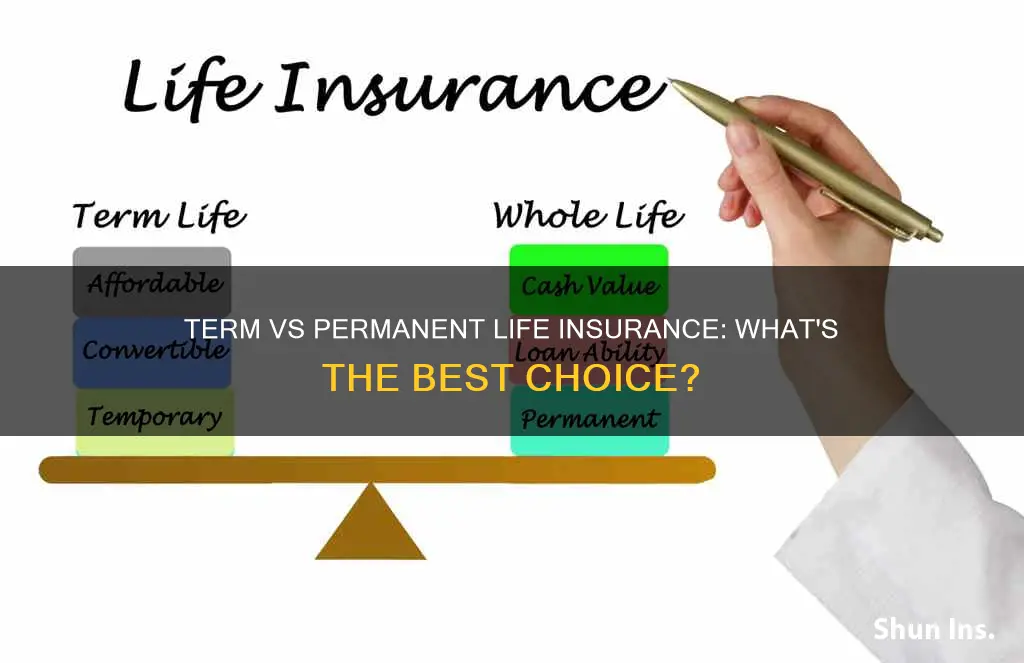

Life insurance is an important financial tool to protect your loved ones in the event of your passing. There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance covers you for a fixed period, such as 10, 20, or 30 years, and pays out a death benefit if you die during the term. Permanent life insurance, on the other hand, is designed to last your entire life and often includes additional benefits such as a cash value component. While term life insurance is typically more affordable, permanent life insurance may offer more flexibility and long-term value. The choice between term and permanent life insurance depends on individual needs, budget, and financial goals.

What You'll Learn

- Cost: Term life insurance is usually more affordable than permanent life insurance

- Duration: Term life insurance covers a specific period, while permanent life insurance is lifelong

- Flexibility: Term life insurance policies can't be changed, while permanent policies allow modifications

- Cash value: Permanent life insurance has a cash value component that can be used during your lifetime

- Death benefit: Term life insurance pays a death benefit if you die during the term, while permanent life insurance always pays a death benefit

Cost: Term life insurance is usually more affordable than permanent life insurance

Term life insurance is generally more affordable than permanent life insurance. This is because term life insurance is temporary and has no cash value. Whole life premiums are much higher because the coverage typically lasts a lifetime and the policy grows in cash value. Whole life insurance is the most common type of permanent life insurance and usually costs more than term life. Whole life insurance also has a cash value component. A portion of your premium goes toward the cash value, which can grow over time. Once you've built up enough cash value, you can borrow against it or surrender the policy for cash.

Term life insurance is ideal if you only need coverage for a finite period, such as while raising children or paying off a mortgage. Whole life insurance is better for those who want coverage for life as well as the ability to build retirement wealth and income through the policy's cash value account. Some term life policies offer a conversion option that allows you to switch to a whole life policy in the future. If you think you might want lifelong coverage eventually, but prefer a lower-cost term life policy for now, look for a convertible term policy.

