determining insurance rates, it is important to note that other factors also come into play, such as gender, credit score, driving record, and the state in which the driver lives. Additionally, not all states permit age as a rating factor, and some states prohibit the use of gender as a rating factor.

Insuring Someone Else's Car

You may want to see also

Men are more inclined to take risks behind the wheel

Auto insurance companies use a variety of factors to determine premiums, and age and gender are among the most significant. Men are more inclined to take risks behind the wheel, and this is reflected in insurance rates. While the specific difference in rates varies depending on the source, men consistently pay more than women for car insurance. This is due to men being more inclined to engage in risky driving behaviour, such as driving fast and not wearing a seatbelt, which can lead to higher rates of severe car accidents.

A British study published in the journal Injury Prevention found that male drivers are more dangerous to other people on the road than female drivers. The study analysed several sets of British data, including policy injury statistics, road traffic statistics, and traffic survey results, and found that the risk posed by men to other road users was double that of women when driving cars or vans, four times higher for trucks, and ten times higher for motorcycles.

The price gap between genders decreases as drivers age, and there are states in the US that do not allow gender to be used as a rating factor when determining insurance premiums. However, in most states, gender is a factor, and men's greater propensity for risk-taking while driving is a significant reason for this.

The difference in insurance rates based on gender is also influenced by other factors, such as credit score and driving record. For example, a male driver with a poor credit score will likely pay more for car insurance than a male with good credit. Additionally, a female driver with a history of accidents or traffic violations will likely pay a higher rate than a male with a clean driving record.

While age is a significant factor in determining insurance rates, with younger and older drivers typically paying higher premiums, gender also plays a notable role. Men's higher insurance rates reflect the increased risk they pose to other road users due to their greater propensity for risky driving behaviours.

Auto Insurance Medical Coverage: What's Included?

You may want to see also

Older drivers are involved in fewer accidents

Firstly, older drivers tend to be more risk-averse than their younger counterparts. They are less inclined to engage in dangerous driving behaviours such as speeding or not wearing a seatbelt, which can lead to higher rates of severe accidents. This increased risk aversion often comes with age and experience, as older drivers are more likely to be aware of their limitations and make adjustments to their driving habits.

Secondly, many older individuals voluntarily self-regulate their driving. They may choose to avoid driving during peak traffic times, at night, or in challenging conditions. Some older individuals may even give up driving entirely if they feel they pose a risk to themselves or others. This self-regulation leaves behind a pool of older drivers who are comparatively safer and more competent.

Finally, older drivers tend to drive less frequently than younger and middle-aged adults. This is partly due to self-regulation, as well as a natural decrease in mobility that comes with age. As a result, older drivers are less likely to be involved in accidents simply because they spend less time on the road.

While older drivers are involved in fewer accidents overall, it is important to note that their crash rates per mile travelled start to increase around the age of 70. This is primarily due to age-related impairments, such as vision or hearing loss, and slower response times. However, it is worth mentioning that these elevated crash rates per mile travelled may be slightly inflated due to the type of driving that older adults typically engage in. Older adults tend to drive more in city conditions, which have higher crash rates than freeway or multilane road driving.

Auto Insurance: Age Discrimination?

You may want to see also

The cost of writing off an older car is cheaper

Insurers may offer lower premiums for older cars because they can keep the car and get the scrap value for the parts. This is in contrast to newer cars, which have more powerful engines and are statistically more likely to be involved in crashes. These crashes tend to lead to more expensive claims.

However, it's important to note that age isn't the only factor that affects insurance costs. The make and model of the vehicle, safety features, and the safety record of the vehicle are also taken into account. Additionally, the driver's age, gender, credit score, and driving record can impact the cost of insurance.

Auto Insurance: Unraveling the Mystery of Policy Pricing

You may want to see also

Senior drivers can expect their insurance rates to increase

According to the Insurance Institute for Highway Safety, drivers aged 16 to 19 are four times more likely to be in a car accident compared to older drivers. However, this trend begins to reverse around the age of 65, with insurance rates increasing again. This is because, as people age, they may experience changes in their hearing or vision, and their reflexes may slow down, leading to a higher risk of accidents.

The cost of car insurance for seniors also takes into account the fact that older adults are more prone to serious injuries in the event of an accident, which can result in expensive hospital bills. Additionally, older drivers may have a higher chance of being involved in accidents than some younger adult drivers, according to the IIHS-HLDI.

While the cost of car insurance for seniors tends to increase with age, there are ways to mitigate these costs. Many states offer mature driver discounts for seniors who enroll in and complete state-approved driving courses, such as the AARP Smart Driver Course. Taking such courses can help seniors improve their driving skills and potentially lower their insurance rates.

It is also important for senior drivers to carefully assess their coverage needs and explore the different policy options offered by insurance providers. Factors such as mileage, coverage limits, and safety features can impact the cost of insurance. Shopping around and comparing policies from different companies can also help seniors find more affordable rates.

Furthermore, insurance companies offer various discounts that can help reduce premiums, such as low mileage discounts, good driver discounts, and discounts for safety features like rearview cameras and collision warning systems.

While senior drivers may face higher insurance rates, it is important to note that these rates are still significantly lower than those for teenage drivers, who are considered the riskiest to insure.

Transferring Car Insurance: MD to Other States

You may want to see also

Frequently asked questions

Yes, auto insurers charge more because of age. Drivers under 25 tend to pay the highest car insurance rates, with rates decreasing until the driver reaches their 70s.

Younger drivers are more likely to have accidents or take risks on the road due to inexperience.

Older drivers are more prone to car accidents due to physical, cognitive, or visual impairments.

There are several ways to get cheaper auto insurance, including:

- Shopping around for quotes from multiple companies.

- Asking about discounts, such as good student discounts or safe driving discounts.

- Joining your parents' policy (for younger drivers).