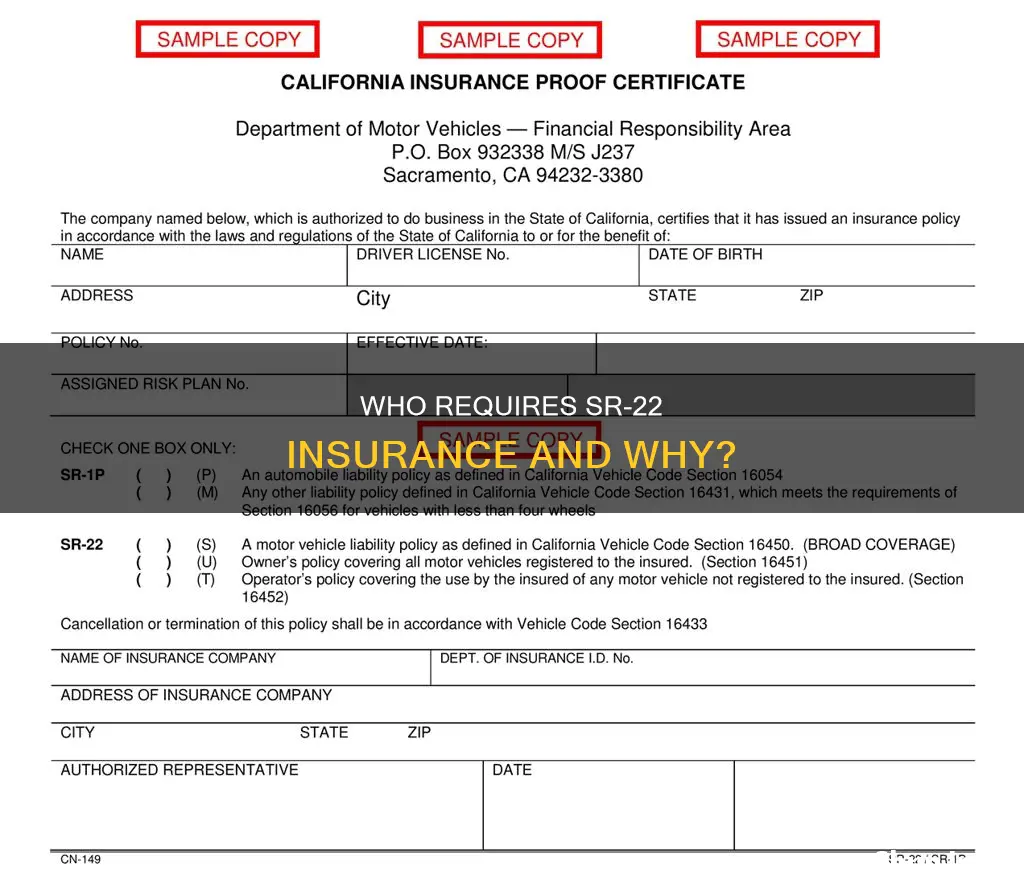

SR-22 insurance is not a type of insurance, but a certificate of financial responsibility that an insurer files with the state on the policyholder's behalf. It is required for high-risk drivers who need to verify that they are carrying the minimum amount of car insurance mandated by law. Offenses that might cause a driver to need an SR-22 include DUI, driving without insurance, or any violation that leads to a revoked or suspended license. SR-22 insurance is typically required by a court or state, and the duration for which it is needed varies, but is usually at least three years.

| Characteristics | Values |

|---|---|

| What is SR-22 Insurance? | SR-22 insurance is coverage for high-risk drivers who are required to verify with the state that they are carrying the minimum amount of car insurance required by law. |

| Is SR-22 Insurance a separate type of insurance? | No, SR-22 is a certificate of financial responsibility that an insurer has to file with the state DMV on a driver's behalf. |

| Offenses that might cause a driver to need an SR-22 | DUI, DWI, driving without insurance, reckless driving, or any violation that leads to a revoked or suspended license. |

| Who orders SR-22 Insurance? | A court or the state. If it's court-ordered, the judge will let you know at the hearing. If it's state-ordered, you'll typically receive a letter from your state's DMV. |

| How much does SR-22 Insurance cost? | The cost to file an SR-22 is typically about $25, but it depends on the state and insurance company. SR-22 insurance costs $742 to $1,465 per year, on average, depending on the insurer and the offense. |

| How long is SR-22 Insurance required for? | SR-22 Insurance is typically required for a minimum of three years, but this can vary depending on the state and the offense. |

