California is one of 25 states that allow drivers to use their smartphones to provide electronic proof of insurance without carrying around paper documents. This means that if you are pulled over by the police, you can show them a digital copy of your insurance card from a mobile app or website. However, you should note that the police officer is not allowed to view anything else on your phone and is not responsible for any lost data or accidental damage.

| Characteristics | Values |

|---|---|

| States that allow electronic proof of insurance | Alaska, Alabama, Arizona, Arkansas, California, Colorado, Florida, Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, North Dakota, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and Wyoming |

| States that do not allow electronic proof of insurance | New Mexico |

| States with pending legislation | Illinois, Missouri, and Wisconsin |

| States with legislation in progress | Michigan, Ohio, and Pennsylvania |

What You'll Learn

- California allows drivers to use smartphones to provide proof of insurance

- California is the seventh state to allow electronic proof of insurance

- California's law reads: Evidence of financial responsibility may be provided using a mobile electronic device

- California DMV is working on a mobile driver's license

- Electronic proof of insurance is also known as an electronic insurance card

California allows drivers to use smartphones to provide proof of insurance

California allows drivers to use their smartphones to provide proof of insurance without carrying paper documents. This was made possible by the passing of Assembly Bill 1708, which made California the seventh state to allow motorists to show proof of insurance via their phones or other electronic devices.

The California Vehicle Code (CVC) 16028, Financial Responsibility, stipulates that a driver must provide proof of insurance or financial responsibility when requested by an accident investigator or peace officer. The code further states that "The evidence of financial responsibility may be provided using a mobile electronic device." This means that if a driver is pulled over and cannot find or does not have their insurance card, they can show a digital copy of their insurance information on their phone. This can be accessed through a mobile app or by downloading the information from the insurance company's website.

It is important to note that the police officer is not allowed to view anything else on the driver's phone and is not responsible for any lost data or accidental damage. Additionally, the law does not specifically exclude a picture of the insurance ID card stored on the phone, and officers should accept this as valid proof of auto insurance.

The acceptance of electronic proof of insurance is part of a larger trend of states moving towards digital options for insurance and driving documents. As of 2023, 25 states allowed electronic proof of insurance, with more states considering similar legislation. This trend is driven by the increasing prevalence of smartphones and the convenience of having important documents easily accessible on mobile devices.

Safe Auto Insurance: Teen Rates Explained

You may want to see also

California is the seventh state to allow electronic proof of insurance

The CA Vehicle Code (CVC) 16028, Financial Responsibility, outlines that drivers must provide proof of insurance or financial responsibility when requested by an accident investigator or peace officer. It further states that "The evidence of financial responsibility may be provided using a mobile electronic device." This means that California drivers can now use their smartphones to provide electronic proof of insurance without carrying paper documents.

It is important to note that a police officer is not permitted to view anything else on the driver's phone and is not responsible for any lost data or accidental damage. The proof of financial responsibility can be in the form of legal documents, such as a "certificate of deposit," a surety bond, or liability insurance.

While most states allow electronic proof of insurance, as of October 2022, New Mexico was the only state that did not. Driving without proof of insurance is not the same as driving without insurance. Failure to provide proof of insurance typically results in a fix-it ticket with minimal impact on insurance rates. On the other hand, a no-insurance conviction can lead to significant fines and the suspension of a driver's license and vehicle registration.

Tort Choice in New Jersey Auto Insurance

You may want to see also

California's law reads: Evidence of financial responsibility may be provided using a mobile electronic device

In California, motorists are allowed to provide evidence of their insurance using their phones or other electronic devices. This is due to the passing of Assembly Bill 1708, which made California the seventh state to allow this.

The California Vehicle Code (CVC) 16028, Financial Responsibility, stipulates that a driver must provide proof of insurance or financial responsibility when requested by an accident investigator or peace officer. The code further states that:

> "The evidence of financial responsibility may be provided using a mobile electronic device."

This means that drivers in California are no longer required to carry a physical insurance card in their vehicle, as long as they have access to a digital copy on their phone or other electronic devices. This can be accessed through a mobile app provided by the insurance company or by downloading the information from the company's website.

It is important to note that a police officer is not allowed to view anything else on the phone and is not responsible for any lost data or accidental damage.

Auto Mileage Tax: The Insurance Question

You may want to see also

California DMV is working on a mobile driver's license

In California, drivers are allowed to use their smartphones to provide electronic proof of insurance without carrying around paper documents. This is due to the passing of Assembly Bill 1708, which made California the seventh state to allow motorists to show proof of insurance via their phone or other electronic devices.

