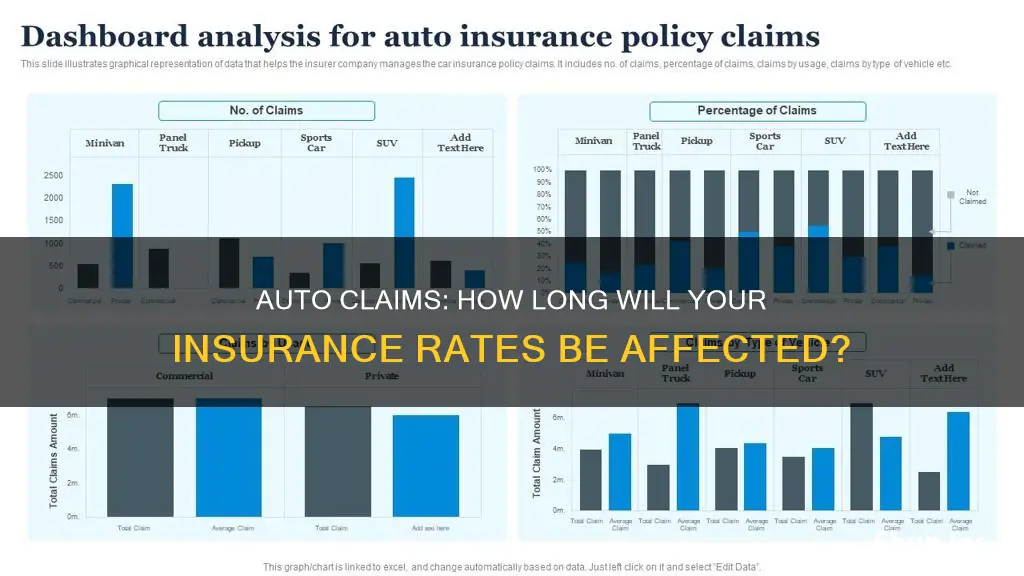

Car insurance rates are calculated based on risk. If you're deemed a high-risk driver, you'll likely be charged higher rates. The more auto insurance claims you file, the more your car insurance will cost, even if the losses were not your fault. Accidents that are your fault will almost always raise your insurance rate. However, accidents that aren't your fault may still increase your rate depending on your state and insurer. Accidents will stay on your record for anywhere from three to five years, depending on your state and the severity of the accident.

| Characteristics | Values |

|---|---|

| How long do auto claims affect insurance rates? | 3-5 years, depending on the state and the severity of the accident |

| What happens if I have multiple accidents within this period? | Your premium increases can add up, making your insurance more expensive |

| What if I have accident forgiveness coverage? | Your premium will not increase as a result of the accident |

| What if I am not at fault? | Your premium may still increase, but probably not by as much as if you were at fault |

| What if I have a clean driving record with no traffic violations? | Your premium may remain relatively the same |

| What if the accident is minor? | Your premium may not increase |

What You'll Learn

At-fault accidents

On average, car insurance rates increase by 49% after an at-fault accident, which equates to around $80 more per month for full coverage. However, this varies by state, with accidents in California doubling insurance rates, while accidents in Alaska increase rates by only 26%. The increase also depends on the insurance company, with Liberty Mutual increasing rates by 167% on average, and Travelers and Erie increasing rates by 34% on average.

Young or new drivers may experience the highest increases after an at-fault accident, as insurers typically view them as a high-risk group. If the accident caused serious injury, extensive property damage, or was due to intoxication, your insurance rates are likely to surge, and your insurer may even deny your policy renewal.

Auto Insurance in Arizona: What You Need to Know

You may want to see also

No-fault accidents

However, there are some situations where your auto insurance rates may still be affected after a no-fault accident:

- Previous claims: If you have previously caused an accident or made a claim, your insurance rates may increase after a no-fault collision. According to the Consumer Federation of America, drivers who have been involved in no-fault accidents see an average premium increase of 10%.

- Uninsured/underinsured motorist: If an uninsured or underinsured driver hits your car, your insurance company may be liable to pay for your injuries and vehicle damage through your uninsured motorist coverage. As this makes it costlier for your insurance provider to do business with you, they may pass on the extra cost by raising your premiums.

- Hit-and-run incidents: If the at-fault driver flees the scene, your insurance company may increase your premiums if you decide to file a non-fault claim. However, a non-fault claim usually comes with a lower surcharge compared to an at-fault claim.

