In Massachusetts, drivers are required to carry a minimum level of auto insurance coverage. This includes liability insurance and uninsured motorist coverage. The minimum coverage amounts are $20,000 for bodily injury liability per person, $40,000 for bodily injury liability per accident, $5,000 for property damage liability per accident, $20,000 for uninsured motorist bodily injury per person, $40,000 for uninsured motorist bodily injury per accident, and $8,000 in personal injury protection. While comprehensive insurance is not mandatory, it is often purchased as additional coverage to protect against non-collision-related damages, such as natural disasters, theft, and vandalism.

| Characteristics | Values |

|---|---|

| Required by law | Yes |

| Minimum level of coverage | Yes |

| Minimum coverage types | Bodily Injury to Others, Personal Injury Protection (PIP), Bodily Injury Caused by an Uninsured Auto, Damage to Someone Else's Property |

| Minimum coverage limits | Bodily Injury to Others: $20,000 per person, $40,000 per accident; Personal Injury Protection: $8,000 per person, $8,000 per accident; Bodily Injury Caused by an Uninsured Auto: $20,000 per person, $40,000 per accident; Damage to Someone Else's Property: $5,000 per accident |

| Required to register a vehicle | Yes |

| Required to drive on public roads | Yes |

| Required to be presented to law enforcement officials | Yes |

| Penalties for driving without insurance | Fines ranging from $500 to $5,000, jail time of up to one year, suspension of driver's license and registration, reinstatement fees |

What You'll Learn

Comprehensive insurance covers non-collision damage

In Massachusetts, comprehensive insurance is not required by state law. However, it is one of the optional coverages that you can choose to purchase to suit your needs. Comprehensive insurance covers non-collision damage to your vehicle, including damage from fire, hail, vandalism, falling trees, and weather damage. It also covers theft of your vehicle or its parts, as well as damage from hitting an animal.

Comprehensive insurance provides financial protection in the event of unexpected incidents that are not collisions. For example, if a fire damages your car or a tree falls on it, comprehensive insurance will help cover the cost of repairs. It is important to note that comprehensive insurance does not cover damage to your vehicle caused by a collision with another vehicle or object; this is covered by collision insurance.

When purchasing comprehensive insurance, you will usually be able to choose a deductible amount, which is the portion of the covered claim that you will need to pay out of pocket. For example, if you select a $500 deductible and the repairs to your vehicle cost $1,500, you would pay the deductible of $500, and your insurance would cover the remaining $1,000. The higher the deductible you choose, the lower your insurance premiums will typically be.

Comprehensive insurance is typically required if you are financing or leasing your vehicle. It helps protect your investment by covering various non-collision incidents. If you own your vehicle outright, comprehensive insurance is usually optional, but it is still recommended to help cover costly repairs or replacement in case of theft or damage.

In Massachusetts, you are required to have certain minimum coverages to register and drive your vehicle, including Bodily Injury to Others, Personal Injury Protection (PIP), Bodily Injury Caused by an Uninsured Auto, and Damage to Someone Else's Property. Comprehensive insurance is not one of the mandatory coverages, but it can provide valuable additional protection.

Non-Admitted Insurance Carriers: What's the Deal?

You may want to see also

Collision insurance covers collision damage

In Massachusetts, drivers are required to have automobile insurance that includes four coverages: Bodily Injury to Others, Personal Injury Protection (PIP), Bodily Injury Caused by an Uninsured Auto, and Damage to Someone Else's Property. These are the compulsory coverages, but drivers can also choose to purchase additional coverages to suit their needs. Collision insurance is one of the optional coverages that drivers in Massachusetts can choose to add to their auto insurance policy.

While collision insurance covers a wide range of collision-related damages, there are some exclusions. It does not cover damage to your vehicle that is not related to driving, such as theft, vandalism, or natural disasters. It also does not cover medical costs for injuries to you or your passengers, or damage caused to another person's vehicle. Additionally, normal wear and tear on your car is not covered by collision insurance.

When purchasing collision insurance, you will need to choose a deductible, which is the amount you pay out-of-pocket before the insurance coverage kicks in. A higher deductible will typically result in a lower premium, but it's important to ensure you can afford the out-of-pocket costs if you need to file a claim. The limit of collision insurance is usually the actual cash value of your vehicle, minus depreciation.

In Massachusetts, collision insurance is typically required if you are leasing or financing your car. If you own your car outright, collision insurance is optional. However, it is worth considering the value of your car and the potential costs of repairs or replacement in the event of an accident when deciding whether to opt for collision coverage.

Malpractice Insurance: Physical Therapists' Standard Practice?

You may want to see also

Comprehensive insurance is not mandatory in Massachusetts

While comprehensive insurance is not mandatory, Massachusetts does have several core car insurance laws that drivers must follow. These include:

- Drivers must carry minimum coverage insurance, including liability and uninsured motorist coverage.

- Drivers must carry no-fault insurance, as Massachusetts is a no-fault state. This means drivers are required to have personal injury protection insurance.

- Drivers must have insurance before registering a vehicle.

- Household members must be added to your policy.

- You cannot be denied coverage for discriminatory reasons such as age, gender, or income.

- All drivers have the right to auto insurance. If a driver is denied coverage from a preferred provider, they can purchase insurance through the Massachusetts Automobile Insurance Plan (MAIP).

The minimum coverage amounts for liability and uninsured motorist insurance in Massachusetts are:

- $20,000 for bodily injury liability per person and $40,000 per accident

- $5,000 for property damage liability per accident

- $20,000 for uninsured motorist bodily injury per person and $40,000 per accident

- $8,000 in personal injury protection (PIP)

While comprehensive insurance is not mandatory, many drivers in Massachusetts choose to purchase it for added peace of mind and financial protection. It's important to remember that comprehensive insurance doesn't cover everything, and there may be exclusions and limitations to your policy. Be sure to carefully review your policy and understand what is and isn't covered.

