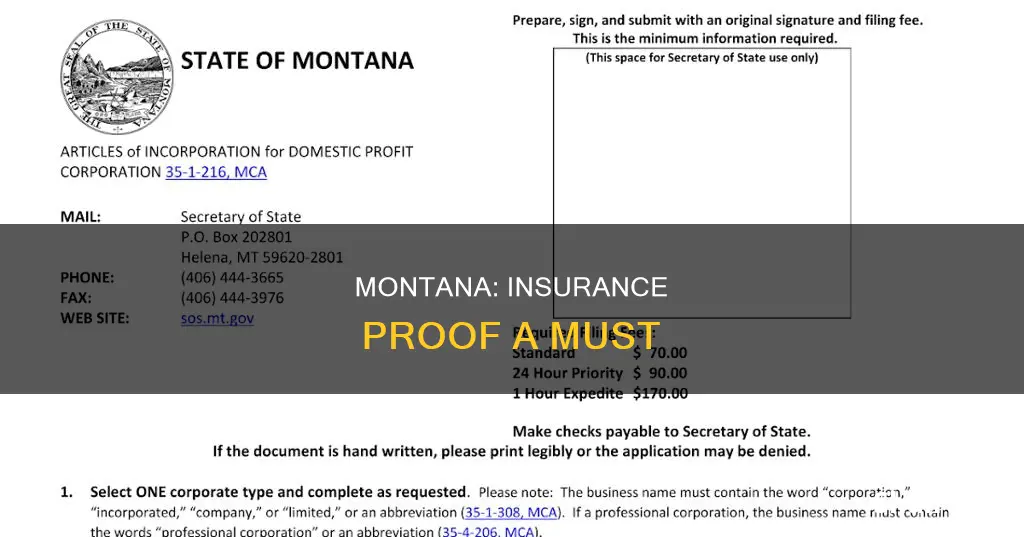

In Montana, drivers are required by law to carry proof of insurance in their vehicles and to show it to law enforcement officers if asked. This can be in the form of a physical insurance card or an electronic version on their phone. The minimum insurance requirements in Montana are $25,000 for bodily injury to/death of one person in an accident, $50,000 for bodily injury to/death of two or more people in an accident, and $20,000 for property damage in an accident. Driving without insurance in Montana is considered a misdemeanour and can result in fines, jail time, and suspension or revocation of one's driver's license.

| Characteristics | Values |

|---|---|

| Minimum liability insurance | $25,000 per person bodily injury |

| $50,000 per accident bodily injury | |

| $20,000 property damage | |

| Proof of insurance | Required to be carried in the vehicle |

| Can be a physical insurance card or an electronic version on your phone | |

| Can be verified by law enforcement using the Montana Insurance Verification System (MTIVS) | |

| Failure to carry insurance | Punishable by fines and/or jail time |

| First offense: fine of $250 to $500 or up to 10 days in jail | |

| Second offense: minimum fine of $350 or 10 days in jail; 90-day driver's license revocation | |

| Third offense: fine of $500, up to 10 days in jail, or both | |

| Fourth and subsequent offenses: up to six months in jail, fine, or both |

What You'll Learn

- What are the minimum liability insurance requirements in Montana?

- What are the penalties for driving without insurance in Montana?

- What is the Montana Insurance Verification System (MTIVS)?

- What is the difference between comprehensive and collision coverage)?

- How do I collect compensation after a car accident in Montana?

What are the minimum liability insurance requirements in Montana?

In the state of Montana, it is mandatory for every driver to carry liability insurance on their vehicle. The minimum liability insurance requirements in Montana are as follows:

- $25,000 for bodily injury to, or the death of, one person in an accident

- $50,000 for bodily injury to, or the deaths of, two or more people in an accident

- $20,000 for property damage in an accident

These minimum coverage limits are outlined in Montana's motor vehicle insurance requirements, which can be found in Mont. Code § 61-6-103 (2023). This law applies to any motor vehicle that is registered and driven on public roads in Montana.

