In Ontario, insurance brokers play a crucial role in helping drivers find the best coverage. One key aspect of their work involves understanding the driving history of their clients. This includes access to information such as past accidents, traffic violations, and driving record details. Brokers often have the ability to review and analyze this data, which is essential for assessing risk and providing tailored insurance solutions. Understanding driver history allows brokers to offer competitive rates and appropriate coverage options, ensuring that drivers receive the protection they need on the road.

| Characteristics | Values |

|---|---|

| Access to Driver History | Insurance brokers in Ontario do not have direct access to driver history. They rely on information provided by the client or obtained from the insurance company's database. |

| Client's Role | Clients must provide their driving record, including any accidents, violations, or claims, to the insurance broker. |

| Insurance Company's Role | The insurance company's database contains the most up-to-date driver history, which the broker can access to assess risk and provide quotes. |

| Data Sharing | Brokers can request driver history from previous insurers or use third-party services to verify information. |

| Legal Considerations | Accessing and using driver history without consent is illegal and can result in legal consequences. |

| Privacy | Brokers are bound by privacy laws and must handle client data securely and confidentially. |

| Risk Assessment | Driver history is crucial for determining insurance rates and coverage options. |

| Broker's Expertise | Brokers can interpret driver history and advise clients on the best insurance options. |

What You'll Learn

- Insurance Broker's Role: Brokers facilitate insurance policies and may access driver history

- Driver History Access: Brokers can review driver records through insurance companies in Ontario

- Policy Customization: Driver history impacts policy rates and coverage, guiding broker recommendations

- Legal Compliance: Brokers must adhere to privacy laws when accessing and using driver data

- Data Sources: Brokers obtain driver history from various sources, including MTO and insurance providers

Insurance Broker's Role: Brokers facilitate insurance policies and may access driver history

Insurance brokers play a crucial role in the insurance industry, acting as intermediaries between insurance companies and clients. In Ontario, Canada, they are authorized to facilitate insurance policies and provide valuable services to drivers. One of their key responsibilities is assessing and managing risk, which often involves accessing and reviewing driver history.

When a client approaches an insurance broker for a policy, the broker will typically request relevant information, including the client's driving record. This is an essential step in determining the client's eligibility for insurance and setting appropriate premiums. Driver history is a critical factor in insurance risk assessment as it provides insight into the individual's driving habits, past accidents, traffic violations, and overall safety record. By reviewing this information, brokers can make informed decisions about the type of coverage to offer and the associated costs.

In Ontario, insurance brokers have the authority to access driver history through various means. They can obtain this data from the Ontario Ministry of Transportation (MTO) or other authorized sources. The MTO maintains a database of driver information, including license status, violations, and accidents. Brokers can request this information on behalf of their clients, ensuring a comprehensive review of the driver's record. This access allows brokers to make well-informed decisions, considering the client's past driving behavior and potential risks.

The process involves brokers verifying the accuracy of the provided information and ensuring it aligns with the client's current driving status. They may also use this data to negotiate terms with insurance companies, advocating for their clients' best interests. For instance, a clean driving record with no violations or accidents can result in lower premiums, while a history of traffic violations might lead to higher rates or even policy exclusions.

In summary, insurance brokers in Ontario have a significant role in facilitating insurance policies and managing risk. Their access to driver history allows them to make informed decisions, ensuring clients receive appropriate coverage and premiums based on their driving records. This process is vital for both the insurance industry and drivers, promoting safer roads and fair insurance practices.

Insuring Additional Drivers

You may want to see also

Driver History Access: Brokers can review driver records through insurance companies in Ontario

In Ontario, insurance brokers play a crucial role in the insurance industry, acting as intermediaries between insurance companies and policyholders. One of the key aspects of their work is assessing and managing risk, which heavily relies on understanding a driver's history. This includes their driving record, which can significantly impact insurance rates and coverage options.

