When it comes to insurance, many drivers wonder if completing a driver awareness course is a requirement. This paragraph aims to shed light on this question, providing clarity on whether insurance companies mandate the declaration of such courses. Understanding the implications of these courses on insurance policies is essential for drivers, as it can impact their premiums and coverage. By exploring this topic, we can help drivers make informed decisions about their insurance and driving education.

| Characteristics | Values |

|---|---|

| Declaration Requirement | Some insurance companies may require you to declare participation in a driver awareness course, especially if it was completed recently or is relevant to your driving record. |

| Impact on Premiums | Completing a driver awareness course might lead to a reduction in insurance premiums for some drivers, as it demonstrates a commitment to safe driving practices. |

| Policy Terms | Check your insurance policy terms and conditions to understand the specific requirements and any potential benefits associated with driver awareness courses. |

| Course Recognition | Insurance providers often recognize courses from reputable organizations, ensuring that the course completion is taken into account during policy adjustments. |

| Timeframe | The declaration might be necessary within a certain timeframe after completing the course, typically within a few months to a year. |

| Discounts | Certain insurance companies offer discounts for completing driver awareness programs, which can be a significant factor in deciding whether to declare the course. |

| Legal Obligations | In some regions, completing a driver awareness course might be a legal requirement for certain driving violations or to avoid license suspension. |

| Course Duration | The duration of the course can vary, and insurance companies may consider the length and intensity of the program when assessing its impact on the driver's behavior. |

| Online vs. In-Person | Both online and in-person driver awareness courses may be accepted, but the declaration process might differ slightly between insurance providers. |

| Policy Adjustments | Insurance companies may adjust your policy after declaring the course, potentially improving your driving record and reducing future premiums. |

What You'll Learn

- Insurance Requirements: Check if your insurance provider mandates a declaration of driver awareness courses

- Policy Updates: Ensure your insurance policy reflects completed driver education

- Discounts: Some insurers offer discounts for driver awareness course completion

- Claims History: Course completion may impact insurance claims and coverage

- Legal Obligations: Understand legal requirements for driver education and insurance declarations

Insurance Requirements: Check if your insurance provider mandates a declaration of driver awareness courses

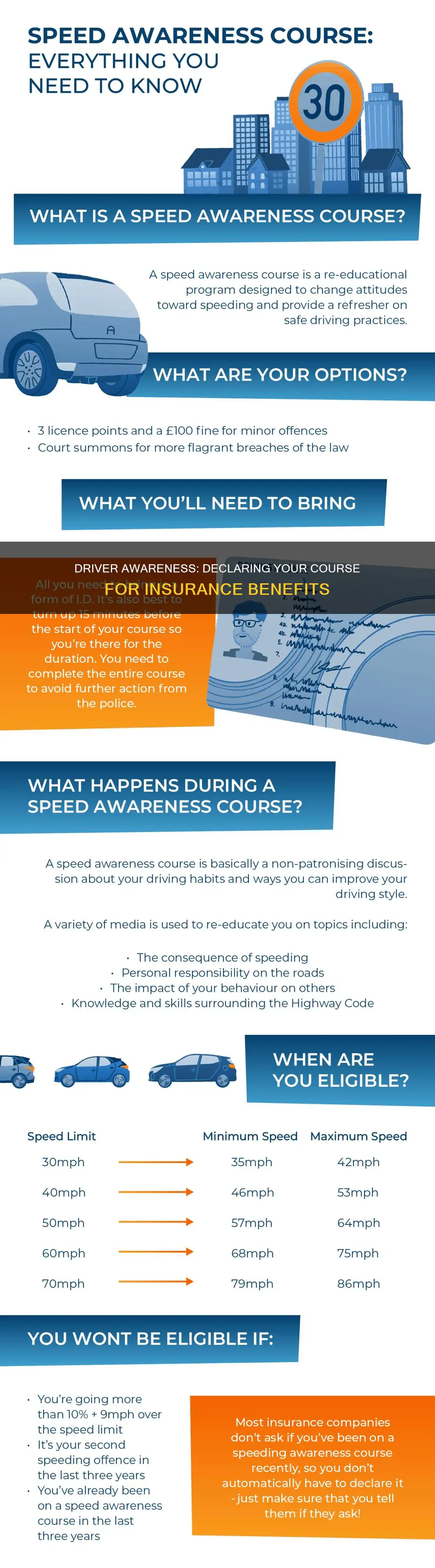

When it comes to insurance requirements, it's essential to understand the specific policies and regulations that may apply to your situation. One aspect that often comes up in discussions about driver awareness is whether or not you need to declare your participation in such courses to your insurance provider. This is a crucial consideration, as it can impact your insurance coverage and premiums.

