If you're considering a career in insurance, you'll need to get licensed. The requirements to sell insurance vary from state to state, but generally, you'll need to meet certain eligibility criteria, complete pre-licensing coursework, pass a state licensure exam, and apply for your license. In some states, you'll also need to complete fingerprinting and a background check. The whole process can take anywhere from two to eight weeks, and you'll need to renew your license periodically, which may involve additional coursework. While it may seem daunting, getting licensed is essential for selling insurance and protecting your business.

| Characteristics | Values |

|---|---|

| License required | Yes |

| License type | Insurance agent or broker license |

| License requirements | Varies by state, but typically includes: pre-licensing courses, a written exam, and a background check |

| Age requirement | 18 years or older |

| Background check requirement | No felony or fraud charges, no overdue federal or state income taxes, and no past-due child support (in some states) |

| Education requirement | High school diploma or GED; some companies may prefer a bachelor's degree |

| Pre-licensing coursework | Yes, with a minimum number of hours that varies by state |

| Licensing exam | Yes, with a passing score of at least 70% |

| Licensing fee | Varies by state |

| Continuing education | Yes, with a minimum number of hours that varies by state |

What You'll Learn

- Do you need a license to sell life insurance?

- What are the consequences of selling life insurance without a license?

- What are the steps to getting a license to sell life insurance?

- What are the requirements to get a license to sell life insurance?

- What are the pros and cons of a career in life insurance sales?

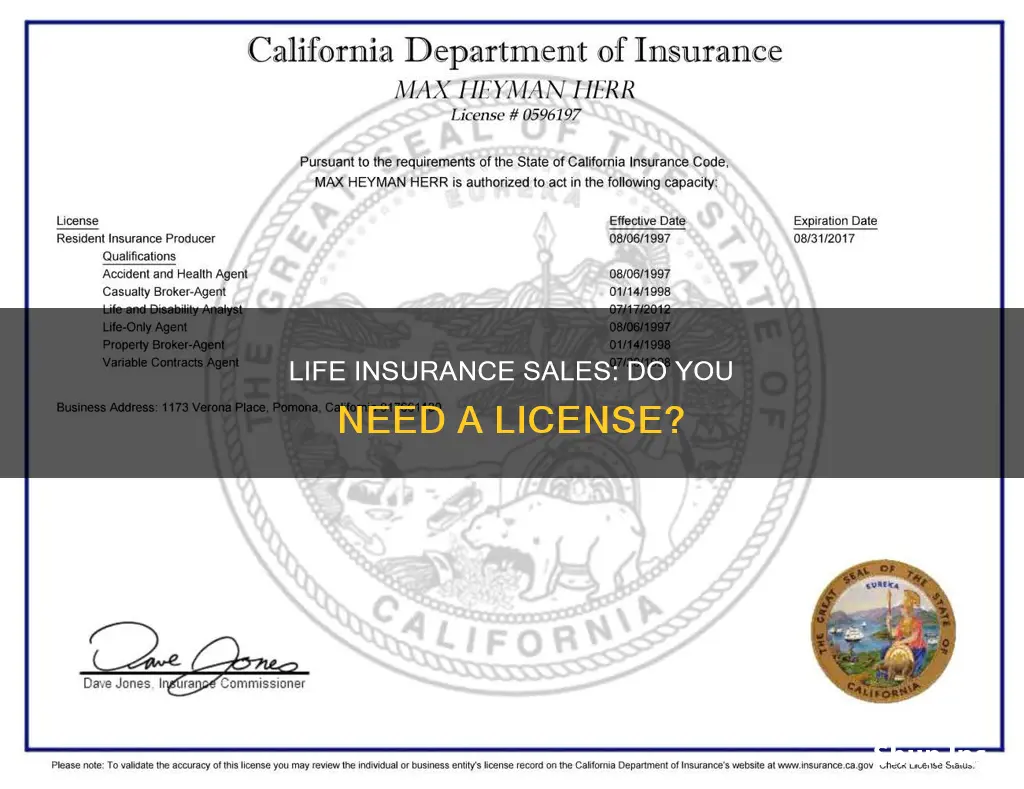

Do you need a license to sell life insurance?

