Permanent life insurance is a type of insurance that provides coverage for an individual's entire life, rather than for a fixed term. It tends to be significantly more expensive than term life insurance due to the extended coverage period and additional benefits. The cost of permanent life insurance varies depending on several factors, including age, gender, health, and the specific policy features. For example, a $500,000 whole life insurance policy for a healthy 30-year-old non-smoker costs around $440 per month on average. This cost increases with age, health issues, and risky behaviours such as smoking. Permanent life insurance offers lifelong protection and can be a valuable investment for individuals seeking comprehensive coverage.

| Characteristics | Values |

|---|---|

| Average monthly cost | $440 |

| Average annual cost | $5,280 |

| Average cost for $500,000 coverage | $451 per month |

| Average cost for $1,000,000 coverage | $1,100 per month |

| Average cost for $250,000 coverage | $24-$29 per month |

| Average cost for a 20-year, $250,000 term life policy | Under $200 per year |

| Average cost for a 30-year-old non-smoker in good health | $451 per month |

| Average cost for a 30-year-old male non-smoker in good health | $472 per month |

| Average cost for a 30-year-old female non-smoker in good health | $408 per month |

| Average cost for a 40-year-old | $31.97-$35.45 per month |

What You'll Learn

- Permanent life insurance costs more than term life insurance

- Whole life insurance is a type of permanent life insurance

- The cost of permanent life insurance depends on age, gender, health, and hobbies

- Permanent life insurance is more expensive because it lasts longer and has a cash value component

- Permanent life insurance policies can be tailored to your needs

Permanent life insurance costs more than term life insurance

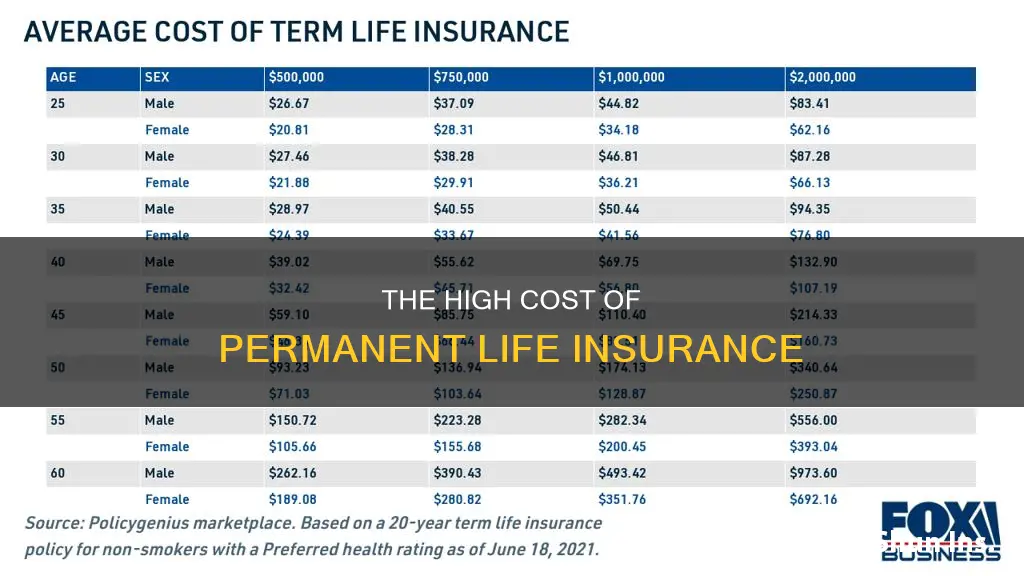

Permanent life insurance is considerably more expensive than term life insurance. This is because permanent life insurance offers lifelong coverage and includes a cash value component that allows you to borrow against your policy or withdraw funds later in life. Term life insurance, on the other hand, is temporary and does not have a cash value component. It simply offers coverage for a set number of years, making it a more affordable option for those who want coverage for a specific period.

Permanent life insurance rates are based on various factors, including age, gender, health, and the amount of coverage. The younger and healthier you are, the cheaper your premiums will be. Permanent life insurance also offers additional benefits such as tax-deferred cash value growth, an income tax-free death benefit, and tax-efficient loans and withdrawals. These benefits contribute to the higher cost of permanent life insurance compared to term life insurance.

While term life insurance is initially less expensive, permanent life insurance may be more cost-efficient in the long run. Permanent life insurance never needs to be renewed, and the rates remain stable as you get older. In contrast, term life insurance rates increase with each renewal, making it more expensive over time.

When deciding between term and permanent life insurance, it's important to consider your needs and budget. Term life insurance is ideal for those who want affordable premiums and coverage for a specific period. On the other hand, permanent life insurance is suitable for those who desire lifetime coverage, access to cash value, and the ability to afford higher premiums.

Life Insurance: Fired, but Still Covered?

You may want to see also

Whole life insurance is a type of permanent life insurance

Permanent life insurance is significantly more expensive than term life insurance. This is because permanent life insurance provides coverage for a lifetime and has a cash value component. The cash value of a permanent life insurance policy grows tax-deferred, and policyholders won't have to pay taxes on the gains until they withdraw them.

- Level Payment: Premiums remain unchanged throughout the duration of the policy.

- Single Premium: The insured pays a one-time large premium, which funds the policy for life.

- Limited Payment: The insured pays a limited number of payments, which are higher than those in a level-payment situation.

- Modified Whole Life Insurance: The insured pays lower premiums in the first few years and higher premiums in the later years.