Many insurance companies offer discounts or incentives for drivers who have completed driver awareness or defensive driving courses. These programs aim to improve road safety and often provide drivers with valuable skills and knowledge to handle various driving scenarios. However, the requirement to declare these courses to your insurance company can vary depending on the jurisdiction and the insurance provider.

To determine if your insurance provider mandates a declaration of driver awareness courses, it's advisable to review your insurance policy documents carefully. These documents should outline the specific requirements and guidelines for claiming any discounts or benefits associated with driver education. Some insurance companies may require you to provide proof of completion, such as a certificate or a record from the course provider, while others might simply ask for a declaration on your part.

If you are considering enrolling in a driver awareness course, it is wise to contact your insurance provider beforehand. Inquire about their specific policies regarding course declarations and any additional information they may require. This proactive approach ensures that you are aware of any potential changes to your insurance coverage and can plan accordingly.

In summary, while driver awareness courses can offer valuable benefits, the need to declare them to your insurance provider depends on the insurance company's policies. Always refer to your insurance documents and consult with your insurer to ensure compliance with their requirements, allowing you to take advantage of any available discounts or incentives.

Commercial Umbrella Insurance: Auto Liability Coverage Explained

You may want to see also

Policy Updates: Ensure your insurance policy reflects completed driver education

When it comes to insurance, staying up-to-date with policy details is crucial, especially after completing a driver education course. Many insurance companies offer discounts or incentives for drivers who have undergone specific training, such as driver awareness programs. These courses can significantly improve driving skills and road safety, and insurers often recognize the value of such initiatives.

If you've recently completed a driver awareness course, it's essential to inform your insurance provider to ensure your policy accurately reflects these changes. This process typically involves a few simple steps. First, contact your insurance company and provide them with the necessary details, including the course name, completion date, and any relevant certificates. They might require you to submit proof of completion, which could be in the form of a certificate or a letter from the course provider.

The insurance company will then review your policy to ensure it includes the appropriate adjustments. This might involve updating your driving record, which could lead to a reduction in your premium if you meet the eligibility criteria. It's important to note that the impact on your insurance rates can vary depending on the insurance provider and the specific terms of your policy. Some companies may offer discounts for defensive driving courses, while others might focus on courses related to specific driving skills or road safety initiatives.

In some cases, declaring these courses on your policy might also be a requirement for maintaining your insurance coverage. Insurance providers often have guidelines and regulations that they must follow, and these rules can vary by region and insurance company. Therefore, it's crucial to understand the specific policies of your insurance provider and ensure you comply with their requirements.

By proactively updating your insurance policy, you can ensure that you receive the correct benefits and discounts. This process also demonstrates your commitment to continuous learning and road safety, which are essential aspects of responsible driving. Remember, insurance companies often view these courses favorably, as they contribute to a safer driving environment for everyone.

Auto Insurance Deductibles: Is $1500 Too High a Price?

You may want to see also

Discounts: Some insurers offer discounts for driver awareness course completion

Many insurance companies recognize the value of driver education and offer incentives to policyholders who complete driver awareness courses. These discounts are designed to encourage safer driving habits and reduce the risk of accidents, ultimately benefiting both the insurer and the policyholder. When considering enrolling in a driver awareness program, it's essential to understand the potential financial benefits that can arise from completing such a course.

One of the primary advantages of these courses is the opportunity to receive a discount on your insurance premiums. Insurance providers often view individuals who have completed driver awareness programs as more responsible and safety-conscious drivers. As a result, they are more likely to offer reduced rates to policyholders who have demonstrated a commitment to improving their driving skills. This discount can be a significant financial incentive, especially for those looking to lower their insurance costs without compromising on coverage.

The amount of discount can vary depending on the insurance company and the specific course completed. Some insurers may offer a flat percentage reduction on the premium, while others might adjust the discount based on the course's content and the policyholder's driving record. For instance, a company might provide a 5% discount for completing a basic driver awareness course and an additional 10% for advanced courses focused on defensive driving techniques. It's crucial to review the terms and conditions of the insurance policy to understand the specific requirements and the potential savings.

To take advantage of these discounts, policyholders should actively inquire about them during the enrollment process or when reviewing their insurance policy. Insurance agents or brokers can provide valuable guidance on the available discounts and the necessary steps to qualify for them. Additionally, some insurers may require proof of completion, such as a certificate or a record of participation, to ensure that the discount is applied correctly.