Montana is a fault-based insurance state, which means that the driver who is legally responsible for a wreck must compensate those who are injured or whose property is damaged. Therefore, Montana requires vehicle owners to purchase certain types of auto insurance to ensure that drivers are able to pay for any damages they may cause.

It is important to note that while these are the minimum requirements, individuals may choose to purchase additional insurance coverage to protect themselves financially in the event of a more severe accident.

Florida Condos: Sinkhole Insurance Essential?

You may want to see also

What are the penalties for driving without insurance in Montana?

Driving without insurance in Montana is a serious offence and can result in various penalties, including fines, jail time, and suspension of driving privileges. Here are the details:

First Offence

For a first-time offender, the penalties include a fine ranging from $250 to $500. Additionally, there is a possibility of imprisonment for up to 10 days, even for the first offence.

Second Offence

If an individual repeats the violation within five years of their last conviction, the penalties increase. The fine for a second offence is $350, and the driver's license will be revoked for 90 days. The driver will also receive five points on their driving record, and a total of 30 points will result in the revocation of their driver's license.

Third Offence and Subsequent Offences

For a third and subsequent offences, the financial penalty is a fine of $500. The court has the discretion to impose imprisonment for up to 10 days, or both the fine and imprisonment.

Repeat Offenders

For repeat offenders, the penalties become more severe. If an individual is convicted of a second or subsequent offence within a five-year period, the court will order the surrender of their motor vehicle registration and license plates. The offender will not be allowed to register their vehicle or reinstate their driver's license until they can provide proof of the required insurance.

For a fourth or subsequent offence within a five-year period, the court will also order the surrender of the individual's driver's license. The reinstatement of the driver's license and registration will require the payment of fines and submission of acceptable proof of insurance.

Impact on Insurance Rates

It is important to note that having a misdemeanour for an insurance lapse on one's driving record can result in higher auto insurance rates in the future. Insurance carriers consider suspensions and revocations on driving records as major factors, which may lead to being labelled a high-risk driver. This designation can make it challenging to obtain an auto insurance policy in the voluntary (consumer) market.

Amish and Insurance: An Unlikely Pair

You may want to see also

What is the Montana Insurance Verification System (MTIVS)?

The Montana Insurance Verification System (MTIVS) is an online motor vehicle insurance verification system that allows police to determine if a vehicle is insured. The MTIVS was implemented to ensure compliance with Montana's minimum liability insurance law for motor vehicles.

Montana law requires that a motor vehicle operated on public roads be insured by a liability insurance policy that meets the state's minimum coverage limits in § 61-6-103, MCA:

- $25,000 because of bodily injury to or death of one person in any one accident and subject to the limit for one person.

- $50,000 because of bodily injury to or death of two or more persons in any one accident.

- $20,000 because of injury to or destruction of property of others in any one accident.

Motorists in Montana are required to show proof of insurance to law enforcement if they are stopped for a traffic violation or are involved in a motor vehicle collision. To enforce this law, the Montana Legislature authorized the creation of an online motor vehicle liability insurance verification system. § 61-6-157, MCA directs the Montana Department of Justice to establish a system capable of confirming that vehicle owners and operators on Montana roadways are in compliance with vehicle liability policy requirements.

The MTIVS uses information from Montana vehicle registration records and insurance companies that write policies in Montana to access up-to-the-minute data to confirm if a vehicle has minimum liability insurance coverage. The MTIVS is accessible to individuals, law enforcement, local courts, the Motor Vehicle Division, and County Treasurers.

The MTIVS assists troopers and motorists in situations where drivers cannot find their proof of insurance card or have an expired card. It also allows troopers to confirm the validity of a proof of insurance card and verify that liability insurance was in effect at the time of an accident. The ultimate goal of the MTIVS is to reduce the number of uninsured drivers in Montana, improving traffic safety and reducing costs for insured motorists.

