Life insurance proceeds received as a beneficiary due to the death of the insured person are generally not taxable and do not need to be reported. However, any interest received is taxable and must be reported. Backup withholding is a type of federal income tax deducted by payers when their 1099 or W-2G payee fails to provide a valid Taxpayer Identification Number (TIN) or show that they are exempt from backup withholding. This tax is taken from any future payments to ensure the Internal Revenue Service (IRS) receives the tax due on this income. It is unclear whether backup tax withholding affects life insurance, but it is important to note that life insurance proceeds are generally not taxable, while interest received on life insurance is taxable.

What You'll Learn

Life insurance and backup tax withholding

Life insurance is a contract between an insurer and an individual, with the insurer promising to pay out a sum of money to the individual's chosen beneficiary upon their death. Life insurance policies are often purchased to provide financial protection for surviving family members or to cover costs related to the death, such as medical bills or funeral expenses.

In the United States, the proceeds from a life insurance contract are generally not considered taxable income for the beneficiary. This means that, in most cases, the money received from a life insurance policy due to the death of the insured person is not subject to income tax and does not need to be reported to the Internal Revenue Service (IRS).

However, there are certain situations where life insurance proceeds may be taxable. For example, if the policy was transferred to the beneficiary in exchange for cash or other valuable consideration, the amount of taxable income is limited to the sum of the consideration paid, additional premiums, and certain other amounts. Additionally, any interest received on the life insurance proceeds is considered taxable income and should be reported to the IRS.