In summary, completing a driver awareness course can lead to significant savings on insurance premiums. By taking advantage of these discounts, drivers can not only improve their skills but also reduce their financial burden. It is a win-win situation, as safer driving habits contribute to lower insurance costs and a reduced risk of accidents on the road.

Louisiana Auto Insurance: Rates, Reasons, and Solutions

You may want to see also

Claims History: Course completion may impact insurance claims and coverage

Completing a driver awareness course can have a significant impact on your insurance claims history and overall coverage. Insurance companies often view these courses as a proactive step towards improving driving skills and reducing the likelihood of accidents. When you declare your participation in such a course, it can lead to several potential outcomes that may affect your insurance experience.

Firstly, it demonstrates a commitment to safe driving practices. Insurance providers often consider individuals who have completed driver awareness programs as lower-risk drivers. This is because these courses typically cover various topics, including defensive driving techniques, hazard recognition, and safe road behavior, which can significantly enhance a driver's skills and awareness. As a result, insurers may offer more competitive rates or consider you for preferred customer programs, especially if you have a history of claims or accidents.

Secondly, declaring your course completion can help in the event of a claim. In the unfortunate occurrence of an accident, having completed a driver awareness program can be beneficial. Insurance adjusters may take into account your proactive approach to improving your driving skills, potentially leading to a more favorable settlement or a faster resolution process. This is particularly true if the course focused on accident prevention and mitigation strategies.

However, it's important to note that the impact on claims history is not guaranteed and depends on various factors. Insurance companies may have specific policies regarding course completion, and the extent of the impact can vary. Some insurers might require proof of course completion and may even offer discounts or incentives for policyholders who have recently completed such programs. Others might simply take it into consideration as part of their overall risk assessment.

In summary, declaring your driver awareness course completion can be a strategic move to potentially improve your insurance rates, enhance your claims experience, and showcase your commitment to safe driving. It is a proactive step that may pay off in the long run, especially if you have a history of claims or are looking to optimize your insurance coverage. Always review your insurance provider's policies and guidelines to understand how they specifically address driver education programs and their potential influence on your policy.

Auto Insurance Conversion: Understanding Coverage Changes

You may want to see also

Legal Obligations: Understand legal requirements for driver education and insurance declarations

The legal obligations surrounding driver education and insurance declarations can vary depending on your location and the specific insurance provider. It is crucial to understand these requirements to ensure compliance and avoid any potential legal consequences. When it comes to declaring a driver awareness course, the answer is not a simple yes or no; it depends on the circumstances and the insurance company's policies.

In many jurisdictions, driver education programs, including awareness courses, are designed to enhance road safety and reduce traffic-related incidents. These programs often aim to improve drivers' skills, knowledge, and awareness of road rules and safe driving practices. While participation in such courses is generally encouraged, it is essential to know if and how these courses must be declared to your insurance provider.

For instance, some insurance companies may require policyholders to notify them if they have completed a driver awareness course, especially if the course is relevant to improving driving skills or addressing specific issues. This declaration could be a formality to update the policyholder's driving record or to offer potential discounts on insurance premiums. However, other insurers may not have specific requirements regarding course completion, and the decision to declare it is often left to the policyholder's discretion.

It is advisable to review your insurance policy documents or contact your insurance provider directly to understand their specific requirements. Insurance companies typically have guidelines or FAQs on their websites that outline what information they need from policyholders. Being proactive and seeking this information can help you make informed decisions and ensure that you comply with any legal obligations related to driver education and insurance.

In summary, while driver awareness courses can be beneficial for all drivers, the legal obligation to declare them to your insurance provider varies. It is essential to be aware of your local regulations and insurance company policies to make the necessary declarations accurately and promptly. Staying informed and taking the necessary steps can contribute to a safer driving environment and potentially lead to more favorable insurance terms.

Get Auto Insurance Without a Driver's License: A Guide

You may want to see also

Frequently asked questions

Yes, it is generally recommended to inform your insurance provider about any driver education or training you have completed. This can sometimes lead to discounts or incentives, as it demonstrates a proactive approach to improving driving skills and safety.

The impact on your insurance rates can vary. Some insurance companies offer discounts for completing such courses, which can result in lower premiums. However, this is not a universal rule, and it's best to check with your insurance provider to understand their specific policies and any potential savings.

Typically, insurance companies may request a certificate of completion or a similar document to verify your participation in the Driver Awareness Course. This can often be provided by the course administrator or the organization that offered the training.

While some insurance companies may not directly offer discounts for the course, you can still highlight your commitment to driver education and safety. This information can be valuable during the insurance review process and may even lead to other benefits or personalized offers from the insurer.