Access to driver history is a critical component of the insurance brokerage process. Brokers often need to review a driver's past records to make informed decisions about insurance policies. This information is typically obtained through the insurance companies with whom the brokers work. When a client applies for insurance, the broker requests the necessary details from the insurance provider, who then retrieves the driver's record from the relevant authorities.

The process is straightforward and efficient. Insurance companies in Ontario have systems in place to access and retrieve driver history information. When a broker requests a driver's record, the insurance company uses secure methods to obtain the data from the provincial or territorial driver's licensing authority. This ensures that the information is accurate and up-to-date.

Brokers can access a variety of driver history details, including past accidents, traffic violations, driving suspensions, and any other relevant incidents. This comprehensive overview allows brokers to assess the driver's risk profile accurately. For instance, a driver with a history of multiple accidents or violations may face higher insurance premiums or limited coverage options. Conversely, a clean driving record could result in more favorable terms.

By reviewing driver records, insurance brokers can provide tailored advice and recommendations to their clients. They can suggest appropriate coverage levels, explain the implications of certain driving incidents, and offer solutions to manage risks effectively. This level of service ensures that policyholders receive the best possible insurance solutions for their needs.

Maximizing Auto Insurance Savings: Navigating the Road to the Best Rates

You may want to see also

Policy Customization: Driver history impacts policy rates and coverage, guiding broker recommendations

Insurance brokers in Ontario play a crucial role in helping individuals and businesses navigate the complex world of insurance. One of the key aspects of their work involves understanding and utilizing driver history to customize insurance policies. Driver history is a critical factor that significantly influences policy rates and coverage options. When a client approaches a broker, the broker's initial step is to gather comprehensive information, including the client's driving record. This information is vital as it provides insight into the client's risk profile, which directly impacts the premium and coverage terms.

In Ontario, insurance brokers have access to a wealth of driver-related data. This includes details such as previous accidents, traffic violations, driving experience, and any claims made. For instance, a driver with a history of multiple at-fault accidents will likely face higher insurance premiums, as they are considered a higher risk. Conversely, a driver with a clean record and a safe driving history may be offered more competitive rates. Brokers use this information to tailor policies, ensuring that the coverage meets the specific needs and risk tolerance of the client.

The impact of driver history on policy rates is significant. Insurance companies use this data to assess the likelihood of future claims. A broker can recommend appropriate coverage and discounts based on the client's driving record. For example, a young, inexperienced driver might be advised to opt for a higher deductible to lower their premium, or a driver with a history of safe driving may be eligible for loyalty discounts. By considering driver history, brokers can provide accurate quotes and ensure that the policy is both affordable and comprehensive.

Moreover, driver history also influences the types of coverage recommended. Brokers can suggest additional coverage options based on the client's driving record. For instance, a driver with a history of accidents might benefit from comprehensive coverage that includes collision and liability protection. In contrast, a safe driver may prefer a more basic policy with liability-only coverage. The broker's expertise lies in matching the client's needs with the most suitable coverage, ensuring they are adequately protected while also managing their insurance costs.

In summary, insurance brokers in Ontario have access to driver history, which is a critical tool for policy customization. By analyzing this data, brokers can provide personalized recommendations, ensuring that clients receive the right coverage at the best possible rates. This process empowers individuals and businesses to make informed decisions about their insurance needs, ultimately leading to more satisfied and protected policyholders. Understanding driver history allows brokers to offer tailored solutions, making the insurance process more efficient and effective.

Insuring Cars Without Credit Scores

You may want to see also

Legal Compliance: Brokers must adhere to privacy laws when accessing and using driver data

Insurance brokers in Ontario, like anywhere else, must navigate a complex web of legal and ethical considerations when it comes to handling personal data, especially sensitive information like driver history. The primary concern here is privacy, and the legal framework in Ontario is designed to protect individuals' privacy rights. When it comes to accessing and using driver data, brokers must adhere to strict privacy laws to ensure they are acting lawfully and ethically.

