Life insurance is a financial safety net that ensures your loved ones are taken care of in the event of your passing. But is it taxable?

In most cases, money paid out from a life insurance policy is not taxable and does not need to be reported as income. However, there are some exceptions. For example, if the contract changes ownership for cash or other valuable consideration, the payout may be subject to taxation. Additionally, if the death benefit is included in your estate's value and the value exceeds a certain threshold, or if the deceased person owns the policy at the time of death, the proceeds may be subject to estate taxes.

It's important to note that any interest earned on the payout, such as through an interest-bearing account or installment payments, is typically considered taxable income.

To ensure compliance with tax laws, it is recommended to consult with a tax professional or financial advisor when shopping for life insurance and to regularly review your policy and beneficiary designations.

| Characteristics | Values |

|---|---|

| Are life insurance payouts taxable? | In most cases, money paid out from a life insurance policy is not taxable. However, there are some exceptions. |

| When might life insurance payouts be taxable? | If the contract changes ownership for cash or other valuable consideration. If the death benefit is paid to the estate of the insured or if the deceased person owns the policy on the date of death. If the payout is in installments, the interest on those payments is taxable. If the policy is sold, and the sale amount exceeds the amount paid in premiums, the gain on that amount could be taxed. If the policy lapses with outstanding loans that exceed the amount paid in premiums, the excess is taxable as income. |

| What is IRS Federal Form 712? | The IRS Federal Form 712 Life Insurance Statement is used to report the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. |

| Do you get a 1099 for life insurance proceeds? | Yes, the beneficiary will receive a 1099 for their tax return. However, this is not because the death benefit is considered income, but because any interest earned is taxable. |

What You'll Learn

Life insurance payouts and taxation

Life insurance payouts are generally not taxable, but there are some exceptions.

Taxation of Life Insurance Payouts

In most cases, money paid out from a life insurance policy is not taxable and does not need to be reported as income. However, there are some exceptions to this rule.

Taxation of Interest on Installments

If the death benefit from a life insurance policy is paid out in installments rather than a lump sum, any interest that accumulates on those payments will be taxed as regular income.

Taxation of Proceeds Paid to the Estate

If the policyholder leaves the death benefit to their estate instead of directly naming a person as the beneficiary, the payout may be subject to estate taxes if the estate's total value exceeds the federal estate tax exemption.

Taxation of Proceeds from Policy Sale

Selling a life insurance policy may trigger income and capital gains taxes. If the policy is sold for more than the total amount of premiums paid, the gain on that amount may be taxed.

Taxation of Proceeds from Policy Loans

If you take out a loan against the cash value of your life insurance policy and the policy lapses before you repay it, you will have to pay taxes on the outstanding loan amount.

Taxation of Proceeds from Modified Endowment Contracts

Withdrawals from a Modified Endowment Contract (MEC) are taxed on a last-in, first-out (LIFO) basis. This means that all withdrawals are treated as taxable income until they equal the total interest earned on the contract.

