Car insurance is a legal requirement in almost every US state, and GEICO offers a range of auto insurance options to meet the needs of its customers. GEICO's car insurance policies can provide financial protection for drivers, passengers, and their property in the event of an accident. While the specific requirements vary by state, GEICO's auto insurance typically includes bodily injury coverage, property damage coverage, and uninsured motorist coverage. Additional coverages, such as emergency roadside assistance, rental reimbursement, and mechanical breakdown insurance, can also be added for extra protection. GEICO also offers several discounts, including those for students, federal employees, and members of the armed forces. With its experienced agents, GEICO is committed to providing personalized service and answering any questions customers may have about their car insurance policies.

What You'll Learn

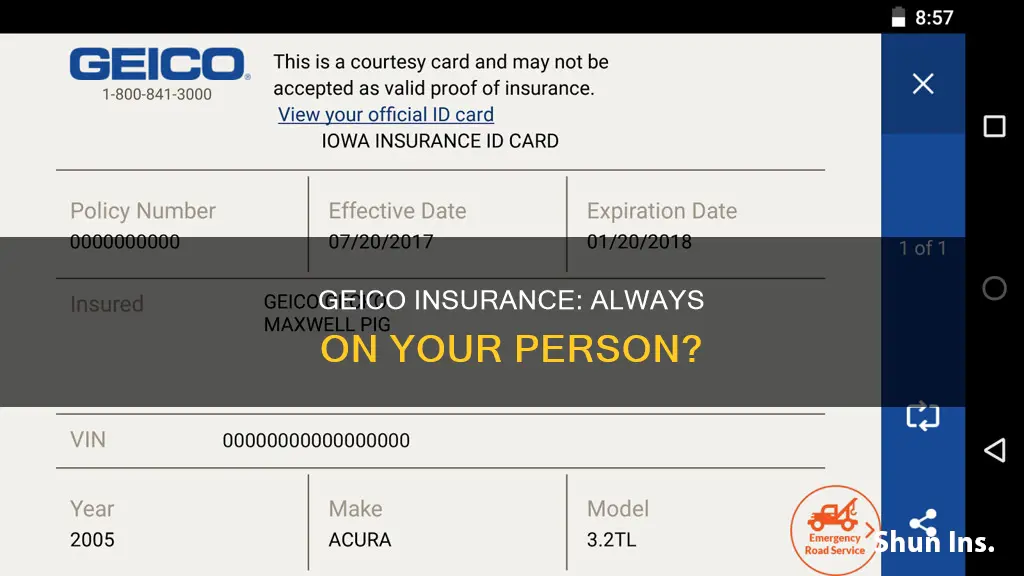

The benefits of carrying your GEICO insurance on your person

Carrying your GEICO insurance on your person can provide several benefits and bring you peace of mind in case of an unexpected event. Here are some advantages of keeping your GEICO insurance policy with you at all times:

- Easy Access to Information: Having your GEICO insurance policy on hand provides easy access to important information. In the event of an accident or emergency, you can quickly retrieve your policy details, including coverage types and contact information for filing a claim. This can expedite the process of seeking assistance and getting the coverage you need.

- Proof of Insurance: In certain situations, such as during a traffic stop or when renting a vehicle, you may be required to provide proof of insurance. By carrying your GEICO insurance policy with you, you can easily demonstrate that you have the necessary coverage. This can help you comply with legal requirements and avoid potential penalties or complications.

- Convenience and Peace of Mind: Keeping your GEICO insurance policy on your person ensures convenience and peace of mind. Whether you're involved in a minor fender bender or a more serious incident, having your policy readily available allows you to quickly confirm your coverage details and take the necessary steps to file a claim or seek assistance. This can reduce stress during an already challenging time.

- Awareness of Coverage Options: Carrying your GEICO insurance policy can help you stay aware of the specific coverage options you have selected. This knowledge can be valuable when making decisions about your vehicle, travel plans, or other insured activities. It empowers you to make informed choices and fully utilize the benefits of your policy.

- Streamlined Claims Process: In the unfortunate event of an accident or incident requiring a claim, having your GEICO insurance policy on hand can streamline the claims process. You can quickly locate your policy number, relevant coverage details, and contact information for filing a claim. This enables you to initiate the claims process promptly, potentially expediting the resolution of your claim.

Remember to keep your insurance information secure and up to date, and always carry it with you to take advantage of these benefits and be prepared for any unforeseen circumstances.

Physician Assistants: Malpractice Insurance

You may want to see also

Digital options for storing your GEICO insurance

GEICO offers a range of digital options for storing your insurance information. The GEICO Mobile app is a convenient way to access your digital insurance ID cards and other policy information. The app is available for both Apple and Android devices, and you can download it from the App Store or Google Play, respectively. Once you have the app installed, simply log in with your GEICO account credentials and access your ID cards by tapping "View ID Cards." You can also add your digital insurance ID card to your Apple Wallet for easy access. To do this, tap "Add to Apple Wallet" on your insurance card in the GEICO app, and then tap "Add" in the upper-right corner. This will allow you to access your insurance information even if you are in an area with spotty cell service.

The GEICO Mobile app provides several benefits. Firstly, it ensures that you always have up-to-date insurance information at your fingertips. The app automatically updates your digital ID card when your policy renews, so you don't have to worry about carrying outdated paper cards. Secondly, the app offers an emergency roadside assistance feature, which can be invaluable if you ever find yourself in a tricky situation on the road. Additionally, the app provides push notifications to remind you when your policy is up for renewal, so you can stay on top of your insurance coverage.