The key legislation in this context is the Personal Information Protection and Electronic Documents Act (PIPEDA), which sets out the rules for how businesses, including insurance brokers, can collect, use, and disclose personal information. PIPEDA requires that personal information be collected, used, and disclosed only for the purposes for which it was originally collected, and that individuals have the right to access and correct their personal information. In the context of driver history, this means that brokers must obtain explicit consent from the driver before accessing any personal data, including driving records.

When a driver provides their personal information to an insurance broker, it is a clear indication that they consent to the broker's use of that information for the purpose of obtaining insurance quotes or policies. However, this consent is specific to the purpose for which it was given. Therefore, brokers must ensure that they only use the driver's data for the intended purpose and not for any other unrelated activities. For instance, a broker cannot use a driver's history to make credit decisions or share the information with third parties without the driver's explicit consent.

Moreover, insurance brokers must also be mindful of the provincial privacy laws that may have additional requirements or restrictions. In Ontario, the Freedom of Information and Protection of Privacy Act (FOIP) provides individuals with the right to access and correct their personal information held by government institutions, which can indirectly affect the practices of private entities like insurance brokers. Brokers must ensure that their data handling practices comply with both federal and provincial privacy laws to avoid legal repercussions.

In summary, insurance brokers in Ontario must navigate a legal landscape that prioritizes privacy. They must obtain explicit consent for accessing driver history, use the data only for the intended purpose, and ensure compliance with both federal and provincial privacy laws. Adhering to these legal requirements is essential to maintaining trust with clients and avoiding potential legal issues. It is a delicate balance between providing necessary services and respecting the privacy rights of individuals.

Full Coverage Auto Insurance in Georgia: What's Included?

You may want to see also

Data Sources: Brokers obtain driver history from various sources, including MTO and insurance providers

