Navigating the intricacies of tax returns can be challenging, especially when it comes to understanding how to report life insurance premiums. This guide aims to clarify where and how to include life insurance premiums on your tax return, ensuring you stay compliant with tax regulations while potentially maximizing your tax benefits.

| Characteristics | Values |

|---|---|

| Policy Type | Term Life, Whole Life, Universal Life |

| Premiums Paid | Annual, Monthly, One-time |

| Tax Deductions | Premiums paid in the current year may be deductible |

| Proceeds Received | Payouts from a life insurance policy are generally not taxable |

| Exclusions | Some types of life insurance policies may be excluded from deductions |

| Form and Line | Depends on the country and tax jurisdiction |

| Documentation | Proof of payment and policy details |

| Reporting Frequency | Annually, or as per tax regulations |

| Country-Specific Rules | Varies by country; consult local tax authorities |

What You'll Learn

- Life Insurance Premiums: Deduct insurance payments from taxable income

- Proceeds and Benefits: Report insurance payouts as income

- Tax Deductions for Policies: Claim deductions for policyholder expenses

- Tax Forms and Schedules: Use specific forms to report life insurance

- State and Local Taxes: Consider state-specific insurance tax rules

Life Insurance Premiums: Deduct insurance payments from taxable income

When it comes to filing your tax return, understanding how to handle life insurance premiums is crucial for maximizing your tax benefits. Life insurance can provide financial security for your loved ones, and it's important to know how to manage the associated costs effectively. Here's a guide on how to approach deducting life insurance premiums from your taxable income:

Understanding the Basics: Life insurance premiums are generally considered an itemized deduction, which means you need to provide specific details to claim them on your tax return. Itemized deductions are typically used when the standard deduction doesn't cover all your eligible expenses. This is especially relevant for individuals who have significant medical expenses, mortgage interest, or other deductible items.

Eligibility for Deduction: To deduct life insurance premiums, you must meet certain criteria. Firstly, the insurance policy must be a qualifying life insurance policy, which includes term life insurance, whole life insurance, and universal life insurance. Additionally, the policy should be owned by you or your spouse, and the premiums must be paid during the tax year. It's important to note that only the premiums paid during the year are deductible; any future payments or loans against the policy are not eligible.

Taxable Income Impact: When you deduct life insurance premiums, it directly reduces your taxable income. This is a significant benefit as it lowers the amount of income subject to taxation, potentially resulting in a lower tax liability. By deducting these premiums, you can effectively lower your overall tax burden, especially if you are in a higher tax bracket.

Filing Process: To claim the deduction, you'll need to provide specific information on your tax return. This includes the total amount of life insurance premiums paid during the year and any related documentation. Typically, you'll find a section on your tax forms (such as Form 1040) where you can list these expenses as itemized deductions. It's essential to keep records of all payments made to ensure accuracy and provide the necessary documentation to support your claim.

Additional Considerations: It's worth mentioning that there are certain limitations and rules associated with life insurance deductions. For instance, if you receive a loan against your policy or make any premium payments with after-tax dollars, these may not be fully deductible. It's advisable to consult a tax professional or accountant to ensure you comply with all the relevant regulations and maximize your deductions. They can provide personalized guidance based on your specific circumstances.

Life Insurance: How Many Policies Should New Jersey Residents Apply For?

You may want to see also

Proceeds and Benefits: Report insurance payouts as income

When you receive a life insurance payout, it's important to understand how to report this income on your tax return. The proceeds from a life insurance policy can be significant, and the tax implications can vary depending on the type of policy and the circumstances. Here's a guide to help you navigate this process:

Understanding the Proceeds: Life insurance payouts are generally considered taxable income. This includes the death benefit received from a term or whole life insurance policy. The key is to recognize that these proceeds are subject to taxation, and proper reporting is essential.

