Navigating the insurance landscape can be tricky, especially when you're a driver for a gig economy platform like Uber Eats. You might be wondering if you need to inform your insurance provider about your side gig. This paragraph aims to shed light on this question, offering insights into the considerations and potential benefits of disclosing your Uber Eats driving activities to your insurance company.

What You'll Learn

- Legal Obligations: Informing insurance about Uber Eats driving is a legal requirement to avoid policy violations

- Coverage Details: Understanding your insurance coverage for Uber Eats driving is essential for financial protection

- Claims Process: Knowing how to file claims with your insurance after an Uber Eats incident is crucial

- Policy Adjustments: Adjusting your insurance policy to reflect Uber Eats driving may be necessary for accurate coverage

- Safety Protocols: Implementing safety protocols while driving for Uber Eats can help prevent accidents and claims

Legal Obligations: Informing insurance about Uber Eats driving is a legal requirement to avoid policy violations

In many jurisdictions, informing your insurance provider about your involvement in food delivery services like Uber Eats is a legal obligation. This is primarily to ensure that your insurance policy accurately reflects your driving activities and to avoid any potential policy violations. Driving for Uber Eats introduces certain risks and liabilities that may not be covered under a standard personal auto insurance policy. Therefore, it is crucial to notify your insurance company to ensure you have the appropriate coverage.

The primary legal requirement arises from the potential for policy violations if you fail to disclose this information. Insurance companies typically have specific terms and conditions regarding the types of driving activities they cover. Driving for a food delivery service may be considered a high-risk activity, and some policies may explicitly exclude coverage for such activities. By informing your insurance, you can assess whether your policy needs to be adjusted or whether you require additional coverage to protect yourself legally and financially.

Non-disclosure could lead to serious consequences. If an accident occurs while driving for Uber Eats and you have not informed your insurance, your policy may be voided, leaving you financially exposed. In some cases, insurance companies may even take legal action against you for fraud if they discover the omission after an incident. It is essential to understand the specific laws and regulations in your region regarding insurance disclosure requirements.

When informing your insurance, provide detailed information about your Uber Eats driving activities, including the frequency and duration of your deliveries. This will help the insurance company assess the risk and determine if any changes to your policy are necessary. They may offer additional coverage options or suggest modifications to your existing policy to ensure you are adequately protected.

Remember, the goal is to maintain transparency and ensure your insurance policy is up-to-date and relevant to your current driving activities. By fulfilling your legal obligation to inform your insurance about driving for Uber Eats, you can avoid potential policy issues and ensure you have the necessary coverage to protect yourself and your vehicle.

Open Claim: New Auto Insurance?

You may want to see also

Coverage Details: Understanding your insurance coverage for Uber Eats driving is essential for financial protection

Understanding your insurance coverage is crucial when you're a driver for Uber Eats, as it ensures you're protected financially in various scenarios. Here's a breakdown of what you need to know:

Standard Auto Insurance: First and foremost, it's essential to have a comprehensive auto insurance policy that covers your personal vehicle. This policy should include liability coverage, which protects you in case you're at fault for an accident. Liability coverage typically covers bodily injury and property damage to others involved in the accident. Make sure your policy meets the minimum requirements set by your state's regulations.

Uber Eats Driver Coverage: When you sign up to drive for Uber Eats, you'll be provided with a specific insurance coverage option. This coverage is designed to protect you while you're actively delivering food for Uber Eats. Here are the key points:

- Liability Insurance: Uber Eats typically offers liability coverage that extends beyond your personal policy. This additional coverage ensures that if you're involved in an accident while delivering, you're still protected. It covers the costs associated with injuries to passengers, pedestrians, or other drivers, as well as property damage.

- Medical Payments: This coverage helps with medical expenses for you and your passengers in the event of an accident, regardless of who is at fault. It can be beneficial if you or your passengers sustain injuries that require medical attention.

- Uninsured/Underinsured Motorist Coverage: This type of coverage protects you if you're involved in an accident with a driver who has insufficient or no insurance. It ensures that you're not left with significant out-of-pocket expenses.

Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, can be beneficial in certain states. It covers medical expenses for you and your passengers, regardless of who is at fault in an accident. This coverage can be especially useful if you're involved in a minor collision where liability is unclear.

Reporting to Your Insurance: When you inform your personal insurance provider about your Uber Eats driving, they may adjust your policy accordingly. They might offer guidance on how to manage your coverage effectively. It's important to be transparent about your additional driving activities to ensure you have the appropriate coverage.

Remember, the specific coverage details can vary depending on your location and the insurance company you choose. Always review the terms and conditions of your Uber Eats driver coverage and consider consulting with an insurance professional to ensure you have the right protection in place. Staying informed about your insurance coverage will help you drive with confidence and peace of mind.

Frontier Master Card: Unraveling the Overseas Auto Insurance Mystery

You may want to see also

Claims Process: Knowing how to file claims with your insurance after an Uber Eats incident is crucial

The process of filing insurance claims after an incident as an Uber Eats driver can be a crucial step to ensure you receive the necessary support and coverage. Here's a detailed guide on how to navigate this process:

- Document the Incident: After any accident or incident, it is essential to document the details immediately. Take photos of the scene, including any damage to your vehicle, the other party's vehicle, and any relevant road markings or signs. Also, collect contact information from any witnesses and make notes about the sequence of events. This documentation will be vital when filing your claim.

- Contact Your Insurance Provider: Reach out to your insurance company as soon as possible after the incident. Inform them about the accident and provide them with the gathered details. Be transparent and accurate in your reporting. Most insurance companies have a dedicated claims team that will guide you through the process and provide the necessary forms or instructions.

- Understand Your Policy: Review your insurance policy to understand the coverage you have. Different policies may offer varying levels of coverage for incidents involving food delivery services. Common coverage options include liability coverage for bodily injury and property damage, collision coverage for vehicle repairs, and comprehensive coverage for non-collision incidents like theft or natural disasters. Knowing your policy will help you navigate the claims process more effectively.

- File the Claim: Your insurance provider will likely request specific documents and information to process the claim. This may include police reports, medical bills (if applicable), repair estimates, and detailed incident reports. Provide all the required documents promptly to ensure a smooth claims process. The insurance company may also assign a claims adjuster to investigate the incident and assess the damages.

- Follow Up and Communicate: Stay in regular communication with your insurance company during the claims process. Keep them updated on any new developments or changes in your situation. If there are any delays or complications, inform your insurance provider promptly. They may provide guidance on temporary solutions or next steps while the claim is being processed.

Remember, each insurance company may have its own specific procedures, so it's important to follow their instructions carefully. Being proactive and providing accurate information will help expedite the claims process and ensure you receive the appropriate compensation for any damages or losses incurred during your Uber Eats driving activities.

Auto Insurance: Moving and Its Impact on Your Policy

You may want to see also

Policy Adjustments: Adjusting your insurance policy to reflect Uber Eats driving may be necessary for accurate coverage

When you start driving for Uber Eats, it's crucial to inform your insurance company about this new activity to ensure you have the appropriate coverage. Driving for a food delivery service introduces additional risks and considerations that may not be covered under your existing policy. Here's a guide on how to navigate this process:

Review Your Policy: Begin by carefully reviewing your insurance policy documents. Understand the coverage provided and the conditions under which it applies. Look for any clauses related to commercial driving, food delivery services, or ride-sharing. This initial review will help you identify potential gaps in coverage.