What You'll Learn

SR22 insurance is for high-risk drivers

SR-22 insurance is for high-risk drivers who are required to verify that they are carrying the minimum amount of car insurance mandated by their state. It is not a separate type of insurance but a certificate of financial responsibility that an insurer has to file with the state DMV on a driver's behalf.

Drivers who are deemed high-risk may have accumulated too many moving violations in a short period of time, such as speeding tickets or at-fault accidents. They may also have committed more serious offences, such as driving under the influence (DUI), driving without insurance, or reckless driving.

In addition, drivers who need to get a suspended or revoked license reinstated may require SR-22 insurance. This is because SR-22 insurance demonstrates that the driver has the required coverage limits set forth by a court order after a violation.

The cost of SR-22 insurance is typically higher than regular insurance because the driver is considered high-risk. The increase in cost will depend on the driver's history and the severity of their offences. For example, a driver with a DUI conviction may pay, on average, $3,270 a year for SR-22 insurance.

To obtain SR-22 insurance, drivers should contact their car insurance company to start the filing process and certify that they will carry at least the minimum amount of car insurance required by their state. They will then need to decide what type of SR-22 certificate they need. There are three types of SR-22 certificates: an owner's certificate, an operator's certificate (also called a non-owner SR-22), and an owner-operator certificate.

Insurance Carrier Definition: What You Need to Know

You may want to see also

It's a certificate of financial responsibility

An SR-22 is a certificate of financial responsibility. It is not a separate type of insurance but a document that proves a driver has the minimum amount of car insurance required by law. It is filed with the state by the insurance company on the driver's behalf.

An SR-22 is typically required for high-risk drivers who have been convicted of major driving violations. These violations may include DUI, DWI, driving without insurance, or reckless driving. Drivers who have accumulated too many traffic tickets in a short time may also be required to have an SR-22. This ensures that high-risk drivers are held responsible and watched more closely while they are on the road.

An SR-22 is also necessary for drivers who need to get a suspended or revoked license reinstated. In addition, filing an SR-22 is a key step in attaining a hardship or probationary license.

The SR-22 is typically required for a minimum of three years, though this may vary depending on the state and the nature of the violation. If a driver's insurance policy is cancelled while they are still required to carry an SR-22, their insurance company must notify the state, which could result in the driver's license being suspended or revoked.

An SR-22 costs approximately $25 to file, though this may vary depending on the state and the insurance company. Obtaining an SR-22 may also lead to an increase in insurance costs, as drivers with an SR-22 are often classified as "high-risk".

Nonprofit Insurance: What's Needed?

You may want to see also

It's required for drivers with major violations

SR-22 insurance is a certificate of financial responsibility that an insurer has to file with the state DMV on a driver's behalf. It is not a separate type of insurance but rather a document that proves that a driver has the minimum amount of car insurance required by law.

SR-22 insurance is required for drivers with major violations, which include:

- Driving under the influence of alcohol or narcotics (DUI, OWI, or DWI)

- Driving with a suspended, revoked, or invalid license

- Reckless or negligent driving

- Speed racing or drag racing

- Using a vehicle to commit a felony

- Leaving the scene of an accident or hit and run

- Refusing to stop or fleeing from a law enforcement officer

- Vehicular homicide, manslaughter, or assault with a vehicle

These violations are considered high-risk behaviours that can lead to increased insurance rates and other consequences such as license suspension, vehicle registration suspension, and hefty fees. SR-22 insurance is a way to ensure that high-risk drivers are held responsible and are monitored more closely while on the road.

In addition to major violations, SR-22 insurance may also be required for drivers who have accumulated too many minor traffic violations, such as speeding, running a red light, or failing to yield, in a short period of time. Repeated offences, such as three or more speeding tickets within six months, can result in the need for SR-22 insurance.

Attune: Surplus Insurance Carrier?