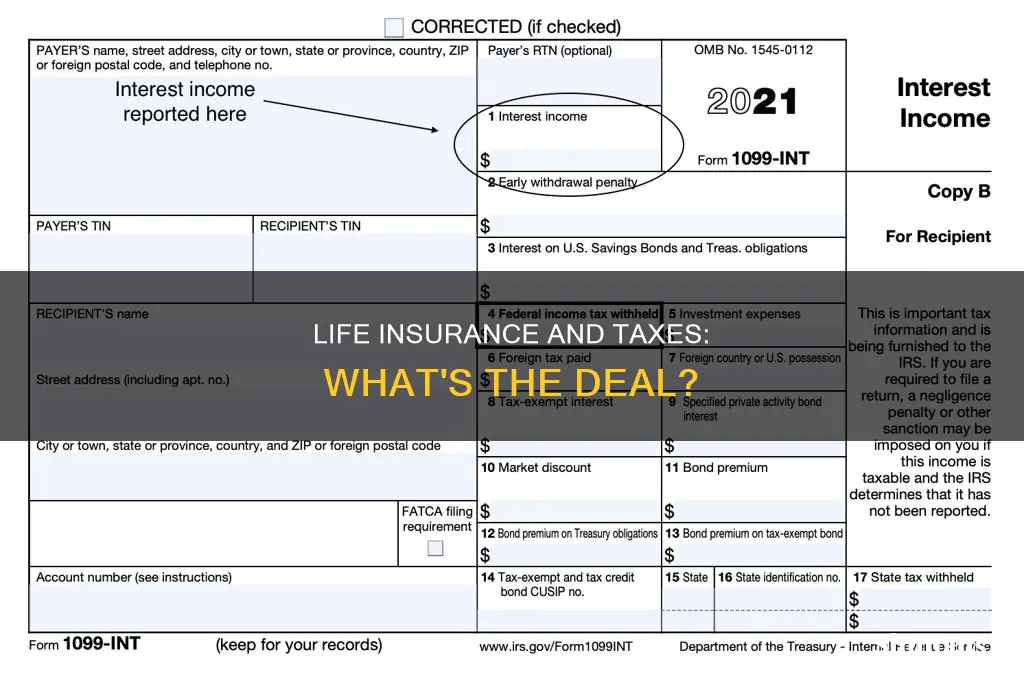

Tax Forms for Life Insurance Payouts

The life insurance company will typically send the beneficiary a 1099 form for their tax return when sending out the life insurance death benefit payment. Form 1099-INT or Form 1099-R may be used to report the taxable amount of the payout. Additionally, the executor of an estate that includes a life insurance policy may be required to file IRS Federal Form 712 Life Insurance Statement to report the value of the policy's proceeds for estate tax purposes.

Creating Generational Wealth: Life Insurance as a Foundation

You may want to see also

Interest on life insurance payouts

Life insurance is a financial product that transfers the risk of death from the policyholder to the policy provider. The policyholder makes premium payments in exchange for a death benefit, typically paid to beneficiaries upon the insured's death.

In most cases, money paid out from a life insurance policy is not taxable. However, there are some exceptions. For example, if the contract changes ownership for cash or other valuable consideration, the proceeds are limited to the sum of the consideration paid, additional premiums paid, and certain other amounts. This is called the transfer-for-value rule.

Another exception occurs when the death benefit is paid to the estate of the insured or if the deceased person owns the policy on the date of death. In these cases, the proceeds from the policy can be subject to estate taxes.

If the beneficiary chooses to receive the life insurance payout in installments instead of a lump sum, any interest that builds up on those payments could be taxed. This is because the interest is considered taxable income, even though the original death benefit is not.

To avoid tax complications, it is important to regularly review beneficiaries and policy details. Using strategies like an irrevocable trust can also help minimize potential tax liabilities.

Juvenile Diabetes: Life Insurance Options for Patients

You may want to see also

Life insurance and estate taxes

Life insurance death benefits are usually tax-free, but there are exceptions. For example, if the payout is set up to be paid in multiple payments, the interest that builds up on those payments is considered taxable income. Another exception occurs when a policyholder leaves the death benefit to their estate instead of directly naming a person as the beneficiary. If the estate's total value is large enough, it may trigger estate taxes.

Life insurance death benefits are a great way to provide for your loved ones after you're gone. One of its biggest advantages is the tax relief it offers. Typically, the death benefit your beneficiaries receive isn't taxed as income, meaning they get the full amount to use for expenses like paying off debts, covering funeral costs, or securing their future.

However, there are a few situations where taxes can come into play. Here are some scenarios to consider:

- Payout structure: Life insurance proceeds paid in a lump sum are generally received by the beneficiary tax-free. However, if the payout is set up to be paid in multiple payments, any interest that accumulates on those payments will be taxed as regular income.

- Policyholder has withdrawn money or taken out a loan: Some life insurance policies, such as whole life, allow policyholders to withdraw or borrow money from the policy's cash value. If the money withdrawn or loaned exceeds the total amount of premiums paid, the excess may be taxable.

