Home insurance is not a legal requirement in Texas. However, if you have a mortgage, your lender will probably require you to have it. Even if you own your home outright, home insurance is a good idea as it can protect you from potentially huge out-of-pocket costs if you need to repair or rebuild due to damage from a burst pipe, fire, or other incidents.

| Characteristics | Values |

|---|---|

| Is home insurance required in Texas? | No, but if you still owe money on your home, your lender will require you to have it. |

| What does home insurance cover? | Financial protection if your home or property is damaged or destroyed by something your policy covers, like a fire or storm. |

| What are the types of home insurance coverages? | Dwelling coverage, personal property coverage, other structures coverage, additional living expenses coverage, personal liability coverage, and medical payments coverage. |

| What risks does a home policy cover? | Damages from sudden and accidental release of water or smoke, vandalism, aircraft and vehicles, windstorm, hurricane, and hail. |

| What risks does a home policy not cover? | Damages from a continuous water leak, termites, losses that occur if your house is vacant for a specified number of days, earthquakes or earth movement, and wind or hail damage to trees and shrubs. |

| What are the two types of home policies? | Replacement cost coverage and actual cash value coverage. |

| What is a deductible? | The amount of a claim that you must pay yourself. |

| What is the difference between a deductible and a dollar limit? | A deductible is what you must pay yourself, while a dollar limit is the maximum amount that a policy will pay out. |

| What is personal property coverage? | Coverage for your clothes, furniture, and other personal items if they are stolen, damaged, or destroyed. |

| What is the Texas FAIR Plan Association? | An organization that sells basic home insurance to those who cannot get coverage through regular insurance companies. |

| What is the Texas Windstorm Insurance Association? | An organization that sells wind and hail coverage for Texas coastal residents. |

What You'll Learn

- Home insurance isn't legally required in Texas, but mortgage lenders usually require it

- Home insurance covers fire, theft, smoke, wind, vandalism, and water damage

- Flood insurance is a separate policy and is required in designated flood zones

- Home insurance costs are impacted by factors like credit score, claims history, location, deductible, and home renovations

- Shop around for the best policy, comparing coverage, price quotes, and company records

Home insurance isn't legally required in Texas, but mortgage lenders usually require it

Home insurance is not a legal requirement in Texas. However, if you have a mortgage, your lender will probably require you to have home insurance. This is to protect your investment and give you peace of mind. Even if you don't have a mortgage, home insurance is a good idea as it can help shield you from potentially massive out-of-pocket costs if your home is damaged or destroyed.

A home insurance policy can cover you financially if your home or property is damaged or destroyed by something covered by your policy, like a fire or storm. Most home policies in Texas include six types of coverage:

- Dwelling coverage: Pays if your house is damaged or destroyed by something covered by your policy.

- Personal property coverage: Pays if your furniture, clothing, or other belongings are stolen, damaged, or destroyed.

- Other structures coverage: Pays to repair structures on your property that aren't attached to your house, like detached garages, storage sheds, and fences.

- Additional living expenses coverage: Pays for things like rent and food if you have to move while your house is being repaired due to covered damages.

- Personal liability coverage: Pays medical bills, lost wages, and other costs for people you're legally responsible for injuring, or if you're responsible for damaging someone else's property. It also covers your court costs if you're sued because of an accident.

- Medical payments coverage: Pays the medical bills of people hurt on your property, including some injuries that happen away from your home, like a dog bite in the park.