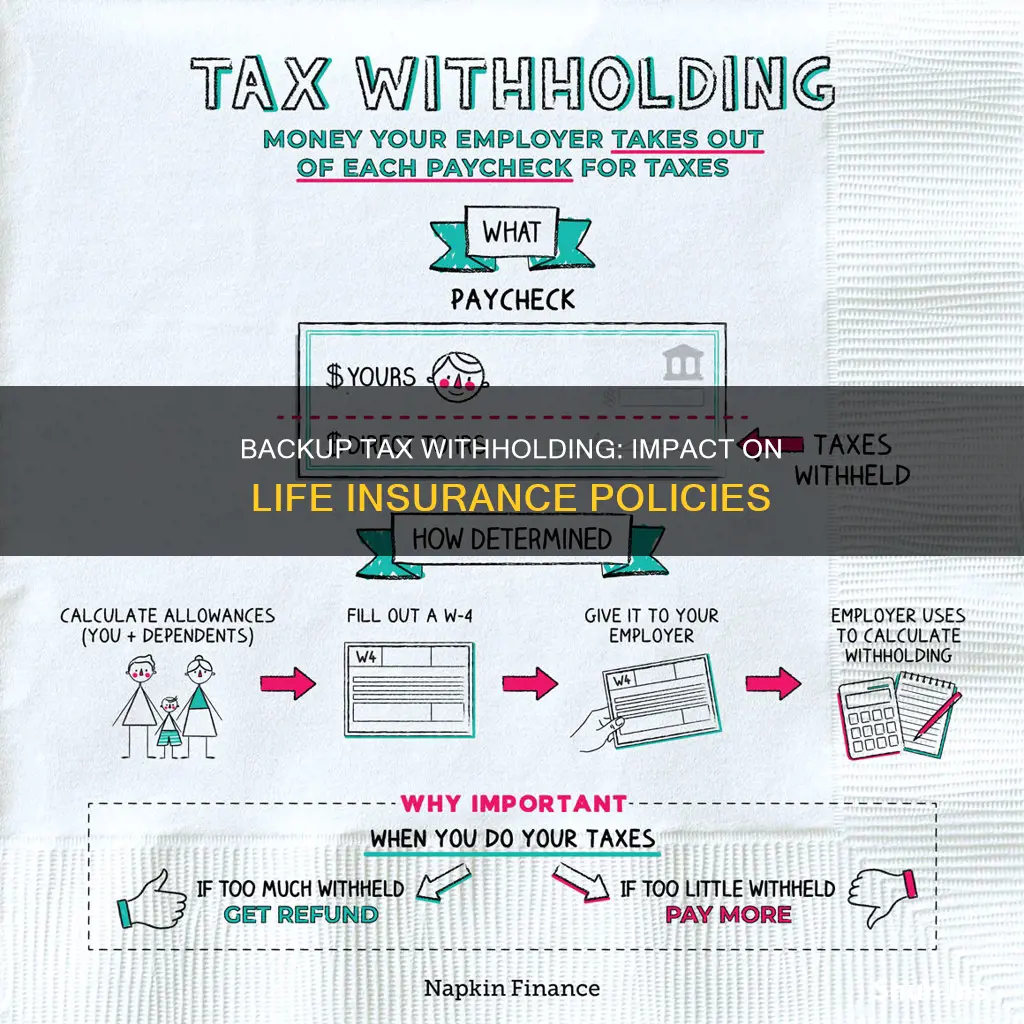

Now, let's discuss how backup tax withholding may affect life insurance. Backup withholding is a type of federal income tax in the United States that is deducted directly by payers when the payee (the recipient of the payment) has failed to provide a valid Taxpayer Identification Number (TIN) or show that they are exempt from backup withholding. This is done to ensure that the IRS receives the tax revenue owed by these individuals. The backup withholding tax rate is typically 24% for US citizens and resident aliens.

Life insurance proceeds are not typically subject to backup withholding because they are generally not considered taxable income. However, if the life insurance proceeds include interest payments, those interest payments may be subject to backup withholding if the beneficiary has not provided a valid TIN or met other requirements. Additionally, if the life insurance policy was transferred for cash or other valuable consideration, resulting in taxable income, backup withholding may apply to the taxable portion of the proceeds if the beneficiary is subject to it.

In summary, backup tax withholding generally does not affect life insurance proceeds, but it may apply to any interest earned on those proceeds or to taxable amounts if the policy was transferred for value. It is important for individuals to understand the tax implications of their life insurance policies and to ensure they comply with IRS requirements to avoid any unexpected tax liabilities.

Applying for a Life Insurance License in New York

You may want to see also

Backup tax withholding and incorrect information

Backup withholding is a tax levied on investment income at a rate of 24%. It is applied when the investor withdraws their income, and the amount is remitted to the government, providing the tax-collecting body with the required funds. This process ties up money that could otherwise be used for investment purposes.

Backup withholding may be applied when the taxpayer provides incorrect information, such as an incorrect taxpayer identification number (TIN), or fails to report certain types of income. A TIN can be a Social Security number (SSN), an employer identification number (EIN), or an individual taxpayer identification number (ITIN).

If a taxpayer does not provide the correct TIN to receive payments that are reportable on Form 1099, the payer is required to withhold at a rate of 24%. The payer might also be required to withhold at this rate if the IRS informs them that the taxpayer has underreported interest or dividends on their income tax returns. In such cases, the taxpayer will be notified four times over a 120-day period of the issue and the intent to institute backup withholding.

To prevent or stop backup withholding, taxpayers must correct the reason they became subject to it. This can include providing the correct TIN to the payer, resolving underreported income and paying the amount owed, or filing missing returns. If a taxpayer receives a notice from a payer notifying them that their TIN is incorrect, they can usually prevent backup withholding by providing their correct name and TIN and certifying that the TIN is correct. If a second notice is received, the taxpayer will need to provide verification of their correct name and TIN.

How to Cancel Your Life Insurance Policy Legally

You may want to see also

Backup tax withholding and unreported interest or dividends

Backup withholding is a 24% tax on certain payments to taxpayers who have failed to give the IRS or payers, such as banks, the necessary information. This tax is remitted to the government, providing the tax-collecting body with the required funds but leaving the investor with less short-term cash flow.

Backup withholding may be applied when an investor has not met rules regarding taxpayer identification numbers (TINs). This includes situations where the investor has provided an incorrect TIN or failed to provide one at all.

There are two programs under which an individual may be subject to backup withholding:

Backup Withholding "B" Program

This applies to taxpayers who fail to provide a correct TIN to entities that pay them. A TIN can be a Social Security number, an employer identification number, or an individual taxpayer identification number.

Backup Withholding "C" Program

This applies to taxpayers who have unreported interest or dividend income on their federal tax return or who have accidentally marked themselves as subject to backup withholding.