- Surrendering your policy: If you surrender your life insurance policy, typically, the amount you paid into your policy (the cash basis) is considered a tax-free return of your principal. However, any funds over your policy's cash basis will be taxed as regular income.

- Employer-paid group life plan: In some cases, an employer-paid plan that pays out more than $50,000 may be taxable, according to the Internal Revenue Service (IRS). Otherwise, the death benefit is paid to beneficiaries tax-free.

- Estate taxes: If life insurance proceeds are included as part of the deceased's estate and, together with the total value of the estate, exceed the federal estate tax threshold, estate taxes must be paid on the proceeds over the allowed limit. The federal estate tax threshold was $12.92 million as of 2023.

Strategies to Minimize Taxes

There are strategies you can use to minimize or avoid potential tax implications on your life insurance benefits:

- Choose a lump-sum payout: By choosing a lump-sum payout, you keep the death benefit income tax-free and avoid taxable interest on installment payments.

- Avoid the Goodman Triangle: In this scenario, three different individuals are involved in a life insurance policy: the policy owner, the insured, and the beneficiary. To avoid a potential gift tax, make sure that only two parties are involved in the policy.

- Use an irrevocable life insurance trust (ILIT): An ILIT can help keep the death benefit out of your taxable estate if certain rules are met. Ensure that the policy is transferred to the ILIT at least three years before death.

- Keep policy loans in check: Monitor your loan balance and ensure the policy doesn't lapse to prevent taxable income from policy loans.

- Transfer ownership early: Transfer ownership of the policy to another person or entity well in advance (more than three years before death) to keep the policy out of your taxable estate.

- Review beneficiaries regularly: Ensure that your estate isn't named as the beneficiary and regularly review and update beneficiaries as life changes occur.

MetLife Group Insurance: Marijuana Testing and You

You may want to see also

Life insurance policy loans

A life insurance policy loan is not the same as a standard loan. Policy owners are not required to repay the loan, but the insurance company will charge interest on the amount borrowed. This interest rate is usually lower than that of a personal loan, typically ranging from 5% to 8%. If the loan is not repaid before the policyholder's death, the insurance company will reduce the face amount of the policy by the amount still owed when the death benefit is paid.

There are several benefits to life insurance policy loans. They are quick and easy to obtain, as there is no approval process, and the funds can be used for any purpose. The funds are also not taxable as long as the policy stays in force. Additionally, there is no repayment schedule or repayment date, and the cash value continues to grow, as it is only being used as collateral.

However, there are also downsides to consider. If the loan is not repaid, the interest can cut into the death benefit, which may result in insufficient funds being paid out to beneficiaries. If the interest increases the loan value beyond the cash value of the policy, the policy could lapse and be terminated by the insurance company. In this case, the outstanding loan balance may be considered taxable income, and the tax bill could be significant.

It is important to carefully consider the pros and cons of a life insurance policy loan before taking one out and, if necessary, to consult a financial advisor to understand how it fits into your overall financial plan.

Selling Life Insurance Part-Time: Is It Possible?

You may want to see also

Life insurance and income tax

Life insurance is often seen as a reliable way to provide for your loved ones after you pass away, and one of its biggest advantages is the tax relief it offers. In most cases, the death benefit your beneficiaries receive isn't taxed as income, meaning they get the full amount to use for expenses like paying off debts, covering funeral costs, or securing their financial future. However, there are some exceptions and special cases to be aware of.

Term Life Insurance Taxation

Term life insurance is generally straightforward when it comes to taxation because there's no cash value component involved. The primary concern with taxation revolves around the death benefit payout and certain specific situations, like selling the policy. Here are some key instances when term life insurance might be taxed:

- Tax on Interest on Installments: If the death benefit is paid out in installments rather than a lump sum, any interest that accumulates on those payments will be taxed as regular income.

- The Goodman Triangle: This occurs when three different individuals are involved in a life insurance policy: the policy owner, the insured, and the beneficiary. In this scenario, the IRS could view the death benefit as a gift from the policy owner to the beneficiary, triggering a gift tax if the amount exceeds the annual exclusion limit.