Reporting Requirements: When filing your tax return, you must report the total amount of insurance proceeds received in the tax year. This is typically done on the appropriate tax forms. For individuals, this usually involves filling out the necessary schedules or sections on Form 1040 or its equivalent, depending on your jurisdiction. It's crucial to provide accurate details about the insurance payout to ensure compliance with tax laws.

Exclusions and Deductions: There are some exceptions and deductions that can apply. For instance, certain types of life insurance policies, such as those used for business purposes or those with specific tax-qualified status, may offer exclusions or deductions. These can help reduce the taxable amount. It's advisable to consult the relevant tax regulations or seek professional advice to understand if you qualify for any such exclusions or deductions.

Record-Keeping: Maintain thorough records of all life insurance payouts received. This documentation is essential for accurate reporting and can be useful if you need to provide evidence of the income for tax purposes. Keep a copy of the insurance payout letter or statement, as well as any supporting documents related to the policy.

Seeking Professional Guidance: Tax laws can be complex, especially when dealing with insurance proceeds. Consider consulting a tax professional or accountant who specializes in insurance and tax matters. They can provide personalized advice based on your specific situation, ensuring that you comply with all reporting requirements and take advantage of any applicable tax benefits.

Life Insurance: Understanding the Basics and Beyond

You may want to see also

Tax Deductions for Policies: Claim deductions for policyholder expenses

When it comes to filing your taxes, understanding how to claim deductions for life insurance policies is essential for maximizing your tax benefits. Life insurance can be a valuable asset in your financial planning, and knowing how to take advantage of the tax deductions it offers can help reduce your taxable income and potentially lower your tax liability. Here's a comprehensive guide on how to claim deductions for policyholder expenses related to your life insurance.

Understanding Policyholder Expenses:

Life insurance policies come with various expenses, such as premiums, administrative fees, and medical exams. These expenses can be tax-deductible if they meet certain criteria. It's important to keep detailed records of these expenses throughout the year to ensure accurate reporting on your tax return. Common policyholder expenses include annual premiums, one-time premiums for term life insurance, and any fees associated with policy administration or rider benefits.

Deduction Rules for Life Insurance Premiums:

The Internal Revenue Service (IRS) allows policyholders to deduct life insurance premiums as a medical expense or as a miscellaneous itemized deduction. Here's how it works:

- Medical Expense Deduction: If you have a standard deduction, you can choose to deduct life insurance premiums as a medical expense. This option is available if the premiums exceed a certain percentage of your adjusted gross income (AGI). For the tax year 2022, the threshold is 7.5% of your AGI. If your premiums exceed this threshold, you can claim the excess amount as a medical expense deduction.

- Miscellaneous Itemized Deduction: Alternatively, you can deduct life insurance premiums as a miscellaneous itemized deduction, which has a 2% floor. This means you can only deduct the amount that exceeds 2% of your AGI. This option is useful if your premiums are below the medical expense threshold.

Record-Keeping and Documentation:

To successfully claim these deductions, proper record-keeping is crucial. Here are some key points to consider:

- Keep a copy of your life insurance policy and any related documentation, including premium receipts, policy statements, and medical exam reports.

- Maintain records of all policyholder expenses, including premium payments, administrative fees, and any other charges.

- If you have a tax professional or accountant, provide them with all the necessary documents to ensure accurate reporting.

Reporting on Your Tax Return:

When filing your tax return, you can claim the deductions for life insurance premiums in the appropriate section. For medical expense deductions, you'll typically report it on Schedule A (Form 1040) and select the "Medical and Dental Expenses" category. For miscellaneous itemized deductions, it is reported on Schedule A as well, under the "Miscellaneous Deductions" section.

By understanding the tax rules and keeping thorough records, you can effectively utilize the deductions for life insurance policies, potentially reducing your tax burden and maximizing the financial benefits of your life insurance coverage. Remember to consult with a tax professional or accountant to ensure compliance with the latest tax regulations.