The California DMV is currently working on a mobile driver's license (MDL) or mDL, which is part of a pilot program active through June 2026. The mDL allows drivers to keep digital versions of their licenses on their smartphones. The app is available for iPhone and Android operating systems. During the pilot, drivers must still have their physical cards accessible when needed. The mDL can be used for identity verification at select locations, such as airports, and to purchase age-restricted products at select retailers. The California DMV anticipates that the mDL will be accepted by more than 20 California airports in the near future and that it will eventually be accepted by all public and private entities that require identity or age verification.

While the pilot program continues to expand, legislative action is needed to make the mDL permanent. There is currently no set timeframe for when this will happen. The California DMV is focused on increasing the number of places that accept the mDL and addressing customer feedback to enhance the program.

Gap Insurance: Mechanical Failure Protection

You may want to see also

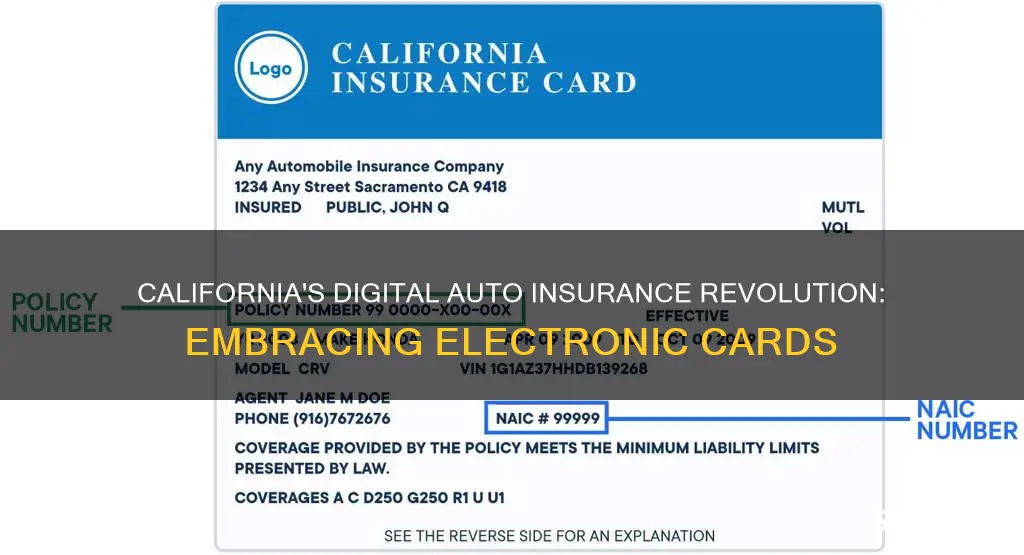

Electronic proof of insurance is also known as an electronic insurance card

An electronic insurance card, also known as electronic proof of insurance, is a convenient way to show that you have the necessary insurance coverage when driving. This digital version of your insurance card can be accessed on your smartphone or tablet, eliminating the need to carry the physical card in your glove compartment. Most auto insurance companies provide their customers with easy access to their digital insurance cards through mobile applications or their official websites.

In most states across the country, including California, electronic proof of insurance is accepted as valid. This means that if you are pulled over or involved in an accident, you can simply show your electronic insurance card to the police officer or the other driver. This can save you from receiving a ticket or paying hefty fines for not having physical proof of insurance.

In California, Assembly Bill 1708 allows motorists to provide proof of insurance using their phones or other electronic devices. This is especially convenient when you may not have the physical card on hand or cannot find it in the moment. With this law in place, all you need is your phone, and you can easily access the digital copy of your insurance card from your insurance company's mobile app or website.

It's important to note that while electronic proof of insurance is widely accepted, there may be some variations in acceptance across states. For example, in New Mexico, law enforcement officers are not required to accept electronic proof of auto liability coverage. Therefore, it is always a good idea to check with your local Department of Motor Vehicles (DMV) to stay informed about the specific requirements in your state.

By utilizing the electronic insurance card, you can ensure that you have the necessary proof of insurance readily available whenever needed. This digital alternative offers convenience and peace of mind, knowing that you are complying with the legal requirements without having to worry about misplacing or forgetting your physical insurance card.

Does Your Auto Insurance Cover Parade Float Towing?

You may want to see also

Frequently asked questions

Yes, California accepts electronic proof of auto insurance.

A digital copy of your insurance card from a mobile app or the insurance company's website is considered valid. An "official-looking" proof of insurance, such as a PDF or an insurance card downloaded from your insurer's mobile application, is preferred.

If you are unable to provide proof of insurance, you may be subject to a ticket for not having insurance. It is recommended to consult a traffic ticket attorney in such cases.