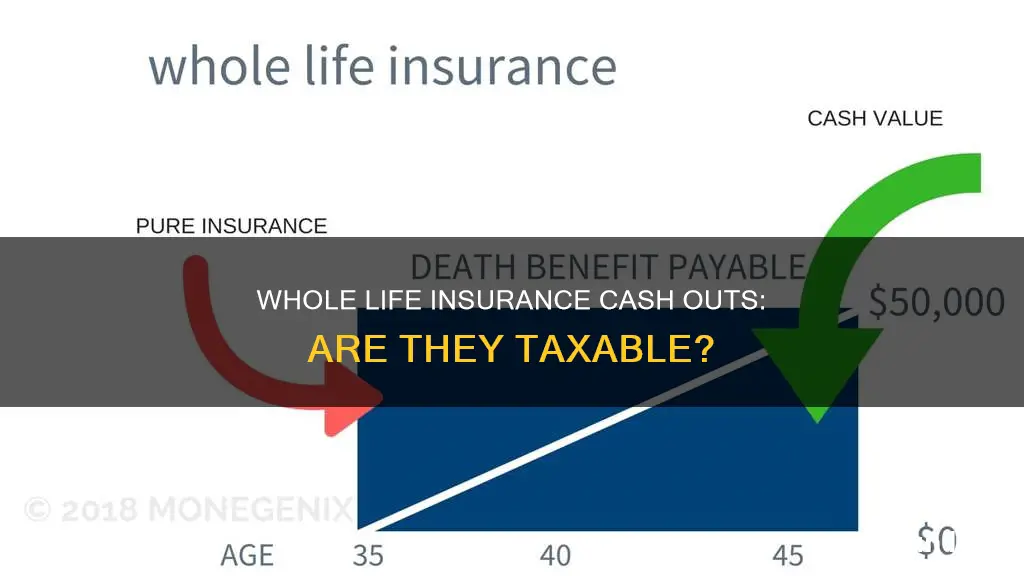

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as you keep up with premium payments. It has a death benefit and a secure cash value account that grows tax-free. While the death benefit is typically tax-free, there are certain situations where cashing out your whole life insurance policy may trigger tax consequences.

The cash value of a whole life insurance policy is not taxed while it's growing, allowing your money to grow faster. You can access this cash value through loans, withdrawals, or by surrendering the policy. Withdrawals up to the total amount of premiums paid are generally not taxable. However, if you withdraw any gains, such as dividends, they may be taxed as ordinary income.

Additionally, if you surrender or cash out your policy, you may incur taxes on the amount that exceeds the total premiums paid. It's important to consult with a tax advisor to understand the specific rules and potential tax implications before making any decisions regarding your whole life insurance policy.

| Characteristics | Values |

|---|---|

| Are cash outs on whole life insurance policies taxed? | If you withdraw up to the amount of the total premiums paid into the policy, the transaction is not taxable as it is considered a return of premiums. If you withdraw any gains on the policy (like dividends), these amounts could be taxed as ordinary income. |

| Are there other ways to access cash from a whole life insurance policy? | Yes, you can borrow against your policy or withdraw from your cash value without surrendering the policy. |

| Are there tax implications for these other ways to access cash? | Withdrawing cash from your policy may be tax-free up to your policy basis, as long as your policy is not classified as a modified endowment contract (MEC). Borrowing against your policy is usually not taxable, but if the policy terminates before you’ve repaid the loan, you might get hit with a tax bill. |

What You'll Learn

Withdrawing more than the cost basis

If you decide to make a withdrawal from a universal life insurance policy, it's important to be aware of the tax implications. The IRS will only tax the portion of the withdrawal that exceeds your cost basis, which is the total amount of premiums you've paid into the policy. Withdrawals up to your cost basis are tax-free, but anything above that amount is considered taxable income and must be reported.

For example, let's say you've paid $50,000 in premiums (your cost basis) over the years and your policy's cash value has grown to $80,000. If you withdraw $30,000, none of it will be taxable because it's below your cost basis. However, if you withdraw the full $80,000, the first $50,000 is tax-free, but the remaining $30,000 will be taxed as income.