Unlocking Cash: Understanding Tax Implications of Life Insurance Payouts

You may want to see also

Tax Forms and Schedules: Use specific forms to report life insurance

When it comes to reporting life insurance on your tax return, it's important to understand the specific forms and schedules that are relevant to your situation. The process can vary depending on the type of life insurance policy you have and the tax laws in your jurisdiction. Here's a breakdown of how to approach this:

Understanding the Basics:

Life insurance proceeds received can be taxable income, and the tax treatment depends on the type of policy. Generally, if you own a life insurance policy and it is paid out upon your death, the proceeds are typically not taxable to you. However, if you are the beneficiary of someone else's life insurance policy, the proceeds may be taxable as income. It's crucial to differentiate between these scenarios.

Form 1099-G:

If you received life insurance proceeds, you will likely receive a Form 1099-G from the insurance company. This form reports the total amount of non-taxable and taxable distributions you received. You'll need to include this information on your tax return. The proceeds are generally reported as income on Schedule 1 (Form 1040) or Schedule E (Form 1040NR) of your tax return, depending on your filing status and residency.

Form 712 (Valuation of Property):

In some cases, if you own a life insurance policy and it has a cash value, you may need to report its value on Form 712. This form is used to value assets for tax purposes and is particularly relevant if you are considering the policy's cash value for financial planning or tax optimization.

Exclusions and Deductions:

There are certain exclusions and deductions related to life insurance that you should be aware of. For example, if you paid premiums for a life insurance policy as a business expense, you may be able to deduct those premiums. Additionally, if you received life insurance proceeds as a result of a business transaction, you might be able to exclude a portion of the proceeds from taxation.

Seeking Professional Advice:

Tax laws can be complex, especially when dealing with life insurance. It's advisable to consult a tax professional or accountant who can provide personalized guidance based on your specific circumstances. They can help ensure that you accurately report your life insurance proceeds and take advantage of any applicable deductions or exclusions.

Marine Health Insurance: Lifetime Coverage for Veterans?

You may want to see also

State and Local Taxes: Consider state-specific insurance tax rules

When it comes to filing your tax return, it's essential to consider the specific rules and regulations related to state and local taxes, especially when dealing with life insurance. Each state has its own unique tax laws, and understanding these can significantly impact how you report your life insurance benefits. Here's a detailed guide to help you navigate this aspect of your tax return:

Understanding State-Specific Insurance Tax Rules:

Start by researching the tax laws in your state. Different states have varying approaches to taxing life insurance benefits. Some states may exempt life insurance proceeds from taxation, while others may impose taxes on the death benefit amount. For instance, in states like New York, life insurance proceeds are generally taxable, and you'll need to report them on your state tax return. On the other hand, states like Florida have no state income tax, and thus, life insurance benefits may not be subject to state-level taxation. It's crucial to know these nuances to ensure compliance.

Reporting Life Insurance Proceeds:

When filing your federal tax return, you typically report life insurance proceeds on Form 1040, Schedule 1, or Form 1040-NR (for non-residents). You'll need to provide details such as the insurance company's name, the policy's death benefit amount, and any applicable tax deductions or credits. However, state tax returns may have different requirements. For example, in states with a state income tax, you might need to file a separate state form to report life insurance benefits. Make sure to consult the instructions for your state's tax forms to ensure accurate reporting.

Exemptions and Deductions:

Some states offer exemptions or deductions for life insurance premiums paid. These can help reduce your taxable income. For instance, in certain states, you may be able to deduct the cost of life insurance premiums as a medical expense deduction. It's essential to understand these deductions to maximize your tax benefits. Additionally, if you reside in a state with no income tax, you might not need to report life insurance proceeds at the state level, simplifying your tax return process.

Stay Informed and Seek Professional Advice:

Tax laws can be complex, and they often change over time. Therefore, it's crucial to stay updated on any modifications to state-specific insurance tax rules. Consider subscribing to official state tax authority newsletters or websites for the latest information. If you have a complex financial situation or are unsure about the tax implications, consulting a tax professional or accountant who specializes in state taxes is highly recommended. They can provide personalized guidance based on your specific circumstances.