The amount of coverage you need depends on many factors, including your age, income, mortgage and other debts, and anticipated funeral expenses. Term life insurance policies are straightforward, focusing purely on the death benefit with no additional cash value or long-term savings feature. Permanent life insurance includes a cash value component, which can be accessed through loans or withdrawals.

While term life insurance is initially less expensive, permanent life insurance may be more efficient in the long run. That's because permanent life insurance never needs to be renewed, and your rates will not be adjusted as you get older. When the period of coverage you select expires, your coverage will come to an end, or you may be able to renew your coverage annually.

Term life insurance could be an excellent choice for those looking for affordable coverage for a set time period to protect their loved ones during critical financial periods. It's popular among young families and those with tight budgets. Permanent life insurance comes with higher premiums because it offers lifetime coverage and includes a cash value component. This cash value grows over time and provides additional financial flexibility, but the higher cost may not fit every budget.

Life Insurance for Couples: Is Joint Coverage Possible?

You may want to see also

Duration: Term life insurance covers a specific period, while permanent life insurance is lifelong

Term life insurance is a temporary form of coverage, typically lasting for a fixed period, such as 10, 20, or 30 years. It is designed to provide financial protection for a specific duration, often aligned with milestones like raising children or paying off a mortgage. Term life insurance offers a death benefit, which is paid out if the insured person passes away during the policy's term. While it doesn't offer cash value accumulation, some term policies have flexible features, like early benefits if the insured becomes terminally ill. Additionally, term life insurance is generally more affordable, especially for younger and healthier individuals. However, the premiums may increase upon renewal, and there is no payout if the insured outlives the policy term.

On the other hand, permanent life insurance, as the name suggests, is designed to provide long-term, often lifelong coverage. Unlike term life insurance, permanent policies don't have a fixed duration and will remain in force as long as the required premiums are paid. Permanent life insurance not only includes a death benefit but also features a cash value component. This cash value can be used in various ways, such as withdrawing during the lifetime, borrowing against it, or listing it as an asset. The premium for permanent life insurance generally remains level throughout the insured's lifetime, providing financial stability for dependents. Additionally, permanent life insurance can be used to safeguard inheritances, as the benefits can be passed down to the next generation. However, permanent life insurance is generally more expensive than term life insurance due to its additional benefits and lifelong coverage.

Joint Life Insurance: Cheaper Option for Couples?

You may want to see also

Flexibility: Term life insurance policies can't be changed, while permanent policies allow modifications

When it comes to flexibility, term life insurance and permanent life insurance differ significantly. Term life insurance policies are designed to provide coverage for a specific period, typically 10 to 30 years, and they expire at the end of that term. These policies are generally more affordable, with some options costing less than $20 per month for $500,000 in coverage for healthy individuals in their twenties. However, the downside is that term life insurance policies cannot be changed or renewed after the initial term. If you want to extend your coverage, you would need to purchase a new policy, and the premiums will likely be higher due to your increased age.

On the other hand, permanent life insurance offers much greater flexibility. Permanent policies are designed to provide lifelong coverage, and they do not expire. As long as you continue to pay the premiums, your coverage will remain in force. Permanent life insurance also offers the benefit of building cash value over time, which you can withdraw or borrow against during your lifetime. This cash value can be used for various purposes, such as emergency funds, starting a business, or paying for college. Additionally, permanent life insurance policies provide the option to receive dividends, further increasing their flexibility and financial benefits.

While permanent life insurance offers more flexibility in terms of coverage duration and cash value accumulation, it is important to consider the trade-offs. Permanent policies are generally more expensive than term life insurance, with higher premiums due to the lifelong coverage and additional benefits. However, the premiums for permanent life insurance are typically locked in at the time of purchase and remain stable throughout the policy's duration.

In summary, term life insurance policies offer limited flexibility due to their fixed terms and lack of renewability. In contrast, permanent life insurance policies provide the advantage of lifelong coverage, the ability to build cash value, and the potential to receive dividends, making them a more flexible option for long-term financial planning.

Life Insurance: Part of the Gross Estate?

