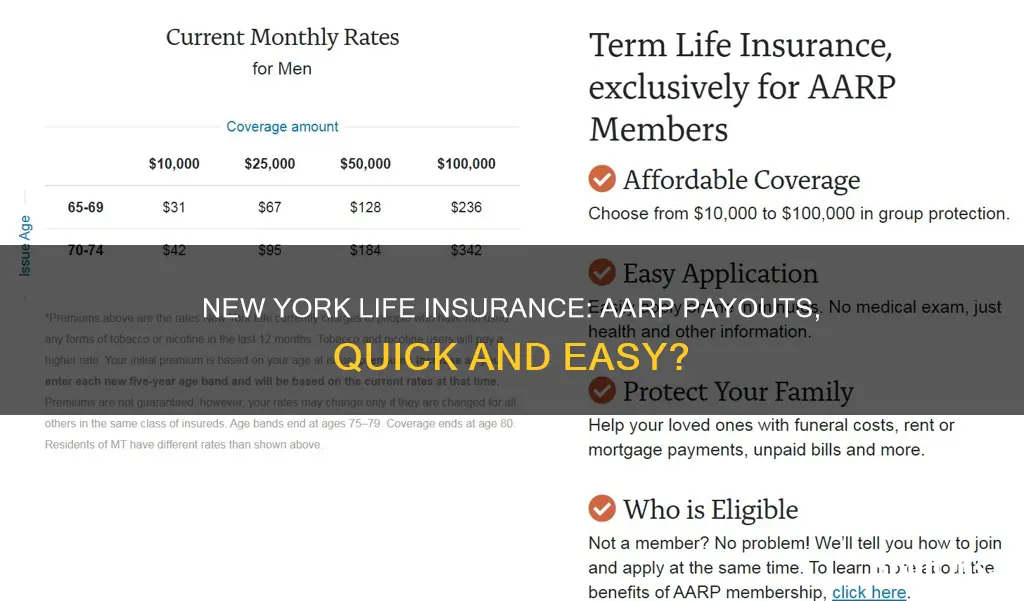

AARP offers term and permanent life insurance coverage options underwritten by the New York Life Insurance Company. AARP members can apply for up to $50,000 in permanent life insurance coverage or up to $150,000 in term life insurance coverage. Both options require no medical exam, just health and other information. Permanent life insurance rates are locked in for the duration of the policy and never increase, while term life insurance rates increase every five years. AARP life insurance includes an accelerated death benefit, allowing the insured to access half of their benefit amount if they are diagnosed with a terminal illness and given a life expectancy of 24 months or less.

| Characteristics | Values |

|---|---|

| Maximum Coverage | $150,000 |

| Medical Exam Required | No |

| Maximum Age for Coverage | 80 years |

| Application Process | Online or by phone |

| Provider | New York Life |

| Payment Methods | One-time payment, AutoPay |

| Website | nylaarp.com |

What You'll Learn

- AARP Term Life Insurance from New York Life offers coverage up to $150,000 until age 80

- AARP Permanent Life Insurance from New York Life offers lifelong coverage up to $50,000 with no premium increases

- AARP Guaranteed Acceptance Life Insurance from New York Life offers coverage up to $30,000 with no premium increases and no medical exam

- AARP Life Insurance Options from New York Life offers customized plans to supplement retirement savings

- AARP Life Insurance from New York Life payments can be made via the nylaarp.com website

AARP Term Life Insurance from New York Life offers coverage up to $150,000 until age 80

AARP Term Life Insurance from New York Life offers coverage of up to $150,000 until the age of 80. This plan is available to AARP members aged 50-74 and their spouses/partners aged 45-74. The plan is underwritten by the New York Life Insurance Company, which has been in business for over 175 years and is licensed in all 50 states.

The AARP Term Life Insurance plan offers a range of benefits, including funeral costs, rent or mortgage payments, and unpaid bills. The application process is straightforward, with approval by email taking just minutes in some cases. There is no medical exam required, but acceptance is based on health information and other details provided by the applicant.

The monthly rate for this plan will vary depending on factors such as age, gender, and smoking status. For example, a female, age 50, non-smoker can expect to pay $11/month for $10,000 of coverage. This rate also applies to a 50-year-old female smoker.

In addition to the Term Life Insurance plan, AARP also offers Permanent Life Insurance and Guaranteed Acceptance Life Insurance through New York Life. The Permanent Life Insurance plan provides up to $50,000 in coverage with no premium increases, while the Guaranteed Acceptance Life Insurance plan offers up to $30,000 in coverage with no medical exam or health questions.

Colonial Life Insurance: AM Best Report Analysis

You may want to see also

AARP Permanent Life Insurance from New York Life offers lifelong coverage up to $50,000 with no premium increases

AARP Permanent Life Insurance from New York Life is a valuable whole life insurance offering that provides lifelong coverage of up to $50,000. This plan is specifically designed for AARP members, offering them comprehensive protection and peace of mind.

One of the key advantages of this policy is the guaranteed rate stability. Policyholders can rest assured that their premiums will remain unchanged throughout their lives, providing financial predictability and ease of planning. This permanent life insurance option ensures that members can maintain their coverage indefinitely, without worrying about unexpected premium hikes.

