Does Auto Insurance Increase When You Turn 65?

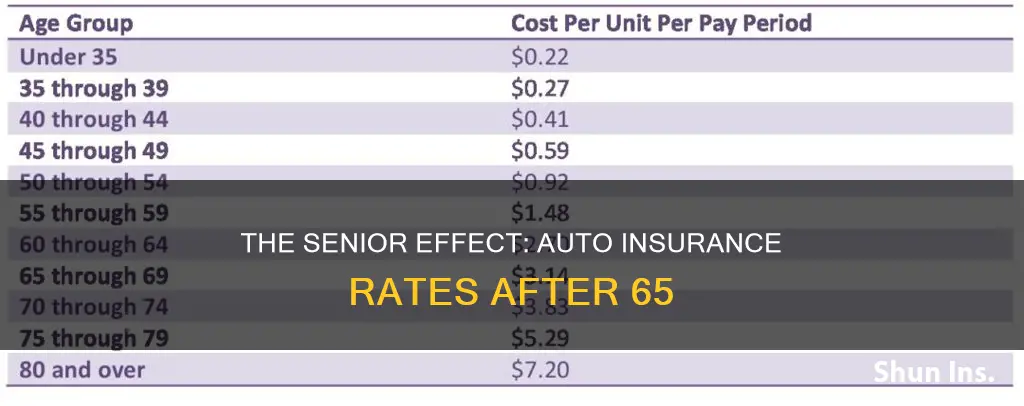

Auto insurance rates typically increase as people get older, and this is especially true once drivers reach their mid-60s. This is because insurance companies consider older drivers to be riskier to insure, as they are more likely to be involved in accidents and are more prone to injuries if a collision occurs. However, it's important to note that insurance rates for seniors can vary widely depending on various factors, and there are ways for older drivers to save on their premiums.

What You'll Learn

Auto insurance rates for seniors

The cost of car insurance for seniors varies depending on several factors, including age, driving record, location, and the insurance company. While some companies may offer lower rates to those between 50 and 65 years old, rates typically begin to increase from age 65 onwards. Seniors who are 70 or older may struggle to find an insurer as they are considered higher-risk due to a higher frequency of accidents.

Factors Affecting Auto Insurance Rates for Seniors

Several factors can influence the cost of auto insurance for seniors, including:

- Age: Insurance rates typically increase with age, especially after 65, as older drivers are considered higher-risk due to age-related changes in health and reflexes.

- Driving Record: A clean driving record can help seniors obtain lower insurance rates, while accidents, speeding tickets, or other violations can increase rates.

- Location: Insurance rates vary by state, with some states having higher average rates than others due to factors such as population density and accident claim statistics.

- Insurance Company: Different insurance companies offer varying rates and discounts for seniors, so it is essential to shop around and compare policies.

- Coverage Options: The type of coverage selected, such as state minimum, liability-only, or full coverage, will impact the cost of insurance. Seniors may also be eligible for additional coverage options, such as accident forgiveness or gap insurance.

- Vehicle Type: The make, model, safety features, and cost of the vehicle can affect insurance rates, as certain vehicles may be more expensive to insure due to repair costs or the risk of theft.

Ways to Save on Auto Insurance for Seniors

- Defensive Driving Courses: Many insurance companies offer discounts for seniors who complete state-approved defensive driving courses. These courses can help seniors improve their driving skills and potentially reduce their insurance rates.

- Compare Quotes: Shopping around and comparing quotes from multiple insurance companies can help seniors find the most competitive rates.

- Discounts: Seniors should inquire about available discounts, such as low-mileage discounts, multi-policy discounts, safe driver discounts, or discounts for specific memberships or affiliations.

- Bundling Policies: Combining home and auto insurance policies or bundling multiple vehicles under one policy can often result in significant savings.

- Increase Deductibles: Opting for a higher deductible can lower the overall cost of the insurance premium.

- Choose a Vehicle with Safety Features: Vehicles with advanced safety technology and collision avoidance systems may be eligible for discounts and can also enhance the safety of senior drivers.

Santander Loans: Gap Insurance Included?

You may want to see also

Why auto insurance increases for seniors

Auto insurance rates for seniors can increase due to a variety of factors. One of the main reasons is that insurance companies consider older drivers to be riskier to insure. This is because seniors are statistically more prone to accidents than younger drivers, due to age-related changes in hearing, vision, reflexes, and overall health. As a result, insurers charge higher premiums to offset the potential cost of claims.