You may want to see also

Cash value: Permanent life insurance has a cash value component that can be used during your lifetime

Permanent life insurance has a cash value component that can be used during your lifetime. This is a significant advantage of permanent life insurance over term life insurance, which does not offer any cash value accumulation. Permanent life insurance, such as whole life and universal life, can accumulate cash value over time. This cash value can be used for various purposes, such as borrowing or withdrawing cash, paying policy premiums, or even supplementing retirement income.

The cash value in a permanent life insurance policy grows as a result of the fixed premiums paid by the policyholder. In the early years of the policy, a larger portion of the premium goes towards building the cash value. Over time, the amount allocated to cash value decreases, as the cost of insuring the policyholder's life increases with age. The cash value may grow with potential tax savings, and some policies offer guaranteed interest rates on the accumulated cash value.

The cash value component of permanent life insurance provides policyholders with flexible access to funds while they are still alive. Policyholders can take out loans against the cash value, make withdrawals, or use the funds to pay premiums. However, it is important to note that withdrawing cash or taking out loans against the policy will reduce the death benefit.

The ability to build a cash value nest egg is especially beneficial for those who may struggle to save money on their own. Permanent life insurance provides a mechanism for policyholders to accumulate funds for future use, with a portion of each premium deposited into an interest-bearing savings account. This cash value grows tax-free over the lifetime of the deposit, providing a valuable financial tool during the policyholder's lifetime.

When deciding between term and permanent life insurance, it is essential to consider your financial situation and goals. Permanent life insurance is generally more expensive than term life insurance due to the cash value component. However, the ability to build and access cash value during your lifetime can make permanent life insurance a more efficient choice in the long run.

Comdex Ratings: Understanding Your Life Insurance Score

You may want to see also

Death benefit: Term life insurance pays a death benefit if you die during the term, while permanent life insurance always pays a death benefit

Term life insurance and permanent life insurance are both designed to protect the financial well-being of your loved ones in the event of your death. However, they differ in terms of coverage duration, features, benefits, and premium structures.

Term life insurance provides a death benefit for a specified period, typically 10 to 30 years. If the insured person dies during the policy term, their beneficiaries will receive a lump-sum death benefit, which is generally tax-free. Term life insurance is usually more affordable than permanent life insurance, with some policies priced at less than $20 per month for $500,000 of coverage for healthy individuals in their twenties. The premiums are based on the person's age, health, and life expectancy, and they remain fixed for the selected coverage period. However, if the policy is renewed, the premiums will increase annually. Most term life insurance policies expire without paying a death benefit, which lowers the insurer's risk and allows them to charge lower premiums.

On the other hand, permanent life insurance provides lifelong coverage as long as the required premiums are paid. It combines a death benefit with a cash value or savings benefit. The death benefit is tax-free, and the savings benefit can be used by the policyholder in various ways, such as withdrawing during their lifetime or borrowing against it. Permanent life insurance is generally more expensive than term life insurance because it funds both the death benefit and the cash value account. The premium amount remains level throughout the insured's lifetime, providing stability and making it efficient in the long run.

While term life insurance offers short-term protection with a defined end date, permanent life insurance provides lifelong coverage with additional savings benefits. Term life insurance is suitable for individuals seeking affordable coverage for a specific period, such as until their children become financially independent. In contrast, permanent life insurance is ideal for those who want lifelong protection and are interested in building savings through their premiums.

CVS and Tricare: Insurance and Life Coverage Options

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a specific timeframe, such as 10, 20 or 30 years, and pays out if you die during the term. Permanent life insurance is designed to last a lifetime and has additional benefits (like cash value) that you can use while you’re living.

Term life insurance is usually the more affordable option. Permanent life insurance tends to be more expensive. However, permanent life insurance premiums generally remain level through the insured’s lifetime, whereas term life insurance premiums will increase if you choose to renew your coverage.

Permanent life insurance never needs to be renewed, and your rates will not be adjusted as you get older. It also has a cash value component that can be used by the policyholder in a variety of ways, such as to help pay for college or as supplemental income during retirement.