Ohio: Uninsured Motorist Insurance — Mandatory or Optional?

You may want to see also

Comprehensive insurance covers damage from natural disasters

In Massachusetts, auto insurance is mandatory to register and drive your vehicle. While there are four types of insurance coverage that are compulsory, comprehensive insurance is not one of them. It is, however, an optional coverage that is commonly purchased by consumers.

Comprehensive insurance covers damage to your vehicle that doesn't arise from a collision. This includes damage caused by natural disasters, such as hurricanes, floods, storms, fires, vandalism, falling objects, and more. It is important to note that comprehensive insurance is separate from liability insurance, which covers expenses related to injuries and property damage caused by a crash.

The actual cash value of your car typically determines the limit of what your insurer will pay under a comprehensive policy. Comprehensive coverage pays up to your vehicle's actual cash value minus your chosen deductible. The higher the deductible, the cheaper your premium. However, this also means you will pay more out of pocket when filing a claim.

While comprehensive insurance is optional, lenders or lessors may require it if you finance or lease a car. Additionally, if you live in an area prone to natural disasters and cannot afford to pay for potential vehicle repairs out of pocket, it is wise to consider this type of coverage.

Trucking Insurance: Who Pays When Trucks Crash?

You may want to see also

Comprehensive insurance covers damage from vandalism

In Massachusetts, drivers are required to have automobile insurance, which must include four coverages: Bodily Injury to Others, Personal Injury Protection (PIP), Bodily Injury Caused by an Uninsured Auto, and Damage to Someone Else's Property. These are known as Compulsory or Mandatory Coverages.

While comprehensive insurance is not mandatory, it is often purchased by consumers as an optional coverage. Comprehensive insurance covers damage to your car not related to a collision. This includes damage from vandalism, natural disasters, storms, fires, falling objects, larceny, and contact with a bird or animal.

Comprehensive insurance will cover the cost of repairs to your car if it has been vandalised. Vandalism is the intentional damage or defacing of property and can take many forms, including broken windows, spray-painted graffiti, keyed doors or scratches, and slashed or stolen tires. If you have comprehensive insurance, it will cover the cost of repairs minus your deductible. The deductible is your share of the cost for an insurance claim and is separate from your insurance premium.

If your car has been vandalised, it is important to begin the claims process as soon as possible. Take photos of the damage and, if necessary, file a police report. Contact your insurance company to file the claim, providing details such as the date and time of the incident, the location of the damage, and the police report number. A claims adjuster will then inspect the vehicle and explain the next steps. Once the claim is approved, take your car to a repair shop.

While comprehensive insurance covers damage to your car, it does not cover personal items inside your car that may have been stolen or damaged in a vandalism incident. Coverage for personal belongings would typically fall under renters or homeowners insurance.

CNMs: Malpractice Insurance — Necessary?

You may want to see also

Frequently asked questions

Comprehensive insurance is not mandatory in Massachusetts, but it is an option that many consumers choose to purchase. Comprehensive insurance covers damage to your car that is not related to a collision with another vehicle. This includes damage from natural disasters, fires, vandalism, and animal collisions.

Comprehensive insurance covers damage to your car that is not caused by a collision. This includes damage from natural disasters, fires, vandalism, animal collisions, falling objects, missiles, explosions, earthquakes, floods, riots, and civil unrest.

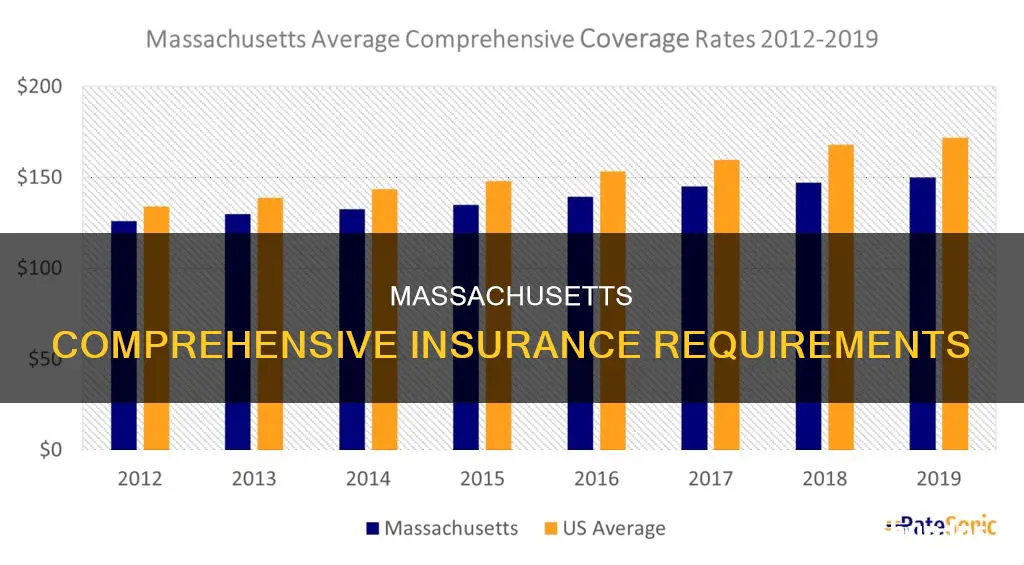

The cost of comprehensive insurance in Massachusetts will vary depending on the insurance provider and the specific coverage options chosen. It is recommended to consult with an insurance agent or professional to determine the cost and coverage that best suits your needs.