Life insurance and auto insurance are two distinct types of insurance that cover different risks. While life insurance provides financial support to the policyholder's family or beneficiaries in the event of their death, auto insurance covers vehicle damage, accidents, and theft. Auto insurance typically includes liability coverage for damages to others and their property, as well as collision and comprehensive coverage for the policyholder's vehicle. It is essential to understand the differences between these insurance types to ensure adequate protection for different risks.

What You'll Learn

Credit life insurance

However, it's important to note that credit life insurance primarily benefits the lender, not your heirs. The payout from a credit life insurance policy goes directly to the lender, not to your beneficiaries. Additionally, credit life insurance policies tend to be more expensive than traditional life insurance policies. This is because there is a greater risk associated with the product, which makes the premiums higher.

Before purchasing credit life insurance, it is recommended to consider the costs and explore alternatives such as term life insurance, which typically offers similar protection at a lower price. Term life insurance allows you to choose a beneficiary, who can use the payout for any purpose, not just paying off the loan. Additionally, the death benefit of a term life insurance policy stays the same throughout the length of the policy, whereas the death benefit of a credit life insurance policy decreases as the policyholder's debt decreases.

Florida: Selling Auto Insurance with a 440 License

You may want to see also

Auto insurance liability coverage

Property damage liability coverage insures against damage caused to another person's property by your vehicle. This includes repairs to the other driver's vehicle, rental vehicle costs while their car is being repaired, and damage to buildings, fences, or other structures. It also covers damage to personal property, such as electronics or belongings inside the vehicle. Additionally, it provides protection against legal fees if you are sued for property damage and other related costs.

Bodily injury liability coverage, on the other hand, provides payment for injuries sustained by others in an accident. It can include legal fees if you are sued for causing injuries to another person. This type of coverage is crucial, as it helps protect your financial well-being in the event of a significant accident.

It is important to note that liability coverage does not cover damages to your own property or injuries you sustain in an accident. To protect yourself in these situations, you will need separate coverages such as collision coverage, comprehensive coverage, or personal injury protection.

The cost of liability insurance coverage depends on various factors, including the amount of coverage selected. Higher coverage limits may result in higher premiums. It is recommended to purchase more coverage than the state-required minimum to adequately protect yourself and your assets.

Insurance Glitch: Vehicle Registration Woes

You may want to see also

Life insurance beneficiaries

Auto insurance and life insurance are two different types of insurance, covering different risks. Auto insurance covers the policyholder's vehicle in case of accidents, theft, and other damage. On the other hand, life insurance pays out a sum of money upon the death of the policyholder, providing financial support to their family or beneficiaries.

The process of choosing a life insurance beneficiary is a personal decision, and policyholders can select one or multiple beneficiaries. Most commonly, beneficiaries are spouses, children, or other family members. However, beneficiaries can also be charitable organizations, legal entities, or business colleagues.

It is important to carefully consider who to name as a beneficiary, as this decision has financial and legal implications. The primary beneficiary is the first in line to receive the death benefit, and you can name more than one primary beneficiary. In the event that the primary beneficiary is unavailable or passes away before the policyholder, a contingent beneficiary will be designated to receive the payout.

Life insurance plays a crucial role in helping beneficiaries cover expenses, maintain their lifestyle, and achieve financial goals after the loss of a loved one. By selecting the appropriate beneficiaries, policyholders can ensure that their death benefit is distributed according to their wishes and provides financial protection for their loved ones.

Michigan Auto Insurance: Understanding the Requirements

You may want to see also

Auto insurance collision coverage

Auto insurance and life insurance are two different types of insurance, covering different types of risks. Auto insurance covers the policyholder's vehicle in case of accidents, theft, and other damage. It typically includes liability coverage, which covers damages to other people and their property if the policyholder is at fault in an accident. It also includes collision and comprehensive coverage, which cover damages to the policyholder's own vehicle.

Collision coverage pays to repair or replace your vehicle after an accident. This includes accidents involving another vehicle, collisions with objects such as a tree or telephone pole, or if you roll your car. It also covers damage caused by road hazards such as potholes. Collision coverage is not required by state law, but it may be required in certain instances, such as if you are leasing or financing your vehicle.

The cost of collision coverage varies depending on personal details such as age, gender, marital status, and driving record, as well as details about the vehicle and location. Collision coverage is usually sold with a separate deductible, which is the amount you will need to pay each time you file a claim. A higher deductible can lower your monthly premium, but it also means you will pay more out of pocket when an accident occurs.

While collision coverage can provide financial protection in the event of an accident, it is important to note that it does not cover damage to another vehicle, medical expenses, theft or vandalism, or damage caused by weather events. For coverage against these perils, comprehensive coverage is recommended in addition to collision coverage.

Auto Insurance: Adding Additional Drivers

You may want to see also

Auto insurance medical coverage

Auto insurance and life insurance are two different types of insurance that cover different risks. Auto insurance covers the policyholder's vehicle in the event of accidents, theft, or other damage, while life insurance pays out a sum of money upon the death of the policyholder, providing financial support to their family or beneficiaries. While auto insurance does not typically include life insurance coverage, it can include medical coverage for injuries sustained in a car accident.