It's important to note that withdrawing more than your cost basis can also have other consequences. Withdrawals may reduce your death benefit and could even cause your policy to lapse if your cash value becomes too low. Therefore, it's crucial to carefully consider your options and consult a financial advisor before making any withdrawals from your life insurance policy.

Additionally, the tax treatment of withdrawals may differ depending on the specific type of life insurance policy you have. For example, if your policy is a modified endowment contract (MEC), withdrawals may be taxed differently. It's always a good idea to review the terms of your policy and consult a tax professional to understand the tax implications of any withdrawals you make.

Surrendering your policy

Another option for accessing the cash value of your life insurance policy is to surrender the policy. Surrendering your policy means cancelling it and receiving a payout for the cash value. However, surrendering your policy may also have tax implications if you receive more funds than the policy's cost basis. Similar to withdrawals, the amount you receive up to your cost basis is usually tax-free, but any excess amount may be taxed as ordinary income.

For example, let's say you've paid $30,000 in premiums and the cash surrender value of your policy is $45,000. If you surrender the policy, the $15,000 difference between the cash value and your cost basis would typically be taxed as ordinary income. This could potentially push you into a higher tax bracket for that year. Therefore, it's important to consider the tax implications before surrendering your life insurance policy.

It's also worth noting that surrendering your policy may result in other fees or charges, such as surrender charges, which could reduce the amount of money you ultimately receive. Additionally, surrendering your policy means giving up your life insurance coverage, which may not be the best option if you still need the protection it provides. There are alternative options to access the cash value of your policy, such as borrowing or withdrawing from your cash value, that may be worth considering.

Whole Life Insurance: Can You Cancel Your Policy?

You may want to see also

Surrendering a policy

Surrendering your policy may trigger tax consequences if any of the following occur:

- You receive more funds than the policy's cost basis.

- You have outstanding policy loans that exceed the policy's cost basis. The insurance company will deduct the loan amount and any interest from the cash surrender value. You'll owe income tax on the lower surrender value if it exceeds the amount paid in premiums.

The cash surrender value of a life insurance plan is the amount you'll receive if you surrender your policy to your insurer. This amount is based on your cash value, the component of a permanent life insurance policy that can help you build cash value through regular premium payments.

A policy's cash surrender value can depend on the policy's duration, growth, and assets. Surrendering your policy earlier in the term may result in a lower cash surrender value since the cash value will be smaller, and you may owe surrender charges. However, if you surrender the policy later, you could receive a larger payout since the cash value will be larger, and you'll pay fewer fees.

If you surrender the policy during the early years of ownership, when the value is relatively low, the company will likely charge surrender fees, reducing your cash value. These charges vary depending on how long you've had the policy and, often, on the amount being surrendered. Some policies can levy surrender charges for many years after the policy is issued.

In addition, when you surrender your policy for cash, the gain on the policy is subject to income tax. Additional taxes could be incurred if you have an outstanding loan balance against the policy.

Although surrendering the policy can get you the cash you need, you're relinquishing the right to the death-benefit protection afforded by the insurance. If you want to replace the lost death benefit later, getting the same coverage might be more complicated or more expensive.

If you have the means, consider other options before using your life insurance policy for cash, such as borrowing against your 401(k) plan or taking out a home equity loan. None of these options comes without mitigating issues, but based on your current financial circumstances, some choices may be better than others.

- The cash surrender value

- The cost of getting another life insurance policy

- Future financial goals

Fasting for Life Insurance Tests: Is It Necessary?

You may want to see also

Borrowing from a policy

Borrowing from a whole life insurance policy is a quick and easy way to get cash in hand when you need it. However, it's important to understand the specifics before borrowing. Here are some key points to consider:

Eligibility

To be eligible to borrow from your life insurance policy, you must have a permanent life insurance policy, such as a whole life insurance or universal life insurance policy. Term life insurance, which is cheaper and more suitable for many people, does not have a cash value and therefore cannot be borrowed against.

Loan Process

The loan process is straightforward and does not require a long approval process. You borrow from the insurer, who uses the cash value in your policy as collateral. There is no credit check or impact on your credit score, and you don't have to state the reason for needing the money.