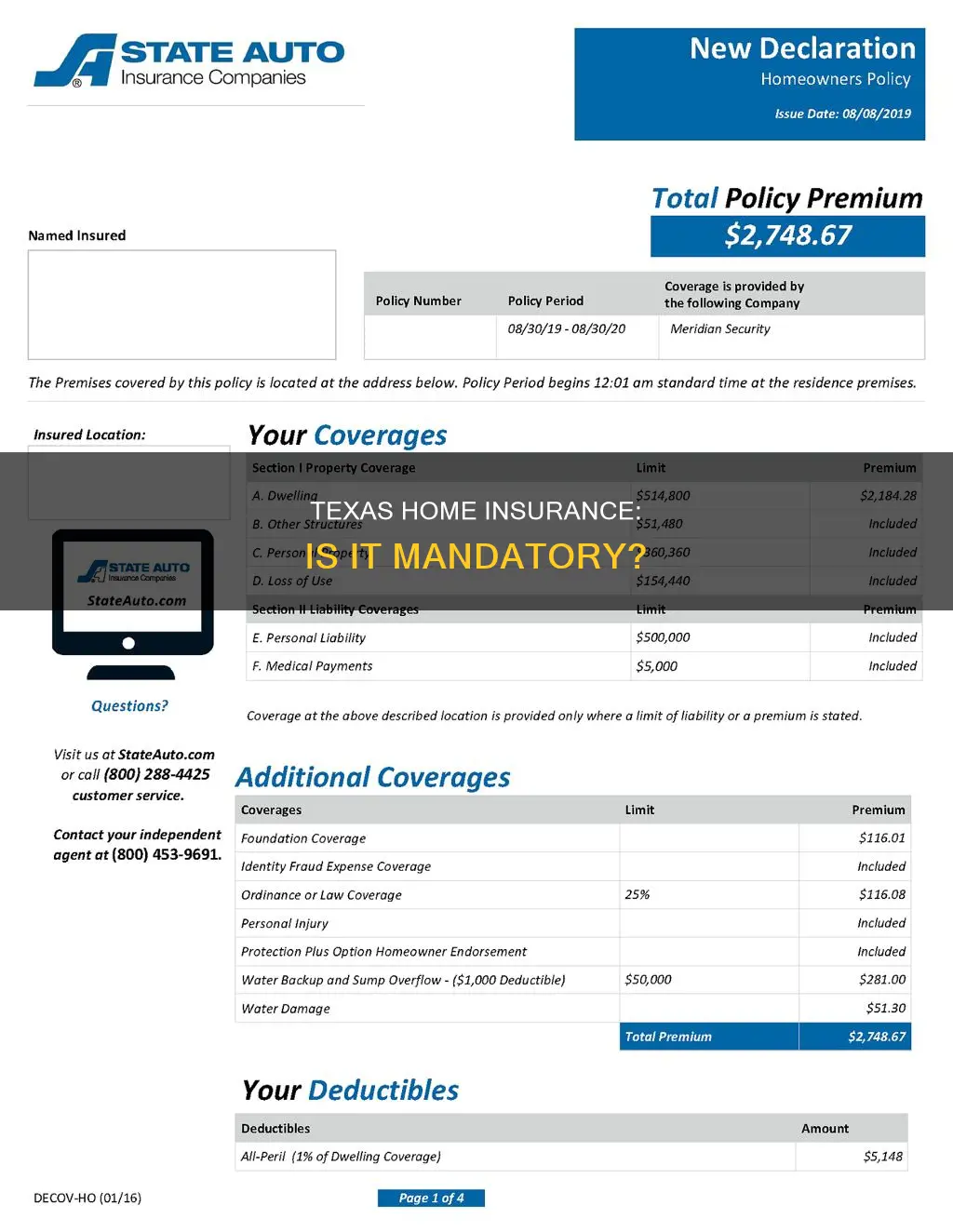

When shopping for home insurance in Texas, you can choose between a replacement cost policy and an actual cash value policy. A replacement cost policy will pay to repair or rebuild your home based on current construction costs. An actual cash value policy will pay to repair or rebuild your home minus depreciation, so the payout will be lower.

Most mortgage companies will require a replacement cost policy. You can shop around for home insurance in Texas by using resources like TDI's HelpInsure website, which provides sample prices and allows you to compare policies. It's important to consider your coverage needs and any lender requirements when choosing a policy.

Home insurance covers fire, theft, smoke, wind, vandalism, and water damage

In Texas, there is no law requiring you to have home insurance. However, if you have a mortgage, your lender will likely mandate it. Even if it is not legally required, home insurance is a good idea as it helps protect your home and other assets. Home insurance covers losses and damage to an owner's residence, furnishings, and other possessions, and provides liability protection.

Home insurance typically covers a broad range of possible damages. Most policies cover damages from a sudden and accidental release of water or smoke, vandalism, malicious mischief, riot, civil commotion, aircraft and vehicle damage, windstorm, hurricane, and hail. It is important to note that if you live on the Gulf Coast, your policy may not cover wind and hail damage.

Additionally, home insurance covers the personal belongings within your home, including heating and cooling systems, kitchen appliances, furniture, clothing, and other possessions. If you have high-value items, such as jewelry or artwork, you may need to consider additional coverage.

Home insurance also provides coverage for detached outbuildings on your property, such as garages, barns, or sheds, as well as outdoor features like fences or walls. In the event that your home becomes unlivable due to covered damage, your insurance will also pay for your living expenses, including rent, food, and other costs, up to a certain limit.

Furthermore, home insurance offers personal liability protection, covering medical bills, lost wages, and other costs for people you are legally responsible for injuring. It also covers damages to someone else's property and court costs if you are sued due to an accident.

While home insurance provides comprehensive coverage, there are certain exclusions to be aware of. Most policies do not cover damages from continuous water leaks, termites or other pests, earthquakes or earth movement, and floods. For coverage against these perils, you may need to purchase additional policies or endorsements.

Cattle Conundrum: Unraveling Insurance Options for Farmers

You may want to see also

Flood insurance is a separate policy and is required in designated flood zones

While Texas law does not require you to have home insurance, it is still a good idea to have one to protect your home and other assets. If you still owe money on your home, your lender will require you to have home insurance. Home insurance policies in Texas typically include six types of coverage: dwelling, personal property, other structures, additional living expenses, personal liability, and medical payments coverage.