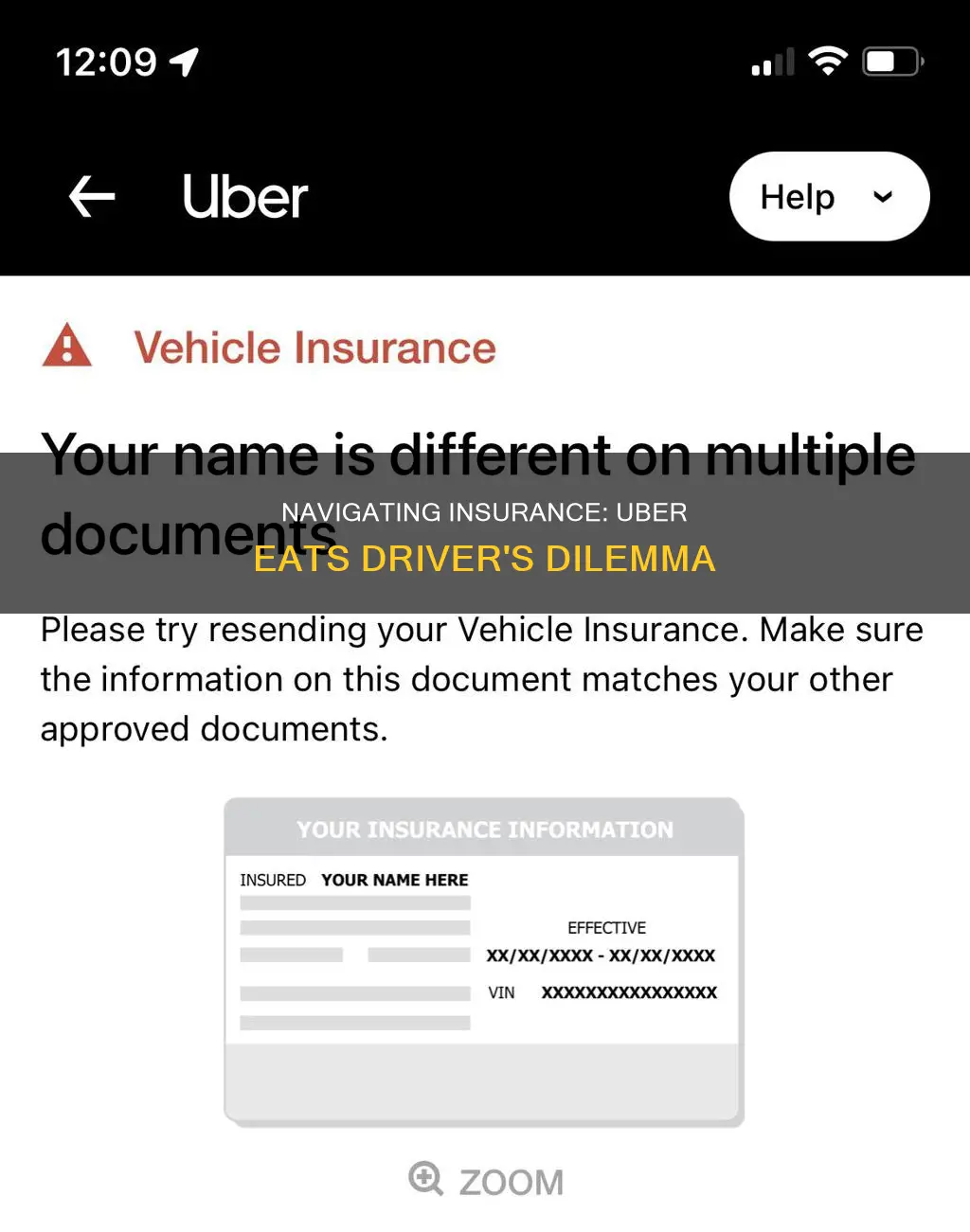

Contact Your Insurer: Reach out to your insurance provider and inform them about your Uber Eats driving. Be transparent and provide details about your new driving activities. Many insurance companies offer specific policies tailored to drivers using ride-sharing platforms. They may have partnerships with Uber Eats or similar services, ensuring that your policy is adjusted accordingly.

Adjustments to Policy: Depending on your insurance provider's response, you might need to make some policy adjustments. This could involve adding a rider or endorsement to your existing policy to cover the new driving activities. For instance, you may need to pay an additional premium to include coverage for commercial driving or food delivery services. Some insurers might offer discounts if you have a clean driving record, so highlight any relevant experience.