Interest and Repayment

Interest is charged on the loan amount, and it's important to make timely repayments to avoid accruing excessive interest. Flexible repayment options are usually available, but the longer you take to repay, the more interest you will pay.

Death Benefit Impact

Borrowing against your life insurance policy will reduce the death benefit that your beneficiaries will receive. The loan amount, plus any interest owed, will be subtracted from the death benefit. It's important to consider this impact and ensure that your loved ones will still receive the intended financial support.

Tax Implications

Borrowing from your life insurance policy is generally tax-free as long as the policy remains active. However, if the policy lapses or is surrendered with an outstanding loan, the amount of the loan that exceeds the premiums paid may be considered taxable income. It's important to understand these tax consequences and plan accordingly.

Risks and Considerations

While borrowing against your life insurance policy can provide quick access to cash, it's important to weigh the potential risks and drawbacks. The loan may impact your death benefit, and if left unpaid, it could cause your policy to lapse. Additionally, the interest on the loan accumulates over time, and if it exceeds the cash value of your policy, you could lose your coverage. Therefore, it's crucial to have a repayment plan in place and regularly review your policy to avoid these potential issues.

Middle-Class Life Insurance: How Big Is Too Big?

You may want to see also

Dividends from the insurance company

Dividends from a whole life insurance policy are based on the performance of the company's financials, including interest rates, investment returns, and new policies sold. The dividends can be distributed as cash, used to purchase additional paid-up insurance, or to reduce premiums due. The amount of the dividend is tied to the price of the premiums paid by the policyholder.

Whole life insurance dividends are generally not subject to income tax since they are considered a return of premium. However, dividends can be taxable if the amount returned to the policyholder in cash exceeds the total amount they paid in premiums. Additionally, if the policyholder chooses to have their dividends accumulate interest with the insurance company, the interest will be taxable.

There are several options for using whole life policy dividends:

- Cash or check: The policyholder may request that the insurer send a check for the dividend amount.

- Premium deductions: The policyholder may request that the dividend be put toward future premiums to offset the cost.

- Additional insurance: The policyholder may use the dividend amount to purchase additional insurance or prepay on their policy.

- Savings account: The policyholder may decide to keep the dividend with the insurance company to earn interest on the amount.

The best option is usually to take the cash or check from dividends and reinvest the proceeds in an investment vehicle that could earn more income.

Life Insurance: Rising Costs and What to Expect

You may want to see also

Naming the estate as the beneficiary

Naming your estate as the beneficiary of your whole life insurance policy is not advisable. While it is possible to do so, it is not recommended because it gives creditors access to the death benefit. This means your loved ones could receive less money.

When you name your estate as the beneficiary, your estate and assets will first go through probate court, where a judge determines what debts you owe. If you have any outstanding debts, creditors will be able to collect repayment from your estate before your assets are distributed according to your wishes.

On the other hand, when the life insurance death benefit is paid directly to your beneficiaries, it does not have to go through probate court. This means creditors cannot collect the death benefit if they are not listed on your policy, regardless of the debts you owe.

Therefore, to ensure your loved ones receive the full benefit, it is best to list them directly as beneficiaries. If you want to connect your life insurance to your estate, you can set up a trust. Any assets included in a trust do not have to go through probate court, but it is important to work with an estate planning attorney and a financial advisor to ensure your belongings and the life insurance payout are distributed according to your wishes.

It is also important to keep your beneficiary designations up to date and make changes as needed, especially after major life events such as marriage, divorce, or the birth of children.

Utah Life Insurance: Annuities and Their Coverage

You may want to see also

Frequently asked questions

The cash value of your whole life insurance policy is generally not taxed while it's growing. However, taxes may apply if you withdraw more than the total premium payments made.

The death benefit from your whole life insurance policy is typically not taxed as income. However, there are some exceptions. For example, if your beneficiary chooses to receive the payout in installments, any interest that accumulates on those payments will be taxed as regular income.

Surrendering your whole life insurance policy may trigger tax consequences if you receive more funds than the policy's cost basis or if you have outstanding policy loans that exceed the policy's cost basis.