Yes, you need a license to sell life insurance. The requirements to obtain a license vary depending on the state, but there are some general steps that can be followed to obtain a license.

First, meet the basic eligibility requirements. These may include being at least 18 years old, having no fraud or felony charges, and being free of any overdue federal or state income taxes.

Second, complete the pre-licensing coursework. This will prepare you for the state licensure examinations, which cover topics such as insurance industry regulations and insurance principles. The number of hours required for the coursework will vary by state.

Third, pass the state insurance licensure exam. This exam will test your knowledge of the topics covered in the pre-licensing coursework. The format and passing score of the exam will also vary by state.

Fourth, apply for your life insurance license. You can submit your application to your state's department of insurance regulation, along with the required licensing fee. The review process may take some time, and the department may contact you to clarify any information that comes up during the background check.

It is important to note that even after obtaining a license, your education is not over. To renew your license, you will need to complete continuing education courses and comply with all relevant laws and regulations.

In addition, life insurance agents may choose to expand their practice by obtaining additional licenses. This could include licenses to sell insurance in multiple states or to offer various types of insurance beyond life insurance.

Primerica Life Insurance: Borrowing Options and Benefits

You may want to see also

What are the consequences of selling life insurance without a license??

Yes, you need a license to sell life insurance. As an agent or broker, you must have a license to discuss policy options with a client and conduct a sale.

Consequences of Selling Life Insurance Without a License

Selling insurance without a license can result in significant financial and criminal penalties. In some cases, selling insurance to anyone without a license could result in a felony charge.

To protect your business and avoid these consequences, it is essential to obtain the proper licenses, bonds, and insurance. The specific requirements for selling life insurance, such as the type and number of licenses needed, may vary depending on the state in which you operate. It is important to consult the relevant state authorities and seek legal advice to ensure compliance with the applicable laws and regulations.

Contingent Life Insurance: Am I the Primary Beneficiary?

You may want to see also

What are the steps to getting a license to sell life insurance?

To sell life insurance, you must obtain a license from your state's insurance regulation department. Here are the steps to getting a license to sell life insurance:

- Meet the basic eligibility requirements: These may vary depending on the state but typically include being at least 18 years old, having no fraud or felony charges, being free of overdue federal or state income taxes, and passing a background check. Some states also require that insurance agents and brokers do not have past-due child support payments.

- Complete the pre-licensing coursework: This will prepare you for the state licensure examinations. You can take the subjects online or in a classroom. Each course has a minimum number of mandatory hours, covering topics such as insurance industry regulations and insurance principles.

- Pass the state insurance licensure exam: If you're getting a life insurance license, you need to pass the Life, Accident, & Health (LA&H) test. The exam can have 50 to 200 items and must be completed in 2 to 3 hours. The passing score varies by state but is typically around 70%. The test results are valid for two years, so you must apply for your license within that time frame.

- Apply for your life insurance license: Submit your license application to your state's department of insurance regulation. You will need to pay a licensing fee, which varies between states. The insurance regulation department will review your application, and you may need to provide additional information.

- Watch for your application results: The department will notify you once your application has been approved. In some cases, you may need to provide additional information or clarify any issues that arise during the background check.

It's important to note that the process can take between two and eight weeks, and you will need to renew your license periodically, which typically involves completing continuing education credits.

Life Insurance Options for People with Health Issues

You may want to see also

What are the requirements to get a license to sell life insurance?

To sell life insurance, you must obtain a license from your state's insurance regulation department. While the specific requirements vary depending on the state, there are some general criteria that must be met. Here are the requirements to get a license to sell life insurance:

Meet the Basic Eligibility Requirements:

- Age: You must be at least 18 years old, which is the minimum age to apply for a license in most states.

- Criminal Record: You should be free of any fraud or felony charges.

- Financial Standing: You should not owe any federal or state income taxes and should not have past-due child support.

- Background Check: You need to pass a background check.