The application process for AARP Permanent Life Insurance is straightforward and convenient. AARP members can apply online or by phone, and there is no requirement for a medical exam. New York Life simply asks for health and other relevant information to determine eligibility. This simplified application process makes it accessible to individuals who may have difficulty undergoing a medical examination.

The coverage amount of up to $50,000 can be a significant financial safety net for loved ones, helping them cover funeral costs, rent or mortgage payments, unpaid bills, and other expenses. This insurance plan ensures that your loved ones will have the financial support they need during a difficult time.

AARP's collaboration with New York Life, a trusted name in the insurance industry, adds to the appeal of this permanent life insurance offering. With their highest ratings for financial strength from leading independent rating services, New York Life provides assurance and confidence to policyholders.

Life Insurance for Soldier's Spouse: Who Qualifies?

You may want to see also

AARP Guaranteed Acceptance Life Insurance from New York Life offers coverage up to $30,000 with no premium increases and no medical exam

AARP Guaranteed Acceptance Life Insurance from New York Life is a permanent group insurance plan that offers coverage of up to $30,000 for your entire life. This plan is unique in that it guarantees acceptance for AARP members aged 50-85 (50-75 in New York) and their spouses/partners aged 45-85 (45-75 in New York). There are no premium increases, meaning your rates will remain the same for the duration of the policy, and no medical exam is required.

The plan provides peace of mind for you and your loved ones, helping to cover funeral costs, rent or mortgage payments, unpaid bills, and more. With no health questions asked, this policy is ideal for those who may have pre-existing conditions or who do not wish to undergo a medical examination.

AARP's Guaranteed Acceptance Life Insurance stands out for its simplicity and accessibility. The application process is straightforward, allowing you to apply online in minutes. The policy also offers flexibility, as you can choose coverage amounts that best suit your needs, with rates that are now 21% lower on average.

This insurance plan is underwritten by the New York Life Insurance Company, a trusted name in the industry for over 175 years. The company boasts the highest ratings for financial strength from leading independent rating services like A.M. Best, Fitch, and Moody's Investors Service.

In conclusion, AARP Guaranteed Acceptance Life Insurance from New York Life offers a valuable combination of guaranteed coverage, rate stability, and ease of application for AARP members seeking life insurance. With no medical exam required and coverage of up to $30,000, it provides a convenient way to help secure your family's financial future.

Life Insurance: Signing Up and Getting Covered

You may want to see also

AARP Life Insurance Options from New York Life offers customized plans to supplement retirement savings

AARP Life Insurance Options from New York Life offers customized plans to supplement your retirement savings. These plans are designed to help you protect your family and ensure your financial security during retirement.

With AARP Life Insurance Options, you can access a range of insurance solutions tailored to your needs. Specially trained New York Life agents are available to help you evaluate your unique situation and explore insurance solutions. This service is available to both AARP members and non-members.

The AARP Life Insurance Program is underwritten by New York Life Insurance Company and is available to those who meet the Program eligibility requirements. The specific products, features, and gifts offered may vary depending on your state or country of residence.

AARP Life Insurance Options from New York Life provides flexible options to meet your retirement goals. By creating a customized plan, you can rest assured that your financial needs will be taken care of, allowing you to focus on enjoying your retirement years.

To learn more about AARP Life Insurance Options from New York Life, you can visit the New York Life website or contact them by phone. Their trusted providers will be able to provide you with detailed information and guidance on finding the perfect plan for your retirement savings.

COVID Antibody Test: Impact on Life Insurance Policies

You may want to see also

AARP Life Insurance from New York Life payments can be made via the nylaarp.com website

AARP Life Insurance from New York Life is the only life insurance program developed exclusively for AARP members. It offers valuable coverage with both term and permanent group coverage options. The program provides up to $150,000 in protection that can last up to age 80 with lower initial rates that increase over time. There is also an option for permanent life insurance with whole life protection of up to $50,000 with rates that never increase.

Payments for AARP Life Insurance from New York Life can be made via the nylaarp.com website. It is important to note that other sites like Doxo that may appear in Google search results are not connected to AARP Life Insurance. Using such sites could result in extra fees and delays in payment. Therefore, it is recommended to use only the official nylaarp.com website for making payments.

Creating an account on the nylaarp.com website offers additional benefits, such as the ability to edit personal information, update beneficiaries, and access important forms. To set up an account, users will need to provide their personal details to connect their contract. This allows for easy management of their insurance policy and ensures a smooth payment process.

The AARP Life Insurance Program from New York Life is a trusted choice for AARP members, providing flexible coverage options and a convenient payment process through the nylaarp.com website. By utilizing the official website, members can avoid potential issues associated with unofficial third-party sites and maintain control over their insurance payments.

Life Insurance and Self-Directed 401(k)s: What You Need to Know

You may want to see also

Frequently asked questions

You can get up to $150,000 of coverage to help with funeral costs, rent or mortgage payments, unpaid bills, and more.

Yes, the coverage ends at age 80.

No, you don't need to undergo a medical exam. Acceptance is based on your health and other information.

You can pay for your AARP Life Insurance from New York Life by using the nylaarp.com website.

You can get started with an online quote. Depending on your state, you can then apply online or request information to apply by mail.