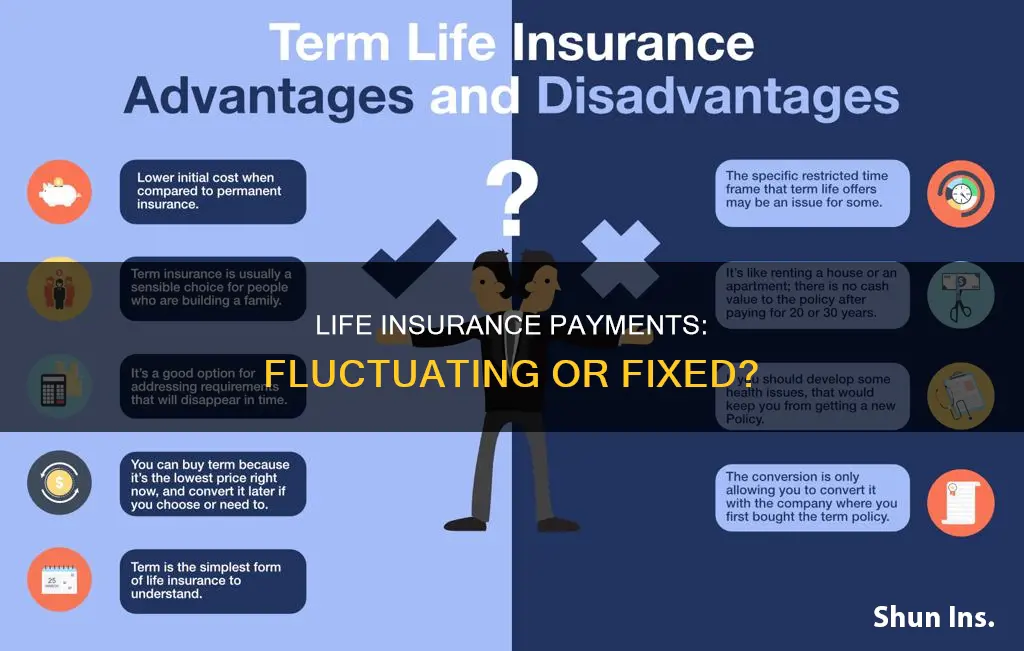

Term life insurance is a type of insurance that provides a death benefit for a specified period, typically between 10 and 30 years. Once the term expires, policyholders can either renew it for another term, convert it to permanent coverage, or let the policy lapse. The decision to renew or convert term life insurance is often influenced by factors such as age, health, and changing financial obligations. While term life insurance premiums are generally affordable, they can increase over time, especially when converting to permanent coverage or renewing an expired policy. Understanding the options available and the associated costs is crucial for individuals seeking to maintain continuous coverage and provide financial protection for their loved ones.

| Characteristics | Values |

|---|---|

| Term length | Typically 10-30 years |

| Renewal | Possible, but at a higher premium |

| Conversion to permanent life insurance | Possible, but at a higher premium |

| Return of premium | Possible with a return of premium rider |

| Premium | Based on age, health, and life expectancy |

| Payout | Death benefit paid to beneficiaries if the insured dies during the term |

| Tax | Not typically taxable |

What You'll Learn

- Term life insurance payments are based on age, health and life expectancy

- Premiums are level and don't change during the policy term

- You can convert term life insurance to a permanent life insurance policy

- Term life insurance is more cost-effective than permanent life insurance

- You can extend your term life insurance coverage

Term life insurance payments are based on age, health and life expectancy

Term life insurance payments are based on several factors, including age, health, and life expectancy. When determining the premium for a term life insurance policy, insurers consider the policy's value, or the payout amount, as well as the age, gender, and health of the individual purchasing the policy. The older an individual is, the more they will typically pay for a policy due to the increased risk of death with age.

Health is another critical factor in determining term life insurance payments. Insurers will often require a medical exam to evaluate an individual's health, including their occupation, lifestyle, and hobbies. Certain hobbies, such as scuba diving, are deemed risky and may result in higher rates. Additionally, dangerous occupational environments, such as working on an oil rig, can also increase premiums.

Life expectancy also plays a role in determining term life insurance payments. Insurers consider mortality rates for each age group when setting premiums. Other factors that can influence premiums include the insurance company's business expenses, investment earnings, and state regulations.

It is worth noting that term life insurance premiums are typically level, meaning they remain the same throughout the policy term. However, if the policy is renewed or extended, the premiums will increase to reflect the individual's current age and the higher risk presented to the insurer.

Florida's Life Insurance Replacement: What You Need to Know

You may want to see also

Premiums are level and don't change during the policy term

Term life insurance is a type of insurance that guarantees a death benefit to the insured's beneficiaries if the insured person dies during the specified term. The premiums for term life insurance are based on a person's age, health, and life expectancy. The insurance company also considers its business expenses, earnings from investments, and mortality rates for each age.

Term life insurance policies typically have level premiums, which means the premium amount remains the same throughout the policy term. The policy term can range from 10 to 30 years, depending on the needs of the policyholder. With level-premium insurance, the premium amount is fixed for the entire duration of the policy. This means that the monthly premium stays the same, providing stability and predictability for the policyholder.

The level-premium structure is advantageous because it allows policyholders to know their exact financial commitment for the duration of the policy. It also enables them to plan their finances effectively, as they don't have to worry about fluctuating premium amounts. Additionally, level premiums can be more cost-effective in the long run, especially when compared to annually-renewable policies.

It's important to note that while the premiums remain level, the coverage amount for term life insurance policies remains the same and does not grow over time. This is in contrast to permanent life insurance policies, where the coverage amount increases over the life of the policy. However, term life insurance is generally more affordable than permanent life insurance, making it a popular choice for individuals seeking financial protection for their loved ones.