It's worth noting that digital insurance cards are valid in most US states, but there may be exceptions, so it's a good idea to check the state insurance requirements before solely relying on a digital copy. GEICO's website provides information on which states accept digital ID cards as proof of insurance.

If you prefer not to use the mobile app, you can also access your digital ID cards by logging into your GEICO account on their website, geico.com. This allows you to view and download your insurance information from any device with a web browser.

By utilizing the GEICO Mobile app or the GEICO website, you can conveniently store and access your insurance information digitally, eliminating the need to carry physical copies of your insurance cards.

Uninsured: A Growing Concern

You may want to see also

How to get a physical copy of your GEICO insurance

GEICO offers several ways to obtain a physical copy of your insurance. Firstly, you can request that GEICO mails you a physical copy of your insurance card. Alternatively, you can access your insurance information online and print off a copy of your insurance card. To do this, log in to your GEICO My Account page and select "Auto Policy". From there, you can view and print your policy documents. If you have recently purchased a policy online, GEICO will email you temporary insurance cards that you can download from the confirmation email or your My Account page. These temporary cards are usually valid for about a month.

It is recommended that you keep a physical copy of your insurance ID card in your wallet or car, or both. This way, you can easily provide proof of insurance when needed, such as when registering your vehicle or renewing your license plate.

Dealerships: Insured Test Drives?

You may want to see also

When to keep your GEICO insurance on your person

It is important to always keep your GEICO insurance on your person when driving or riding in a vehicle. This includes driving a car, motorcycle, ATV, or any other type of vehicle. If you are involved in an accident, having your insurance information readily available will make the process of filing a claim and exchanging information with the other driver much smoother. It is also important to have your insurance information on hand if you are pulled over by law enforcement.

In addition to keeping your insurance information on your person, it is a good idea to keep a copy of your insurance card in your vehicle. This will ensure that you have a backup in case you forget or misplace your insurance card. You should also take photos of your insurance card and store them on your phone or other electronic devices. This will allow you to access your insurance information even if you don't have the physical card with you.

Another reason to keep your GEICO insurance on your person is when you are travelling, especially if you are renting a car or driving in a new location. GEICO offers rental car coverage, which can be helpful if you need to rent a car while your vehicle is being repaired or if you are on a trip. By having your GEICO insurance information with you, you can easily verify your coverage and take advantage of the benefits offered by your policy.

Furthermore, keeping your GEICO insurance on your person is important when you need to make changes to your policy or update your address. With the GEICO Mobile app, you can easily access your policy information, make changes, and update your address. Having your insurance information readily available will streamline the process of making any necessary adjustments to your coverage.

Finally, it is always a good idea to keep your insurance information with you in case of emergencies or unexpected events. This includes situations such as medical emergencies, natural disasters, or incidents where your vehicle is broken into. By having your GEICO insurance on your person, you can quickly contact the appropriate departments, file a claim, and receive the assistance you need.

Trailer Insurance: What's Required in North Carolina?

You may want to see also

The consequences of not carrying your GEICO insurance on your person

While GEICO does not explicitly state the consequences of not carrying your insurance on your person, it is important to understand the implications of not having proof of insurance in general. Not having proof of insurance can result in fines, suspension of your registration or driver's license, and difficulties in obtaining insurance in the future. Additionally, it is essential to know the insurance requirements of your state, as these may vary.

GEICO offers various methods to access your insurance information, such as through their mobile app or by logging into your account on their website. You can also contact their customer service representatives for assistance. It is recommended to keep your insurance information easily accessible, either on your person or in your vehicle, to avoid any potential consequences.

Furthermore, understanding your insurance coverage is crucial. GEICO offers a range of coverages, including liability coverage, bodily injury coverage, property damage coverage, and uninsured motorist coverage. These coverages provide financial protection and help cover expenses in the event of an accident. By familiarizing yourself with your specific coverage, you can ensure that you are adequately protected.

In addition to standard coverages, GEICO offers optional coverages such as emergency roadside assistance, rental reimbursement, and mechanical breakdown insurance. These additional coverages provide extra benefits and peace of mind. It is important to review your policy and understand the extent of your coverage to make informed decisions about your protection.

Not carrying your GEICO insurance on your person may result in inconvenience and delays, especially if you need to provide proof of insurance during an emergency or unexpected situation. It is always advisable to keep essential documents, including insurance information, readily available to avoid any complications.

In summary, while the consequences of not carrying your GEICO insurance on your person may vary depending on your specific situation and state regulations, it is essential to prioritize accessibility and compliance. By taking the necessary steps to ensure your insurance information is readily available, you can avoid potential fines, legal issues, and difficulties in obtaining future insurance coverage. Being proactive about understanding your coverage and keeping your insurance information at hand demonstrates responsible decision-making and contributes to your overall peace of mind.

Non-Profits: Workers' Comp Insurance Necessity

You may want to see also

Frequently asked questions

Yes, it is important to carry proof of your insurance on your person. You can use the GEICO Mobile app or request an ID card through the GEICO Manage Your Policies online service or the GEICO mobile app.

If you are unable to provide proof of insurance when requested by law enforcement, you may face penalties such as fines and suspensions of your registration or driver's license.

The GEICO Mobile app allows you to easily access your insurance information, make payments, report and track claims, request emergency road service, and more.