Auto-Owners Insurance offers a range of insurance products, including homeowners insurance. The company provides local, personalized expertise through independent agents and has an A++ rating from AM Best for its financial stability. Auto-Owners Insurance is available in several states, including Florida, and offers competitive rates with various discounts.

| Characteristics | Values |

|---|---|

| Does Auto-Owners sell homeowners insurance in Florida? | Yes |

| What does the homeowners insurance cover? | Dwelling and personal property, personal liability protection, additional living expenses, homeowners plus, guaranteed home replacement cost, special personal property coverage, water backup of sewers or drains, increased cost endorsement |

| What are the benefits of Auto-Owners homeowners insurance? | In-person, on the phone and online access to your policy and claim information, award-winning claims service, multi-policy discount |

What You'll Learn

Homeowners insurance in Florida: what's covered and what's not

Homeowners insurance in Florida covers damage or loss from a range of perils, including fire, leaks, water discharge, fallen trees, and storms. It also typically includes wind or windstorm insurance. However, it's important to note that flood damage is generally not covered and requires a separate flood insurance policy.

Here's a more detailed breakdown of what's typically covered and what's not:

What's Covered:

- Dwelling: This includes the cost to rebuild your home after a disaster and can also cover attached structures.

- Personal Property: Your homeowners insurance can compensate for losses or damage to your personal belongings, with the option to include special items like jewelry or collectibles.

- Personal Liability Protection: This coverage protects you financially if a lawsuit is brought against you or your family due to accidents or injuries that occur on your property.

- Additional Living Expenses: If your home becomes uninhabitable due to severe storm damage or fire, your insurance can cover additional living expenses such as hotel stays and food.

- Fire Department Charges and Debris Removal: Your insurance can cover the cost of fire department services and debris removal after a covered peril.

What's Not Covered:

- Flood Damage: Flood insurance is typically not included in standard homeowners insurance policies in Florida. To protect your home from potential flood damage, you will need to purchase a separate flood insurance policy.

- Sewer Backup: Some homeowners' insurance policies do not include coverage for water backup from sewers or drains. However, this coverage can often be added as an endorsement.

- Earthquakes: While not common in Florida, earthquakes are not typically covered by standard homeowners insurance policies. If you want protection against earthquake damage, you may need to purchase a separate policy.

It's important to remember that insurance policies can vary among insurers, so it's essential to carefully review your specific policy to understand what is covered and what is not. Additionally, you may have the option to add endorsements or additional coverages to your base policy to suit your unique needs.

Bundling Home and Auto Insurance: The Money-Saving Myth

You may want to see also

How to get a quote for Auto-Owners Insurance in Florida

Auto-Owners Insurance provides several types of insurance, including homeowners insurance, auto insurance, life insurance, and business insurance. The company works with independent agents who provide local, personalized expertise.

To get a quote for Auto-Owners Insurance in Florida, you can follow these steps:

Step 1: Find an Independent Agent

Auto-Owners Insurance offers its insurance products through independent agents. You can use the company's Agency Locator tool on its website to find an independent insurance agent that represents Auto-Owners near you. These agents can provide you with a quote for the insurance coverage you need.

Step 2: Provide Vehicle and Personal Information

To get an accurate quote for auto insurance, you will need to provide certain information about your vehicle and yourself. This includes the year, make, model, and vehicle identification number (VIN) of your car. Additionally, you will need to provide your name, date of birth, driver's license number, and information about any previous insurance coverage.

Step 3: Share Your Driving History

Your driving history is an important factor in determining your auto insurance premium. Be prepared to disclose any accidents, violations, or license suspensions on your record. If you are under 25 years old and have a clean driving record, you may be eligible for a discount on your premium.

Step 4: Consider Your Coverage Options

Auto-Owners Insurance offers various coverage options, including bodily injury liability, property damage liability, uninsured/underinsured motorist coverage, and personal injury protection. You can discuss these options with your independent agent to determine which coverages are required in Florida and which additional coverages may be beneficial for you.

Step 5: Explore Discount Opportunities

Inquire about any discounts you may be eligible for to lower your premium. For example, Auto-Owners Insurance may offer discounts for safe driving, bundling multiple policies, or being a student with good grades. Ask your agent about the specific discounts available in Florida.

Step 6: Compare Quotes

It is recommended to compare quotes from multiple insurance providers to ensure you are getting the best coverage at a competitive price. You can use online tools or speak to independent agents representing different companies to obtain and compare quotes.

By following these steps, you can obtain a quote for Auto-Owners Insurance in Florida and make an informed decision about your auto insurance coverage. Remember to review the coverage options, discounts, and terms carefully before finalizing your insurance policy.

Vehicle Totaled: What to Tell Your Insurer

You may want to see also

Pros and cons of Auto-Owners Insurance

Auto-Owners Insurance is a longstanding company that provides auto, home, life, and business insurance in 26 states, including Florida. The pros of Auto-Owners Insurance include:

- Award-winning claims services

- Excellent financial stability

- Affordable insurance premiums

- A variety of homeowners' insurance discounts

- Online access to policy and claim information

- In-person, phone, and online services

- Local, personalized expertise

On the other hand, cons of Auto-Owners Insurance include:

- Lack of BBB accreditation

- Inability to purchase a policy online

- Limited online support

- Lack of national coverage

Auto Insurance in NJ: How Much?