Life Insurance 101: Understanding Term 80 Policies

You may want to see also

You can convert term life insurance to a permanent life insurance policy

Conversion Process

Converting a term life policy to a permanent one is generally simpler than applying for a new policy. First, check your existing policy to see if conversion is an option. Next, check the term conversion period, which is the timeframe during which you can convert. Some companies allow conversion at any point, while others may limit this period. Contact your insurance agent or company to initiate the conversion process, which typically does not require a medical exam or underwriting. Simply fill out a questionnaire, and your new permanent policy will be issued within a few days.

Cost of Conversion

There are generally no fees for converting a term policy to a permanent one, but your premium will increase. The new rate will depend on several factors, including your age at the time of conversion, the amount you convert, and the type of permanent policy you choose.

Reasons for Conversion

There are several reasons why converting your term policy to a permanent one may be beneficial:

- Change in health: Converting allows you to extend your coverage without going through the underwriting process, which can be valuable if your health deteriorates.

- Budget changes: If your budget has improved, you may now be able to afford the higher premiums associated with a permanent policy.

- Desire for a cash value asset: Permanent life insurance policies build cash value over time, allowing you to access funds during retirement or for other reasons tax-free.

- Leaving a legacy: Converting to a permanent policy ensures that you can leave an inheritance for your children, even if you spend more liberally during retirement.

- Covering final expenses: Converting a portion of your term policy to permanent coverage can help ensure your family isn't burdened with funeral or other final expenses.

Considerations for Conversion

Before deciding to convert your term policy, consider the following:

- Goals and affordability: Understand your objectives and discuss them with your insurance agent to choose the right permanent policy. Ensure you can afford the higher premiums now and in the future, especially during retirement.

- Available permanent policies: Different insurers offer different permanent policy options for conversion. Some may only allow conversion to specific types, such as universal life policies.

- Long-term care benefits: If you're interested in adding long-term care coverage, check if your insurer offers this benefit and on which types of permanent policies.

- Rising death benefit: If you want a higher death benefit, you may need to go through the underwriting process again, unless the insurer offers a permanent policy with a rising death benefit.

Partial Conversion

If you cannot afford to convert your entire term policy to a permanent one, some insurers may offer the option of partial conversion. This means you can convert only a portion of your term policy to permanent coverage, reducing the financial burden while still providing some long-term protection.

Lucrative Life Insurance: Agent Earnings Explored

You may want to see also

Term life insurance is more cost-effective than permanent life insurance

Term life insurance premiums are based on a person's age, health, and life expectancy. The insurance company will also consider the company's business expenses, investment earnings, and mortality rates for each age. In most cases, a medical exam is required, and the insurance company may inquire about your driving record, current medications, smoking status, occupation, hobbies, and family history.

Term life insurance is ideal for people who want substantial coverage at a low cost. The premiums are generally locked in for the period of coverage selected, and the death benefit is guaranteed to stay the same throughout the term. While term life insurance does not offer any cash value accumulation, some policies may include flexible features that allow you to access your benefits early if you become terminally ill or need help paying your premiums if you become disabled.

On the other hand, permanent life insurance provides lifelong coverage as long as the premiums are maintained. It also has a cash value component that grows tax-free over time and can be withdrawn or borrowed against. However, permanent life insurance is significantly more expensive than term life insurance, with premiums costing approximately 17 times more for the same death benefit. The higher cost is due to the inclusion of both insurance and investment components.

When deciding between term and permanent life insurance, it's important to consider your needs and budget. Term life insurance is sufficient for most people, especially those who only need coverage for a specific period, such as while raising children or paying off a mortgage. It is also a good option for those on a budget or those who want flexibility in case their needs or circumstances change. Permanent life insurance, on the other hand, is suitable for those who need long-term financial protection, want to create an inheritance for their heirs, or prefer stable premiums.

Life Insurance: Secret Marriage Payouts?

You may want to see also

You can extend your term life insurance coverage

Each insurance company has different provisions for the conversion process, but most of the time, you won't have to provide evidence of insurability by undergoing a new medical exam. However, your premium will increase because you are older and because permanent policies present more risk to insurers.

Some companies may only allow you to convert to certain types of permanent insurance, such as a whole life policy, a universal life policy, or an indexed life policy. Discussing this with an experienced insurance agent can help you navigate the complexities of converting a term policy to permanent insurance.

It is important to be aware that some providers may have deadlines for when you can convert a policy. This may be an age restriction or when your original policy hits certain milestones, such as five or ten years of coverage.

Another option to extend your term life insurance coverage is to renew your term coverage. Most term life insurance policies offer the option to renew for a limited number of years without requiring evidence of insurability. This means you can extend your coverage even if your health has changed. For example, a 10-year term policy may be renewable each year for up to 10 additional years. During each renewal, your premium will increase based on your current age.

Zoloft Use: Life Insurance Impact and Implications

You may want to see also

Frequently asked questions

When your term life insurance expires, the policy's coverage ends, and you stop paying premiums. If you pass away after the policy ends, your beneficiaries will not be eligible to receive a death benefit.

No, you can't get your money back after your term life insurance expires, unless you have a return of premium rider. This optional add-on lets you receive a refund of premiums if you outlive your policy term.

Here are some options to continue coverage after your term life insurance expires:

- Convert your term policy to a permanent life plan for higher premiums.

- Extend your current policy.

- Get a new term life policy.

- Get a permanent life insurance policy.

Term life insurance premiums are based on a person's age, health, and life expectancy. Premiums are typically lower for younger people in good health.