However, most home insurance policies do not cover flood damage. Flood insurance is a separate policy and is highly recommended for all Texans, even renters. Flooding is the most common natural disaster in the United States and can occur anywhere, including in designated flood zones and outside of them. Texas, in particular, is prone to floods, with almost every major city in the state located in an area at high risk of flooding.

If your home is in a designated flood zone, your lender will require you to purchase flood insurance. A flood zone is defined as an area with a 1% chance of flooding in any given year. You can determine if your property is located in a flood zone by looking up its address on the FEMA website.

Flood insurance policies typically cover up to $250,000 for your home and $100,000 for your personal belongings. It is important to note that most flood policies have a 30-day waiting period before they take effect, so it is advisable to purchase coverage well in advance of any potential storms or floods.

The Ever-Present Pitchman: Unraveling the Ageless Wonder of the Farmers Insurance Spokesperson

You may want to see also

Home insurance costs are impacted by factors like credit score, claims history, location, deductible, and home renovations

Home insurance costs are influenced by a variety of factors, some of which are within the homeowner's control, while others are not. Here are some of the key factors that impact the cost of home insurance:

Credit Score

In most states, insurance companies are allowed to use an individual's credit-based insurance score when determining their home insurance rates. A higher credit score is associated with lower risk and can lead to lower insurance premiums. Homeowners with poor credit may face higher insurance rates, as insurers consider them more likely to file claims. Improving one's credit score can be a way to reduce home insurance costs.

Claims History

Insurance companies often take into account previous claims filed by the homeowner, even if they were at a different property. A history of filing insurance claims, regardless of their size, can indicate an increased risk of future claims. As a result, insurance companies may charge higher premiums to homeowners with a history of claims. Being selective about the claims filed can help keep insurance costs lower.

Location

The location of a home is a significant factor in determining insurance costs. If a home is located in an area with a history of losses, such as vandalism, theft, or weather-related events, insurance rates are likely to be higher. On the other hand, living close to a fire station or in an area with lower crime rates can positively impact insurance premiums. Additionally, the replacement cost of a home can vary depending on the region, as construction costs, including labor and materials, differ across locations.

Deductible

The deductible is the amount a homeowner must pay out of pocket before their insurance coverage kicks in. Agreeing to a higher deductible can lead to lower insurance premiums. However, this approach should be considered carefully, as it means the homeowner will need to cover a larger portion of the cost in the event of a claim. It's important to assess one's budget and financial constraints when deciding on the deductible amount.

Home Renovations

Upgrades and renovations to a home can impact insurance costs. For example, improving the electrical system or making renovations that enhance the safety of the home may result in lower insurance premiums. On the other hand, finishing a basement or adding features such as a swimming pool can increase the replacement cost value of the home, leading to higher insurance costs. Keeping the insurance company informed about any renovations is essential to avoid issues when filing claims.

Farmers' Malpractice Insurance: Overcoming the Challenges of Agricultural Risks

You may want to see also

Shop around for the best policy, comparing coverage, price quotes, and company records

Shopping for insurance is similar to shopping for any other major item. It is always a good idea to shop around and compare different policies to find the one that best meets your needs and budget. Here are some tips to help you shop for the best home insurance policy in Texas:

- Choose your coverage: There are different types of home insurance policies available. Most mortgage companies will require that you have a replacement cost policy, which will pay to repair or rebuild your home based on current construction costs. There are also actual cash value policies that pay to repair or rebuild your home minus depreciation.

- Pick a coverage amount: Ensure that you have enough coverage to replace your house if it is destroyed. Your agent can help you determine the cost to rebuild your home. You should also make sure you have enough coverage for your personal property.

- Get several price quotes: Use resources like TDI's HelpInsure to get sample prices and compare policies. Once you have narrowed down your options, contact your top choices to get price quotes.

- Look at a company's record: Assess a company's customer service by looking at its complaint record. You can also check a company's financial rating through resources like HelpInsure.com.

- Consider the deductible: The deductible is the amount you have to pay before the insurance company will pay. A higher deductible will result in a lower premium. If a policy has a deductible that is a percentage, make sure you understand how that translates to a dollar amount.

- Check for discounts: Most companies offer discounts if you reduce the chances of a loss. Common discounts include having an alarm system, fire alarms or a sprinkler system, having multiple policies with the same company, and being claim-free for a certain number of years.

- Look at other coverages: Depending on where you live and what you are insuring, you might need additional coverage. For example, if you live in a flood zone or an area prone to windstorms and hail, you will need separate flood insurance or windstorm and hail insurance. You may also want extra coverage for valuable items like jewelry, fine arts, or electronics.

By following these steps and comparing coverage, price quotes, and company records, you can make an informed decision when shopping for the best home insurance policy in Texas.

Farmers and Boat Insurance: Navigating Coverage Options

You may want to see also

Frequently asked questions

Is home insurance mandatory in Texas?

What is the purpose of home insurance?

What are some common types of home insurance coverage?