Medical payments coverage, also known as MedPay, is an additional coverage option for auto insurance policies in most US states. MedPay helps pay for medical expenses resulting from a car accident, including hospital visits, surgeries, ambulance fees, and health insurance deductibles. It covers the driver, their family members, and passengers in the car at the time of the accident, and can even protect them as pedestrians. Importantly, MedPay does not cover lost wages due to missed work as a result of injuries.

Personal injury protection (PIP) is another form of medical coverage that is available in some US states. PIP is similar to MedPay in that it covers medical expenses, but it also includes lost wages and the cost of replacing services normally performed by someone injured in an accident. PIP is mandatory in some states with no-fault insurance laws, where every driver must file a claim with their own insurance company after a collision, regardless of who is at fault.

While auto insurance liability coverage may cover the other driver's bodily injuries if you are at fault in an accident, it typically does not cover medical expenses for you or your passengers. Therefore, adding medical payments coverage to your auto insurance policy can provide financial protection in the event of injuries resulting from a car accident.

Lienholder Rights: Auto Insurance Claims in Connecticut

You may want to see also

Frequently asked questions

No, auto insurance and life insurance are two different types of insurance. Auto insurance covers the policyholder's vehicle in case of accidents, theft, and other damage, while life insurance pays out a sum of money upon the death of the policyholder to provide financial support to their family or beneficiaries.

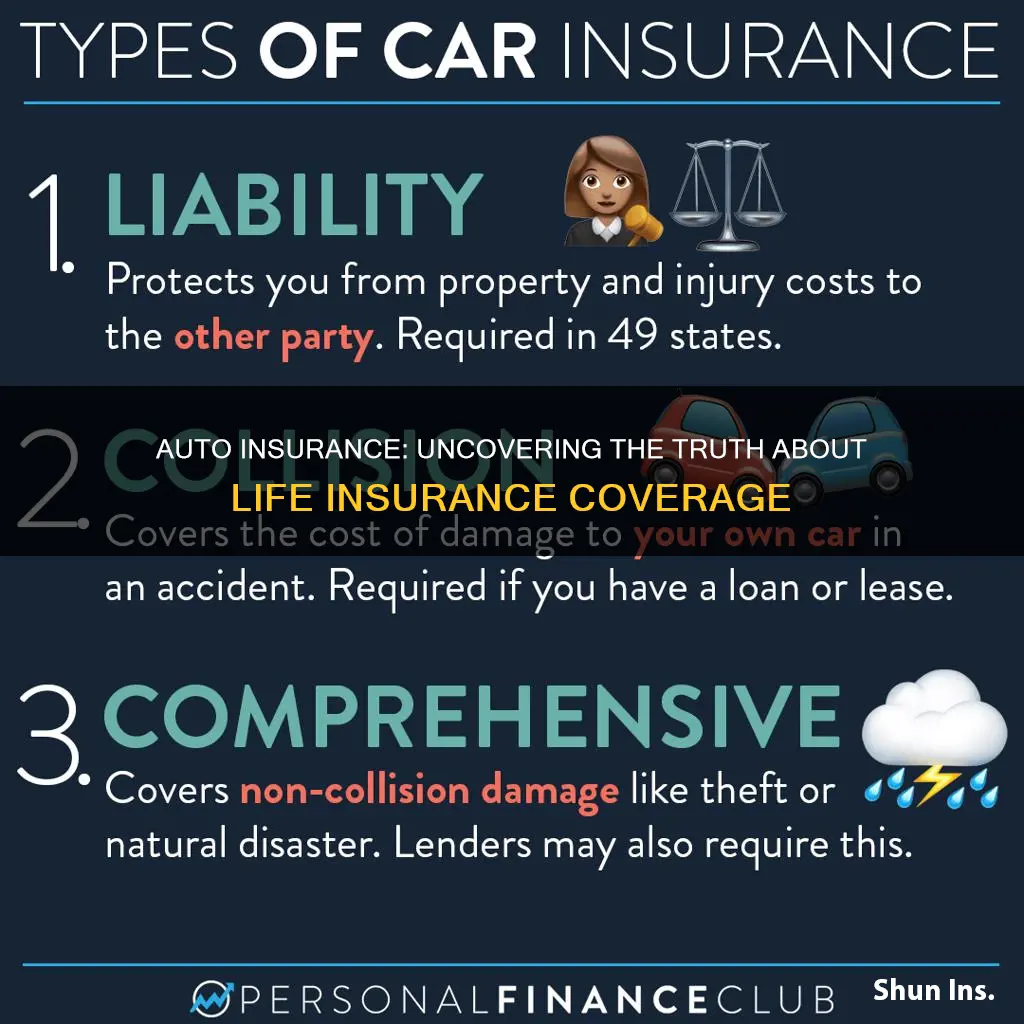

Auto insurance typically includes liability coverage, which covers damages to other people and property if the policyholder is at fault in an accident, as well as collision and comprehensive coverage, which cover damages to the policyholder's own vehicle.

The six types of auto insurance coverage are bodily injury liability, personal injury protection, property damage liability, collision, comprehensive, and uninsured/underinsured motorist.

Life insurance is a type of insurance that provides financial protection for the policyholder's family or beneficiaries in the event of their death. It comes in different types, such as term life insurance, whole life insurance, and universal life insurance, each with varying premiums and coverage.

Yes, some insurance companies offer both auto insurance and life insurance. It is recommended to compare quotes and policies from different companies to find the best coverage for your needs.