Whole life insurance policies are also categorised as participating or non-participating plans. With a non-participating policy, any excess of premiums over payouts becomes profit for the insurer. With a participating policy, any excess of premiums is redistributed to the insured as a dividend.

Whole life insurance policies are generally more expensive than universal life insurance policies. The premiums are typically fixed and cannot be adjusted. The death benefit is also established when the policy is issued and cannot be directly increased. However, dividends can be used to purchase additional coverage.

Life Insurance Money and Tithing: What's the Verdict?

You may want to see also

The cost of permanent life insurance depends on age, gender, health, and hobbies

The cost of permanent life insurance is influenced by a variety of factors, including age, gender, health, and hobbies.

Age is a primary factor in determining life insurance premiums. The older an individual is when purchasing a policy, the more expensive the premiums will be as the likelihood of a claim being made increases. Permanent life insurance premiums may also rise annually as the policyholder ages. Generally, younger people pay less for life insurance as their life expectancy is higher.

Gender also plays a role in the cost of permanent life insurance. Men generally pay higher premiums than women due to a shorter average life expectancy and a higher risk of early heart attacks, among other factors. Women often have lower premiums as they tend to live longer than men, resulting in lower rates for the same age and health profile.

Health is another critical factor in determining the cost of permanent life insurance. Pre-existing health conditions, such as diabetes or heart conditions, can increase premiums. Insurers also consider an individual's height and weight, blood pressure and cholesterol levels, and family medical history when calculating premiums.

Finally, hobbies and lifestyle choices can impact the cost of permanent life insurance. High-risk activities, such as skydiving, racing, or extreme sports, can result in higher premiums or even denial of coverage. The frequency and experience of these activities are also considered, with more frequent participation leading to higher premiums.

Pan-American Life Insurance: Understanding the Insurance Category and Benefits

You may want to see also

Permanent life insurance is more expensive because it lasts longer and has a cash value component

Permanent life insurance is a type of insurance that offers lifelong coverage. It is more expensive than term life insurance because it lasts longer and has a cash value component. Term life insurance, on the other hand, only covers a limited amount of time, typically 10, 20, or 30 years. Permanent life insurance policies, such as whole life insurance, provide coverage for the entire life of the policyholder, even if they live to 100 years old. This longer coverage period comes at a higher cost.

Another factor that makes permanent life insurance more expensive is the cash value component. Whole life insurance policies, for example, have a cash value account that grows over time. This account is funded by a portion of the premium payments made by the policyholder. The cash value can be borrowed against, withdrawn, or used to pay premiums. This additional benefit increases the cost of permanent life insurance compared to term life insurance, which does not have a cash value component.

The cost of permanent life insurance also depends on several factors, including age, gender, health, and hobbies. Generally, younger people pay lower premiums because they are less likely to have health problems. Women tend to pay less than men because they have a longer life expectancy. Other factors that can affect the cost of permanent life insurance include smoking status, occupation, and medical history.

In summary, permanent life insurance is more expensive than term life insurance due to its longer coverage period and the inclusion of a cash value component. The cost of permanent life insurance can vary depending on the policyholder's age, gender, health status, and other factors. It is important to consider these factors when deciding between permanent and term life insurance.

Is Bankers Life & Casualty Life Insurance Trustworthy?

You may want to see also

Permanent life insurance policies can be tailored to your needs

Waiver of Premium Rider

If you become disabled and can't work, this rider will pay your entire premium, allowing you to keep your policy. A similar rider, called "Waiver of Cost of Insurance", only pays the death benefit portion of your premiums, not the cash value portion.

Accelerated Benefit Rider

This rider provides an option to accelerate a portion of the death benefit while you are still alive if you become terminally ill or chronically ill (unable to perform at least two out of six Activities of Daily Living).

Guaranteed Insurability Rider

This allows you to increase the size of your death benefit at certain times without providing evidence of insurability or undergoing a new medical exam – effectively letting you lock in lower rates now and get a bigger policy later. Guardian, for example, gives you up to eight option dates throughout your life to purchase additional coverage.

Accidental Death Rider

This rider pays an added death benefit if you are killed in an accident.

Critical Illness Rider

This rider provides a lump sum that can be used to cover medical treatment if you are diagnosed with a life-threatening condition or illness. The amount used will be deducted from the total death benefit.

The cost of permanent life insurance varies depending on age, gender, tobacco use, overall health, and the amount of coverage. Permanent life insurance costs significantly more than term life insurance because it provides more benefits and can be used in ways that term life can't. Whole life insurance rates also tend to be higher than universal life insurance rates.

Life Insurance: Bequests and Your Legacy

You may want to see also

Frequently asked questions

The cost of permanent life insurance depends on factors such as age, gender, health, and hobbies. The average cost of a $500,000 whole life insurance policy for a healthy 30-year-old is $440 per month.

In addition to age, gender, and health, hobbies and risky behaviours such as smoking or skydiving can also affect the cost of permanent life insurance.

Permanent life insurance is generally more expensive than term life insurance as it provides lifelong coverage and includes a cash value component. The average cost of a $500,000 20-year term life policy is $26 per month, while the average cost of a $500,000 whole life policy is $451 per month.

You can get a quote for permanent life insurance by contacting an insurance company or an independent broker, who can help you find the best policy for your needs.

Permanent life insurance provides lifelong coverage and includes a cash value component that can be borrowed against, used to pay premiums, or cashed in for retirement funding. It also offers tax benefits, such as tax-deferred cash value growth and an income tax-free death benefit.