- State-specific factors: Some states have no-fault laws that require drivers to file claims with their own insurance companies, regardless of fault. In these states, your rates typically won't increase after a no-fault accident unless you have a history of frequent claims or other factors that increase your risk. However, in other states, your insurer may consider you a higher risk and raise your rates even if you weren't at fault.

- Company-specific factors: Some insurance companies may increase your rates after a no-fault accident based on their own criteria, such as the number and type of claims filed, the severity of the accident, and the amount of the claim. Additionally, some companies use a rating system to calculate your premium based on your risk level, which may increase after a no-fault accident.

It's important to note that the impact of a no-fault accident on your insurance rates may vary depending on your state and insurance company. Therefore, it's recommended to understand your insurance company's policies and compare different companies before choosing one that suits your needs.

Auto Insurance: Prepaid or Postpaid?

You may want to see also

Comprehensive claims

Comprehensive insurance is an optional addition to most car insurance policies. It covers damage caused by or related to theft, animals, vandalism, and weather, but not collisions with another vehicle. Comprehensive claims are less expensive than collision or liability insurance claims.

Some insurance companies do not increase premiums for drivers with previous comprehensive claims. USAA, GEICO, and State Farm are the cheapest options for drivers who have previously filed a comprehensive claim.

If you have multiple comprehensive claims, you can take steps to lower your auto insurance premiums. These include limiting the number of claims you file each year, avoiding paying for more coverage than necessary, and using in-car monitoring to reduce your deductible.

Obtaining Auto Insurance Without a License: Understanding Your Options

You may want to see also

Accident forgiveness

However, not everyone is eligible for accident forgiveness. It is usually only available to drivers who already have a spotless driving history. That means, ironically, that the drivers who would most need accident forgiveness might not qualify. For example, drivers under Liberty Mutual are eligible for accident forgiveness if they have had no accidents or violations in the last five years. Similarly, GEICO's free accident forgiveness applies to qualifying drivers who have been accident-free for five years or more and may not apply to drivers under 21 years of age. Progressive also offers Large Accident Forgiveness to customers who have stayed with them for at least five years and have remained accident and violation-free for up to five consecutive years.

IHG Credit Card: Unlocking Overseas Auto Insurance Benefits

You may want to see also

Insurance rate increases

Firstly, the type of accident plays a significant role. At-fault accidents, where you are deemed responsible for the incident, typically lead to higher rate increases compared to no-fault accidents. This is because insurance companies consider at-fault drivers as high-risk, and they want to protect themselves from potential future losses. The severity of the accident also matters; more extensive damage or higher claim amounts will likely result in steeper rate hikes.

Secondly, your driving history is a key consideration. If you have a long history of safe driving with your current insurance company, you may experience less dramatic rate increases than someone with a poor driving record. Insurance companies view safe drivers as lower risk, and they may be more flexible with their rates. Additionally, if you have gone several years without accidents or violations, your insurer may be more lenient with minor accidents.

Thirdly, the specific policies and practices of your insurance company will determine the impact on your rates. Some companies may increase your premium for any claim, regardless of fault or damage amount. In contrast, other companies may not raise your rates for minor accidents or if you have a good driving record. It's important to understand your insurance company's policies and guidelines regarding rate adjustments.

Lastly, accident forgiveness programs offered by some insurance companies can help prevent rate increases after your first at-fault accident. These programs are often available to customers with good driving records and can provide peace of mind in the event of an accident. However, they may come with additional costs or eligibility requirements, so it's essential to review the specific terms and conditions.

While insurance rate increases are a possibility after a car accident, there are ways to mitigate these increases. Shopping around for new insurance coverage, taking a driver's education course, and adjusting your insurance coverage or deductible can all help lower your rates. Additionally, maintaining a clean driving record over time can help reduce the long-term impact of an accident on your insurance premiums.

Backdating Auto Insurance: Is It Possible?

You may want to see also

Frequently asked questions

If you are at fault, your insurance rates may be affected for around three to five years, depending on your state and company.

Accidents that aren't your fault may still increase your insurance rates, depending on your state and insurer.

Accident forgiveness coverage means your insurance rates won't increase after your first at-fault accident.

If you have a clean driving record, your insurance rates may not increase as much as they would if you had a poor driving record.