You may want to see also

It's needed to reinstate a suspended or revoked license

An SR-22 is a certificate of financial responsibility that your insurance company must file with the state on your behalf. It is not a separate type of insurance, but rather a document that proves you have at least the state-required minimum liability car insurance.

If your license has been suspended or revoked, you will likely need to obtain SR-22 insurance to get it reinstated. A suspended license is a temporary hold on your license that prohibits you from legally driving. A revoked license is a permanent cancellation of your driving privileges. Whether or not you can get a new license after revocation varies by state and the reason for revocation.

To get your license reinstated, you will typically need to complete certain steps, such as paying outstanding fines, completing a defensive driving course, and providing proof of car insurance. Your insurance company may also need to file an SR-22. This is because, in many cases, you will need to prove to the state that you have the required amount of insurance to get your license reinstated.

An SR-22 is often required due to a court order resulting from a serious driving violation, such as a DUI, reckless driving, or driving without insurance. It is important to note that SR-22 insurance usually costs more than regular coverage because the driver is considered high-risk. Obtaining an SR-22 certificate requires a one-time filing fee, which typically ranges from $15 to $40, depending on your state.

In addition to the filing fee, you can expect to pay higher car insurance premiums. SR-22 insurance costs $742 to $1,465 per year, on average, depending on the insurer and the offence that led to the SR-22 requirement. An SR-22 requirement can raise a driver's premium by up to 18%. It is important to maintain continuous insurance coverage while you have an SR-22 on file. If your coverage lapses or is cancelled, your insurance provider is required by law to notify the state, which could result in further penalties or fines.

Contractor Insurance: What Policies Are Essential?

You may want to see also

It's not a type of insurance

SR-22 insurance is not a type of insurance but rather a certificate of financial responsibility. It is a form filed with a state to prove that an individual has car insurance that meets the minimum coverages required by law. It is also known as an "SR-22 Bond" or "SR-22 Form".

An SR-22 is not something that everyone needs. It is typically required if an individual has been caught driving without insurance or a valid license. Other reasons for needing to file an SR-22 form include DUI or DWI convictions, driving without enough insurance, too many at-fault accidents or violations, and repeat offences in a short time frame.

The SR-22 form is filed by the driver's insurance company directly with the state's Department of Motor Vehicles (DMV). It serves as a guarantee that the driver will maintain the required insurance coverage for a specified period. The SR-22 certificate is issued in one of the following forms:

- Operator's Certificate — covers the motorist in the operation of any non-owned vehicle.

- Owner's Certificate — covers vehicles owned by the driver.

- Operators-Owners Certificate — covers all vehicles owned or non-owned by the driver.

The SR-22 certificate is sent directly to the Secretary of State's office and may take up to 30 days for processing. The individual will receive a copy of the SR-22 from the insurance company and a letter from the Secretary of State's office. The insurance must be maintained for three years. If the SR-22 expires or is cancelled, the insurance company is required by law to notify the Safety and Financial Responsibility Section. Upon receipt, the driving record will be suspended.

In summary, SR-22 insurance is not a type of insurance but rather a certificate of financial responsibility that is filed with the state to prove that an individual has the required minimum car insurance coverage.

Accounting Firms: Insured or Not?

You may want to see also

Frequently asked questions

SR-22 insurance is required for high-risk drivers who need to verify with the state that they are carrying the minimum amount of car insurance required by law. SR-22 insurance is not a separate type of insurance but a certificate of financial responsibility that an insurer has to file with the state DMV on a driver's behalf.

There are several reasons why someone might need SR-22 insurance, including:

- DUI or DWI conviction

- Driving without insurance

- Too many moving violations or at-fault accidents

- Repeat offences in a short time frame

- Not paying court-ordered child support

- Reinstating a revoked or suspended license

- Unpaid parking tickets or accident fines

To get SR-22 insurance, you need to contact your car insurance company to start the filing process. You will need to certify that you will carry at least the minimum amount of car insurance required by your state. If you do not already have car insurance, you will need to purchase a sufficient amount of coverage before an SR-22 can be filed. You will also need to decide what type of SR-22 certificate you need, such as an owner's certificate or an operator's certificate.