Additionally, older individuals are more likely to suffer severe injuries and fatalities in car accidents, leading to larger claim payments and increased insurance rates. The increased cost of medical care and the higher likelihood of long-term care for seniors can also contribute to higher insurance rates.

The specific age at which auto insurance rates start to increase for seniors can vary. Some sources indicate that rates can begin to rise as early as 65, while others suggest that the most significant increases occur around the age of 75. However, it's important to note that the best car insurance for seniors will depend on various factors, including location, driving record, and individual circumstances.

To mitigate the impact of increasing auto insurance rates, seniors can take advantage of various discounts offered by insurance companies. These include mature driver discounts for completing state-approved driving courses, low mileage discounts, good driver discounts, and discounts for safety features in their vehicles. Shopping around and comparing rates from multiple insurance providers can also help seniors find the most cost-effective coverage.

Audi Connect: Insurance Tracking System?

You may want to see also

How to save on auto insurance for seniors

Auto insurance rates for seniors vary depending on factors such as age, driving record, address, vehicle make and model, credit report, and coverage limits. While rates typically increase for seniors over 65, there are several ways to save on auto insurance.

Take a defensive driving course

Many insurance companies offer discounts for seniors who take a defensive driving course. These courses help to refresh driving skills, update knowledge of traffic laws, and promote safe driving practices. AARP, AAA, and The National Safety Council (NSC) are among the organizations that provide these courses. Taking a defensive driving course can result in a discount of 5% to 15% on car insurance premiums.

Keep a safe driving record

Maintaining a safe driving record is crucial for keeping insurance costs down. Insurance companies often reward drivers for having an accident-free history. For example, Geico offers a 22% discount on most coverages if you have been accident-free for five years.

Maintain vehicle safety

Equipping your vehicle with safety features can qualify you for additional discounts. This includes airbags, anti-lock brakes, anti-theft systems, and anti-collision technology. For instance, State Farm offers discounts on 1994 and newer-model-year private-passenger vehicles with safety equipment.

Bundle insurance policies

Bundling your auto insurance with other types of insurance, such as home or renters insurance, can result in significant savings. Most insurance providers offer multi-policy discounts, which can help reduce your overall insurance costs.

Shop around and compare rates

Insurance rates can vary widely between companies, so it is essential to shop around and compare rates from multiple providers. Getting quotes from different insurers and comparing their coverage options and discounts can help you find the best deal.

Increase your deductible

Raising your deductible will lower your insurance premium. Just make sure that you can comfortably cover the higher out-of-pocket expense in the event of an accident.

Choose a vehicle with good safety ratings

Vehicles with advanced safety features may qualify for lower insurance rates. Additionally, these safety features can also help keep you safer on the road.

Consider usage-based insurance

Usage-based insurance policies charge by the mile rather than a flat rate. If you are a low-mileage driver, this type of policy can result in significant savings.

Ask about senior discounts

Some insurance companies offer mature driver discounts for seniors with clean driving records. It is worth inquiring about any age-based discounts that may be available to you.

Review your coverage

If you have an older car, you may consider dropping full coverage or adjusting your deductible to lower your premium. Additionally, you can explore removing someone from your policy if they no longer drive.

Choose the right insurance provider

Different insurance providers offer varying rates and discounts for seniors. It is essential to compare rates and discounts from multiple companies to find the best option for your needs.

While auto insurance rates may increase for seniors, implementing these strategies can help mitigate the costs and ensure affordable coverage.

Vehicle Finance Insurance: What You Need to Know

You may want to see also

Best auto insurance companies for seniors

While car insurance rates typically increase for seniors, there are still some great options for auto insurance companies that offer competitive rates and benefits for older drivers.

Geico

Geico is a great option for seniors, as it has some of the cheapest rates for senior drivers and has a strong reputation among customers and industry professionals. It earns high marks for its variety of coverage options, ease of use, and multitude of discounts. Geico also offers specific car insurance for senior drivers through its Prime Time program, available to certain drivers over the age of 50.

USAA

USAA offers the most affordable full-coverage insurance for military-affiliated seniors, with an average rate of $1,158 per year or $97 per month. It also has a robust selection of insurance products and consistently performs well in insurance studies. However, USAA is only available for retired veterans, active-duty military members, and their families.