Launching an Insurance Carrier: Where to Start

You may want to see also

What is the difference between comprehensive and collision coverage?)

In the state of Montana, drivers are required by law to carry proof of insurance in their vehicles and to show this proof if they are stopped by law enforcement. This is to ensure that all drivers are able to pay for any damage or injuries they cause in a crash.

Now, here is an overview of the differences between comprehensive and collision coverage:

Comprehensive Coverage

Comprehensive insurance covers damage to your car caused by something other than a collision. This includes damage from fire, natural disasters, falling objects, and vandalism. It also covers theft of the vehicle and damage from collisions with animals. So, if your car is damaged by a deer running into it, or by a tree falling on it during a storm, comprehensive insurance will cover the cost of repairs. Comprehensive insurance is particularly useful if you live in an area with a high crime rate or is prone to natural disasters.

Collision Coverage

Collision insurance, on the other hand, covers repairs to your vehicle when you collide with another vehicle or object, or if you overturn. So, if you hit a guardrail or another car, collision insurance will cover the cost of fixing your vehicle. Collision coverage is particularly important if you are a driver with a history of accidents or live in a high-traffic area.

Both types of coverage are optional under state laws, but if your car is financed or leased, your lender will likely require you to have both. They are often sold together as a package, and collision coverage is usually more expensive than comprehensive coverage.

Insurance Proof: Mandatory in Georgia?

You may want to see also

How do I collect compensation after a car accident in Montana?

Yes, drivers in Montana are required to carry proof of insurance in their vehicles and produce it if a law enforcement officer asks to see it. Driving without insurance in the state is a misdemeanour.

Now, here's how you can collect compensation after a car accident in Montana:

Montana is a fault-based insurance state, which means that the driver who is legally responsible for the accident must compensate those who are injured or whose property is damaged. If you've been in a car accident in Montana and need to collect compensation, there are a few steps you should take:

- Notify the police: Montana law requires you to file a police report if you've been in an accident that resulted in at least $1,000 in damages or if anyone has been injured. If you're unable to notify the police, you must file a crash report with the Montana Highway Patrol within 10 days of the accident.

- Gather information and evidence: If possible, collect the name, contact information, and insurance information of the other driver(s) involved. Take pictures or videos of the accident scene and the surrounding area. If you are injured and unable to gather this information, don't panic. It should be included in the police report.

- Seek medical care: Even if you don't feel injured, it's important to seek medical attention as soon as possible after a car accident. Some injuries, such as head trauma, internal bleeding, whiplash, and back injuries, may not be apparent at the scene but can have serious consequences.

- Inform your insurance company: Let your insurance company know that you've been in an accident. You may also need to start a third-party claim, which means seeking compensation from the other driver's insurance policy.

- Speak to an attorney: Consider consulting a Montana car accident attorney to help you navigate the process of filing a claim and ensure you receive the full amount of compensation you are entitled to. An attorney can help you prove who was at fault, determine the full extent of your losses, and make sure you receive the medical care you need.

It's important to note that Montana follows the "modified comparative negligence" rule, which means you can recover damages as long as you are not more than 50% at fault for the accident. However, your compensation will be reduced by your percentage of fault.

Vets: Malpractice Insurance—Yes or No?

You may want to see also

Frequently asked questions

Yes, you are required by law to carry proof of insurance in your car and show it if a law enforcement officer asks to see it.

The minimum insurance requirements in Montana are:

- $25,000 for bodily injury, per person.

- $50,000 for total bodily injury of multiple people hurt in an accident.

- $20,000 for total property damage.

Driving without insurance in Montana is considered a misdemeanor and can result in fines, jail time, and suspension or revocation of your driver's license.

You can obtain a proof of insurance through your Montana car insurance company or agent, usually in the form of an insurance ID card. You can also use an electronic version on your phone or verify your insurance status using the Montana Insurance Verification System (MTIVS).