- Selling Your Policy: Selling a life insurance policy, or a life settlement, might trigger income and capital gains taxes. If you sell your policy for more than you've paid in premiums, the gain on that amount could be taxed.

- Death Benefit and Estate Taxes: If you own a term life insurance policy when you pass away, the death benefit becomes part of your taxable estate, which could push your estate's total value above the federal estate tax exemption and trigger estate taxes.

Permanent Life Insurance Taxation

With permanent life insurance policies, the tax implications can be more complicated due to the cash value component. While many of the tax concerns that apply to term life insurance also apply here, there are additional considerations when dealing with withdrawals, policy loans, and dividends. Here are some key scenarios to consider:

- Withdrawing More Than Your Cost Basis: If you make a withdrawal from a universal life insurance policy, the IRS will only tax the portion that exceeds your cost basis (the total amount of premiums you've paid into the policy).

- Policy Lapse with Outstanding Loans: Taking out loans against your permanent life insurance policy allows you to borrow against the cash value. However, if your policy lapses due to unpaid premiums or insufficient cash value, any outstanding loan balance that exceeds your cost basis will be treated as taxable income.

- Surrendering Your Policy: Surrendering your permanent life insurance policy might result in tax implications. If the cash surrender value (CSV) is higher than the amount of premiums you've paid, the excess is typically taxed as ordinary income.

- Participating Whole Life Policy: With these policies, dividends can be left in the policy to earn interest, growing the policy's cash value. While the dividends themselves aren't taxed, the interest earned on those dividends is considered taxable income and must be reported.

Avoiding Life Insurance Taxes

While life insurance policies offer many tax advantages, careful planning is necessary to mitigate potential tax liabilities. Here are some strategies to help avoid or minimize tax implications:

- Choose a Lump-Sum Payout: Selecting a lump-sum payout keeps the death benefit income tax-free and helps avoid taxable interest on installment payments.

- Avoid the Goodman Triangle: Prevent gift taxes by making the insured and owner the same person or by ensuring the owner and beneficiary are the same.

- Use an Irrevocable Life Insurance Trust (ILIT): This keeps the death benefit out of your taxable estate if certain rules are met. Transfer the policy to the ILIT at least three years before death.

- Keep Policy Loans in Check: Monitor your loan balance and ensure the policy doesn't lapse to prevent taxable income from policy loans.

- Transfer Ownership Early: Transfer ownership of the policy well in advance (more than three years before death) to keep it out of your taxable estate.

- Regularly Review Beneficiaries: Ensure your estate isn't named as the beneficiary, and name a contingent beneficiary to prevent estate taxes. Update beneficiaries as life changes occur.

Forms and Reporting

It's important to understand the tax reporting requirements and forms related to life insurance proceeds. Here are some key points:

- Form 1099: While life insurance proceeds are generally not taxable, you may receive a Form 1099 for your tax return. Any interest earned on the proceeds is taxable and should be reported.

- IRS Federal Form 712: When an insured person or policy owner dies, and an estate tax return is filed, Form 712 is used to report the value of the life insurance policy's proceeds for estate tax purposes. The executor is typically responsible for filing this form.

- Other Forms: Depending on the situation, other forms such as Form 1099-INT or Form 1099-R may be relevant for reporting taxable amounts. Additionally, IRS Publication 525 provides valuable information on taxable and nontaxable income.

Student Loan Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Generally, the proceeds from a life insurance policy that you receive as the beneficiary are not considered gross income and do not have to be reported on your income taxes. However, any interest you receive is taxable and should be reported.

Although life insurance proceeds are usually tax-free, this isn’t the case 100% of the time. This tool from the IRS can help you determine if you have to pay taxes on a life insurance payout.

You won’t receive a 1099 for life insurance proceeds because the IRS doesn’t typically consider the death benefit to count as income. However, the life insurance company will send the beneficiary a 1099 for their tax return when they send out life insurance death benefit payments.