You may want to see also

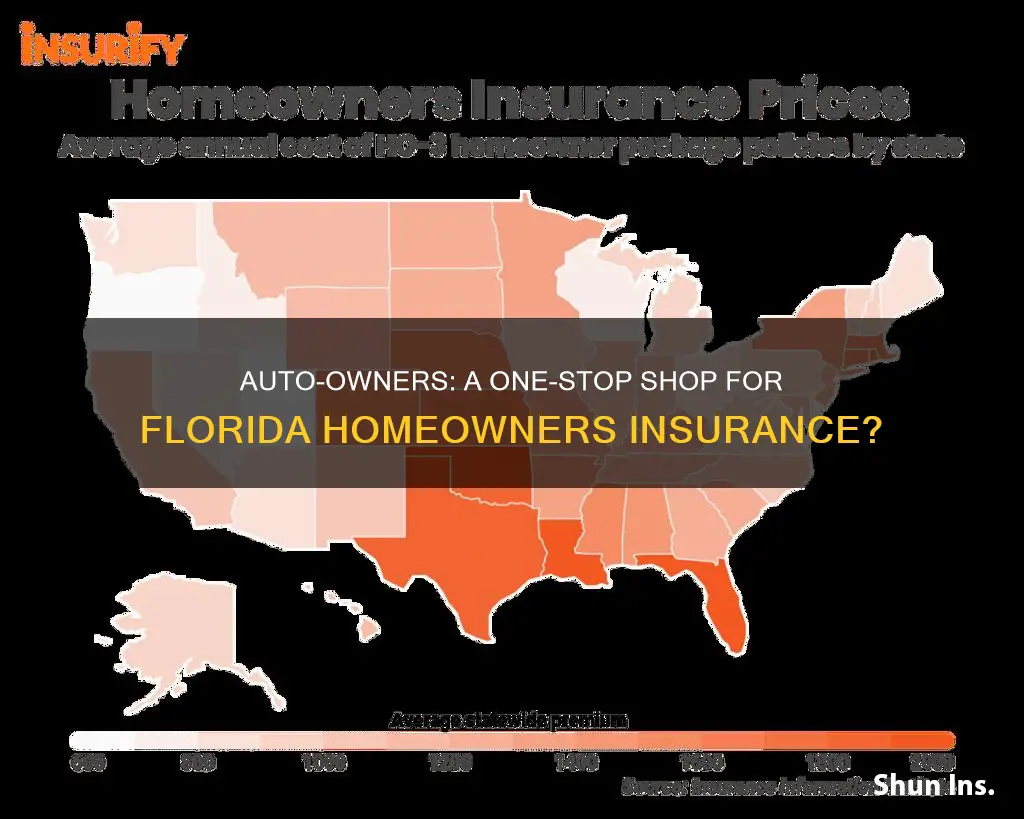

The average cost of homeowners insurance in Florida

Auto-Owners Insurance does not appear to sell homeowners insurance in Florida. However, the average cost of homeowners insurance in Florida is $4,419 a year, well above the national average. The cheapest homeowners insurance in Florida is offered by Travelers, with an average rate of $1,775 a year.

The cost of homeowners insurance in Florida is also affected by the state's high risk of hurricanes, floods, and other natural disasters. Additionally, there has been a population boom in Florida since July 2021, which has increased the cost of living and homeowners insurance premiums.

It's worth noting that the average cost of homeowners insurance can vary by city and county in Florida. For example, Tallahassee has the cheapest homeowners insurance among the state's largest cities, with an average rate of $2,950 per year.

Understanding Auto Insurance Deductibles

You may want to see also

How to choose a Florida home insurance provider

Choosing a Florida home insurance provider can be a challenging experience due to the state's dynamic insurance market. To help you make the right choice, consider the following factors:

- Look for hurricane and flood coverage: Houses in Florida are at a significant risk of hurricane and flood damage. Opt for an insurer that protects against both disasters. Consider insurers that provide flood insurance and coverage against hurricane damage, or seek out individual policies through the National Flood Insurance Program. Also, assess policy hurricane deductibles, which can be unusually high.

- Assess the insurer's financial stability: Florida has faced many natural disasters in recent years, leading to significant losses for insurance companies. Before choosing an insurer, evaluate its financial stability by checking its AM Best rating. This will give you an idea of their ability to pay out substantial claims.

- Evaluate customer satisfaction and claims history: Homeowners in Florida often face high insurance rates, claims-handling delays, a constantly changing market, and a lack of competition. Choose an insurer with a high customer satisfaction rate by reading reviews and comparing companies.

- Compare quotes from multiple providers: Shopping around and comparing quotes from different insurance providers is one of the best ways to save money on Florida homeowners insurance. Speak to agents about available discounts, and consider bundling your home and auto insurance policies for additional savings.

- Adjust deductibles and coverage limits: Increasing your deductible (what you pay after a claim) can lead to lower premiums. Similarly, lowering your coverage limits (what the insurance company pays after a claim) can also reduce your costs. However, keep in mind that these options may result in higher out-of-pocket expenses if you need to file a claim.

DMV and Gap Insurance: What's the Deal?

You may want to see also

Frequently asked questions

The average cost of homeowners insurance in Florida is $2,490 per year, or about $208 per month, which is slightly lower than the national average of $2,511.

The state of Florida does not require you to carry homeowners insurance, but your mortgage lender likely does. If you live in a high-risk flood zone, you may also be required to carry a flood insurance policy.

Auto-Owners Insurance earns an 8.9/10.0 rating for low-rate options based on coverage, cost, availability, reputation and customer experience scores.