State Farm

State Farm is a good option for seniors, especially those who prefer to do business in person, as it has a large network of local agents. It also offers a large number of car insurance discounts, including for safe driving and accident-free records. State Farm scored highest for ease of use, with an easy-to-use website and highly-rated mobile apps.

The Hartford

The Hartford has an auto insurance program designed specifically for AARP members, with discounts and coverage options tailored to drivers aged 50 and over.

Nationwide

Nationwide is a good choice for seniors looking for usage-based insurance, with its SmartMiles program offering up to 40% lower rates for those who drive less.

Other Options

Other auto insurance companies that offer good rates and benefits for seniors include Esurance, AAA, Travelers, Mercury, and Allstate.

It's important to note that insurance rates are personalized, and the best option for you will depend on factors such as your age, driving record, address, and the make and model of your car. It's always a good idea to compare quotes from multiple providers to find the best rate and benefits for your specific needs.

Auto Insurance: Understanding Windshield Repair Coverage

You may want to see also

How to choose the best auto insurance for seniors

When it comes to choosing the best auto insurance for seniors, there are several factors to consider. Here are some instructive guidelines to help you make an informed decision:

- Compare quotes from multiple providers: It is advisable to get quotes from at least three different insurance companies to find the most suitable coverage at a competitive rate. Shopping around allows you to leverage your options and make an informed decision.

- Consider your specific needs and circumstances: The best auto insurance for seniors will vary depending on individual factors such as age, driving record, location, and vehicle type, among others. Evaluate your unique requirements and choose a plan that aligns with your circumstances.

- Look for senior-specific discounts: Many insurance companies offer discounts tailored specifically for senior citizens. These may include mature driver discounts for those over a certain age, as well as discounts for completing defensive driving or accident prevention courses. Ask about these discounts and determine if you are eligible for any of them.

- Inquire about usage-based insurance: If you are a senior citizen who drives less frequently or has low mileage, consider usage-based insurance programs. These policies calculate premiums based on your actual driving habits, and you may be rewarded with lower rates if you drive safely and sparingly.

- Bundle your policies: Combining your auto insurance with other types of insurance, such as homeowners or renters insurance, can often lead to significant discounts. Ask your insurance provider about bundling options and the potential savings you could achieve.

- Maintain a safe driving record: Keeping your driving record free of accidents, tickets, and violations is one of the most effective ways to offset premium increases due to age. Insurance companies reward safe drivers, so a clean record can help you secure more affordable coverage.

- Review customer service and claims processing: When choosing an insurance provider, consider their customer service reputation and claims processing efficiency. Opt for companies with high marks for customer satisfaction and a seamless claims process, as this will make your overall experience more positive.

- Evaluate additional coverage options: Consider the add-on coverage options offered by different insurance providers. Features like accident forgiveness, new car replacement, gap insurance, and diminishing deductibles can provide valuable financial protection in the event of an accident.

- Seek recommendations and referrals: Ask fellow seniors or consult with organizations like AARP for recommendations and feedback on their experiences with specific insurance providers. Word-of-mouth referrals can provide valuable insights into the quality of service, responsiveness, and overall customer satisfaction.

- Compare rates regularly: Even after selecting an insurance provider, it is beneficial to periodically compare rates from other companies. Insurance rates fluctuate, and by reviewing the market periodically, you may uncover more cost-effective options or negotiate better terms with your current provider.

Remember, the best auto insurance for seniors will depend on your unique circumstances and requirements. Taking the time to research, compare, and ask questions will help you make a well-informed decision that provides the coverage you need at a price that fits your budget.

Transamerica Gap Insurance: Protection Explained

You may want to see also

Frequently asked questions

Yes, auto insurance rates tend to increase when drivers reach 65 years of age. This is due to an increased risk of accidents, injuries, and subsequent claims as people age.

In addition to age, factors such as gender, driving record, credit history, vehicle type, and annual mileage can impact auto insurance rates for seniors.

Yes, many insurance companies offer discounts for seniors. These include defensive driving course discounts, low mileage discounts, multi-policy discounts, and safe driver discounts, among others.

Seniors can save money by shopping around for the best rates, comparing policies, and taking advantage of available discounts. Bundling home and auto insurance, choosing a vehicle with safety features, and increasing deductibles can also help lower premiums.

The average cost of auto insurance for seniors varies depending on age, driving record, and other factors. For a 65-year-old driver, the average cost is around $1,740 per year, while for a 75-year-old, it increases to $2,008 per year.