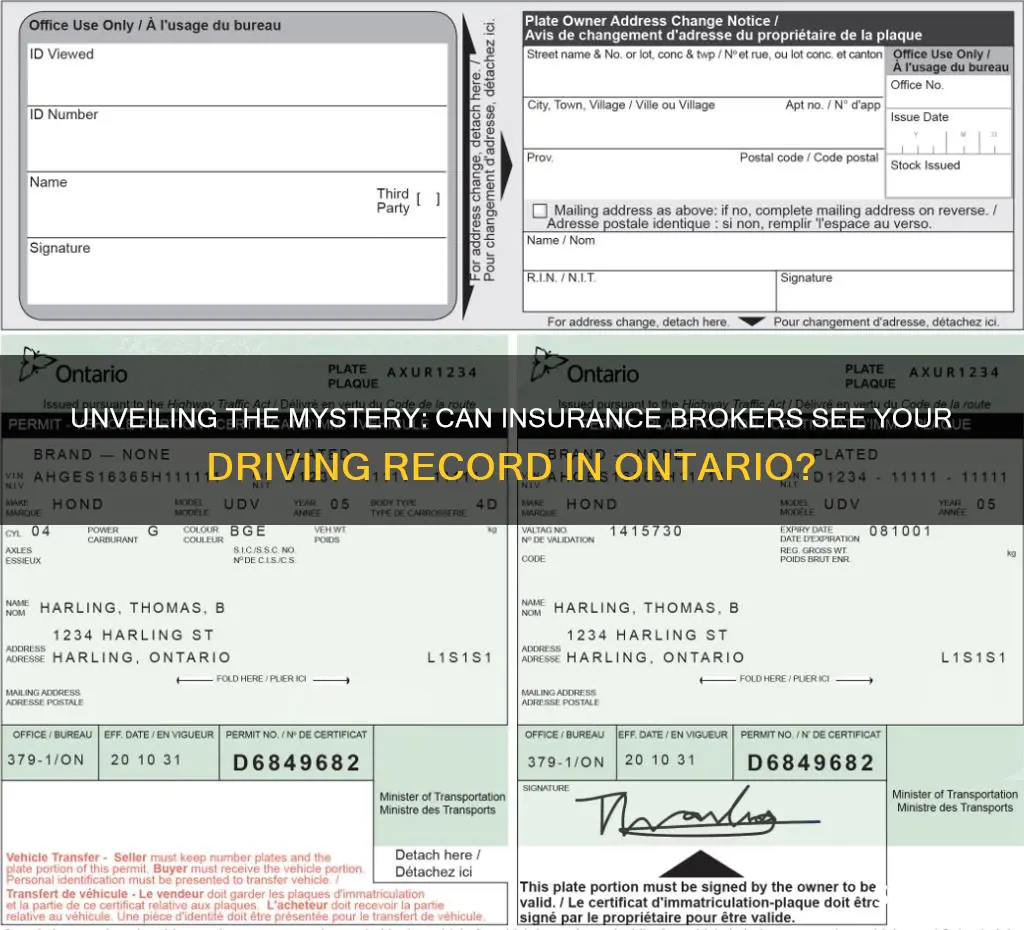

Insurance brokers in Ontario have access to driver history through a variety of sources, ensuring they can provide accurate and comprehensive quotes to their clients. One primary source is the Ministry of Transportation of Ontario (MTO), which maintains a central database of driver information. This database includes details such as driving record, license status, and any violations or penalties incurred. When a client provides their driver's license number to an insurance broker, the broker can request this information directly from the MTO, ensuring they have the most up-to-date and accurate data.

In addition to the MTO, insurance brokers also obtain driver history from insurance providers themselves. When a driver applies for insurance, the insurance company will typically request a driving record from the MTO and may also conduct a credit check. This information is then used to assess the driver's risk profile and determine the appropriate insurance premium. Brokers often have access to these records, especially if the driver has previously been insured with the same or another provider. By obtaining this data, brokers can offer tailored advice and quotes based on the specific driving history of the individual.

Another source of driver history is the driver's own record, which they provide to the broker during the application process. This includes details such as previous accidents, traffic violations, and any claims made. Brokers may also verify this information with the driver's previous insurance providers or the MTO to ensure its accuracy. This self-reported data, combined with the information obtained from other sources, allows brokers to make informed decisions and provide personalized recommendations.

Furthermore, insurance brokers can access driver history through their connections within the industry. They may have relationships with MTO representatives or insurance adjusters who can provide insights or share relevant data. These industry connections can be particularly useful in obtaining information that might not be readily available through official channels. By leveraging these networks, brokers can enhance their understanding of a driver's history and make more informed decisions.

In summary, insurance brokers in Ontario have access to driver history through multiple sources, including the MTO, insurance providers, and industry connections. This comprehensive approach ensures that brokers can provide accurate and personalized services to their clients, helping them make informed decisions about their insurance coverage. Understanding these data sources is crucial for both brokers and clients to navigate the insurance process effectively.

Obesity: Auto Insurance Premiums Affected?

You may want to see also

Frequently asked questions

No, insurance brokers do not have direct access to your driver's license or personal driving records. This information is typically held by the Ministry of Transportation of Ontario (MTO) and is not shared with insurance companies or brokers without your explicit consent.

Insurance brokers in Ontario rely on the information provided by you during the application process. This includes details about your driving experience, any previous accidents or violations, and the type of vehicle you intend to insure. They may also verify this information through the MTO's database, but this is done with your permission and in compliance with legal requirements.

No, insurance brokers are bound by ethical and legal standards to obtain your consent before accessing any personal or driving-related information. They cannot check your driving record without your explicit permission, and doing so would be a breach of privacy and trust.

It is essential to be transparent with your insurance broker. They need accurate and up-to-date information to provide the best coverage options. If you have a previous accident or ticket, disclose this information during the application process. Your broker can then help you understand the implications and guide you on how to proceed, ensuring you have the appropriate coverage.