Understand the Coverage: When discussing with your insurer, ensure you understand the coverage provided. Ask about any limitations or exclusions related to Uber Eats driving. For example, standard policies might not cover personal injuries or property damage that occurs during food delivery. Knowing these details will help you make informed decisions and potentially add specific coverage options.

Consider the Risks: Driving for Uber Eats may expose you to unique risks, such as accidents involving food deliveries or customer-related incidents. Inform your insurance company about these potential risks and inquire about the available coverage options. They might offer specialized policies or endorsements to address these concerns.

By taking the initiative to inform your insurance provider and make the necessary policy adjustments, you can ensure that your coverage accurately reflects your new driving activities. This proactive approach helps protect you and your vehicle while driving for Uber Eats. Remember, each insurance company may have different policies, so it's essential to have open communication to find the best solution for your specific situation.

At-Fault Auto Insurance: What You Need to Disclose

You may want to see also

Safety Protocols: Implementing safety protocols while driving for Uber Eats can help prevent accidents and claims

Driving for Uber Eats can be a convenient way to earn extra income, but it's crucial to prioritize safety to avoid accidents and potential insurance complications. Here are some essential safety protocols to implement while on the road:

Stay Focused and Alert: Driving for food delivery services requires your full attention. Avoid distractions like using your phone for calls or texts while driving. Keep your eyes on the road and be aware of your surroundings, including pedestrians and other vehicles. Maintaining focus is key to preventing accidents and ensuring the safety of yourself and others.

Obey Traffic Rules: Adhere to traffic laws and regulations at all times. This includes stopping at red lights, yielding when necessary, and respecting speed limits. Uber Eats may have specific guidelines or requirements for drivers, so familiarize yourself with these rules to ensure compliance. By following traffic rules, you minimize the risk of accidents and potential legal issues.

Vehicle Maintenance: Regular vehicle maintenance is essential for safe driving. Keep your car in good condition by performing routine checks and addressing any mechanical issues promptly. Ensure your tires are properly inflated, brakes are responsive, and all lights and signals are functional. Well-maintained vehicles are less likely to break down or malfunction, reducing the chances of accidents caused by mechanical failures.

Customer Interaction: When interacting with customers, maintain a professional and courteous demeanor. Be friendly and helpful, but always prioritize your safety. Avoid engaging in lengthy conversations or accepting rides that make you uncomfortable. If a customer requests a specific route or destination, clarify and confirm it to ensure you are heading in the right direction. Clear communication can prevent misunderstandings and potential hazards.

Emergency Preparedness: Be prepared for unexpected situations. Carry a basic first-aid kit in your vehicle and familiarize yourself with emergency procedures. In case of an accident or breakdown, know how to respond and have the necessary contacts readily available. Quick action and a calm mindset can significantly reduce the impact of emergencies and potential insurance claims.

By implementing these safety protocols, you can significantly reduce the risk of accidents and potential insurance-related issues. Remember, your well-being and the safety of others are paramount while driving for Uber Eats. Staying alert, obeying rules, maintaining your vehicle, and being prepared for emergencies will contribute to a safer and more enjoyable driving experience.

Leased Cars: Higher Insurance?

You may want to see also

Frequently asked questions

Yes, it is generally a good idea to inform your insurance provider about any additional driving or business activities, especially if they involve using your vehicle for work. This ensures that your insurance policy is up-to-date and covers any potential risks associated with your new endeavors.

Even if you have a comprehensive insurance policy, it's still important to notify your insurance company about Uber Eats. They might offer specific coverage options or endorsements to accommodate your new driving needs. Additionally, they can help you understand any policy limitations and ensure you have the appropriate coverage.

Not informing your insurance company could lead to potential legal and financial consequences. In some cases, failing to disclose relevant information may result in policy cancellations or denial of claims if an accident occurs while using your vehicle for Uber Eats. It's best to be transparent to maintain a valid and effective insurance policy.