By carefully considering state-specific insurance tax rules, you can ensure that your tax return is accurate and compliant. Remember, each state's tax laws are unique, so it's essential to tailor your approach accordingly. Staying informed and seeking professional advice when needed will help you navigate the complexities of state and local taxes related to life insurance.

William Penn Life Insurance: Is It Worth the Cost?

You may want to see also

Frequently asked questions

Yes, you should report life insurance on your tax return if you meet certain criteria. Generally, if you are the primary beneficiary of a life insurance policy and the policy has a cash value, you may need to include it in your taxable income.

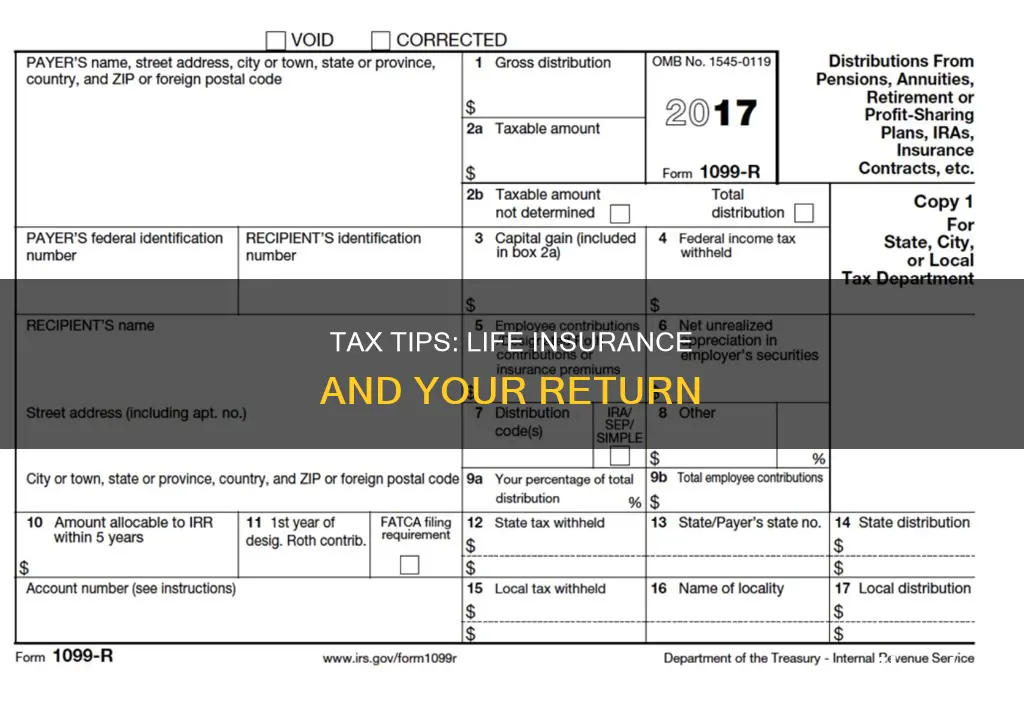

The specific form and section for reporting life insurance can vary depending on your country and tax jurisdiction. In the United States, for example, you would typically report it on Form 1099-R, which is a form used to report distributions from retirement plans, including life insurance proceeds.

Yes, there are exceptions. If you are the sole owner of the policy and the premiums are paid with after-tax dollars, you may not need to report the policy itself. However, any cash value or proceeds received may still be taxable.

As a beneficiary, you generally do not need to report the policy or its proceeds on your tax return. The owner of the policy is responsible for reporting any taxable events related to the policy.

In some cases, you may be able to deduct life insurance premiums as a medical expense deduction if the premiums exceed a certain percentage of your adjusted gross income. However, this is a complex area, and it's best to consult a tax professional for personalized advice.