If you are subject to backup withholding, you will receive at least one letter notifying you of this before it starts. If you are subject to the "B" program, the payer you failed to provide a valid TIN to will send you notices asking for the missing information. If you are subject to the "C" program, the IRS will send you up to four notices over a 120-day period asking you to correct your income tax return to account for the unreported income.

Backup withholding can apply to most kinds of payments reported on Form 1099 and W-2G, including:

- Interest payments

- Dividends

- Payment card and third-party network transactions

- Patronage dividends

- Rents, profits, or other gains

- Commissions, fees, or other payments for work as an independent contractor

- Payments by brokers/barter exchanges

- Payments by fishing boat operators

- Royalty payments

- Gambling winnings

- Certain government payments

To stop backup withholding, you'll need to correct the reason you became subject to it in the first place. This can include providing the correct TIN to the payer, resolving the underreported income, and paying the amount owed, or filing the missing return(s).

Thrivent's Whole Life Insurance: Is It Worth the Investment?

You may want to see also

Payments subject to backup tax withholding

Backup withholding is a 24% tax on certain payments to taxpayers who have failed to give the IRS or payers, such as banks, the necessary information. This tax is remitted to the government, providing the tax-collecting body with the required funds but leaving the investor with less short-term cash flow.

Backup withholding can apply to most kinds of payments reported on Forms 1099 and W-2G. These include:

- Attorney's fees (Form 1099-NEC) and gross proceeds such as settlements paid to an attorney (Form 1099-MISC)

- Interest payments (Form 1099-INT)

- Dividends (Form 1099-DIV)

- Payment Card and Third-Party Network Transactions (Form 1099-K)

- Patronage dividends, but only if at least half the payment is in money (Form 1099-PATR)

- Rents, profits, or other gains (Form 1099-MISC)

- Commissions, fees, or other payments for work performed as an independent contractor (Form 1099-NEC)

- Payments by brokers/barter exchanges (Form 1099-B)

- Payments by fishing boat operators, but only the part that is in money and that represents a share of the proceeds of the catch (Form 1099-MISC)

- Royalty payments (Form 1099-MISC)

- Gambling winnings (Form W-2G) may also be subject to backup withholding.

STDs and Life Insurance: Impact and Implications

You may want to see also

Stopping backup tax withholding

To stop backup withholding, you'll need to correct the issue that caused it in the first place. This can include:

- Providing the correct Taxpayer Identification Number (TIN) to the payer. A TIN can be a Social Security Number (SSN), an Employer Identification Number (EIN), or an Individual Taxpayer Identification Number (ITIN).

- Resolving any underreported income and paying the amount owed.

- Filing missing returns.

If you receive a notice from a payer saying that the TIN you gave is incorrect, you can usually prevent backup withholding by giving the payer your correct name and TIN and certifying that the TIN is correct. If you receive a second notice from the payer, you'll need to provide verification of your correct name and TIN.

"B" Backup Withholding

If you're subject to "B" backup withholding, stopping it is a matter of sending the payer a W-9 form with a correct TIN. The payer may send you a W-9 form when they notify you of their intent to begin backup withholding. If not, you can download it from the IRS website.

"C" Backup Withholding

To stop "C" backup withholding due to unreported interest or dividend income, you'll need to report that income and pay taxes on it if applicable. This might mean filing missing or past-due tax returns, for which you'll need to find the Form 1040 for the appropriate prior year on the IRS website. Or it might mean filing an amended tax return with Form 1040-X.

If you've become subject to "C" backup withholding accidentally due to an error while filling out a form, contact the customer service department of the relevant bank, brokerage, or other payer institution to see if they can help. They may ask you to send them a new W-9 form to stop backup withholding.

Group Life Insurance: Taxable or Not?

You may want to see also

Frequently asked questions

No, life insurance payouts are not subject to backup tax withholding. Life insurance proceeds received as a beneficiary due to the death of the insured person are generally not taxable income.

Backup tax withholding is a type of federal income tax deducted by payers when their 1099 or W-2G payee has failed to provide a valid Taxpayer Identification Number (TIN) or proof of exemption from backup withholding. It is calculated at a rate of 24% for US citizens and resident aliens.

To stop backup tax withholding, you need to correct the reason you became subject to it. This could include providing the correct TIN to the payer, resolving any underreported income, and paying any amount owed, or filing missing returns.