Complete the Pre-Licensing Coursework:

Before taking the state licensure exam, you must complete pre-licensing coursework to prepare for the exam. The number of hours required for this coursework varies by state. For example, Florida requires 40 hours of pre-license education, while Georgia requires a 40-hour prelicensing course for the "Life, Accident, and Sickness" license. These courses can be taken online or in a traditional classroom setting and cover topics such as insurance industry regulations, insurance principles, and health insurance (if you plan to branch out and sell health insurance policies).

Pass the State Insurance Licensure Exam:

The state licensure exam, also known as the Life, Accident, & Health (LA&H) test, covers a broad range of topics. The exam typically consists of 50 to 200 items and must be completed within two to three hours. It is proctored, meaning it is supervised by an official proctor in a controlled environment. The passing score varies by state, but generally, you need to get at least 70% of the answers correct. Each attempt at the exam costs around $40 to $150, and you must present a valid signature-bearing ID with your photo and the original copy of your pre-licensing education certificate to be allowed to take the test.

Apply for Your Life Insurance License:

After passing the exam, you can apply for your life insurance license by submitting an application to your state's department of insurance regulation. There is typically a licensing fee, which varies between states. The insurance regulation department will review your application, and the process may be delayed if something comes up during the background check. You can check the status of your application through the department's website, and once approved, you can request a copy of your license, which may need to be downloaded and printed.

Additional Requirements:

In addition to the above requirements, some states may mandate specific education requirements, such as a high school diploma or GED. Furthermore, if you plan to sell life insurance in multiple states or offer various types of insurance, you will need to obtain additional licenses. Each state has its own licensing requirements, and you must comply with the regulations of each state in which you intend to sell insurance.

Barclays Bank: Life Insurance Options and Benefits

You may want to see also

What are the pros and cons of a career in life insurance sales?

To sell life insurance, you need a license. This typically involves completing a pre-licensing course, undergoing a background check, and passing an exam.

Pros

- High earning potential: Life insurance sales jobs are abundant and easy to find, and commission percentages are very high compared to other insurance sales. Plus, you can get paid commission renewals for as long as a sold policy is in force.

- Fewer entry barriers: You don't need a college degree to sell insurance, although having one can be an advantage. Most companies provide training and mentorship programs for new hires.

- Flexible work arrangements: Many insurance sales professionals can set their own work schedules and work from home.

- Rewarding work: Insurance is a continuously evolving industry, so you'll often need to come up with innovative solutions. You'll also act as an expert resource, helping clients make informed decisions about their financial protection.

Cons

- Unpredictable income: As commission-based pay, your earnings will depend on the number of successful sales. If you don't push yourself, your income will reflect that.

- High-pressure work environment: Selling insurance can be stressful, requiring long work hours and constant pressure to meet quotas and targets.

- Finding new leads can be challenging: Given the competitive market, the leads you find may already have been contacted by several other agents.

- Limited paid time off: As an independent agent or broker, you won't have access to a full range of employee benefits, including paid time off.

- Rejection: You will meet people who treat insurance sales professionals with disdain and disrespect, and you'll hear "no" a lot.

Overall, a career in life insurance sales can be demanding and challenging, but it can also be rewarding and lucrative for those with strong work ethics and good perseverance.

Life Insurance: Exploring Unique Characteristics and Features

You may want to see also

Frequently asked questions

Yes, you need a license to sell life insurance. The requirements and steps to obtain a license vary depending on the state, but typically include being at least 18 years old, completing pre-licensing education, passing a licensing exam, and undergoing a background check.

The basic requirements to obtain a life insurance license vary by state but typically include being at least 18 years old, being free of any fraud or felony charges, having no overdue federal or state income taxes, and passing a background check. Some states also require that insurance agents and brokers do not have past-due child support payments.

The pre-licensing coursework covers a range of topics, including insurance industry regulations, insurance principles, and health insurance (if you choose to branch out and sell health insurance policies). The required number of hours varies by state.

After completing the pre-licensing coursework, you will need to pass a state insurance licensure exam. The exam covers a broad range of topics, including state-specific insurance concepts, regulations, and practices. The passing score varies by state, but it is typically around 70%.